Understanding And Monitoring The NAV Of The Amundi DJIA UCITS ETF

Table of Contents

What is Net Asset Value (NAV) and why is it important for the Amundi DJIA UCITS ETF?

Net Asset Value (NAV) represents the total value of an ETF's underlying assets minus its liabilities, divided by the number of outstanding shares. For ETFs like the Amundi DJIA UCITS ETF, which tracks the Dow Jones Industrial Average (DJIA), the NAV calculation involves valuing the ETF's holdings, reflecting the combined worth of the stocks mirroring the DJIA index.

Monitoring the Amundi DJIA UCITS ETF NAV is vital for several reasons: it's your primary tool for tracking performance. The daily NAV calculation provides a precise snapshot of your portfolio's performance relative to the underlying index. This contrasts with the market price, which can fluctuate throughout the trading day due to supply and demand. Discrepancies between NAV and market price are common, particularly for less liquid ETFs, but understanding the difference is key to assessing true value.

- NAV reflects the ETF's underlying asset value: It's a true representation of the value of the assets held within the ETF.

- Daily NAV calculation provides a snapshot of portfolio performance: Allows for day-to-day tracking of investment growth or loss.

- Monitoring NAV helps assess investment returns and potential risks: Essential for evaluating investment success and managing potential downsides.

- Understanding NAV helps compare the ETF's performance against benchmarks: Enables a direct comparison with the DJIA index performance.

Where to Find the Amundi DJIA UCITS ETF NAV?

Accessing reliable and up-to-date Amundi DJIA UCITS ETF NAV information is straightforward. Several reputable sources provide real-time and historical data:

- Amundi's official website: The most authoritative source for NAV data. Look for investor relations sections or dedicated ETF pages. [Insert link to Amundi website ETF section if available].

- Major financial data providers: Bloomberg Terminal, Refinitiv Eikon, and similar professional platforms offer comprehensive ETF data including NAV. These usually require subscriptions.

- Brokerage platforms: If you hold the Amundi DJIA UCITS ETF through a brokerage account, the platform will typically display the current NAV alongside market pricing information.

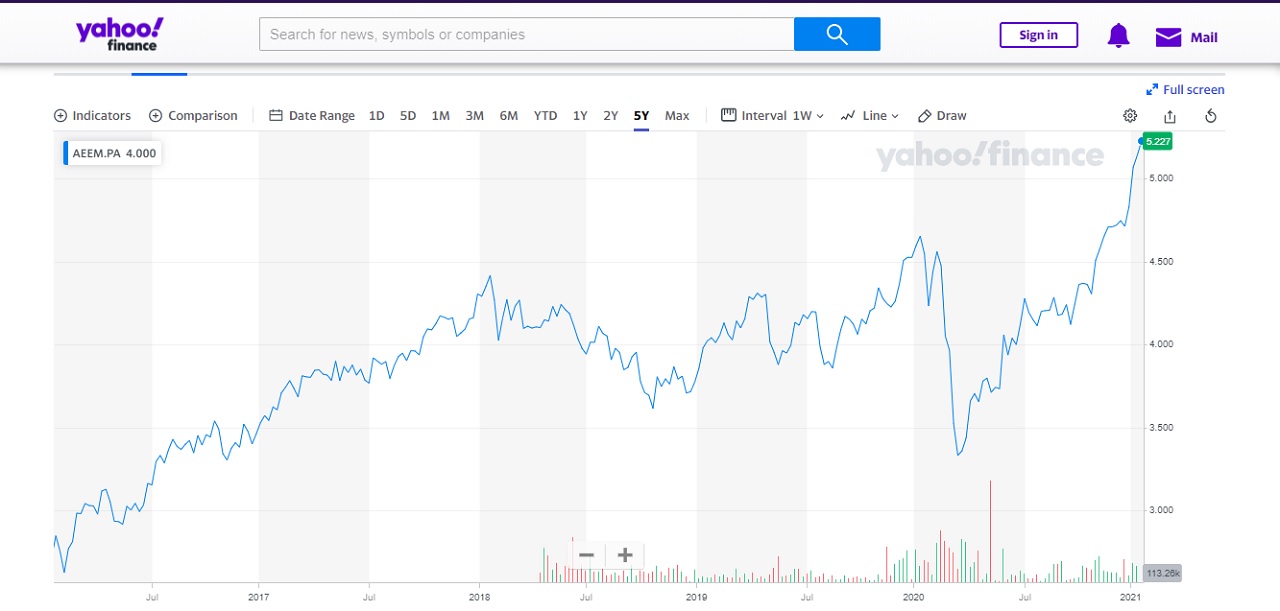

- Financial news websites: Reputable financial news sources (e.g., Yahoo Finance, Google Finance) often list ETF NAV data, though it may not always be real-time.

Always prioritize official sources and well-established financial data providers to ensure the accuracy of the NAV information you use. Avoid unreliable or less-known websites to prevent misinformation.

Factors Influencing the Amundi DJIA UCITS ETF NAV

The primary driver of the Amundi DJIA UCITS ETF NAV is the performance of the Dow Jones Industrial Average (DJIA). Any increase or decrease in the DJIA's value will directly and proportionally impact the ETF's NAV.

However, other factors play a role:

- Currency exchange rate fluctuations (if applicable): If the ETF holds assets denominated in currencies other than the base currency of the ETF, exchange rate movements can affect the NAV.

- Expense ratio: The ETF's expense ratio, which covers administrative and management fees, slightly erodes the NAV over time.

- Dividend distributions: When underlying companies in the DJIA pay dividends, the ETF receives these dividends, which are then either reinvested or distributed to shareholders. This can influence the NAV, especially around the ex-dividend date. Understanding the ex-dividend date is crucial for accurate NAV interpretation.

Interpreting NAV Changes and Making Informed Decisions

Analyzing NAV movements requires considering both short-term fluctuations and long-term trends. Daily changes might reflect market volatility, while longer-term trends reveal the ETF's overall performance.

- Consider long-term trends rather than focusing solely on daily fluctuations: Market volatility can cause temporary NAV dips; long-term trends provide a more accurate picture of performance.

- Compare NAV performance to relevant benchmarks (e.g., DJIA): Track how closely the ETF mirrors the performance of its underlying index.

- Integrate NAV analysis with other investment factors (risk tolerance, financial goals): NAV is one piece of the puzzle. Align your investment decisions with your broader financial plan.

Using NAV data alongside other key metrics like the ETF's expense ratio, trading volume, and its correlation with the DJIA, will enable you to make more informed investment choices.

Conclusion

Understanding and regularly monitoring the Amundi DJIA UCITS ETF NAV is essential for effective investment management. By utilizing the reliable sources outlined above and considering the factors influencing the NAV, you can make informed decisions aligned with your investment strategy. Remember to compare the Amundi DJIA UCITS ETF NAV to the DJIA itself, consider long-term trends, and incorporate this information alongside your overall financial goals. Continue researching and exploring additional resources to deepen your understanding of Amundi DJIA UCITS ETF NAV and ETF investing in general. Actively monitoring your Amundi DJIA UCITS ETF NAV is key to maximizing your investment potential.

Featured Posts

-

Glastonbury Festival 2025 Olivia Rodrigo The 1975 And More Confirmed

May 25, 2025

Glastonbury Festival 2025 Olivia Rodrigo The 1975 And More Confirmed

May 25, 2025 -

Nvidia Rtx 5060 Transparency And Expectations In The Gpu Market

May 25, 2025

Nvidia Rtx 5060 Transparency And Expectations In The Gpu Market

May 25, 2025 -

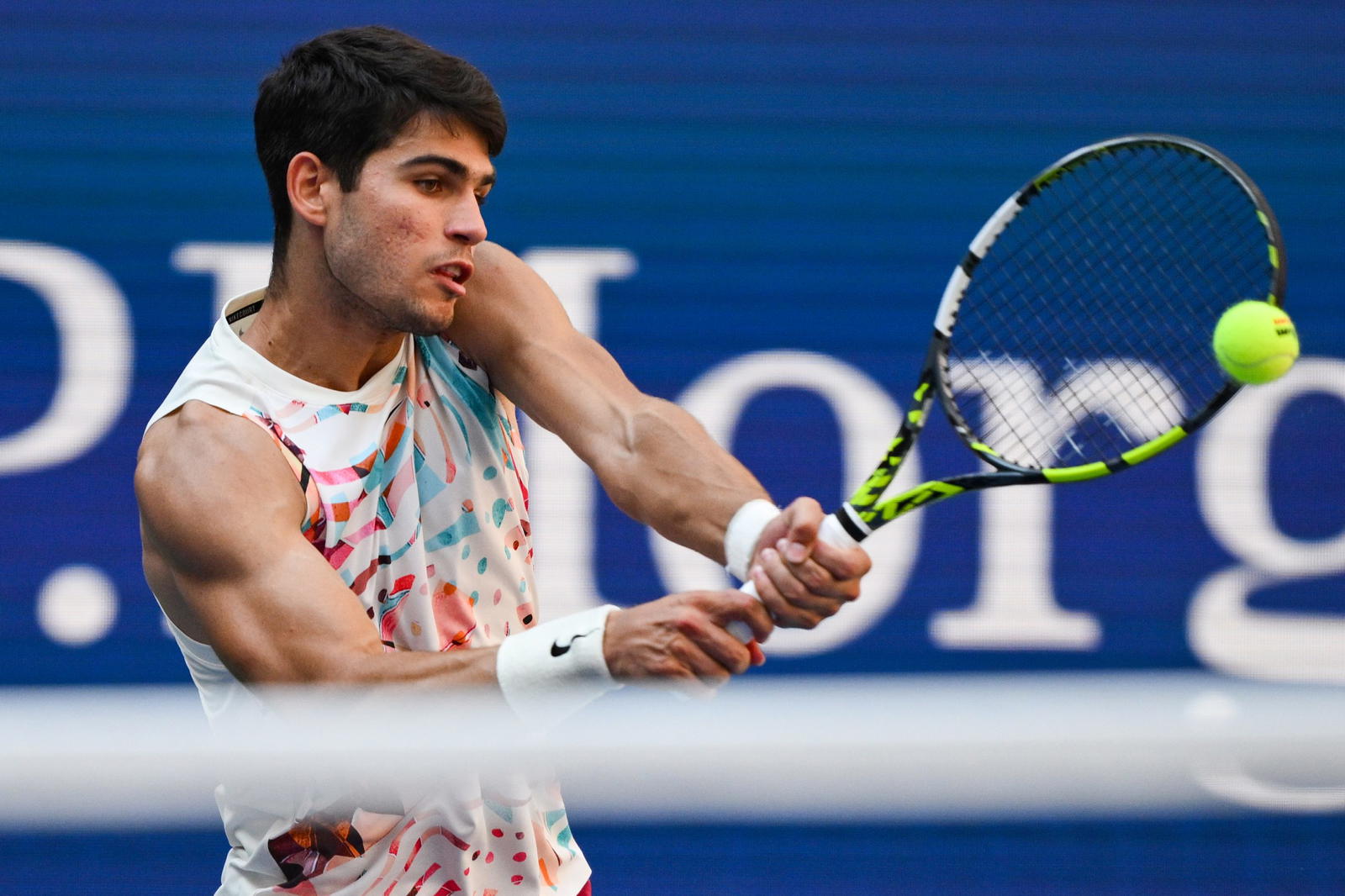

Italian Open Alcaraz And Sabalenka Begin With Victories

May 25, 2025

Italian Open Alcaraz And Sabalenka Begin With Victories

May 25, 2025 -

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Recesie

May 25, 2025

H Nonline Sk Nemecke Firmy A Masivne Prepustanie Dosledky Hospodarskej Recesie

May 25, 2025 -

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025

Amundi Msci All Country World Ucits Etf Usd Acc Daily Nav And Its Importance

May 25, 2025