Understanding Principal Financial Group (PFG): An Analyst's Perspective

Table of Contents

PFG's Business Model and Core Offerings

Principal Financial Group (PFG)'s business model centers around providing a diverse range of financial products and services catering to individual and institutional clients. Their core offerings span across several key segments: retirement planning, insurance solutions, and asset management. PFG's target market is broad, encompassing individuals saving for retirement, corporations seeking retirement plan solutions for their employees, and institutional investors needing sophisticated asset management strategies.

- Retirement Plans: PFG offers a comprehensive suite of retirement solutions, including 401(k) plans, annuities, and other retirement savings vehicles. Their market share in the retirement planning sector is substantial, reflecting their strong brand recognition and wide distribution network. Understanding PFG retirement solutions is key to comprehending their overall market position.

- Insurance Products: The company provides a variety of insurance products, such as life insurance, disability insurance, and long-term care insurance, aimed at protecting individuals and families against financial risks. These products are designed to offer various levels of coverage and flexibility.

- Investment Management Services: PFG offers a broad range of investment management services, utilizing diverse investment strategies to meet the varying needs of their clients. These services cater to both individual and institutional investors, leveraging professional expertise to build and manage portfolios. Examples of successful products and services include their tailored retirement plan designs for corporations and their actively managed mutual funds that have consistently outperformed benchmarks.

The strengths of PFG's business model lie in its diversification across various financial services, its established brand reputation, and its extensive distribution network. However, weaknesses include its sensitivity to interest rate changes and its exposure to market volatility, common vulnerabilities within the PFG business model.

Financial Performance Analysis of Principal Financial Group (PFG)

Analyzing Principal Financial Group (PFG)'s financial performance requires examining key metrics such as revenue growth, profitability, and financial ratios. Reviewing PFG financial statements reveals consistent performance over the years, though results can fluctuate based on market conditions.

- Yearly Revenue Growth Analysis: PFG has demonstrated consistent revenue growth over the past several years, although the rate of growth has varied depending on economic conditions. This trend should be analyzed further by comparing it against industry averages. Access to PFG financial statements is crucial for this in-depth analysis.

- Profitability Margins and Trends: Profitability margins, including net profit margins and return on equity (ROE), have shown a positive trend, indicating effective cost management and operational efficiency. Further scrutiny of PFG earnings reports is needed to evaluate the sustainability of these trends.

- Key Financial Metrics Compared to Industry Benchmarks: Comparing PFG's key financial metrics, such as return on assets (ROA) and debt-to-equity ratio, against industry benchmarks provides insights into its relative performance and financial health. This comparative analysis is vital in determining PFG's competitive strength.

Significant financial events, such as acquisitions or divestitures, also impact PFG’s financial performance. A thorough examination of these events and their impact is crucial for a comprehensive analysis. Interest rate changes and overall market conditions are other significant factors impacting PFG's financial performance.

Competitive Landscape and Strategic Positioning of PFG

Principal Financial Group (PFG) operates in a highly competitive financial services landscape. Identifying PFG competitors and assessing PFG’s competitive advantages is critical. Major competitors include other large financial services companies offering similar products and services.

- Competitive Analysis of Market Share: PFG holds significant market share in several segments, particularly in retirement planning and insurance. However, competition is intense, and market share fluctuates due to evolving consumer preferences and technological advancements.

- Comparison of PFG's Products and Services against Competitors: PFG's competitive advantage lies in its diversified offerings, strong brand reputation, and established distribution networks. However, competitors offer similar services, making product differentiation and strong branding vital.

- Analysis of PFG's Strategic Initiatives: PFG's strategic initiatives, including mergers, acquisitions, and technological investments, aim to enhance its competitive position and expand its market reach. Examining these initiatives reveals their impact on overall market standing. PFG’s brand reputation and customer loyalty also play a significant role in its overall competitive position.

PFG's long-term strategic direction focuses on innovation, diversification, and customer-centricity. Sustainability of these strategies is a critical factor in evaluating the company's long-term prospects.

Future Outlook and Investment Implications for Principal Financial Group (PFG)

The future outlook for Principal Financial Group (PFG) depends on various factors, including macroeconomic conditions, technological advancements, and regulatory changes. Several key considerations shape the future:

- Potential Future Acquisitions or Strategic Partnerships: PFG may pursue strategic acquisitions or partnerships to expand its product offerings or enter new markets. These actions significantly influence future growth prospects.

- Analysis of Technological Disruptions: The impact of technological disruption on PFG's operations and business model is a significant concern. Adaptability to FinTech advancements is crucial for long-term success.

- Projected Revenue and Earnings Growth Forecasts: Analyzing revenue and earnings growth forecasts provides insights into the potential returns on investment in PFG. These projections should be considered cautiously, given inherent market uncertainty.

- Potential Risks and Uncertainties: Risks and uncertainties associated with PFG include market volatility, interest rate fluctuations, and regulatory changes. Understanding these risks is vital for informed investment decisions.

Based on the above analysis, an investment recommendation for PFG would need to consider factors such as risk tolerance, investment horizon, and market outlook. A balanced approach to investment in PFG considering both the opportunities and risks presented is paramount.

Conclusion: Understanding Principal Financial Group (PFG): Key Takeaways and Call to Action

This analysis of Principal Financial Group (PFG) highlights its diverse business model, consistent financial performance, strong competitive position, and promising future outlook, while acknowledging the inherent risks in the financial services industry. PFG's strengths lie in its diversification, brand recognition, and established distribution networks. However, sensitivity to market volatility and interest rate fluctuations remain key weaknesses.

The future success of PFG depends on its ability to adapt to technological advancements, navigate regulatory changes, and capitalize on growth opportunities. Further research into Principal Financial Group (PFG) dividend payout and PFG ESG initiatives would provide a more nuanced understanding of the company's financial health and commitment to sustainability. We encourage investors to conduct further due diligence before making any investment decisions, considering the analysis presented here as a valuable starting point. Understanding PFG is crucial for anyone navigating today’s complex financial landscape.

Featured Posts

-

The Listeners March Lineup A Guide To End Of The Valley And Temuera Morrison

May 17, 2025

The Listeners March Lineup A Guide To End Of The Valley And Temuera Morrison

May 17, 2025 -

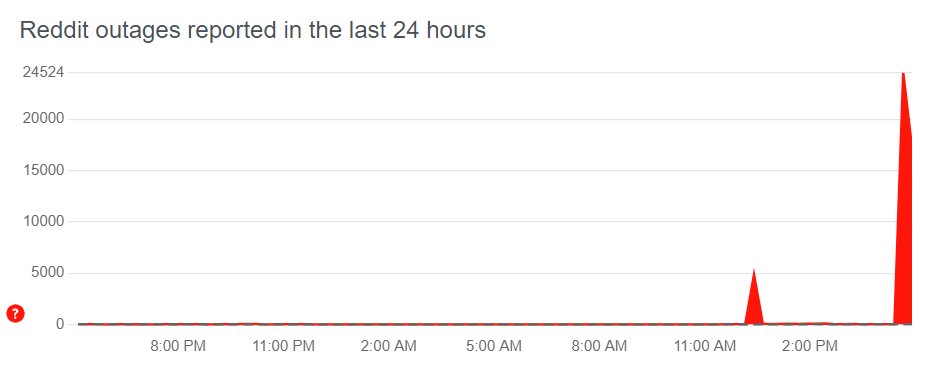

Worldwide Reddit Outage Leaves Thousands Offline

May 17, 2025

Worldwide Reddit Outage Leaves Thousands Offline

May 17, 2025 -

Facing A Salary Gap In Todays Job Market Finding Your Next Career Move

May 17, 2025

Facing A Salary Gap In Todays Job Market Finding Your Next Career Move

May 17, 2025 -

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025

Novak Djokovic Kortlarda Zirvenin Yenilmez Krali

May 17, 2025 -

Analyzing The Challenges Why Bmw And Porsche Are Facing Difficulties In China

May 17, 2025

Analyzing The Challenges Why Bmw And Porsche Are Facing Difficulties In China

May 17, 2025