Understanding The Reasons Behind CoreWeave's (CRWV) Thursday Stock Decrease

Table of Contents

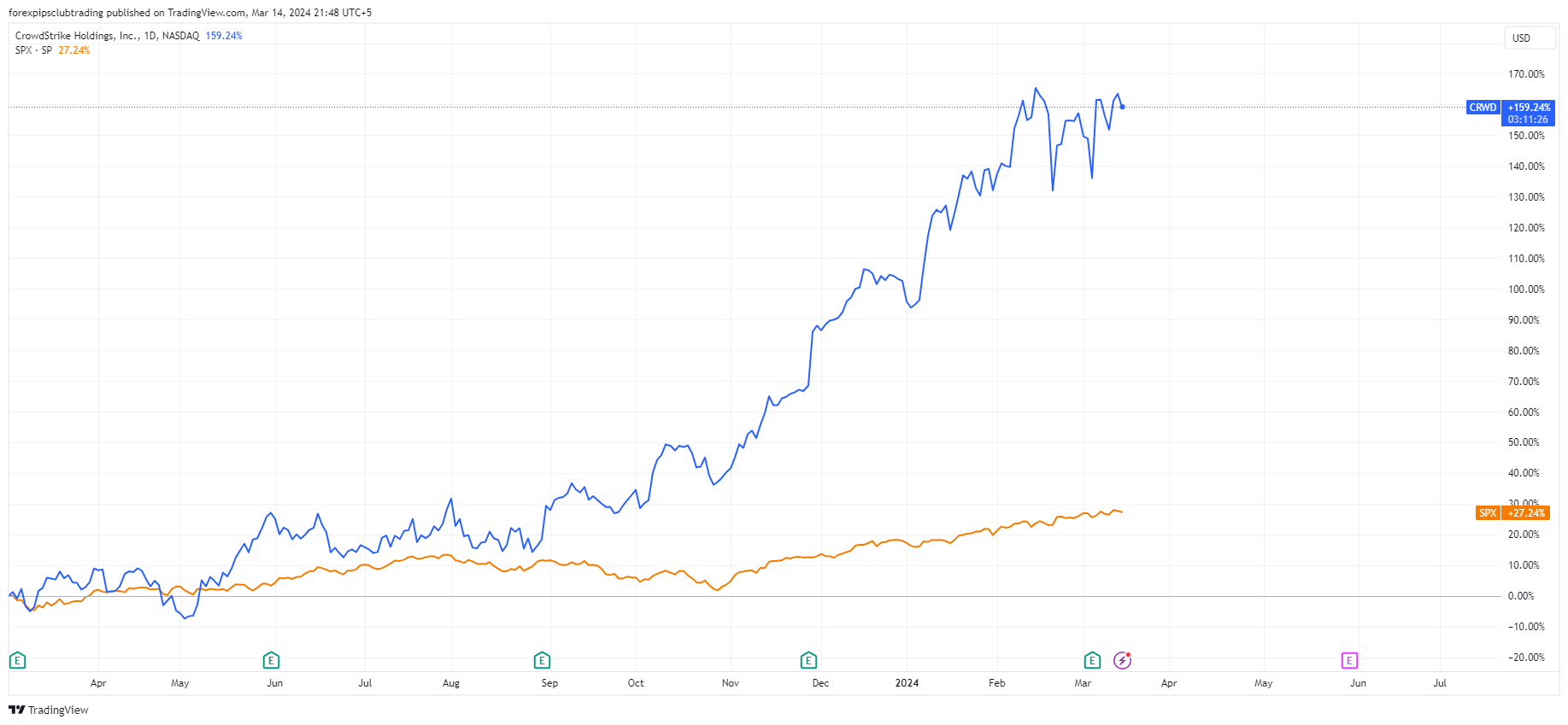

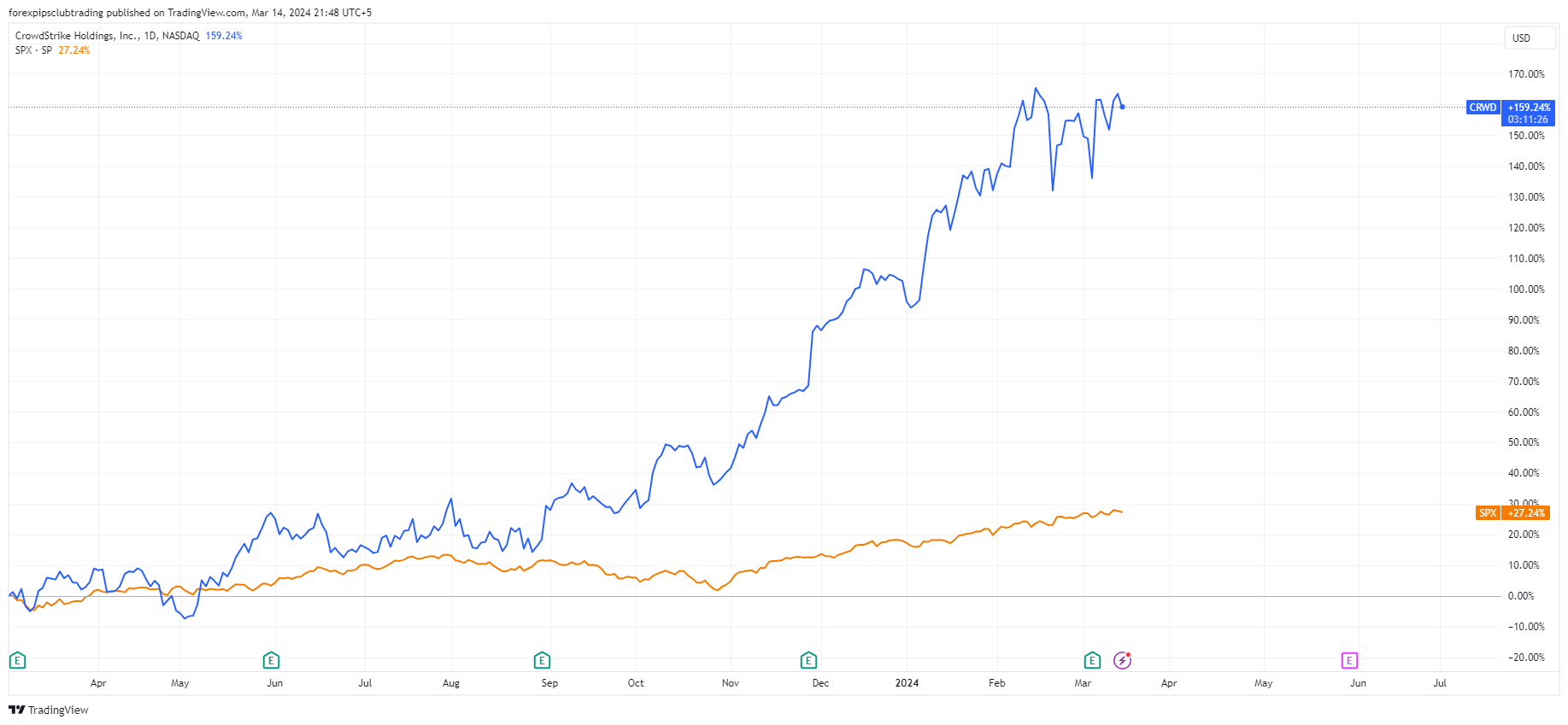

Market-Wide Downturn and Tech Sector Volatility

Thursday's decline in CoreWeave's stock price wasn't an isolated incident. The broader market experienced a downturn, with significant negative impacts felt across the technology sector. This volatility, particularly pronounced in the cloud computing and AI infrastructure segments, played a major role in CRWV's fall.

- Market Indices: The NASDAQ Composite, a key indicator for technology stocks, experienced a substantial drop of Y% on Thursday, reflecting a general negative sentiment towards tech investments. The S&P 500 also showed considerable decline, further indicating a widespread market correction.

- Macroeconomic Factors: Rising interest rates and persistent inflation concerns continue to weigh heavily on investor sentiment. The fear of a potential recession is impacting investment decisions, pushing investors towards more conservative options and away from riskier growth stocks like CRWV.

- Significant News Events: Any major geopolitical events or unexpected economic announcements on Thursday could have exacerbated the existing market anxieties, contributing to the widespread sell-off across the tech sector, including CoreWeave.

CoreWeave-Specific News and Announcements

While the broader market certainly contributed to CRWV's decline, it's essential to consider any company-specific news or announcements that might have further spooked investors.

- Press Releases and Earnings Reports: Did CoreWeave release any press releases, earnings reports, or regulatory filings on Thursday that could have negatively impacted investor perception? A disappointing earnings report or a warning about future performance could trigger a significant sell-off.

- Negative Press Coverage: Any negative press coverage, highlighting concerns about the company's operations, financial stability, or competitive landscape, could also have contributed to the stock's decline. Scrutiny regarding specific business practices or controversies could impact investor confidence.

- Analyst Downgrades: Analyst ratings play a significant role in shaping investor sentiment. A sudden downgrade from a prominent analyst firm could trigger a wave of selling, amplifying the negative impact on the stock price. Analyzing any analyst reports released close to the time of the drop is crucial.

Competition and Industry Dynamics

The competitive landscape within the cloud computing and AI infrastructure market is fierce. Analyzing the actions of CoreWeave's competitors is vital to understanding the context of Thursday's stock drop.

- Competitor Activities: Major competitors like AWS, Azure, and Google Cloud are constantly innovating and expanding their offerings. Any significant announcements from these competitors, such as new product launches or strategic partnerships, could have diverted investor attention and capital away from CoreWeave.

- Industry Shifts: Rapid technological advancements and shifts in industry trends can significantly impact a company's market position. The emergence of new technologies or a change in market demand could affect CoreWeave's prospects, leading to investor uncertainty and a decline in stock price.

- Mergers and Acquisitions: Mergers, acquisitions, or partnerships within the industry can reshape the competitive landscape. These events could impact CoreWeave's market share and growth potential, influencing investor sentiment and stock valuations.

Investor Sentiment and Trading Activity

Understanding the trading activity surrounding CRWV on Thursday is crucial for a complete picture.

- Trading Volume: An unusually high trading volume on Thursday could indicate a significant shift in investor sentiment, with many investors simultaneously selling their shares. Analyzing the volume compared to previous trading days provides valuable insights.

- Short Selling: A surge in short selling, where investors bet against the stock's future performance, could have amplified the downward pressure on CRWV's price. Identifying any unusual short-selling activity can provide clues about the market's perception of the company.

- Social Media Sentiment: Social media platforms and online forums can significantly influence investor sentiment. Negative sentiment expressed on these platforms could contribute to a sell-off, as investors react to perceived risks or negative news.

Conclusion: Understanding and Investing in CRWV's Future

CoreWeave's (CRWV) Thursday stock decrease resulted from a complex interplay of market-wide factors, including broader tech sector volatility and macroeconomic concerns, as well as company-specific news and competitive pressures. Understanding these factors is crucial for evaluating the situation and making informed investment decisions.

Key Takeaways: The decline highlights the sensitivity of growth stocks to market fluctuations and the importance of monitoring both macro and microeconomic factors. Analyzing the competitive landscape and company-specific news is vital for assessing future performance.

Call to Action: Understanding CoreWeave's (CRWV) stock performance is crucial for informed investing. Stay updated on the latest news affecting CoreWeave (CRWV), including earnings reports, analyst ratings, and competitive developments, to make smart investment choices. Conduct thorough research and consider your own risk tolerance before investing in CRWV or any other stock.

Future Outlook: While CoreWeave operates in a promising market with strong growth potential, the current market conditions and competitive pressures necessitate a cautious outlook. Continued monitoring of the company's performance and the broader market dynamics is essential for assessing its long-term prospects.

Featured Posts

-

Core Weave Crwv Stock Soars Analyzing Last Weeks Performance

May 22, 2025

Core Weave Crwv Stock Soars Analyzing Last Weeks Performance

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison Family And New Music

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And New Music

May 22, 2025 -

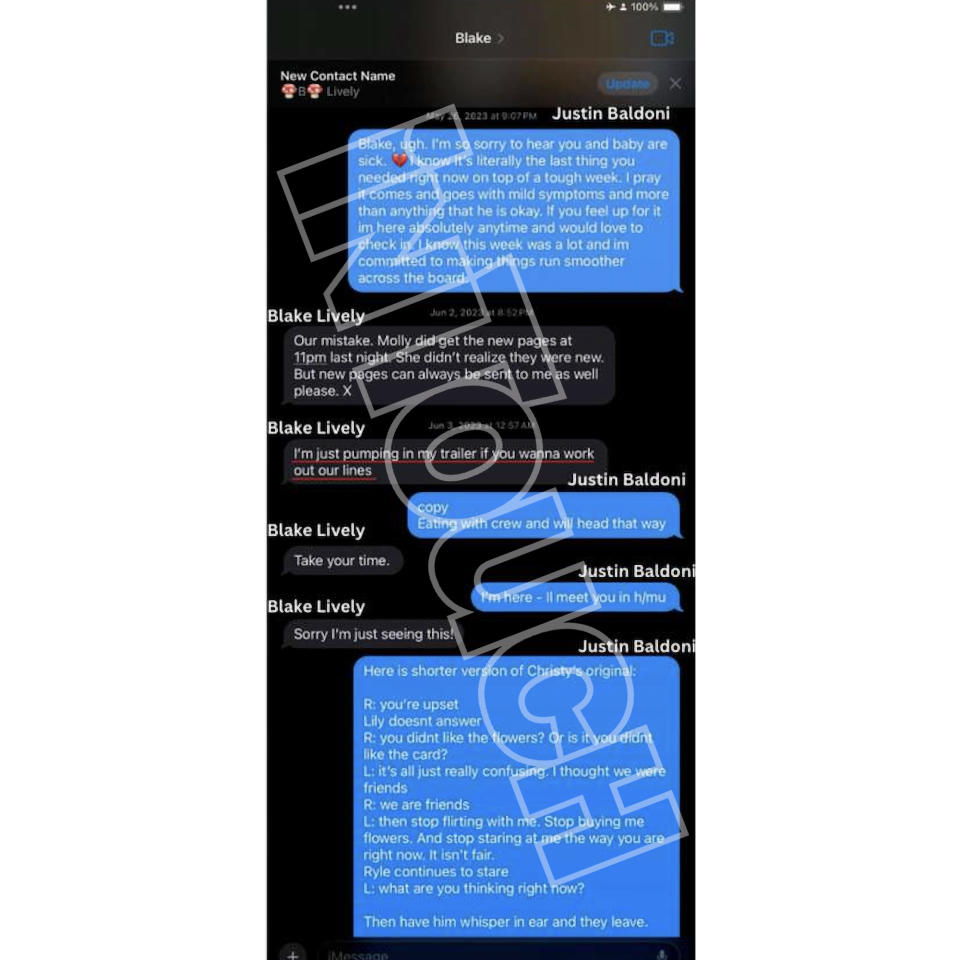

Exploring Recent Reports And Allegations Involving Blake Lively

May 22, 2025

Exploring Recent Reports And Allegations Involving Blake Lively

May 22, 2025 -

Analyse De Les Grands Fusains De Boulemane Par Abdelkebir Rabi Au Book Club Le Matin

May 22, 2025

Analyse De Les Grands Fusains De Boulemane Par Abdelkebir Rabi Au Book Club Le Matin

May 22, 2025 -

From Food Hero To Business Mentor A Young Louth Entrepreneurs Journey

May 22, 2025

From Food Hero To Business Mentor A Young Louth Entrepreneurs Journey

May 22, 2025

Latest Posts

-

Hora Y Canal Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025

Hora Y Canal Mexico Vs Panama Final De La Liga De Naciones Concacaf

May 22, 2025 -

Seleccion Mexicana Vs Panama Guia Completa Para Ver La Final De La Concacaf

May 22, 2025

Seleccion Mexicana Vs Panama Guia Completa Para Ver La Final De La Concacaf

May 22, 2025 -

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 22, 2025

Donde Y Cuando Ver El Partido Mexico Vs Panama Final Liga De Naciones Concacaf

May 22, 2025 -

Mexico Vs Panama Final Liga De Naciones Concacaf Fecha Hora Y Transmision

May 22, 2025

Mexico Vs Panama Final Liga De Naciones Concacaf Fecha Hora Y Transmision

May 22, 2025 -

Mexico Vs Panama Hora Canal Y Donde Ver La Final De La Liga De Naciones Concacaf

May 22, 2025

Mexico Vs Panama Hora Canal Y Donde Ver La Final De La Liga De Naciones Concacaf

May 22, 2025