Understanding The Friday Rally In D-Wave Quantum (QBTS) Shares

Table of Contents

Potential Catalysts for the QBTS Stock Surge

Several factors could have contributed to the recent surge in QBTS stock. Let's examine the most likely candidates:

Positive News and Announcements

Positive news is often a significant driver of stock price increases. Any recent developments, such as press releases, strategic partnerships, or groundbreaking technological advancements, could have ignited investor enthusiasm. Positive analyst reports and upgrades also significantly influence market sentiment. Keywords: QBTS news, D-Wave partnership, quantum computing breakthrough, stock upgrade.

- Successful product launches: The announcement of a new quantum computing system or a significant improvement in existing technology could have boosted investor confidence.

- Strategic partnerships: Collaborations with major technology companies or research institutions can signal increased market adoption and validation of D-Wave's technology.

- Positive financial results: Better-than-expected earnings reports or revenue growth can significantly influence investor perception.

- Analyst upgrades: Upward revisions of price targets by financial analysts can lead to increased buying pressure.

- Example: A successful demonstration of a new quantum annealing algorithm significantly reducing computation time, potentially leading to increased investor confidence.

Market Sentiment and Overall Sector Performance

The overall market sentiment and the performance of the quantum computing sector play a crucial role. A broader positive trend in the tech sector or a surge of interest in quantum computing stocks could have lifted QBTS along with its peers. Keywords: quantum computing market trends, tech stock rally, market sentiment, sector performance.

- Broader market trends: A general upward trend in the stock market can often lift individual stocks, including those in the quantum computing sector.

- Sector-specific optimism: Positive news or developments within the broader quantum computing industry can create a ripple effect, benefiting individual companies like D-Wave Quantum.

- Increased institutional investment: A surge in investment from large institutional investors could drive up the share price.

- Example: Positive investor sentiment towards the future of quantum computing technology, driven by government initiatives and private investment, may be driving increased investment across the sector, including QBTS.

Short Squeeze and Increased Trading Volume

A short squeeze, where investors who bet against the stock (short sellers) are forced to buy to cover their positions, can cause a rapid price increase. This is often accompanied by a significant rise in trading volume. Keywords: short squeeze, QBTS trading volume, stock volatility, short interest.

- High short interest: A substantial number of investors betting against QBTS could make the stock vulnerable to a short squeeze.

- Increased trading volume: A sudden and significant increase in trading volume often accompanies a short squeeze, indicating a high level of buying pressure.

- Example: A significant increase in trading volume alongside a short squeeze could potentially amplify the price increase, particularly if the short interest was high.

Analyzing the Sustainability of the QBTS Rally

While the Friday rally is noteworthy, determining its long-term sustainability requires a deeper analysis of D-Wave Quantum's prospects and inherent risks.

Long-Term Growth Potential

D-Wave Quantum's long-term prospects depend on several factors, including its technological advancements, financial performance, and competitive landscape. Keywords: D-Wave Quantum future, long-term investment, quantum computing growth, competitive landscape.

- Technological leadership: D-Wave's ability to maintain a technological edge in quantum annealing and develop new applications will be crucial for long-term success.

- Financial stability: The company's ability to generate revenue, secure funding, and manage its expenses will impact its long-term viability.

- Market adoption: The rate at which D-Wave's quantum computing technology is adopted by various industries will determine its growth potential.

- Example: A strong patent portfolio and strategic partnerships suggest a promising long-term growth trajectory, but market acceptance remains a critical factor.

Risks and Uncertainties

Investing in a relatively young company like D-Wave Quantum carries inherent risks. The quantum computing market is still nascent, and several challenges remain. Keywords: investment risk, QBTS risk, quantum computing challenges, market volatility.

- Competition: Intense competition from other quantum computing companies could hinder D-Wave's progress.

- Technological hurdles: Developing and scaling quantum computing technology faces significant technological challenges.

- Market volatility: The stock market is inherently volatile, and QBTS shares could experience substantial price fluctuations.

- Regulatory uncertainty: Changes in regulations could impact the company’s operations and future prospects.

- Example: High competition in the quantum computing market poses a significant risk to D-Wave Quantum's long-term success, demanding continuous innovation and adaptation.

Conclusion: Understanding the QBTS Friday Rally and Future Implications

The Friday rally in QBTS shares likely resulted from a combination of positive news, favorable market sentiment, and potentially a short squeeze. While the short-term price increase is notable, long-term investors must carefully consider both the growth potential of D-Wave Quantum and the inherent risks associated with investing in this emerging technology. The sustainability of this rally will depend on D-Wave’s continued innovation, successful market penetration, and the overall evolution of the quantum computing industry. Before investing in D-Wave Quantum (QBTS) or any other quantum computing stock, thorough research and careful consideration of your risk tolerance are crucial. Conduct further research and make informed decisions before investing in D-Wave Quantum stock. Consider consulting with a financial advisor to assess your risk tolerance and investment goals before investing in QBTS.

Featured Posts

-

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025 -

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025

Sta Se Krije Iza Promene Imena Vanje Mijatovic

May 21, 2025 -

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025 -

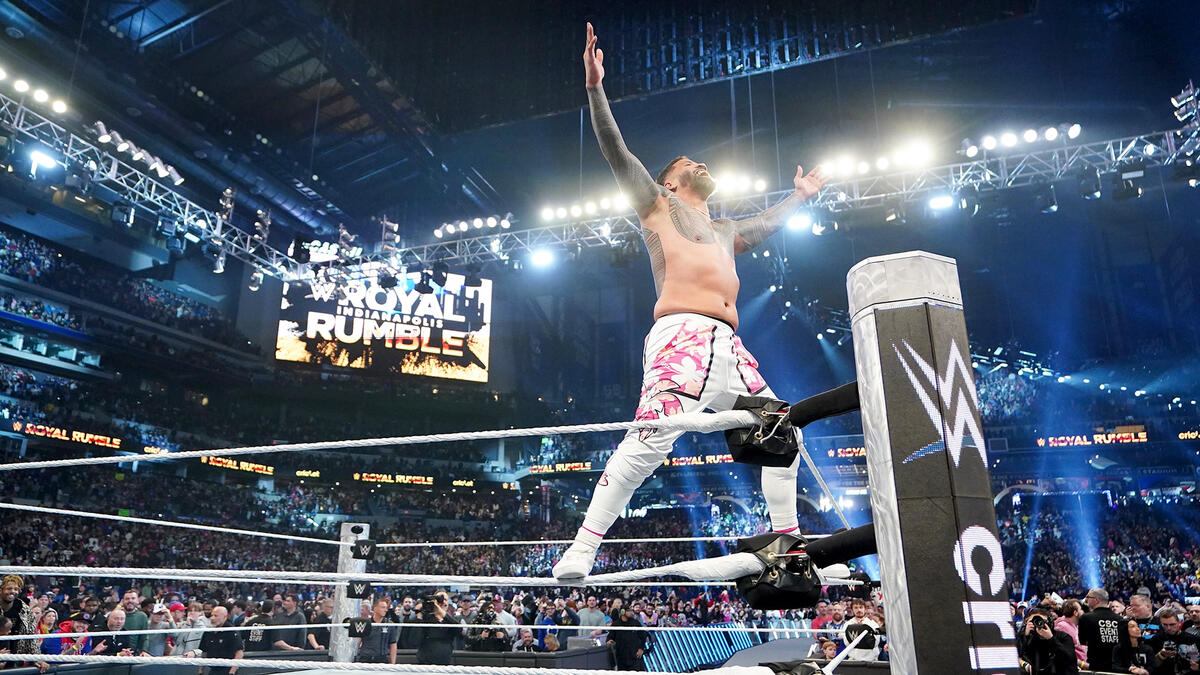

Wwe Raw The Impact Of Tyler Bates Return

May 21, 2025

Wwe Raw The Impact Of Tyler Bates Return

May 21, 2025 -

Switzerland And China Tensions Rise Over Military Exercises

May 21, 2025

Switzerland And China Tensions Rise Over Military Exercises

May 21, 2025

Latest Posts

-

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025

Mntkhb Alwlayat Almthdt Thlathy Jdyd Tht Qyadt Almdrb Bwtshytynw

May 22, 2025 -

1 3

May 22, 2025

1 3

May 22, 2025 -

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 22, 2025

Wjwh Jdydt Fy Tshkylt Mntkhb Amryka Thlathy Mmyz Yndm Lawl Mrt

May 22, 2025 -

Bwtshytynw Ystdey Thlathy Jdyd Lmntkhb Alwlayat Almthdt

May 22, 2025

Bwtshytynw Ystdey Thlathy Jdyd Lmntkhb Alwlayat Almthdt

May 22, 2025 -

Thlatht Njwm Amrykyyn Jdd Yndmwn Lmntkhb Alwlayat Almthdt Tht Qyadt Bwtshytynw

May 22, 2025

Thlatht Njwm Amrykyyn Jdd Yndmwn Lmntkhb Alwlayat Almthdt Tht Qyadt Bwtshytynw

May 22, 2025