Understanding High Stock Market Valuations: BofA's View

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's stance on current stock market valuations often fluctuates, reflecting the dynamic nature of the market. While they don't offer a simple "bullish," "bearish," or "neutral" label, their assessments are typically data-driven and nuanced. They utilize a range of valuation metrics to form a comprehensive picture.

-

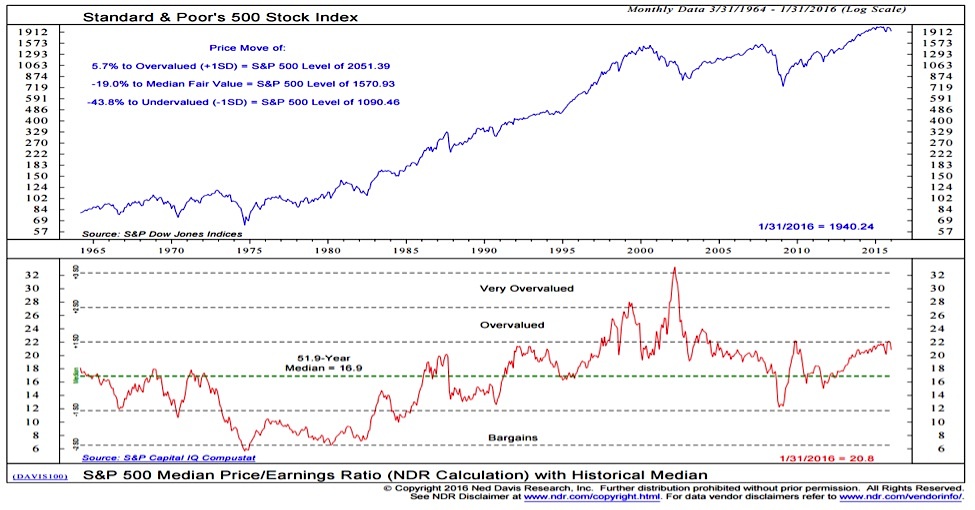

Specific valuation metrics used by BofA: BofA analysts frequently employ the Price-to-Earnings ratio (P/E ratio), the Shiller PE ratio (CAPE ratio, or cyclically adjusted price-to-earnings ratio), and other forward-looking metrics to assess market valuation. They may also consider measures like the market-to-book ratio and dividend yield. The specific weight given to each metric varies depending on the prevailing economic climate and market conditions.

-

BofA's justification for their assessment: BofA's justification for their assessment often considers a confluence of factors. Historically low interest rates, which encourage investment in riskier assets like stocks, play a significant role. Strong corporate earnings, particularly in certain sectors, also contribute to higher valuations. Furthermore, BofA's economic growth projections influence their outlook on stock market valuations. Positive forecasts typically support higher valuations, while negative projections suggest caution.

-

Specific sectors BofA highlights: BofA's research frequently highlights specific sectors as either overvalued or undervalued. For instance, during periods of robust technological advancement, the technology sector might be flagged as potentially overvalued. Conversely, sectors exhibiting slower growth or facing headwinds may be deemed undervalued. Their analysis considers the interplay between sector-specific factors and broader market dynamics to provide a nuanced perspective.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the elevated stock market valuations, many of which are central to BofA's analysis. These interconnected elements create a complex picture requiring careful consideration.

-

Impact of monetary policy: The Federal Reserve's monetary policy, including low interest rates and quantitative easing (QE) programs, has significantly influenced stock market valuations. Low interest rates reduce the cost of borrowing for businesses, encouraging investment and boosting corporate earnings, while QE increases the money supply, potentially inflating asset prices.

-

Role of technological advancements: Technological advancements and the growth of specific sectors, such as technology and renewable energy, have fueled stock market valuations. Investor enthusiasm for innovative companies and disruptive technologies often leads to higher valuations, even in the face of limited near-term profitability.

-

Influence of investor sentiment: Investor sentiment and market psychology play a crucial role. The "fear of missing out" (FOMO) can drive up prices, as investors rush to participate in what they perceive as a rapidly appreciating market. Increased participation from retail investors, fueled by easy access to trading platforms, can also amplify market movements.

-

Geopolitical factors: Geopolitical events and uncertainties exert a notable influence on stock market valuations. International conflicts, trade disputes, and political instability can create volatility and impact investor confidence, affecting valuations positively or negatively depending on the specific circumstances.

Potential Risks and Opportunities Associated with High Valuations

Investing in a highly valued market presents both risks and opportunities. BofA's research emphasizes the need for a balanced perspective.

-

Risk of market corrections or crashes: High valuations increase the vulnerability to market corrections or crashes. A sudden shift in investor sentiment or an unexpected economic downturn can trigger significant price declines.

-

Potential for higher volatility: Highly valued markets tend to exhibit higher volatility. Price swings can be more pronounced, increasing the risk for investors with shorter time horizons.

-

Opportunities for long-term investors: Despite the risks, high valuations don't necessarily preclude opportunities. Long-term investors with a diversified portfolio can potentially benefit from the long-term growth potential of the market.

-

Specific sectors or investment strategies: BofA may suggest specific sectors or investment strategies to mitigate risk and capitalize on opportunities. This may involve focusing on undervalued sectors, employing defensive investment strategies, or exploring alternative investment classes.

BofA's Recommendations for Investors

Navigating the current market environment requires a thoughtful and strategic approach. BofA typically advises investors to take a measured approach.

-

Investment strategies for mitigating risk: BofA often emphasizes the importance of diversification to mitigate risk. Spreading investments across different asset classes, sectors, and geographies can help reduce the impact of market downturns. Hedging strategies, such as using options or futures contracts, can further protect against losses.

-

Specific asset classes: Beyond equities, BofA might recommend other asset classes, such as bonds or real estate, to diversify portfolios and reduce overall risk. Alternative investments, such as private equity or hedge funds, may also be considered depending on investor risk tolerance and investment goals.

-

Importance of long-term horizons: BofA consistently stresses the importance of long-term investment horizons. Focusing on long-term growth potential, rather than short-term market fluctuations, can help investors weather market volatility and achieve their financial objectives.

-

Portfolio rebalancing: Regular portfolio rebalancing is crucial to maintain the desired asset allocation and manage risk. This involves selling some assets that have appreciated and buying others that have declined, bringing the portfolio back to its target allocation.

Conclusion

Understanding high stock market valuations is paramount for successful investing. BofA's analysis highlights the interplay of various factors – monetary policy, technological advancements, investor sentiment, and geopolitical events – in shaping current valuations. While high valuations present risks such as market corrections and increased volatility, they also offer long-term opportunities for diversified portfolios. BofA's recommendations emphasize risk mitigation through diversification, hedging, and long-term investment strategies, alongside careful consideration of asset allocation and portfolio rebalancing. By carefully considering BofA's perspective and incorporating their insights into your investment strategy, you can make more informed decisions about managing your portfolio in this dynamic market. Continue to research and stay updated on current stock market valuations to make optimal investment choices.

Featured Posts

-

Haaland Tynnplate As Strategisk Partnerskap Innen Global Forsvarsindustri

May 19, 2025

Haaland Tynnplate As Strategisk Partnerskap Innen Global Forsvarsindustri

May 19, 2025 -

Elderly British Driver Involved In French Motorway Crash After Wrong Way Drive

May 19, 2025

Elderly British Driver Involved In French Motorway Crash After Wrong Way Drive

May 19, 2025 -

Kypriako O Kateynasmos Enanti Tis Afairesis Tis Toyrkikis Simaias Apo Ton Pentadaktylo

May 19, 2025

Kypriako O Kateynasmos Enanti Tis Afairesis Tis Toyrkikis Simaias Apo Ton Pentadaktylo

May 19, 2025 -

I Istoria Toy Eyaggelismoy Tis T Heotokoy Sta Ierosolyma

May 19, 2025

I Istoria Toy Eyaggelismoy Tis T Heotokoy Sta Ierosolyma

May 19, 2025 -

From Scatological Documents To Engaging Podcast The Power Of Ai

May 19, 2025

From Scatological Documents To Engaging Podcast The Power Of Ai

May 19, 2025