Understanding The House Republican Plan For Trump Tax Cuts

Table of Contents

Core Principles of the House Republican Tax Plan

The overarching goals of the House Republican tax plan, closely aligned with the Trump administration's economic agenda, were to stimulate economic growth, simplify the tax code, and reduce the tax burden on businesses and individuals. The plan aimed to achieve these goals through several key strategies.

- Lowering individual and corporate tax rates: A central tenet was significantly reducing both individual and corporate tax rates, believing this would incentivize investment and job creation.

- Simplifying the tax code: The plan sought to streamline the tax code by reducing the number of deductions and credits, making it easier for individuals and businesses to comply. This simplification, however, was a source of much debate, with some arguing it disproportionately benefited the wealthy.

- Promoting economic growth through investment incentives: By lowering taxes, the plan aimed to encourage businesses to invest more, leading to increased economic activity and job growth. This trickle-down economic theory was a core justification for the plan.

- Focus on reducing the tax burden on businesses to stimulate job creation: A substantial reduction in the corporate tax rate was intended to make American businesses more competitive globally and encourage domestic investment, ultimately leading to more jobs.

Individual Tax Cuts Under the Plan

The House Republican tax plan proposed significant changes to the individual income tax system, impacting various income levels differently.

- Changes to marginal tax rates: The plan reduced the number of individual income tax brackets and lowered the marginal tax rates for most brackets. For example, the top individual income tax rate was significantly reduced. The exact percentage changes varied across brackets.

- Impact on the standard deduction: The standard deduction was increased, providing a larger tax break for many taxpayers, particularly those with lower incomes. This change aimed to simplify tax filing and provide relief to a broader segment of the population.

- Changes to itemized deductions: The plan limited or eliminated several itemized deductions, such as state and local tax (SALT) deductions and certain personal exemptions. These changes were highly controversial, as they disproportionately impacted taxpayers in high-tax states.

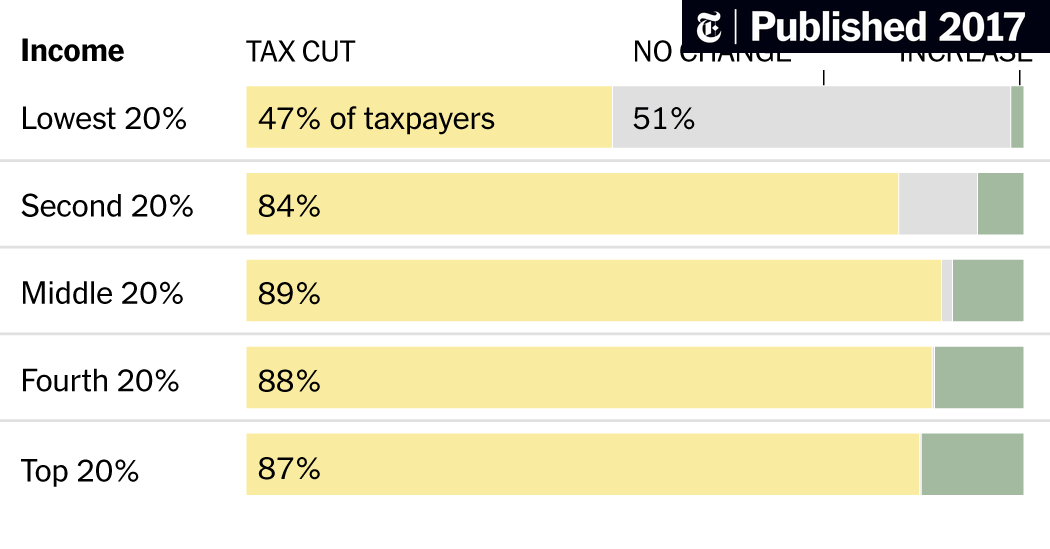

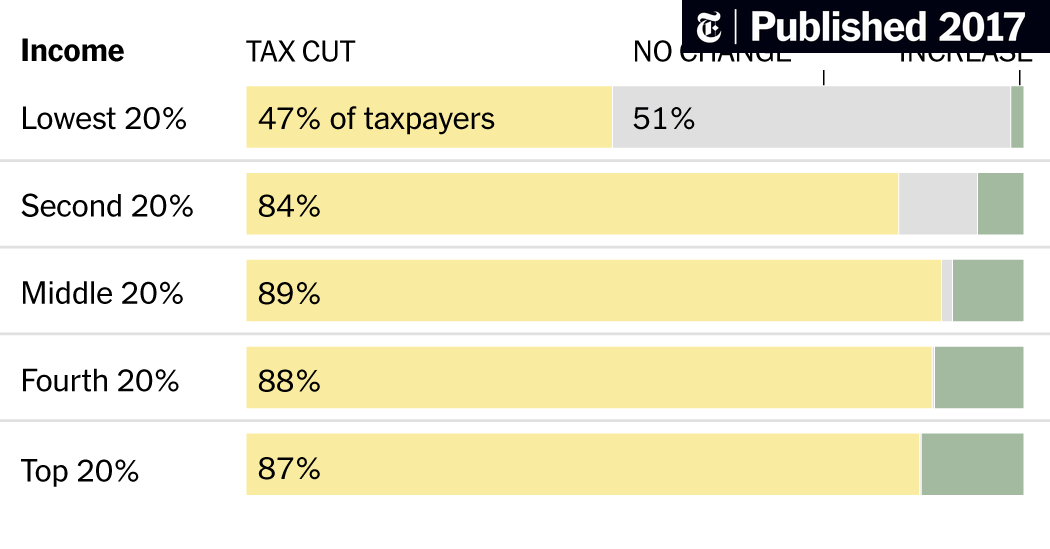

- Potential effects on various income levels: While proponents argued the plan benefited all income levels, critics pointed out that the tax cuts were disproportionately larger for higher-income individuals and corporations, potentially exacerbating income inequality.

Corporate Tax Cuts and Their Implications

A cornerstone of the House Republican plan was a dramatic reduction in the corporate tax rate.

- Proposed corporate tax rate: The plan proposed a significant cut in the corporate tax rate, from a higher rate to a substantially lower rate. This was intended to increase the competitiveness of American businesses on a global scale.

- Impact on corporate profitability and investment: Proponents argued the lower rate would boost corporate profits, leading to increased investment in new equipment, technology, and job creation.

- Potential effects on job creation and wages: The plan posited that increased corporate profits would translate into higher wages and more job opportunities for workers. However, critics argued that these benefits might not materialize, with corporations potentially using the extra profits for stock buybacks or executive bonuses instead of investing in their workforce.

- Debate surrounding repatriation of overseas profits: The plan also addressed the issue of repatriating overseas corporate profits, potentially incentivizing companies to bring their money back to the US and invest it domestically. This aspect was debated extensively, with differing opinions on its effectiveness and potential consequences.

Economic Impacts and Criticisms of the House Republican Plan

The House Republican plan for Trump tax cuts sparked intense debate regarding its potential economic consequences.

- Projected impact on GDP growth: Proponents predicted significant increases in GDP growth as a result of the tax cuts, citing increased investment and consumer spending.

- Estimates of the increase in the national debt: Critics countered that the tax cuts would lead to a substantial increase in the national debt due to reduced government revenue. This concern fueled much of the opposition to the plan.

- Criticisms regarding income inequality and tax fairness: A major criticism focused on the plan's potential to exacerbate income inequality, with a larger share of the tax benefits going to higher-income earners and corporations. Concerns about fairness and equity were central to this critique.

- Arguments for and against the plan's effectiveness in stimulating economic growth: The effectiveness of supply-side economics, the underlying principle of the plan, was a subject of ongoing debate. Evidence supporting its effectiveness in stimulating robust economic growth remained inconclusive.

Conclusion

This article explored the core components of the House Republican plan for Trump tax cuts, analyzing its provisions for individual and corporate tax rates, projected economic effects, and the ongoing debate surrounding its impact. While supporters championed its potential to stimulate economic growth, critics raised serious concerns about its potential to widen income inequality and dramatically increase the national debt. Understanding the nuances of the Trump tax cuts and the House Republican plan is crucial for every citizen. Stay informed about future economic developments and continue researching the long-term implications of this significant tax policy to form your own informed opinion on the House Republican plan for Trump tax cuts and its lasting legacy on the American economy.

Featured Posts

-

Court Upholds Ruling Against Trump In Alien Enemies Act Dispute

May 13, 2025

Court Upholds Ruling Against Trump In Alien Enemies Act Dispute

May 13, 2025 -

Skarlet Gioxanson Oristiki I Apofasi Den Epistrefei Os Black Widow

May 13, 2025

Skarlet Gioxanson Oristiki I Apofasi Den Epistrefei Os Black Widow

May 13, 2025 -

Dodgers Defeat Cubs 3 0 Yamamotos Two Hit Performance Edmans Three Run Homer

May 13, 2025

Dodgers Defeat Cubs 3 0 Yamamotos Two Hit Performance Edmans Three Run Homer

May 13, 2025 -

The Impact Of Jurisdiction On Sentencing The Meg Thee Stallion Case

May 13, 2025

The Impact Of Jurisdiction On Sentencing The Meg Thee Stallion Case

May 13, 2025 -

Fans Rejoice Heist Film Sequel Arrives On Amazon Prime This Month

May 13, 2025

Fans Rejoice Heist Film Sequel Arrives On Amazon Prime This Month

May 13, 2025