Understanding The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Table of Contents

What is the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV?

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is an exchange-traded fund that tracks the performance of the MSCI World Index, a broad market-capitalization weighted index representing large and mid-cap companies across developed markets globally. Its investment strategy aims to replicate the index's performance as closely as possible. This ETF is designed for investors seeking diversified exposure to the global equity market. The “USD Hedged” aspect means the fund employs strategies to mitigate the risk associated with fluctuations in the exchange rate between the underlying assets (primarily denominated in USD) and the investor's base currency. The “Dist NAV” indicates that the ETF distributes dividends to its shareholders.

This ETF is particularly suitable for:

- Long-term investors looking for broad global diversification.

- Risk-averse investors who want to minimize currency risk.

- Investors seeking a relatively low-cost way to gain exposure to the global equity market.

Key features of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV include:

- Global market exposure across developed economies.

- USD currency hedging to mitigate exchange rate risk.

- Regular dividend distributions.

- UCITS (Undertakings for Collective Investment in Transferable Securities) compliant, meaning it adheres to strict EU regulatory standards.

- A competitive expense ratio (check the fund's official documentation for the most up-to-date figure).

Understanding the "USD Hedged" Aspect

The "USD Hedged" feature of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is crucial for understanding its risk profile. Currency hedging involves using financial instruments (such as forward contracts or options) to offset potential losses from exchange rate fluctuations. In this case, the ETF aims to protect investors from losses if the value of the USD falls against their base currency.

For example, if an investor's base currency is the Euro (€) and the USD depreciates against the Euro, the hedging strategy aims to minimize the impact of this depreciation on the investor's returns. However, it's important to note that hedging is not a perfect solution. If the USD appreciates against the investor's base currency, the hedging strategy might slightly reduce potential gains.

NAV (Net Asset Value) Explained

The NAV (Net Asset Value) of the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV represents the value of the ETF's underlying assets per share. It's calculated daily by subtracting liabilities from the total market value of the ETF's holdings and dividing by the number of outstanding shares. Monitoring the NAV is essential for tracking the ETF's performance. While the ETF's market price may fluctuate throughout the trading day, the NAV provides a more accurate reflection of the fund's intrinsic value. You can typically find the daily NAV on the ETF's official website or through your brokerage account.

Distributions and Dividend Yield

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV distributes dividends to its shareholders, typically on a regular basis (check the fund's documentation for the exact frequency). These dividends are derived from the dividends paid by the underlying companies within the MSCI World Index. It's crucial to understand the tax implications of these dividend distributions in your jurisdiction. Investors can typically track dividend payments and reinvestment options through their brokerage accounts. Historical dividend yield data, if available, can provide insights into the ETF's past dividend payout history.

Risks and Considerations

While the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV offers diversification and currency hedging, it's important to acknowledge the inherent risks:

- Market risk: The value of the ETF can fluctuate significantly due to changes in the overall market conditions.

- Currency risk: Despite the hedging strategy, some currency risk remains.

- Counterparty risk: There is a small risk that the ETF's counterparties may default on their obligations.

- Geopolitical risks: Global events can impact the performance of the underlying companies.

- Interest rate changes: Interest rate fluctuations can affect the valuation of the ETF's holdings.

Before investing in the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV or any other investment, conducting thorough due diligence and seeking advice from a qualified financial advisor is crucial.

Conclusion: Making Informed Decisions with the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV offers a compelling pathway to global diversification, incorporating currency hedging and dividend distribution. This article has outlined its key features, including its investment strategy, the benefits of USD hedging, the significance of NAV, dividend policy, and associated risks. Remember that while the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV aims to mitigate currency risk, it doesn't eliminate it entirely. Understanding the NAV is vital for performance tracking, and awareness of dividend distributions and their tax implications is equally important. Before investing in the Amundi MSCI World II UCITS ETF, or any similar MSCI World ETF, carefully consider your risk tolerance and investment goals. Consult the official fund documentation and seek professional financial advice to determine its suitability for your specific circumstances.

Featured Posts

-

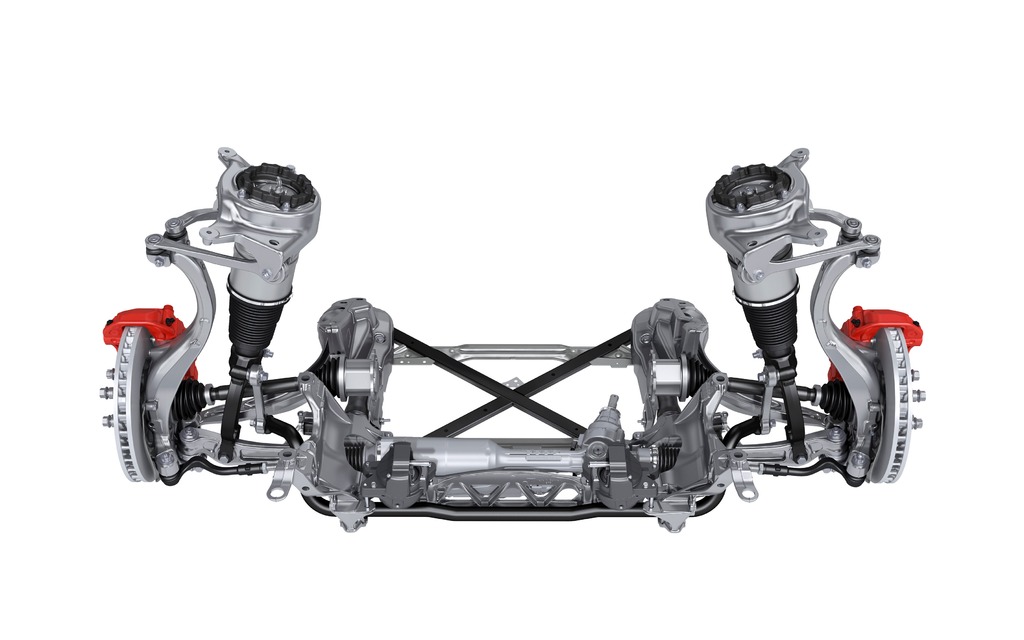

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025

2024 Porsche Macan Buyers Guide Find The Perfect Suv

May 24, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025

Amundi Dow Jones Industrial Average Ucits Etf Understanding Net Asset Value Nav

May 24, 2025 -

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025

Avrupa Borsalari Ecb Faiz Kararindan Sonra Nasil Etkilendi

May 24, 2025 -

Oleg Basilashvili Test Na Znanie Ego Roley

May 24, 2025

Oleg Basilashvili Test Na Znanie Ego Roley

May 24, 2025 -

Waiting By The Phone A Modern Tale Of Delayed Gratification

May 24, 2025

Waiting By The Phone A Modern Tale Of Delayed Gratification

May 24, 2025

Latest Posts

-

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 24, 2025 -

Euronext Amsterdam Stock Market Reaction 8 Gain After Trumps Tariff Announcement

May 24, 2025

Euronext Amsterdam Stock Market Reaction 8 Gain After Trumps Tariff Announcement

May 24, 2025 -

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Decision

May 24, 2025 -

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025

Trumps Tariff Delay Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025 -

11 Drop In Three Days Amsterdam Stock Exchange In Freefall

May 24, 2025

11 Drop In Three Days Amsterdam Stock Exchange In Freefall

May 24, 2025