Understanding Investor Reactions During Market Corrections

Table of Contents

Common Investor Behaviors During Market Corrections

Market corrections trigger a range of emotional responses. Fear, panic, and regret are common feelings, often leading to impulsive actions that can negatively impact long-term investment goals. Understanding these typical reactions is the first step towards mitigating their effects.

- Panic Selling: This is the impulsive selling of assets at a loss, driven primarily by fear. Investors, seeing their portfolio values decline, often react by selling everything, locking in losses and missing out on potential future gains. This is a classic example of emotional investing overriding rational decision-making.

- Herd Behavior: The tendency to follow the actions of others, particularly during times of uncertainty, is known as herd behavior. If many investors are selling, others may follow suit, exacerbating the market downturn and creating a self-fulfilling prophecy. This market sentiment can lead to irrational decisions.

- Emotional Decision-Making: Fear and greed are powerful emotions that can significantly influence investment choices. During market corrections, fear often dominates, prompting investors to abandon their long-term investment strategies and make decisions based on short-term market fluctuations.

- Ignoring Long-Term Goals: The focus shifts from long-term investment objectives to the immediate market turmoil. Investors may abandon their carefully crafted plans, jeopardizing their financial future.

Analyzing Rational Responses to Market Corrections

While emotional responses are common during market corrections, rational investors employ strategies focused on long-term growth and risk management. Sticking to a well-defined investment plan is critical during these periods.

- Sticking to Your Investment Plan: The cornerstone of successful investing is having a robust plan and adhering to it, even during market corrections. This requires discipline and a long-term perspective.

- Portfolio Rebalancing: Regularly reviewing and adjusting your asset allocation to maintain your desired risk level is crucial. Market corrections can disrupt your carefully planned asset allocation; rebalancing helps restore it.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market fluctuations, helps mitigate the risk of buying high and selling low. This strategy leverages market volatility to your advantage over the long term.

- Value Investing: Market corrections often create opportunities to identify undervalued assets. Value investors patiently search for these opportunities, taking advantage of the temporary dips to build their portfolios.

The Role of Diversification in Mitigating Losses During Market Corrections

Diversification is a fundamental principle of risk management. It significantly reduces the impact of market corrections on a portfolio. Spreading investments across different asset classes and geographies mitigates the risk of significant losses.

- Diversification Across Asset Classes: A well-diversified portfolio includes stocks, bonds, real estate, and potentially alternative investments. Different asset classes tend to react differently to market downturns, offering a degree of protection.

- Geographic Diversification: Investing in assets from different countries reduces exposure to country-specific risks and economic downturns. Global diversification helps buffer your portfolio against localized market corrections.

- Sector Diversification: Investing across different industry sectors ensures that your portfolio isn’t overly reliant on the performance of a single sector. This reduces exposure to sector-specific downturns.

Understanding Your Risk Tolerance

Before making any investment decisions, it's essential to understand your own risk tolerance. Your investment strategy should align with your personal risk profile, financial goals, and time horizon.

- Risk Assessment: Honest self-assessment is crucial. Consider your comfort level with potential losses and your ability to withstand market volatility.

- Risk Tolerance Questionnaire: Online questionnaires can help you objectively assess your risk tolerance.

- Financial Advisor Consultation: Consulting a financial advisor can provide valuable insights and personalized guidance to develop an investment strategy tailored to your needs.

Conclusion

Market corrections are a normal part of the investment cycle. While understanding investor behavior during these periods is crucial, equally important is developing rational responses. By sticking to a well-defined investment plan, utilizing strategies like portfolio rebalancing and dollar-cost averaging, and ensuring proper diversification, investors can mitigate losses and potentially capitalize on market opportunities. Knowing your risk tolerance is paramount in guiding your investment decisions. Learning to navigate market corrections is a continuous process, but by understanding your own investor reactions and embracing disciplined investment practices, you can improve your chances of long-term success. Continue learning about managing your investments during market corrections and developing a robust investment strategy suited to your personal financial goals. Explore our related articles on risk management and portfolio diversification to further enhance your understanding.

Featured Posts

-

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025

Hudsons Bay Closing Sale Deep Discounts On Remaining Inventory

Apr 28, 2025 -

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025

Coras Strategic Lineup Tweaks For Red Sox Doubleheader

Apr 28, 2025 -

Legal Showdown Minnesota Challenges Trumps Transgender Athlete Ban

Apr 28, 2025

Legal Showdown Minnesota Challenges Trumps Transgender Athlete Ban

Apr 28, 2025 -

Uae Tourist Sim Card 10 Gb Data And 15 Off Abu Dhabi Attractions

Apr 28, 2025

Uae Tourist Sim Card 10 Gb Data And 15 Off Abu Dhabi Attractions

Apr 28, 2025 -

Michael Jordan Backs Denny Hamlin Analyzing The You Boo Him Mentality

Apr 28, 2025

Michael Jordan Backs Denny Hamlin Analyzing The You Boo Him Mentality

Apr 28, 2025

Latest Posts

-

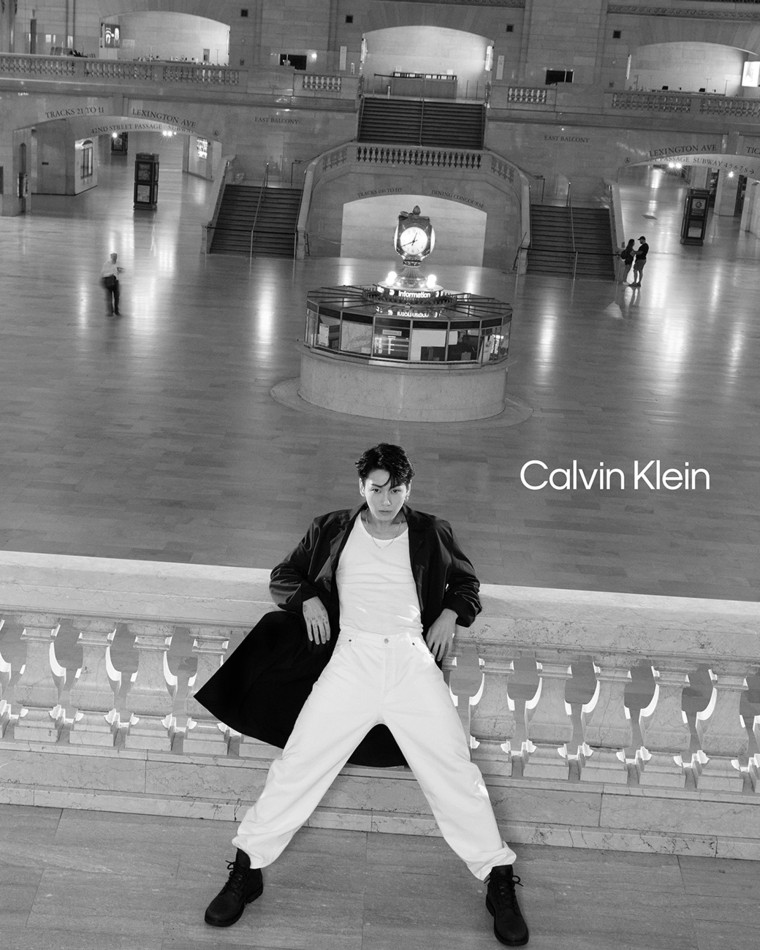

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 11, 2025

Lily Collins Stars In A New Calvin Klein Campaign See The Photos

May 11, 2025 -

Kim Kardashi An Stilska Kreatsi A Shto Gi Potentsira Ne Zinite Atributi

May 11, 2025

Kim Kardashi An Stilska Kreatsi A Shto Gi Potentsira Ne Zinite Atributi

May 11, 2025 -

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133600

May 11, 2025

Lily Collins Sizzling New Calvin Klein Campaign Photo 5133600

May 11, 2025 -

Lily Collins Shares Her Experience As A New Mom

May 11, 2025

Lily Collins Shares Her Experience As A New Mom

May 11, 2025 -

Lily Collins And Charlie Mc Dowells Growing Family Photos Of Tove

May 11, 2025

Lily Collins And Charlie Mc Dowells Growing Family Photos Of Tove

May 11, 2025