Understanding High Stock Market Valuations: BofA's Viewpoint

Table of Contents

BofA's Key Indicators of High Valuations

BofA employs a range of metrics to assess market valuations, providing a comprehensive picture of market health. Key indicators frequently cited by BofA include:

-

Price-to-Earnings Ratio (P/E): This classic metric compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, often indicating high expectations for future growth. BofA's recent reports frequently mention P/E ratios exceeding historical averages across various sectors.

-

Shiller PE (CAPE Ratio): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a ten-year period, providing a more stable measure of valuation. BofA often uses the CAPE ratio to compare current valuations with historical norms, helping identify potential overvaluation.

-

Market Cap to GDP: This metric compares the total market capitalization of all publicly traded companies to the nation's gross domestic product (GDP). A high ratio can signal an overvalued market. BofA's analysis often incorporates this metric to gauge overall market health.

Examples of BofA's findings: Recent BofA reports have indicated that many of these key valuation metrics currently sit at levels exceeding those observed during previous market peaks. For example, they may cite a specific P/E ratio of 25, compared to a historical average of 15, highlighting a potential overvaluation of 67%. This comparison underscores the concern surrounding the current high stock market valuations.

Factors Contributing to High Valuations According to BofA

BofA identifies several macroeconomic factors contributing to the elevated stock market valuations:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies, boosting investment and potentially inflating asset prices, including stocks. This lowers the opportunity cost of investing in stocks, driving up demand.

-

Quantitative Easing (QE): Central bank policies like QE, where central banks inject liquidity into the financial system, can increase the money supply and fuel asset price inflation. BofA analysts often point to the impact of QE on market liquidity and investor sentiment.

-

Strong Corporate Earnings: Robust corporate earnings, particularly in the technology sector, support higher stock prices. However, BofA may caution that these earnings might not always justify the current high valuations if sustained growth isn’t projected.

-

Technological Innovation: Rapid technological advancements, particularly in areas like artificial intelligence and cloud computing, foster growth expectations and drive investment in technology stocks, contributing to overall market valuations.

BofA's Outlook and Potential Risks

BofA's outlook on the market often incorporates a nuanced perspective, acknowledging both the potential for further growth and the inherent risks associated with high valuations.

-

BofA's Predicted Market Trajectory: While BofA might express a cautiously optimistic or neutral outlook, they would also acknowledge the potential for market corrections.

-

Potential Scenarios Leading to a Market Correction: Factors like rising inflation, unexpected interest rate hikes, or geopolitical instability could trigger a market correction. BofA's analysts typically outline several scenarios and their probabilities.

-

Risks Associated with Inflation and Interest Rate Changes: Rising inflation and subsequent interest rate increases could negatively impact stock valuations by increasing borrowing costs and reducing corporate profitability. BofA’s analysis often highlights this risk.

-

BofA's Recommended Risk Mitigation Strategies: BofA typically advises investors to diversify their portfolios, implement hedging strategies, and carefully consider risk tolerance when making investment decisions.

Alternative Investment Strategies in a High-Valuation Market (BofA's Suggestions)

Given the potential risks associated with high stock market valuations, BofA often suggests exploring alternative investment options to diversify portfolios and mitigate risk:

-

Bonds: BofA may suggest allocating a portion of the portfolio to high-quality bonds, which can offer stability and income during periods of market uncertainty.

-

Real Estate: Real estate investments, both residential and commercial, can offer diversification and potential for capital appreciation.

-

Alternative Assets: This broad category includes private equity, hedge funds, and commodities, offering potential returns that are not always correlated with traditional stock markets. BofA might suggest specific alternative assets based on current market conditions.

Conclusion: Understanding and Navigating High Stock Market Valuations – A BofA Perspective

BofA's analysis indicates that current high stock market valuations present both opportunities and risks. The confluence of factors such as low interest rates, QE, robust corporate earnings, and technological innovation have contributed to elevated valuations. However, the risks associated with potential market corrections, inflation, and interest rate hikes cannot be ignored. BofA's suggested strategies – diversification, careful risk assessment, and consideration of alternative investments – are crucial for navigating this complex market landscape. Learn more about managing your portfolio in a high valuation market by exploring BofA's detailed reports and analysis. Understanding the implications of high stock market valuations with BofA's expert analysis is essential for making informed investment decisions.

Featured Posts

-

Farcical Misconduct Nottingham Families Plea For Procedural Delay

May 10, 2025

Farcical Misconduct Nottingham Families Plea For Procedural Delay

May 10, 2025 -

The China Market A Case Study Of Bmw And Porsches Struggles And Strategies

May 10, 2025

The China Market A Case Study Of Bmw And Porsches Struggles And Strategies

May 10, 2025 -

The 10 Best Film Noir Movies Ever Made

May 10, 2025

The 10 Best Film Noir Movies Ever Made

May 10, 2025 -

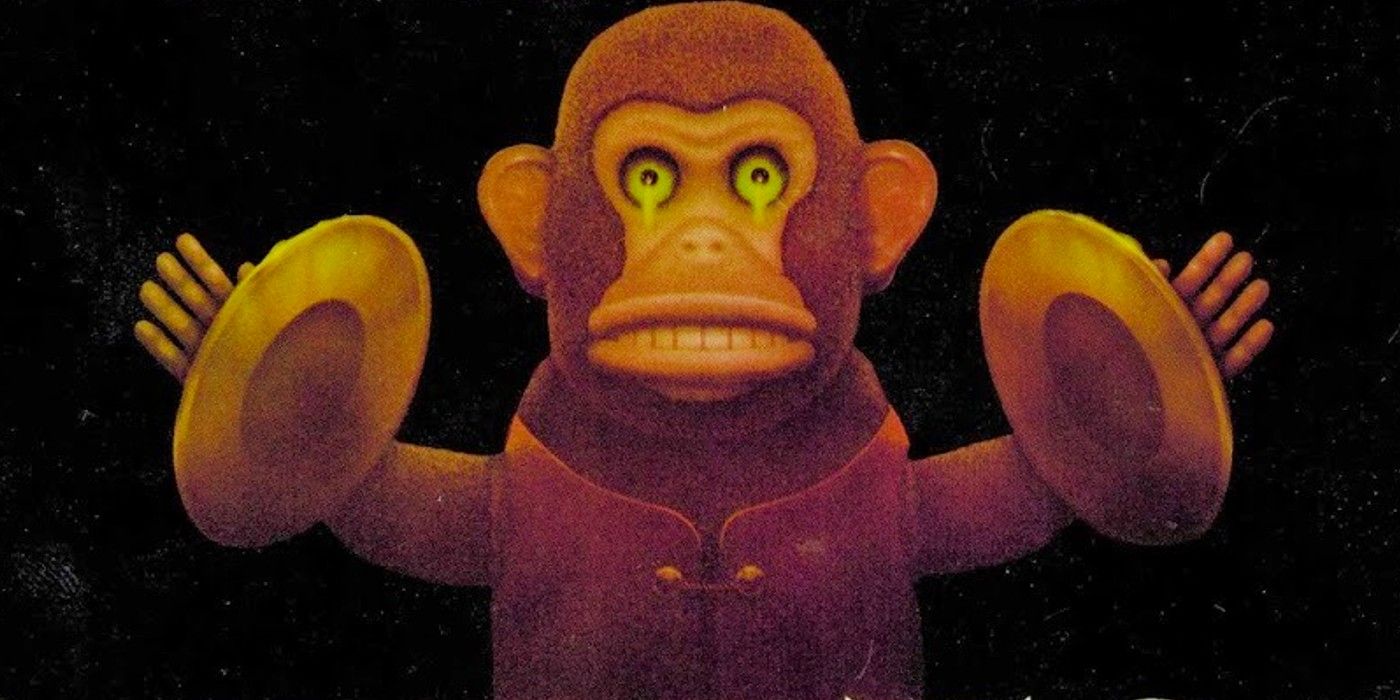

Stephen Kings 2025 Will The Monkey Adaptation Define A Successful Year

May 10, 2025

Stephen Kings 2025 Will The Monkey Adaptation Define A Successful Year

May 10, 2025 -

Reviving Downtowns The Role Of Sports Stadiums In Urban Renewal

May 10, 2025

Reviving Downtowns The Role Of Sports Stadiums In Urban Renewal

May 10, 2025