Understanding The Next Key Price Levels For AAPL

Table of Contents

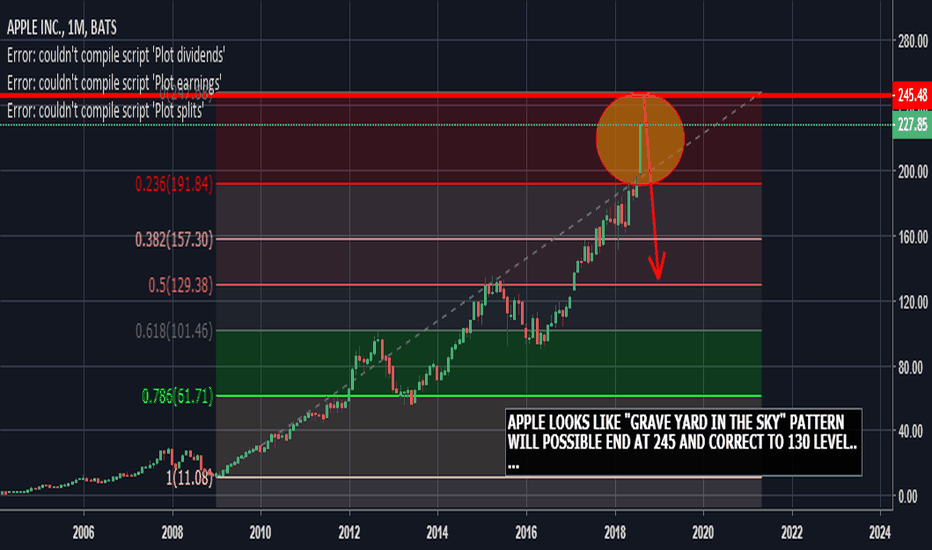

Identifying Key Support Levels for AAPL

Support levels in technical analysis represent price points where buying pressure is expected to outweigh selling pressure, preventing a further price decline. Identifying these levels helps investors anticipate potential price floors and manage risk. Analyzing AAPL's historical price charts reveals several potential support levels:

- Level 1: $150 - This level represents a significant psychological barrier and a previous low from [Month, Year]. A break below this could signal a more substantial downturn.

- Level 2: $145 - Strong buying volume was observed around this price point in [Month, Year], suggesting a potential area of support. This correlates with a trendline support identified on the [Timeframe] chart.

- Level 3: $140 - This level aligns with a long-term 200-day moving average, often used as a key indicator of long-term trend.

A break below these support levels could indicate increased bearish sentiment and potentially trigger further declines in the AAPL stock price. It’s crucial to monitor volume alongside price action to confirm the significance of any potential break.

Pinpointing Key Resistance Levels for AAPL

Resistance levels, conversely, are price points where selling pressure is anticipated to overcome buying pressure, hindering further price increases. Identifying these levels allows investors to anticipate potential price ceilings and plan their trading strategies. Analyzing AAPL's past performance shows several potential resistance levels:

- Level 1: $175 - This price represents a previous high and a significant psychological level. Overcoming this resistance would signal strong bullish sentiment.

- Level 2: $180 - This level coincides with a previous failed breakout attempt, suggesting a strong area of resistance. The chart shows a clear horizontal resistance line at this price point.

- Level 3: $185 - This area is close to a short-term 50-day moving average which often acts as a resistance level during upward trends.

A successful break above these resistance levels would suggest growing bullish momentum and could potentially lead to significant price appreciation in the AAPL stock. This would need to be confirmed by strong volume and a sustained move above the resistance.

Analyzing AAPL's Fundamental Factors and Their Impact on Price

While technical analysis provides valuable insights into price movements, understanding AAPL's fundamental factors is crucial for a comprehensive view. These fundamentals influence investor sentiment and ultimately affect the stock's price. Key factors include:

- Product releases and sales figures: New iPhone, iPad, and Mac releases significantly impact sales figures and investor expectations. Strong sales translate to increased revenue and potential stock appreciation.

- Financial performance: Earnings reports, revenue growth, and profit margins are key indicators of Apple's financial health. Consistent strong performance boosts investor confidence.

- Market competition and industry trends: Competition from other tech companies and evolving market trends can influence Apple's market share and profitability.

- Economic outlook and investor sentiment: Global economic conditions and overall investor sentiment play a significant role in shaping AAPL's stock price.

A strong correlation exists between these fundamental factors and the AAPL stock price. Positive fundamentals often support higher price levels, while negative news can trigger price declines.

Predicting Future Price Movement: Combining Technical and Fundamental Analysis

To accurately predict future price movement, a combination of technical and fundamental analysis is essential. By integrating both, we can develop plausible scenarios:

- Scenario 1: Breakout above resistance: If AAPL successfully breaks above the identified resistance levels (e.g., $185), it could signal strong bullish momentum and potentially lead to price targets of [Price Target 1] and even [Price Target 2].

- Scenario 2: Consolidation within a range: The price may consolidate between the identified support and resistance levels, suggesting a period of sideways trading. This scenario is likely if fundamental factors remain relatively stable.

- Scenario 3: Break below support: A break below the key support levels (e.g., $140) could trigger further price declines, with potential targets around [Price Target 3] and below.

It's crucial to remember that market predictions are inherently uncertain. These scenarios represent potential outcomes, but the actual price movement may differ.

Conclusion: Navigating the AAPL Stock Price Landscape

Understanding the next key price levels for AAPL requires a comprehensive approach combining technical analysis of support and resistance levels, ($140-$185 being key areas to watch), with a thorough assessment of fundamental factors. The potential scenarios outlined above highlight the importance of considering various outcomes. Successfully navigating the AAPL stock price landscape necessitates careful monitoring of both technical indicators and fundamental news, coupled with a realistic understanding of the inherent market volatility. Remember to always conduct your own thorough research and consider consulting a financial advisor before making any investment decisions regarding AAPL stock price and future levels. Analyzing AAPL's next price move requires diligent observation and a balanced approach to interpreting data.

Featured Posts

-

Hells Angels Mourn Loss Of Member In Motorcycle Accident

May 25, 2025

Hells Angels Mourn Loss Of Member In Motorcycle Accident

May 25, 2025 -

Bbc Radio 1 Big Weekend Everything You Need To Know About Ticket Applications

May 25, 2025

Bbc Radio 1 Big Weekend Everything You Need To Know About Ticket Applications

May 25, 2025 -

Alex De Minaurs Madrid Open Campaign Ends In Straight Sets Swiatek Triumphs

May 25, 2025

Alex De Minaurs Madrid Open Campaign Ends In Straight Sets Swiatek Triumphs

May 25, 2025 -

Hells Angels An In Depth Analysis

May 25, 2025

Hells Angels An In Depth Analysis

May 25, 2025 -

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 25, 2025

Dokumentalniy Film Menya Vela Kakaya To Sila Zhizn I Tvorchestvo Innokentiya Smoktunovskogo

May 25, 2025