Understanding High Stock Market Valuations: A BofA Analysis

Table of Contents

Key Indicators of High Stock Market Valuations

Several key indicators help us gauge whether stock market valuations are high. BofA's research frequently utilizes these metrics to assess market health and potential risks.

Price-to-Earnings Ratio (P/E):

The Price-to-Earnings ratio (P/E) is a primary metric for evaluating stock valuations. It represents the price an investor pays for each dollar of a company's earnings. BofA's analysis often compares current P/E levels to historical averages to determine whether valuations are elevated. Variations like the forward P/E (based on projected earnings) and the cyclically adjusted P/E (CAPE), which smooths out earnings fluctuations over a longer period, provide further insights.

- Comparison of current P/E ratios across different sectors: BofA's research often highlights disparities in P/E ratios across various sectors, indicating potentially overvalued or undervalued segments. Some sectors may exhibit significantly higher P/E ratios than their historical averages, signaling potential risk.

- Historical context of P/E ratios and their relationship to market cycles: Understanding the historical context of P/E ratios is crucial. High P/E ratios have often preceded market corrections or crashes, though not always. BofA's research often examines these historical relationships to provide context for current valuations.

- BofA's interpretation of current P/E levels and their projections: BofA regularly publishes reports interpreting current P/E levels and offering projections for future market performance. Their analyses consider macroeconomic factors and sector-specific trends to provide a comprehensive outlook.

Other Valuation Metrics:

While the P/E ratio is widely used, other valuation metrics provide a more comprehensive picture. BofA considers these additional indicators to refine its market valuation analysis.

- Advantages and disadvantages of using each metric: Metrics like Price-to-Sales (P/S), Price-to-Book (P/B), and dividend yield each have strengths and weaknesses. P/S is useful for companies with negative earnings, while P/B offers insights into a company's net asset value. Dividend yield reflects the return from dividends relative to the stock price. BofA weighs these factors in its assessment.

- How these metrics complement the P/E ratio: Using multiple valuation metrics provides a more robust assessment than relying solely on the P/E ratio. BofA's analysis often combines these metrics to identify potential discrepancies and refine its valuation conclusions.

- BofA’s assessment of these metrics in the current market: BofA's reports regularly analyze the interplay of these various metrics within the current market context, providing a holistic view of market valuation.

Interest Rate Impact:

Interest rates significantly influence stock valuations. Higher interest rates typically lead to lower stock prices, as investors shift towards higher-yielding bonds. BofA's outlook on interest rate hikes is a crucial component of its stock market valuation analysis.

- Explanation of the inverse relationship between interest rates and stock valuations: The inverse relationship stems from the opportunity cost of investing in stocks versus bonds. When interest rates rise, the attractiveness of bonds increases, potentially drawing investment away from stocks.

- BofA's predictions for future interest rate movements: BofA's economists regularly forecast future interest rate movements, providing valuable input for assessing potential impacts on stock valuations.

- How investors can adapt their strategies based on interest rate projections: Based on BofA's interest rate projections, investors can adjust their portfolio strategies, potentially shifting towards more defensive assets if rates are expected to rise significantly.

Potential Risks Associated with High Valuations

High stock market valuations inherently carry risks. BofA's research consistently highlights these potential downsides.

Market Corrections & Crashes:

Historically, periods of high valuations have often been followed by market corrections or even crashes. BofA analyzes historical data to assess the likelihood of such events.

- Examples of past market corrections and their causes: BofA's research often cites examples of past market corrections, analyzing their underlying causes, such as excessive speculation, economic downturns, or geopolitical events.

- BofA's assessment of the likelihood of a market correction: BofA's reports regularly assess the probability of a market correction or crash, considering current valuation levels, macroeconomic factors, and geopolitical risks.

- Strategies to mitigate risk during market volatility: BofA may suggest strategies to mitigate risk during periods of market volatility, such as diversifying investments, hedging strategies, or reducing exposure to riskier assets.

Inflationary Pressures:

Inflation erodes purchasing power and can impact corporate earnings, affecting stock valuations. BofA analyzes inflation's current trajectory and its effect on investor sentiment.

- How inflation erodes purchasing power and impacts corporate earnings: High inflation reduces the real value of future earnings, potentially leading to lower stock prices. BofA's research explores how inflation affects various sectors differently.

- BofA's analysis of inflation's effect on specific sectors: Certain sectors are more vulnerable to inflation than others. BofA's analyses highlight these vulnerabilities, helping investors make informed decisions.

- Strategies for investing during inflationary periods: BofA may suggest strategies for investing during inflationary periods, such as investing in inflation-protected securities or companies with pricing power.

Geopolitical Uncertainty:

Geopolitical instability can significantly impact stock market valuations. BofA analyzes global events and their potential market impact.

- Examples of geopolitical events that have impacted stock markets: BofA's research provides examples of past geopolitical events and their impact on stock markets, highlighting the potential for sudden shifts in investor sentiment.

- BofA's assessment of current geopolitical risks: BofA's analysts regularly assess current geopolitical risks and their potential impact on stock valuations, informing investors about potential market disruptions.

- Strategies for navigating geopolitical uncertainty: BofA may suggest strategies for navigating geopolitical uncertainty, such as diversifying geographically or investing in more resilient assets.

Conclusion:

Understanding high stock market valuations demands a comprehensive approach. BofA's analysis underscores the importance of considering multiple valuation metrics, recognizing the inherent risks associated with high valuations, and accounting for macroeconomic factors such as interest rates and inflation. While high valuations don't automatically predict a market crash, they necessitate a cautious strategy and careful consideration of your investment approach. By staying informed on BofA's research and other expert analyses, investors can navigate the complexities of high stock market valuations and make more informed decisions. Continue your research into understanding high stock market valuations and develop a robust investment strategy tailored to your risk tolerance.

Featured Posts

-

Newcastle United And Chelseas Pursuit Of Ligue 1 Talent

May 27, 2025

Newcastle United And Chelseas Pursuit Of Ligue 1 Talent

May 27, 2025 -

How Students Are Saving Affinity Graduations After College Policy Changes

May 27, 2025

How Students Are Saving Affinity Graduations After College Policy Changes

May 27, 2025 -

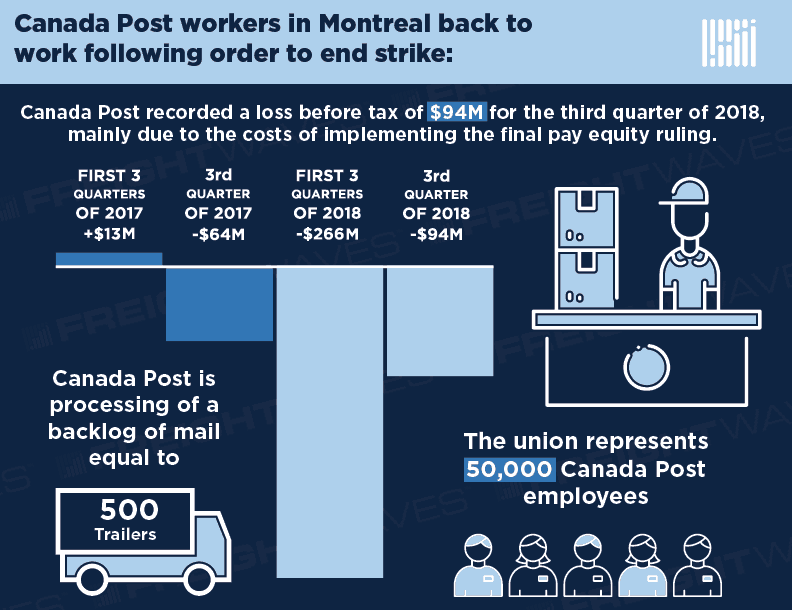

Will A Canada Post Strike Drive Customers To Competitors

May 27, 2025

Will A Canada Post Strike Drive Customers To Competitors

May 27, 2025 -

No Season 4 For Sex Lives Of College Girls Whats Next For The Cast

May 27, 2025

No Season 4 For Sex Lives Of College Girls Whats Next For The Cast

May 27, 2025 -

Ecole Maternelle Saint Ouen Vote Pour Un Demenagement Au Printemps

May 27, 2025

Ecole Maternelle Saint Ouen Vote Pour Un Demenagement Au Printemps

May 27, 2025

Latest Posts

-

Elon Musks Daughters New Career A Closer Look

May 30, 2025

Elon Musks Daughters New Career A Closer Look

May 30, 2025 -

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025

From Silicon Valley To Runway Vivian Musks Journey

May 30, 2025 -

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025

Analysis Of Vivian Jenna Wilsons Modeling Debut And Family Life

May 30, 2025 -

A Public Feud Bill Gates Serious Allegations Against Elon Musk And The Response

May 30, 2025

A Public Feud Bill Gates Serious Allegations Against Elon Musk And The Response

May 30, 2025 -

The Musk Gates Dispute Accusations Of Negligence And Child Mortality

May 30, 2025

The Musk Gates Dispute Accusations Of Negligence And Child Mortality

May 30, 2025