Understanding ING Group's 2024 Performance: A Look At The Form 20-F

Table of Contents

Key Financial Highlights from ING Group's 20-F Filing

ING Group's 20-F filing for 2024 (replace with actual year once available) will reveal key financial metrics that provide a snapshot of their overall performance. These metrics will be instrumental in assessing the company's profitability, growth trajectory, and overall financial health. We will analyze crucial elements including net profit, revenue growth, and return on equity (ROE). Year-over-year comparisons will highlight the trends and provide context for understanding the company's performance. Key performance indicators (KPIs) will be examined for significant changes, providing valuable insights into the drivers of ING Group's financial results.

- Net income growth/decline percentage: (Insert data from the 20-F filing once available. For example: "A 5% increase in net income compared to 2023 suggests strong financial performance.")

- Revenue growth/decline percentage: (Insert data from the 20-F filing once available. For example: "Revenue growth of 8% indicates expansion in key market segments.")

- Significant changes in key expense categories: (Analyze expense categories like operating expenses, interest expenses, and identify significant variations and their impact on profitability. For example: "A decrease in operating expenses due to cost-cutting measures contributed to improved profitability.")

- ROE and other profitability metrics: (Include data and interpretation of ROE, Return on Assets (ROA), and other relevant metrics to assess the efficiency and profitability of ING Group's operations. For example: "A robust ROE of 12% reflects efficient capital utilization and strong profitability.")

Keywords: ING Group financial results, key performance indicators, profitability, revenue, net income, return on equity.

ING Group's Segment Performance Analysis (20-F)

ING Group operates across various segments, including Wholesale Banking, Retail Banking, and potentially others. Analyzing the performance of each segment independently provides a more granular understanding of ING Group's overall performance. The 20-F filing will offer detailed breakdowns of each segment's contribution to revenue and profit, allowing for a nuanced assessment of their individual strengths and weaknesses. Comparing segment performance year-over-year will illuminate growth trends and highlight areas of strategic focus.

- Growth or decline in each segment: (Analyze the growth or decline in each segment and provide specific numerical data from the 20-F filing. For example: "The Wholesale Banking segment experienced a 10% increase in revenue, while Retail Banking showed a more moderate growth of 5%.")

- Contribution of each segment to overall revenue and profit: (Show the percentage contribution of each segment to total revenue and profit, highlighting the most significant contributors. For example: "Wholesale Banking contributed 60% to total revenue, reflecting its importance in ING Group's overall business.")

- Market share analysis (if data available): (If market share data is available in the 20-F filing, analyze the trends and implications for ING Group's competitive positioning.)

Keywords: ING Group segments, wholesale banking, retail banking, segment performance, market share.

Risk Factors and Outlook as Detailed in the ING Group 20-F

The Form 20-F filing will include a detailed discussion of the risks facing ING Group. Understanding these risks is critical for assessing the company's future prospects and potential challenges. The analysis will focus on significant risk factors disclosed, examining their potential impact on future performance and how management plans to mitigate them.

- Key identified risks (e.g., geopolitical, economic, regulatory): (Identify and discuss major risks such as geopolitical instability, economic downturns, regulatory changes, cybersecurity threats, and credit risk based on the 20-F filing.)

- Management's response to these risks: (Analyze how management intends to address and mitigate these identified risks, outlining their strategies and contingency plans.)

- Potential impact on future earnings: (Assess the potential financial impact of these risks on future earnings and profitability. For example: "Increased regulatory scrutiny could lead to higher compliance costs, potentially impacting short-term profitability.")

Keywords: ING Group risks, risk factors, financial outlook, regulatory risks, economic risks, geopolitical risks.

Interpreting ING Group's 20-F for Investment Decisions

The information contained within ING Group's 20-F filing is invaluable for investors seeking to make informed decisions. This section will offer insights into how investors can utilize the 20-F data to develop effective investment strategies. A balanced perspective will be presented, considering both the opportunities and challenges facing ING Group.

- Valuation analysis (if possible): (If data permits, perform a basic valuation analysis to determine if ING Group's stock is undervalued or overvalued based on financial metrics from the 20-F.)

- Comparison to competitors: (Compare ING Group's financial performance and key metrics with its main competitors to assess its relative strength and position in the market.)

- Long-term growth potential: (Assess ING Group's long-term growth potential based on its strategic initiatives, market position, and overall financial health as detailed in the 20-F.)

Keywords: ING Group investment, stock analysis, financial analysis, investment strategy, long-term investment.

Understanding ING Group's 2024 Performance – Key Takeaways and Next Steps

In conclusion, a thorough analysis of ING Group's 2024 Form 20-F filing provides valuable insights into their financial performance, segmental contributions, risk factors, and future outlook. Understanding this information is crucial for investors and stakeholders to make informed decisions. This analysis highlights the importance of reviewing the complete 20-F for a comprehensive understanding of ING Group's financial position. For a deeper dive into ING Group's financial performance and to access the full 20-F filing, visit [link to ING Group investor relations website]. Keywords: ING Group 20-F, ING Group financial statements, ING Group investor relations.

Featured Posts

-

Autobezit En Occasionverkoop Positieve Cijfers Bij Abn Amro

May 22, 2025

Autobezit En Occasionverkoop Positieve Cijfers Bij Abn Amro

May 22, 2025 -

Fans React To Peppa Pigs Mums Baby Gender Reveal

May 22, 2025

Fans React To Peppa Pigs Mums Baby Gender Reveal

May 22, 2025 -

Gospodin Savrsenog Vanja I Sime Fotografije Koje Su Zapalile Internet

May 22, 2025

Gospodin Savrsenog Vanja I Sime Fotografije Koje Su Zapalile Internet

May 22, 2025 -

A Young Louth Food Business Success Story Mentoring And Growth

May 22, 2025

A Young Louth Food Business Success Story Mentoring And Growth

May 22, 2025 -

Lideri Finansovogo Sektoru Ukrayini Za Pidsumkami 2024 Roku Reyting Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025

Lideri Finansovogo Sektoru Ukrayini Za Pidsumkami 2024 Roku Reyting Credit Kasa Finako Ukrfinzhitlo Atlani Ta Credit Plus

May 22, 2025

Latest Posts

-

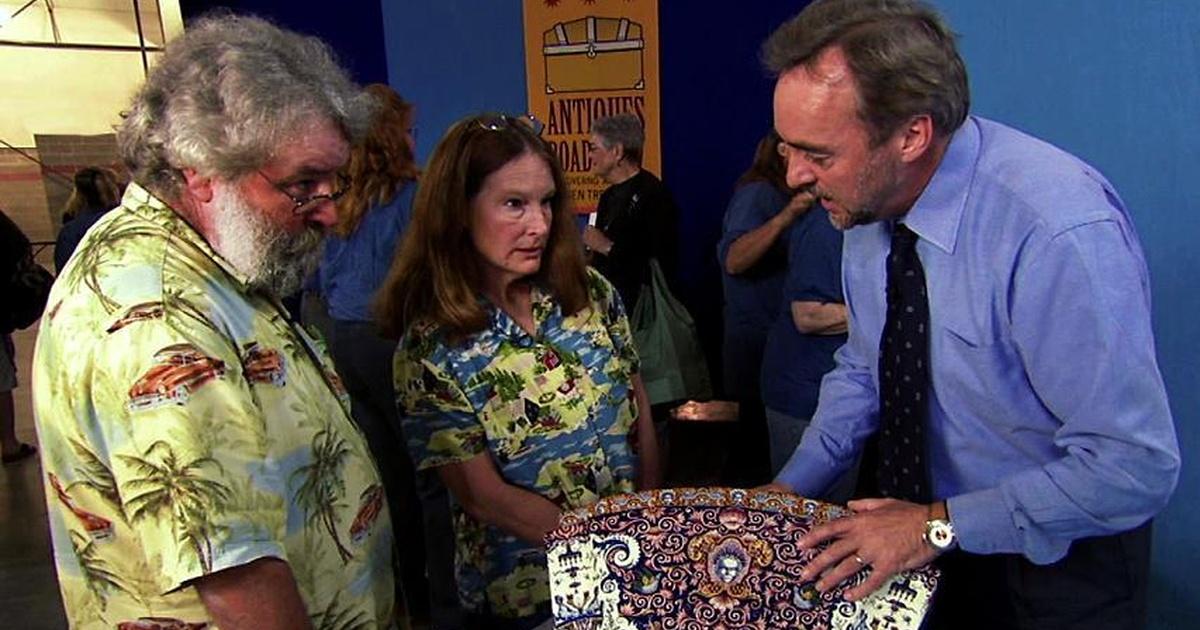

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025

Antiques Roadshow National Treasure Appraisal Leads To Arrest Of Couple For Trafficking

May 22, 2025 -

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025

Antiques Roadshow Stolen Artifacts Result In Couples Arrest

May 22, 2025 -

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025

National Treasure Trafficking Antiques Roadshow Episode Results In Arrests

May 22, 2025 -

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025

Antiques Roadshow Leads To Jail Time For Couple With Stolen Items

May 22, 2025 -

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025

Us Couple Facing Charges After Bbc Antiques Roadshow Episode

May 22, 2025