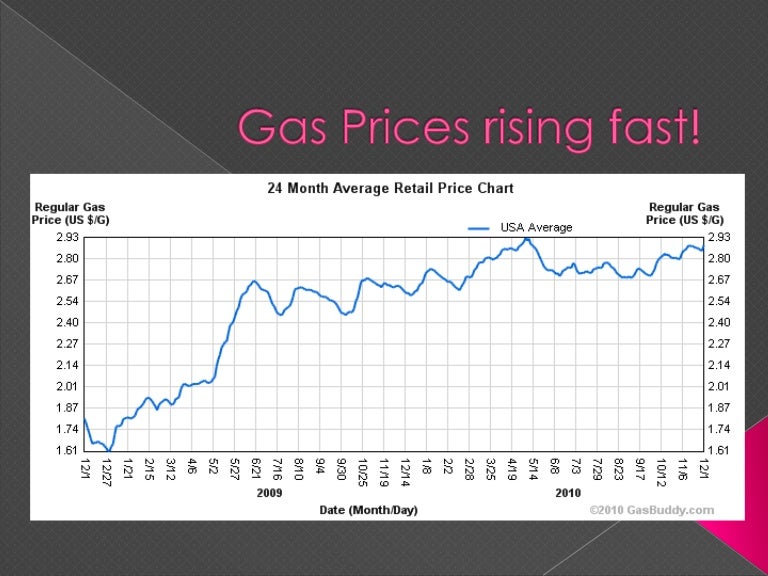

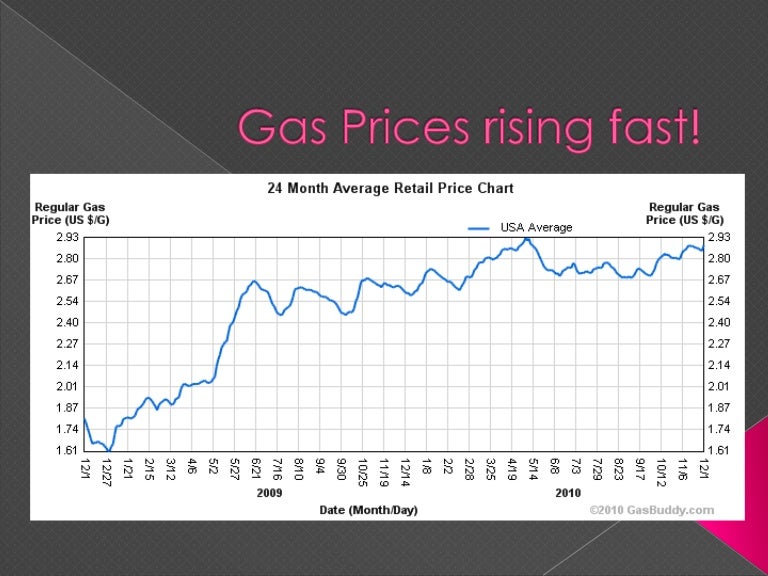

Understanding The 20-Cent Rise In Average Gas Prices

Table of Contents

Global Crude Oil Market Fluctuations and Their Impact

The price of gasoline is intrinsically linked to the price of crude oil. Several factors in the global crude oil prices market have significantly influenced the recent gas price increase.

Increased Global Demand

Post-pandemic recovery has fueled a dramatic increase in global oil demand. As economies rebounded, so did travel and industrial activity.

- Growth in travel: Increased air travel, road trips, and commuting contributed significantly to higher gasoline consumption.

- Manufacturing demands: The resurgence of manufacturing and industrial production boosted the demand for oil-based fuels and lubricants.

The International Energy Agency (IEA) reported a substantial year-on-year increase in global oil consumption, exceeding pre-pandemic levels. This increased oil demand, coupled with relatively stable OPEC production, created a tighter market, pushing crude oil prices higher.

Geopolitical Instability and Supply Chain Disruptions

Geopolitical tensions and global instability play a crucial role in influencing crude oil prices. Wars, sanctions, and political unrest often disrupt oil production and distribution, leading to supply shortages and price hikes.

- The impact of sanctions: International sanctions on certain oil-producing nations have restricted supply, thereby affecting the global oil supply chain.

- Conflict's role: Ongoing conflicts in various regions create uncertainty in the global oil market, impacting production and transportation.

These events create geopolitical risk, which translates directly into higher crude oil prices and, subsequently, higher gas prices.

OPEC+ Production Decisions

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) play a significant role in setting global oil production quotas. Their decisions regarding production levels directly impact the global crude oil supply.

- OPEC+'s influence on supply: OPEC+'s production decisions often balance supply and demand, aiming to stabilize the crude oil market.

- Recent production cuts: Recent decisions by OPEC+ to limit oil production, often cited as a response to fluctuating demand and geopolitical uncertainties, have contributed to tighter supply and higher prices.

These strategic decisions by the oil cartel impact the availability of crude oil, thereby influencing the average gas price.

Refining Capacity and Distribution Costs

Beyond the price of crude oil, other factors influence the final gas price.

Reduced Refining Capacity

Reduced refining capacity in several key regions has contributed to the gas price increase.

- Refinery closures and maintenance: Several refineries have undergone closures or significant maintenance periods, reducing the capacity to process crude oil into gasoline.

- Impact on supply: This reduced gasoline refining capacity has led to tighter supply and higher prices for refined products.

The lack of sufficient petroleum refining capacity has exacerbated the impact of higher crude oil prices.

Transportation and Distribution Challenges

Challenges in gasoline distribution and transportation also impact the final gas price.

- Rising fuel costs for trucking: The price of diesel fuel, used to transport gasoline, has also increased, adding to transportation costs.

- Pipeline issues and logistical bottlenecks: Various logistical issues, including pipeline maintenance and disruptions, further contribute to supply chain disruptions, increasing the cost of getting gasoline to consumers.

These transportation costs are passed on to consumers, contributing to the overall gas price increase.

Seasonal Factors and Speculation

Seasonal variations and market speculation further contribute to gas price fluctuations.

Seasonal Demand

Seasonal demand plays a major role in price shifts.

- Summer driving season: Increased travel during the summer months leads to higher demand for gasoline, driving up prices.

This increased seasonal demand exacerbates the existing supply and demand pressures, leading to higher gas prices.

Market Speculation and Investor Sentiment

Market speculation and investor sentiment can significantly influence gas prices.

- Futures market influence: The futures market allows investors to speculate on future crude oil prices, impacting current market dynamics.

- Market expectations: Positive or negative market expectations about future supply or demand can drive up or down current prices.

This market speculation contributes to the volatility of gas prices, amplifying the effect of other factors.

Conclusion: Understanding the 20-Cent Gas Price Hike and What to Expect

The 20-cent increase in the average gas price is a result of a confluence of factors: global crude oil prices driven by increased demand and geopolitical instability; reduced refining capacity and transportation costs; seasonal demand surges; and, finally, market speculation. Understanding these intertwined elements is crucial for navigating the volatile world of fuel prices. Future gas price fluctuations will likely continue to be influenced by these factors. Stay informed about the latest developments impacting gas prices by regularly checking reputable news sources and energy market analysis.

Featured Posts

-

Used Car Lot Fire Extensive Damage Reported

May 22, 2025

Used Car Lot Fire Extensive Damage Reported

May 22, 2025 -

Un Nou Serial Netflix Cu O Distributie All Star Ce Asteptari Putem Avea

May 22, 2025

Un Nou Serial Netflix Cu O Distributie All Star Ce Asteptari Putem Avea

May 22, 2025 -

Rutte Ve Sanchez Elektrik Kesintileriyle Muecadele Konusunda Goeruestue

May 22, 2025

Rutte Ve Sanchez Elektrik Kesintileriyle Muecadele Konusunda Goeruestue

May 22, 2025 -

Exclusive Partnership Ford And Nissan Join Forces For Ev Battery Plant

May 22, 2025

Exclusive Partnership Ford And Nissan Join Forces For Ev Battery Plant

May 22, 2025 -

The Goldbergs The Impact Of The Show On Popular Culture

May 22, 2025

The Goldbergs The Impact Of The Show On Popular Culture

May 22, 2025

Latest Posts

-

Memes Canada Vs Mexico Liga De Naciones Concacaf 2024

May 22, 2025

Memes Canada Vs Mexico Liga De Naciones Concacaf 2024

May 22, 2025 -

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025

Liga De Naciones Los Memes Que Dejo La Derrota De Panama Ante Mexico

May 22, 2025 -

Protecting Israeli Diplomatic Missions A Response To Recent Threats

May 22, 2025

Protecting Israeli Diplomatic Missions A Response To Recent Threats

May 22, 2025 -

Panama Vs Mexico Recopilacion De Los Mejores Memes De La Final

May 22, 2025

Panama Vs Mexico Recopilacion De Los Mejores Memes De La Final

May 22, 2025 -

La Derrota De Panama Los Memes Que Inundaron Las Redes

May 22, 2025

La Derrota De Panama Los Memes Que Inundaron Las Redes

May 22, 2025