Understanding The Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value

Table of Contents

What is Net Asset Value (NAV) and How Does it Relate to this Specific ETF?

The Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, per share. In simpler terms, it's the net worth of the ETF. For the Amundi MSCI World Catholic Principles UCITS ETF Acc, the NAV calculation considers its diverse global holdings, primarily stocks, selected according to stringent Catholic principles and Environmental, Social, and Governance (ESG) criteria.

NAV Calculation for this ETF:

- Underlying Assets: The ETF invests in a globally diversified portfolio of companies meeting specific Catholic values criteria. The value of these holdings directly impacts the NAV. Fluctuations in the prices of these individual stocks will directly influence the overall NAV.

- Currency Fluctuations: Because the ETF holds assets denominated in various currencies, exchange rate movements can affect the NAV. A strengthening Euro against the US dollar, for example, could positively influence the NAV if a significant portion of the holdings are in US dollar-denominated assets.

- Expense Ratios: The ETF has expense ratios, which are deducted from the assets, thus slightly lowering the NAV. These are typically small but consistently impact the net asset value over time.

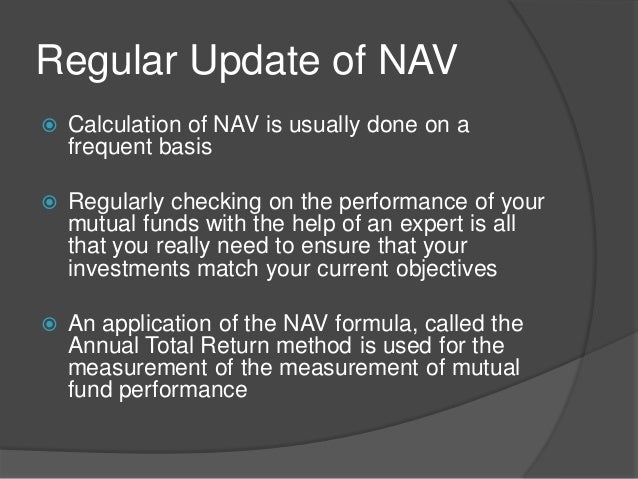

Daily NAV Updates and Access:

The NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc is typically calculated and published daily, reflecting the closing prices of its underlying assets. You can find the daily NAV on the official Amundi website, major financial news websites (like Bloomberg or Yahoo Finance), and through your brokerage account.

Factors Influencing the Amundi MSCI World Catholic Principles UCITS ETF Acc NAV

Several factors dynamically influence the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc. Understanding these factors is essential for informed investment decisions.

Market Performance:

The global market's performance is the most significant driver of the ETF's NAV. A bull market generally leads to an increase in the NAV, while a bear market will likely cause a decrease.

- Sectoral Impact: The performance of specific sectors within the global market (e.g., technology, energy, healthcare) will disproportionately affect the NAV depending on the ETF's allocation to those sectors. A strong technology sector, for instance, would likely boost the NAV if the ETF holds significant tech stocks.

- Geopolitical Events: Major geopolitical events (wars, trade disputes, political instability) can significantly impact global markets and, consequently, the ETF's NAV.

Currency Fluctuations:

As mentioned earlier, currency exchange rates play a crucial role. Changes in exchange rates between the currency of the underlying assets and the ETF's base currency (likely Euros) directly impact the NAV.

ESG and Catholic Principles Screening:

The ETF's adherence to Catholic principles and ESG criteria acts as a filter, influencing its performance and NAV. Companies that fail to meet these criteria are excluded, potentially impacting the portfolio's overall value and, therefore, the NAV. This can lead to a slightly different performance trajectory compared to a more broadly diversified global ETF.

Using NAV to Make Informed Investment Decisions

While the NAV is a crucial metric, it shouldn't be the sole factor influencing your investment decisions.

NAV and Investment Timing:

Monitoring the NAV can help you identify potential buying or selling opportunities. However, relying on short-term NAV fluctuations for investment timing is risky. Long-term trends are far more relevant for making informed decisions.

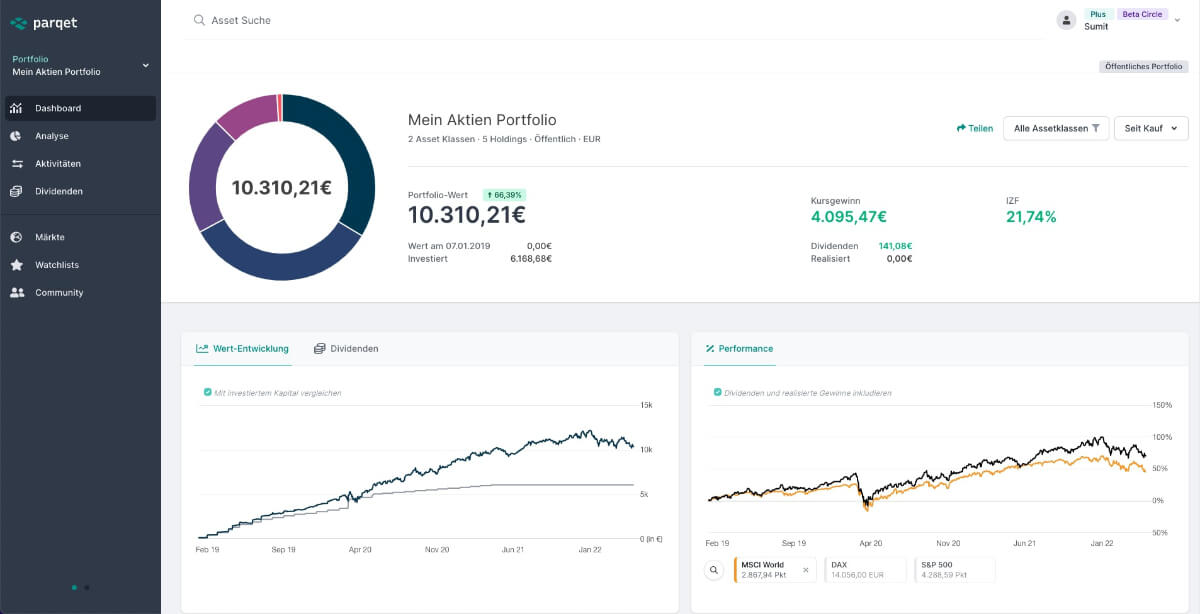

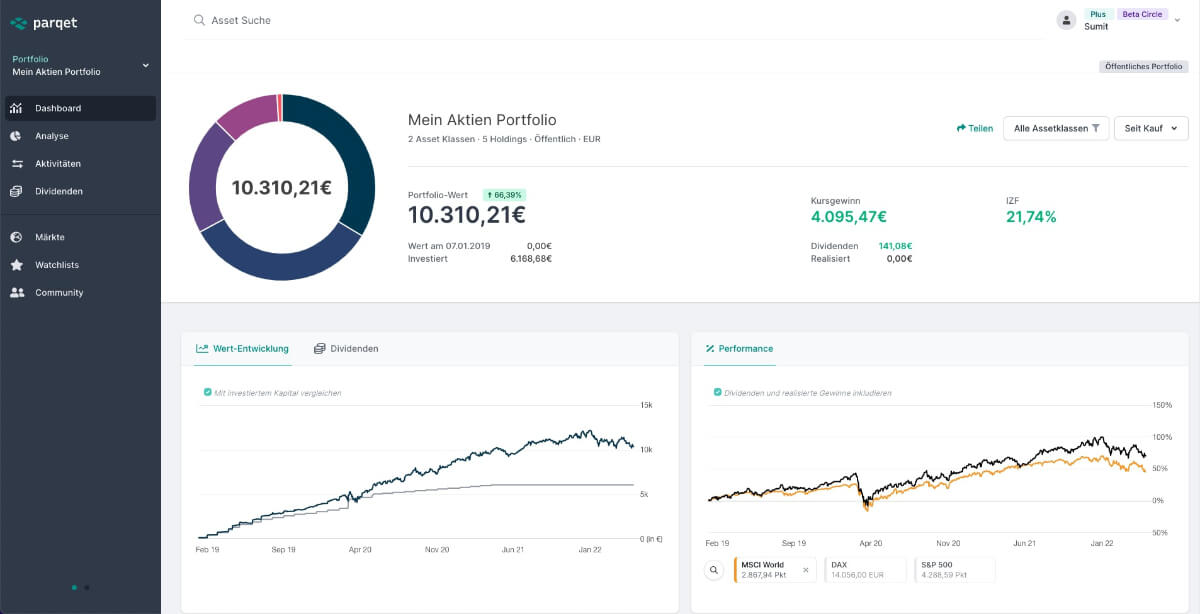

NAV and Performance Tracking:

Tracking NAV changes over time provides a clear picture of the ETF's overall performance. Comparing the NAV's growth against benchmarks or other similar ETFs helps evaluate its long-term success.

Comparing NAV to Other ETFs:

Comparing the NAV of the Amundi MSCI World Catholic Principles UCITS ETF Acc with similar ETFs (e.g., other globally diversified ETFs with different investment philosophies) allows for a relative performance evaluation. This helps determine if the Catholic values investing approach yields comparable or superior returns.

Conclusion: Mastering the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value

Understanding the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value requires considering market performance, currency fluctuations, and the unique impact of its ESG and Catholic principles screening. Regularly checking the NAV, along with understanding the underlying holdings and investment strategy, is vital for informed investment decisions. For a deeper understanding of the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value and its implications for your investment strategy, visit [link to relevant resource]. Start monitoring the Amundi MSCI World Catholic Principles UCITS ETF Acc Net Asset Value today and make informed investment choices!

Featured Posts

-

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

How To Interpret The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

Green Space As Refuge A Womans Story From Early Pandemic Seattle

May 25, 2025

Green Space As Refuge A Womans Story From Early Pandemic Seattle

May 25, 2025 -

Porsche 911 80 Millio Forintert Az Extrak

May 25, 2025

Porsche 911 80 Millio Forintert Az Extrak

May 25, 2025 -

Frankfurt Stock Market Update Dax Climbs Nearing Record High

May 25, 2025

Frankfurt Stock Market Update Dax Climbs Nearing Record High

May 25, 2025 -

How To Interpret Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

How To Interpret Net Asset Value Nav For The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Latest Posts

-

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 25, 2025

Seeking Change Facing Punishment A Guide To Protecting Yourself

May 25, 2025 -

Dreyfus Affair French Parliament Considers Posthumous Military Honor

May 25, 2025

Dreyfus Affair French Parliament Considers Posthumous Military Honor

May 25, 2025 -

Change And Punishment Navigating The Risks Of Advocating For Reform

May 25, 2025

Change And Punishment Navigating The Risks Of Advocating For Reform

May 25, 2025 -

Facing Retribution The Consequences Of Challenging The Status Quo

May 25, 2025

Facing Retribution The Consequences Of Challenging The Status Quo

May 25, 2025 -

The Perils Of Change When Seeking Improvement Leads To Punishment

May 25, 2025

The Perils Of Change When Seeking Improvement Leads To Punishment

May 25, 2025