Understanding HMRC's Nudge Letters For Online Sellers (eBay, Vinted, Depop)

Table of Contents

What are HMRC's Nudge Letters?

HMRC nudge letters are friendly reminders, not formal tax assessments. They gently prompt online sellers on platforms such as eBay, Vinted, Depop, and others to check if they're meeting their tax obligations. Think of them as a helpful nudge in the right direction, rather than a threatening demand. These letters aren't about punishing you; they're about ensuring you're complying with tax laws. They typically contain information about your potential tax liabilities and links to helpful HMRC resources.

- Example Subject Line: "Check your online selling income – a reminder from HMRC"

- Types of Income Covered: Profits from sales, Value Added Tax (VAT) if applicable.

- Key Phrases Used: "Online sales," "tax obligations," "self-assessment," "register for self-assessment."

Why Did I Receive an HMRC Nudge Letter?

You might receive an HMRC nudge letter due to several reasons:

- Data Sharing: HMRC shares data with online marketplaces like eBay, Vinted, and Depop, allowing them to identify individuals who may not be declaring their income correctly.

- Algorithms: Sophisticated algorithms analyze sales data to pinpoint potential tax non-compliance.

- Inconsistencies: Previous tax returns might show inconsistencies that warrant further investigation.

Receiving a nudge letter doesn't automatically mean you're in trouble. It simply means HMRC wants to ensure you're aware of your responsibilities. Understanding your personal tax allowance and thresholds is crucial.

- Common Scenarios: Consistently high sales volume, selling high-value items, or failing to declare income from online sales.

- Income Triggers: Regular sales exceeding the personal allowance, income from multiple online platforms.

- Incorrect Letter: If you believe the letter contains inaccurate information, contact HMRC immediately using the details provided in the letter.

How to Respond to an HMRC Nudge Letter

Responding promptly to an HMRC nudge letter is essential. Delaying your response could lead to penalties. The best course of action depends on your individual circumstances:

- Register as Self-Employed: If you're not already registered, you need to register as self-employed with HMRC.

- File a Self-Assessment Tax Return: You'll need to complete and submit a self-assessment tax return, declaring your online sales income and any relevant expenses.

- Update Tax Information: If you're already registered, ensure your tax information is up-to-date and accurate.

HMRC offers various resources to help you navigate this process:

- Steps to Register: Visit the GOV.UK website to register for self-assessment.

- Tax Return Deadlines: Check the HMRC website for the relevant deadlines for submitting your tax return.

- HMRC Guidance: Access comprehensive guidance on online sales and tax obligations on the HMRC website.

- HMRC Contact: Use the contact information provided in the nudge letter or find contact details on the HMRC website.

Avoiding Future HMRC Nudge Letters

Proactive tax planning can prevent future nudge letters. Here are some essential steps:

- Accurate Record-Keeping: Maintain detailed records of all sales, expenses, and relevant transactions. Use accounting software for efficient record-keeping.

- Understand Tax Obligations: Thoroughly understand your tax obligations related to online sales, including VAT thresholds if applicable.

- Regular Filing: File your tax returns promptly and accurately to avoid any issues.

- Accounting Software: Employ accounting software specifically designed for online sellers to simplify the process and ensure accuracy.

Proactive tax planning offers significant benefits:

- Recommended Methods: Spreadsheet software, dedicated accounting apps, or engaging an accountant.

- Useful Software: Xero, QuickBooks, FreeAgent are just a few examples.

- Tax Regulation Resources: Consult the HMRC website or seek professional advice.

Conclusion: Understanding and Responding to HMRC Nudge Letters for Online Success

HMRC nudge letters are reminders to review your tax obligations as an online seller. Understanding why you received a letter and how to respond appropriately is crucial for avoiding potential penalties. Prompt action is key. Take control of your tax affairs; don't ignore HMRC's nudge letters! Take proactive steps to understand your tax obligations as an online seller on eBay, Vinted, and Depop and avoid potential issues. Visit the HMRC website for more information or seek professional tax advice today.

Featured Posts

-

Huuhkajien Uudistunut Valmennus Ja Tie Mm Karsintoihin

May 20, 2025

Huuhkajien Uudistunut Valmennus Ja Tie Mm Karsintoihin

May 20, 2025 -

Friisin Avauskokoonpano Kamaran Ja Pukin Tilalla Uudet Pelaajat

May 20, 2025

Friisin Avauskokoonpano Kamaran Ja Pukin Tilalla Uudet Pelaajat

May 20, 2025 -

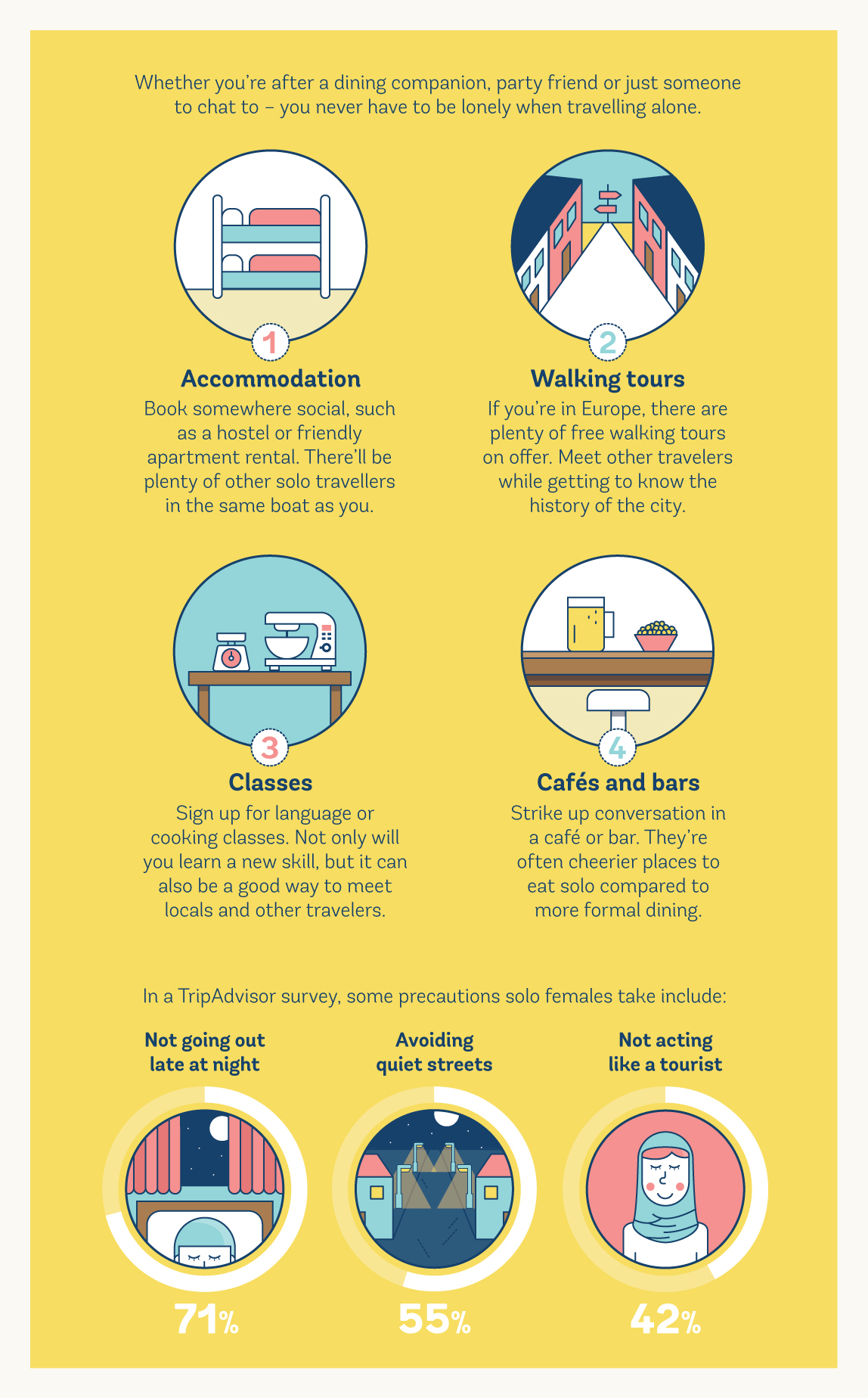

The Ultimate Guide To Solo Female Travel

May 20, 2025

The Ultimate Guide To Solo Female Travel

May 20, 2025 -

Analyzing Suki Waterhouses Iconic Met Gala Appearance

May 20, 2025

Analyzing Suki Waterhouses Iconic Met Gala Appearance

May 20, 2025 -

Exploring Agatha Christies Poirot A Literary Analysis Of The Master Detective

May 20, 2025

Exploring Agatha Christies Poirot A Literary Analysis Of The Master Detective

May 20, 2025