Understanding Dasani's UK Market Strategy (or Lack Thereof)

Table of Contents

Main Points: Deconstructing Dasani's UK Approach

2.1 Dasani's Global Positioning vs. UK Adaptation:

H3: Global Branding Inconsistencies: Dasani's global branding, emphasizing purity and a clean image, hasn't effectively translated to the UK market. While successful in other regions, this approach may not resonate with UK consumer preferences, which often lean towards brands with a stronger sense of place or a specific origin story.

- Global Success vs. UK Failure: Dasani's marketing in the US, for example, emphasizes its purity and purification process. This has been less effective in the UK.

- Cultural Nuances: UK consumers often value provenance and local sourcing, a factor largely absent from Dasani's marketing. The perception of being a “global” brand, rather than a local one, might be a drawback.

- Branding Misinterpretations: The lack of a clear connection to a specific UK location may have led to a perception of Dasani as a generic, less appealing option compared to its competitors with strong regional ties.

H3: Failure to Adapt to Local Tastes: The UK bottled water market demonstrates a clear preference for specific water characteristics, including sparkling vs. still options and mineral content. Dasani hasn't fully catered to this diversity of tastes.

- Product Range Limitations: Compared to competitors offering a wider range of options, including sparkling and naturally mineral-rich waters, Dasani's product line appears less diverse.

- Consumer Feedback: Online reviews and consumer surveys may reveal feedback highlighting a lack of preference for Dasani's taste profile compared to established brands.

- Missed Opportunities: Developing localized product variations, such as a sparkling Dasani infused with UK-sourced fruits or herbs, could have enhanced its appeal to British consumers.

2.2 Distribution and Pricing Strategies:

H3: Limited Distribution Network: Dasani's presence on UK supermarket shelves and in convenience stores seems less extensive than its competitors, hindering its accessibility to a broader consumer base.

- Distribution Density: A comparison of shelf space dedicated to Dasani versus competitors reveals a potential gap in distribution reach.

- Availability Issues: Dasani's presence in smaller retailers or specific regions might be limited, impacting its overall market penetration.

- Geographic Limitations: Analyzing the geographic spread of Dasani's distribution reveals potential weaknesses in reaching key demographic areas.

H3: Pricing Competitiveness: Dasani's pricing strategy needs scrutiny concerning its perceived value. While the price might be competitive with some brands, it might not justify its perceived lack of unique qualities.

- Price Comparison: A direct comparison of Dasani's prices against competitors demonstrates its position in the price spectrum.

- Price Sensitivity: The UK market exhibits varying price sensitivity across different consumer segments. Dasani's pricing needs to consider this aspect.

- Value Proposition: Dasani needs a stronger value proposition that goes beyond its price point. Communicating its unique selling points more effectively is crucial.

2.3 Marketing and Communication Efforts:

H3: Ineffective Marketing Campaigns: Dasani's marketing campaigns in the UK haven't created the same impact as in other markets. Their effectiveness needs a thorough evaluation.

- Marketing Strategy Analysis: Assessing the types of marketing strategies employed (television, digital, print) and their efficacy is crucial.

- Consumer Response: Analyzing consumer responses to Dasani's marketing materials helps identify areas for improvement.

- Benchmarking Against Competitors: Comparing Dasani's marketing spend and strategies against successful competitors provides insights.

H3: Weak Brand Storytelling: Dasani has failed to connect with UK consumers on an emotional level, lacking a compelling brand narrative.

- Brand Messaging Analysis: The brand message needs to be more resonant with UK values and aspirations.

- Emotional Connection: Creating a stronger emotional connection with consumers is key to building brand loyalty.

- Competitive Storytelling: Successful competitors often weave compelling stories around their brand's origin and values, which Dasani lacks.

Conclusion: Re-evaluating Dasani's UK Market Strategy

Dasani's relatively low market share in the UK stems from a combination of factors, including inadequate adaptation to local tastes and preferences, a less effective distribution network, a lackluster marketing strategy, and a failure to cultivate a strong brand narrative. Understanding Dasani's UK market strategy, or rather the lack of a fully realized one, highlights the crucial need for brands to adapt their global strategies to local contexts. Ignoring cultural nuances, consumer preferences, and effective distribution and marketing approaches leads to missed opportunities. Learn from their experiences and develop a robust, localized approach for optimal results in the competitive British bottled water market.

Featured Posts

-

Paddy Pimbletts Post Fight Weight 40lbs Heavier After Ufc 314

May 16, 2025

Paddy Pimbletts Post Fight Weight 40lbs Heavier After Ufc 314

May 16, 2025 -

Kya Tam Krwz Ksy Mshhwr Adakarh Kw Dyt Kr Rhe Hyn

May 16, 2025

Kya Tam Krwz Ksy Mshhwr Adakarh Kw Dyt Kr Rhe Hyn

May 16, 2025 -

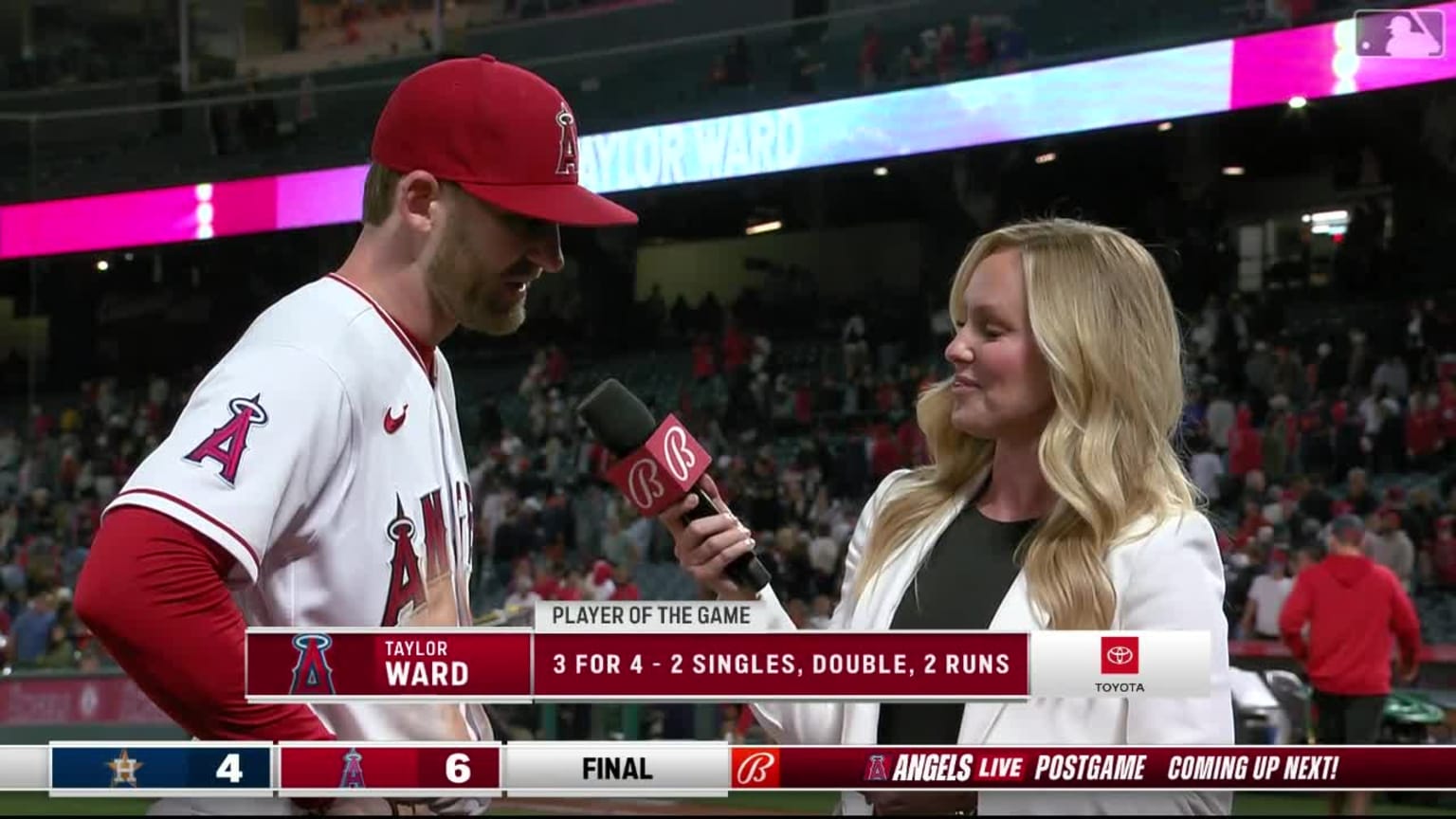

Angels Ward Delivers 9th Inning Grand Slam Stunning Padres

May 16, 2025

Angels Ward Delivers 9th Inning Grand Slam Stunning Padres

May 16, 2025 -

Jaylen Brown Mistakes Action Bronson For Luke Combs Bronsons Response

May 16, 2025

Jaylen Brown Mistakes Action Bronson For Luke Combs Bronsons Response

May 16, 2025 -

Exploring Tom Cruises Romantic History Wives Girlfriends And Speculation

May 16, 2025

Exploring Tom Cruises Romantic History Wives Girlfriends And Speculation

May 16, 2025