Uncertainty Looms: Sasol (SOL) Faces Investor Scrutiny

Table of Contents

Declining Profitability and Financial Performance

Sasol's recent financial reports paint a picture of declining profitability. Key metrics, including revenue, profit margins, and debt levels, all point towards a challenging financial landscape. Several factors contribute to this downturn. Fluctuating energy prices, a cornerstone of Sasol's business model, have significantly impacted revenue streams. Operational challenges, including production bottlenecks and cost overruns, have further squeezed profit margins. Increased competition in the global chemicals market adds another layer of complexity.

- Declining Revenue Streams: A significant decrease in sales of key chemical products, coupled with reduced demand for certain energy products, has directly impacted Sasol's top line.

- Increased Operational Costs: Rising input costs, including raw materials and labor, have substantially increased operational expenses, putting further pressure on profitability.

- Impact of Global Energy Market Fluctuations: The volatile nature of the global energy market, characterized by price swings and geopolitical uncertainty, has created significant headwinds for Sasol's performance.

- Debt Levels and Future Growth: High levels of debt accumulated through past investments and operational challenges limit Sasol's capacity for future investments and hinder its ability to react effectively to market shifts. This significantly impacts investor confidence.

Geopolitical Risks and Supply Chain Disruptions

Sasol's operations are not immune to geopolitical risks and supply chain disruptions. The ongoing war in Ukraine, for example, has led to increased energy prices and supply chain bottlenecks, directly impacting Sasol's production and profitability. The company's exposure to various regions with inherent political and economic instability creates further uncertainty.

- Geopolitical Impact: The war in Ukraine and other global conflicts have created instability in energy markets, affecting both the price and availability of crucial resources for Sasol's operations.

- Supply Chain Vulnerabilities: Sasol's reliance on global supply chains exposes it to potential disruptions, delays, and increased costs, impacting its ability to meet market demands.

- Mitigation Strategies: While Sasol is exploring diversification strategies and seeking to enhance supply chain resilience, the effectiveness of these strategies remains to be seen.

ESG Concerns and Investor Activism

Growing concerns surrounding Sasol's environmental, social, and governance (ESG) performance are contributing to the Sasol (SOL) investor scrutiny. Investors are increasingly demanding greater transparency and accountability on ESG issues. This has led to increased investor activism and campaigns focused on Sasol's carbon footprint, its social impact, and its governance practices.

- Specific ESG Concerns: Investors have raised concerns regarding Sasol's greenhouse gas emissions, its water usage, and its commitment to diversity and inclusion.

- Sasol's Response: The company has responded by outlining its sustainability goals and initiatives, but the effectiveness of these measures is subject to ongoing debate and scrutiny.

- Long-Term Impact: The long-term impact of these ESG concerns on Sasol's reputation and profitability remains uncertain, but the potential for negative consequences is undeniable. This impacts the perception of Sasol amongst environmentally conscious investors.

Future Outlook and Potential Strategies

Sasol is implementing strategic initiatives to address the challenges it faces. These include cost-cutting measures, operational efficiency improvements, and a renewed focus on specific high-growth market segments. However, the success of these strategies remains uncertain, and the outlook for future growth depends on various factors, including global energy prices, geopolitical stability, and the company's ability to effectively address ESG concerns.

- Strategic Initiatives: Sasol is pursuing various strategic initiatives, including divestments, operational restructuring, and investments in renewable energy technologies.

- Feasibility and Impact: The feasibility and potential impact of these strategies vary significantly, and their effectiveness will depend on numerous external and internal factors.

- Catalysts for Stock Movement: Positive catalysts could include improved financial performance, successful implementation of strategic initiatives, and a more stable global energy market. Negative catalysts could include further declines in profitability, increased geopolitical instability, or heightened ESG concerns.

Navigating the Uncertainty Surrounding Sasol (SOL)

In summary, the intense Sasol (SOL) investor scrutiny stems from a confluence of factors: declining profitability, exposure to geopolitical risks, rising ESG concerns, and uncertainty about future growth. The company faces significant challenges but also has opportunities to improve its performance. The trajectory of Sasol's stock price will likely depend on its ability to effectively address these challenges and capitalize on emerging opportunities. To make informed investment decisions, staying informed about developments impacting Sasol (SOL) is crucial. Conduct thorough due diligence and review Sasol's investor relations materials and financial reports before making any investment choices. Understanding the nuances of Sasol (SOL) investor relations is key to navigating this uncertain period.

Featured Posts

-

Uspekh Mirry Andreevoy Biografiya I Analiz Igr

May 20, 2025

Uspekh Mirry Andreevoy Biografiya I Analiz Igr

May 20, 2025 -

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025

China Urges Philippines To Remove Missiles From South China Sea

May 20, 2025 -

Joint Us Australia Military Drills Missile Launcher Deployment And Chinas Reaction

May 20, 2025

Joint Us Australia Military Drills Missile Launcher Deployment And Chinas Reaction

May 20, 2025 -

Is There A Feud David Walliams Criticizes Simon Cowell On Britains Got Talent

May 20, 2025

Is There A Feud David Walliams Criticizes Simon Cowell On Britains Got Talent

May 20, 2025 -

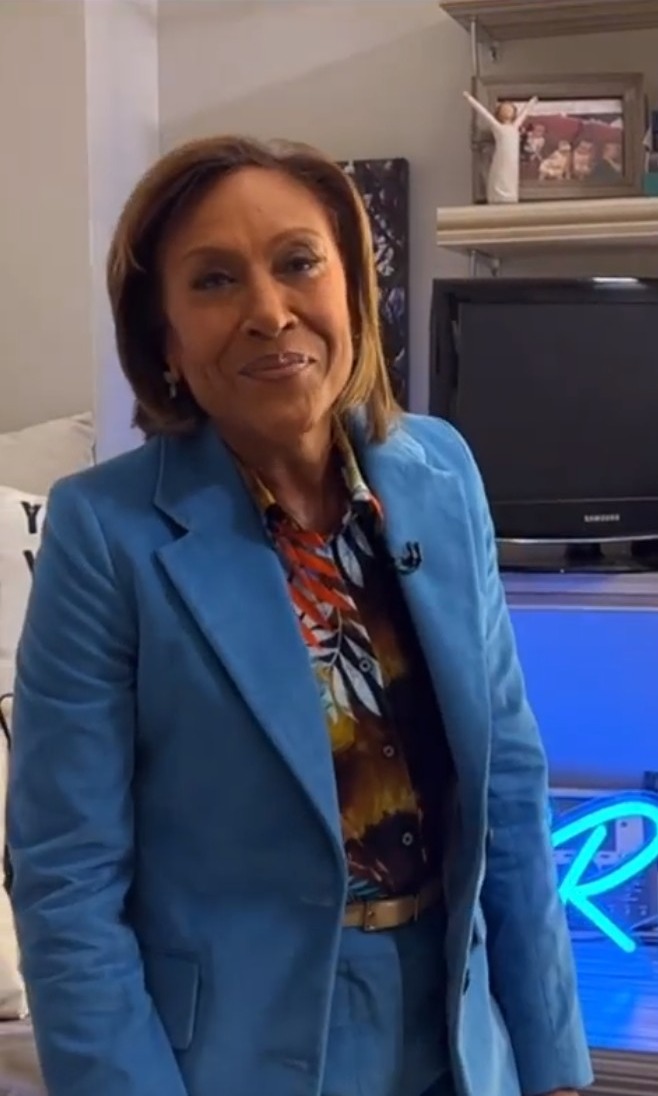

Robin Roberts Upbeat Message Amidst Gma Staff Reductions

May 20, 2025

Robin Roberts Upbeat Message Amidst Gma Staff Reductions

May 20, 2025