Understanding Personal Loan Interest Rates Today: A Borrower's Guide

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors is the first step to securing a low rate.

Credit Score: The Foundation of Your Interest Rate

Your credit score is arguably the most significant factor determining your personal loan interest rates. Lenders use your credit score to assess your creditworthiness – essentially, how likely you are to repay the loan on time. A higher credit score indicates lower risk to lenders, resulting in lower interest rates.

- Excellent credit score (750+): Expect to access the best personal loan interest rates and the most favorable loan terms. You'll likely qualify for the lowest APRs (Annual Percentage Rates) available.

- Good credit score (700-749): You'll still receive competitive rates, but they might be slightly higher than those offered to borrowers with excellent credit.

- Fair credit score (650-699): Be prepared for higher interest rates on personal loans. You might need a co-signer to improve your chances of approval.

- Poor credit score (below 650): Expect significantly higher interest rates, and securing a loan approval may be difficult. Consider exploring options to improve your credit score before applying.

- Improving Your Credit Score: Before applying for a personal loan, take steps to improve your credit score. This includes paying bills on time, keeping credit utilization low, and addressing any errors on your credit report.

Loan Amount and Term: Size and Time Matter

The amount you borrow and the length of your repayment term also impact your personal loan rates. Larger loan amounts and longer repayment terms typically result in higher interest rates due to increased risk for the lender.

- Shorter loan terms: Usually mean higher monthly payments but lower overall interest paid. This is often the most cost-effective approach in the long run.

- Longer loan terms: Result in lower monthly payments, but significantly higher total interest paid over the life of the loan.

- Choosing the Right Term: Carefully consider your budget and repayment capacity when choosing a loan term. Balance affordability with the long-term cost of interest.

Debt-to-Income Ratio (DTI): Showing Financial Responsibility

Lenders assess your debt-to-income ratio (DTI) to determine your ability to manage your existing debts and repay the new personal loan. A higher DTI suggests a greater financial burden, potentially leading to higher interest rates.

- Lowering Your DTI: Before applying for a loan, strive to lower your DTI by paying down existing debts. This demonstrates responsible financial management.

- DTI as a Key Indicator: Lenders view your DTI as a crucial indicator of your financial responsibility and ability to handle additional debt.

- Impact on Interest Rates: A lower DTI significantly improves your chances of securing a lower interest rate on your personal loan.

Lender Type and Competition: Shopping Around for the Best Rates

Different lenders offer varying interest rates on personal loans. Comparing offers from multiple sources is vital to securing the best deal.

- Credit Unions: Often offer lower interest rates than traditional banks, especially for members.

- Online Lenders: Can provide competitive rates and a streamlined application process.

- Banks: While often convenient, banks may not always offer the most competitive rates.

- Comparing Offers: Actively shop around and compare offers from various lenders before making a decision.

How to Find the Best Personal Loan Interest Rates

Securing the best interest rates on personal loans requires proactive steps.

Check Your Credit Report: Accuracy is Key

Before applying for a personal loan, review your credit report for any errors that could negatively affect your score. Dispute any inaccuracies with the relevant credit bureaus.

Improve Your Credit Score: A Proactive Approach

Take steps to improve your credit score before applying. This includes consistently paying bills on time, keeping credit utilization low, and maintaining a diverse credit history.

Compare Loan Offers: Utilize Online Tools

Use online comparison tools and websites to efficiently compare offers from multiple lenders. This allows for a quick overview of available rates and terms.

Negotiate with Lenders: Don't Be Afraid to Ask

Don't hesitate to negotiate with lenders. Explain your financial situation and try to negotiate a lower interest rate based on your creditworthiness and other factors.

Consider Secured Loans: Collateral for Lower Rates

Secured loans, which use collateral (like a car or savings account) to back the loan, often offer lower interest rates than unsecured personal loans.

Conclusion: Securing the Best Personal Loan Rates

Understanding personal loan interest rates is paramount for securing favorable borrowing terms and avoiding overpaying on interest. By understanding the factors influencing rates—credit score, loan amount, DTI, and lender type—borrowers can proactively improve their chances of obtaining the best personal loan interest rates. Remember to check your credit report, compare loan offers from multiple lenders, and negotiate to secure the most advantageous terms. Start comparing personal loan interest rates today and find the best loan that fits your financial needs and budget!

Featured Posts

-

Cristiano Ronaldo Al Nassr Macerasi Devam Ediyor

May 28, 2025

Cristiano Ronaldo Al Nassr Macerasi Devam Ediyor

May 28, 2025 -

Saudia Buka Rute Penerbangan Baru Bali Jeddah

May 28, 2025

Saudia Buka Rute Penerbangan Baru Bali Jeddah

May 28, 2025 -

Prvni Zpravy Pirati A Zeleni Spolupracuji Na Ziskani Snemovny

May 28, 2025

Prvni Zpravy Pirati A Zeleni Spolupracuji Na Ziskani Snemovny

May 28, 2025 -

The Future Of Nintendo Balancing Innovation And Familiar Formulas

May 28, 2025

The Future Of Nintendo Balancing Innovation And Familiar Formulas

May 28, 2025 -

Italian Open Sinners Relief No Grand Slam Absence During Doping Ban

May 28, 2025

Italian Open Sinners Relief No Grand Slam Absence During Doping Ban

May 28, 2025

Latest Posts

-

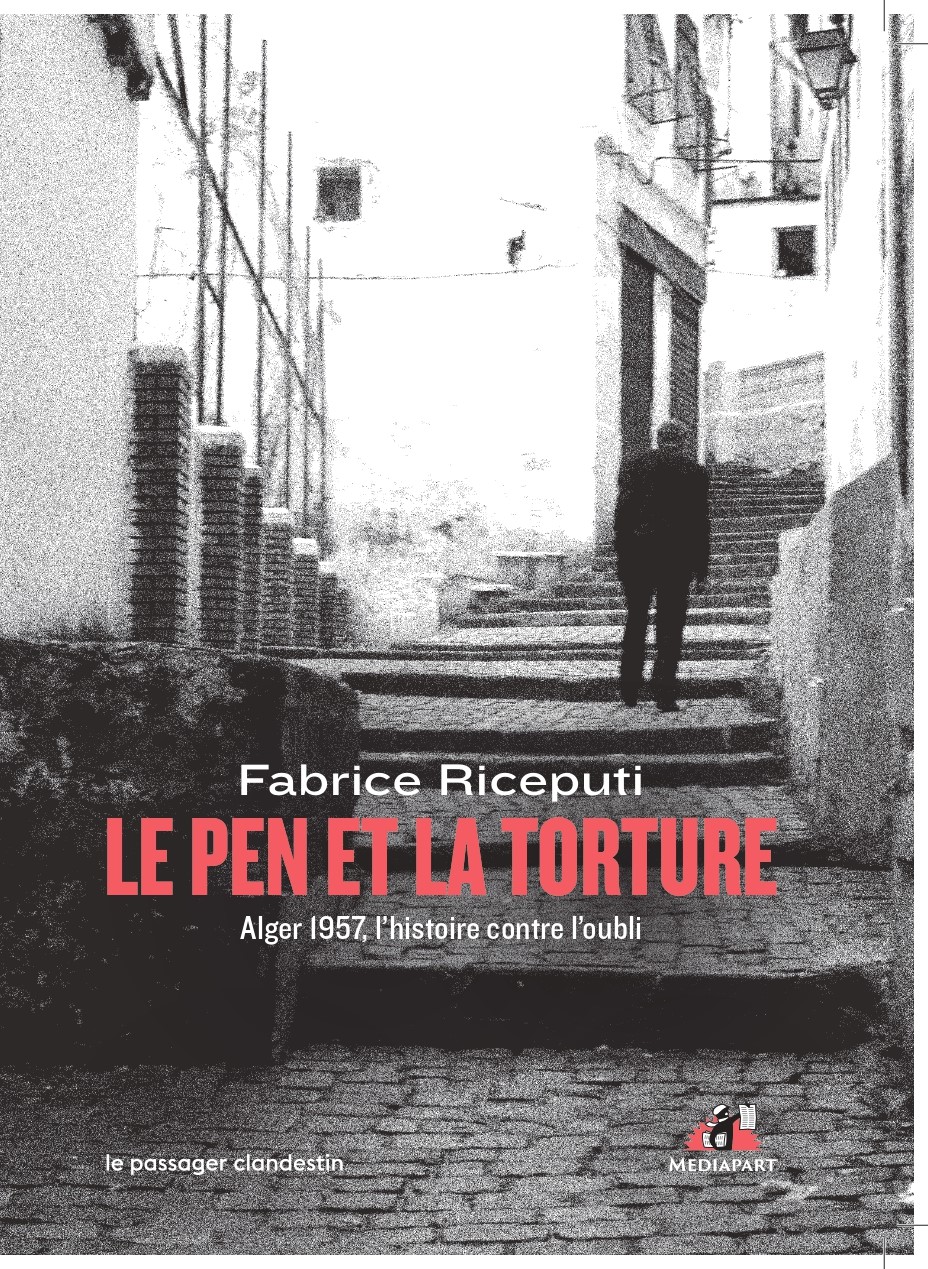

Marine Le Pen Et La Presidentielle 2027 Jacobelli Denonce Une Tentative D Exclusion

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Jacobelli Denonce Une Tentative D Exclusion

May 30, 2025 -

Elections 2027 Laurent Jacobelli Affirme Que Marine Le Pen Pourrait Etre Empechee De Se Presenter

May 30, 2025

Elections 2027 Laurent Jacobelli Affirme Que Marine Le Pen Pourrait Etre Empechee De Se Presenter

May 30, 2025 -

Le 9 Mai 2025 Arcelor Mittal Et La Russie Selon Laurent Jacobelli

May 30, 2025

Le 9 Mai 2025 Arcelor Mittal Et La Russie Selon Laurent Jacobelli

May 30, 2025 -

Hanouna Le Pen 2027 Jacobelli S Inquiete D Une Exclusion De La Candidate

May 30, 2025

Hanouna Le Pen 2027 Jacobelli S Inquiete D Une Exclusion De La Candidate

May 30, 2025 -

Le Depute Jacobelli Se Felicite De La Decision De Justice Concernant Le Rn En 2026

May 30, 2025

Le Depute Jacobelli Se Felicite De La Decision De Justice Concernant Le Rn En 2026

May 30, 2025