Understanding The Reasons Behind D-Wave Quantum (QBTS) Stock's Monday Dip

Table of Contents

Monday saw a noticeable dip in D-Wave Quantum (QBTS) stock price, leaving many investors wondering about the causes. This article delves into the potential reasons behind this decline, examining market factors, company-specific news, and broader industry trends affecting quantum computing investments. By analyzing these contributing elements, we aim to provide a clearer understanding of the volatility surrounding QBTS stock and help investors make more informed decisions.

Market-Wide Factors Influencing QBTS Stock Performance

Several macroeconomic and market-wide factors can significantly influence the performance of even promising growth stocks like QBTS. Understanding these broader trends is crucial for interpreting short-term fluctuations.

Overall Market Sentiment and Downturn

A general negative market trend often disproportionately affects technology stocks, including those in the emerging quantum computing sector. Monday's dip in QBTS might be directly linked to a broader downturn in the market. For instance, a decline in the Nasdaq Composite Index, a key benchmark for technology companies, could foreshadow similar movements in related stocks like QBTS.

- Correlation between broader market dips and QBTS performance: A strong negative correlation often exists, meaning that when the overall market falls, QBTS is likely to follow suit.

- Investor risk aversion and its impact on growth stocks like QBTS: During periods of uncertainty, investors tend to move towards safer investments, selling off riskier growth stocks like QBTS.

- Influence of macroeconomic factors (e.g., inflation, interest rates): Rising inflation and interest rates can increase borrowing costs for companies and reduce investor confidence, negatively impacting stock valuations.

Sector-Specific Pressure on Quantum Computing Stocks

The quantum computing sector itself is subject to its own unique pressures. Negative news or trends within this specific area could also impact QBTS's performance independently of broader market movements.

- News about competitors' advancements or funding: Announcements of breakthroughs or significant funding rounds for competing quantum computing companies could shift investor attention and potentially negatively affect QBTS's valuation.

- Regulatory changes or uncertainties affecting the quantum computing industry: Uncertainties surrounding government regulations or the future direction of the industry could create a climate of risk aversion among investors.

- Investor sentiment shifts concerning the quantum computing market's growth potential: Changes in overall investor confidence in the future of quantum computing could lead to a sell-off in related stocks.

Company-Specific News and Developments Affecting QBTS Stock

In addition to broader market forces, company-specific news and developments can significantly impact QBTS stock performance.

Absence of Positive Catalysts

A lack of positive news or announcements from D-Wave Quantum itself could contribute to a stock price decline. The absence of positive catalysts can lead to a sell-off as investors seek opportunities with more visible near-term growth prospects.

- Absence of major contract wins or partnerships: Failure to secure significant contracts or partnerships could disappoint investors and lead to downward pressure on the stock.

- Delay in product launches or technological breakthroughs: Delays in expected product launches or technological advancements could also dampen investor enthusiasm.

- Lack of positive investor relations activities: A lack of proactive communication and engagement with investors might lead to uncertainty and decreased confidence in the company.

Potential for Negative News or Rumors

Even unsubstantiated rumors or negative news, especially circulated through social media, can have a significant impact on stock prices.

- Analysis of social media and news sentiment surrounding QBTS: Tracking social media sentiment and news coverage regarding QBTS is crucial to understanding potential shifts in investor perception.

- Impact of any analyst downgrades or negative reports: Negative analyst reports or downgrades can create a domino effect, further influencing investor decisions.

- Assessment of the credibility and impact of any circulating rumors: Evaluating the reliability of any rumors circulating is crucial to determine their potential impact on QBTS stock.

Technical Analysis of QBTS Stock Price Movement

Technical analysis provides another perspective on QBTS stock price movements, focusing on chart patterns and trading volume.

Chart Patterns and Trading Volume

Analyzing QBTS's stock chart can reveal potential technical reasons for the dip. This includes examining candlestick patterns and trading volume.

- Analysis of key support and resistance levels: Breaks below key support levels can signal further downward pressure.

- Identification of relevant candlestick patterns: Bearish candlestick patterns, such as shooting stars or dark cloud covers, can indicate a potential shift in market sentiment.

- Examination of trading volume changes: High trading volume during the dip suggests significant selling pressure.

Options Market Activity

Examining options market activity can offer further insights into the price movement.

- Analysis of put/call ratios: High put/call ratios (more puts than calls) often indicate a bearish sentiment among options traders.

- Assessment of unusual option volume or open interest: Unusual spikes in option volume or open interest could suggest large institutional investors taking positions.

- Impact of options trading on QBTS stock price: Significant options trading activity can influence the underlying stock's price.

Conclusion

The Monday dip in D-Wave Quantum (QBTS) stock likely resulted from a confluence of factors, including broader market weakness, sector-specific pressures, and potentially company-specific news or a lack thereof. A comprehensive analysis encompassing fundamental and technical factors is vital for understanding these price fluctuations and making informed investment decisions. Continuously monitoring D-Wave Quantum (QBTS) stock news, market trends, and company developments is essential for navigating the volatility inherent in the quantum computing investment landscape. Stay informed to make sound decisions about your QBTS stock investments.

Featured Posts

-

Abn Group Victoria Chooses Half Dome For Digital Marketing Services

May 21, 2025

Abn Group Victoria Chooses Half Dome For Digital Marketing Services

May 21, 2025 -

Patra Breite Toys Efimereyontes Iatroys Ayto To Savvatokyriako

May 21, 2025

Patra Breite Toys Efimereyontes Iatroys Ayto To Savvatokyriako

May 21, 2025 -

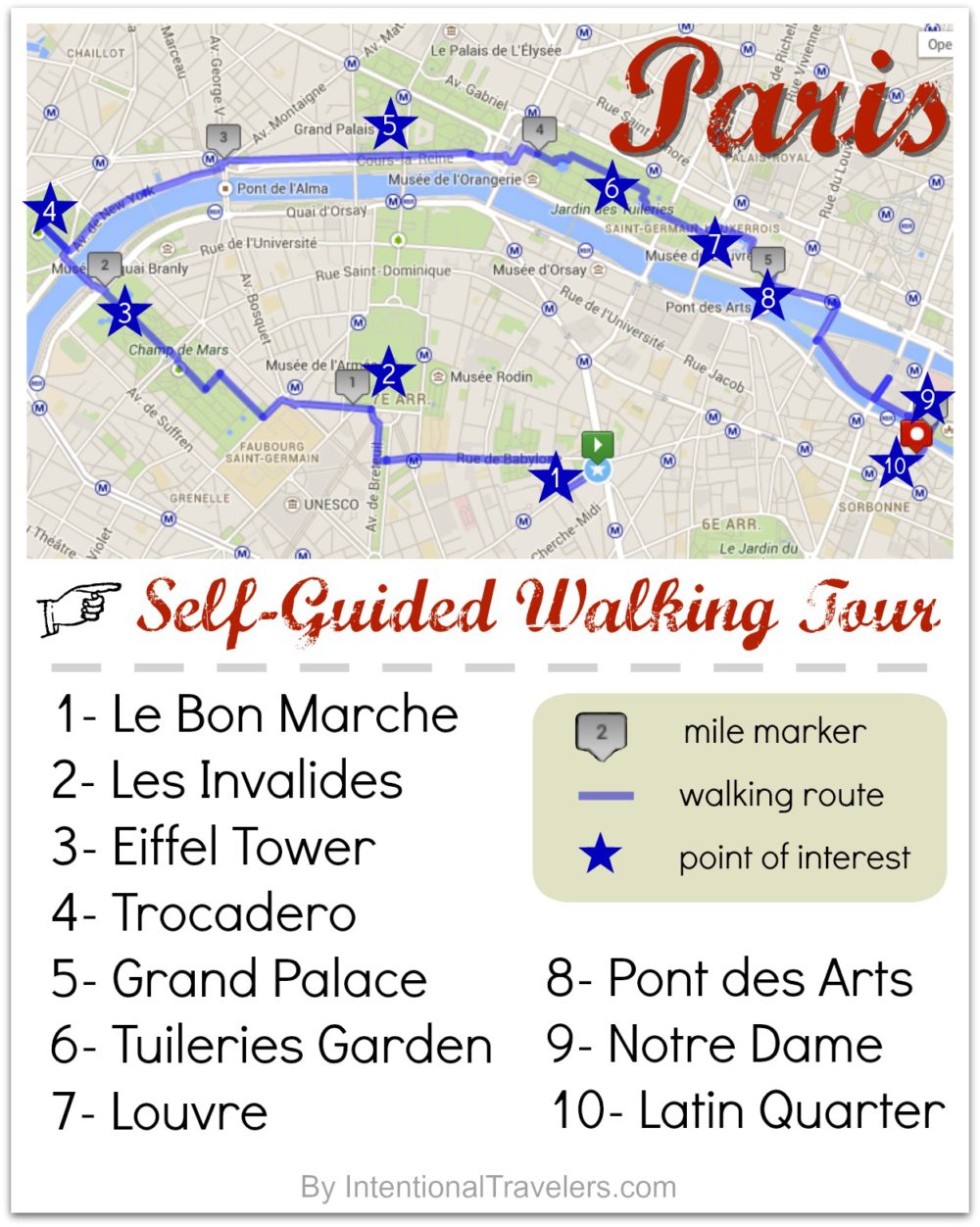

From The Mountains To The Med A Self Guided Walking Tour Of Provence France

May 21, 2025

From The Mountains To The Med A Self Guided Walking Tour Of Provence France

May 21, 2025 -

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 21, 2025

China And Switzerland Urge Dialogue To Resolve Tariff Disputes

May 21, 2025 -

Trinidad Trip Curtailed Dancehall Artists Visit Limited

May 21, 2025

Trinidad Trip Curtailed Dancehall Artists Visit Limited

May 21, 2025

Latest Posts

-

The Sound Perimeter Effect How Music Creates Community

May 22, 2025

The Sound Perimeter Effect How Music Creates Community

May 22, 2025 -

Exploring The Sound Perimeter The Science Of Musical Connection

May 22, 2025

Exploring The Sound Perimeter The Science Of Musical Connection

May 22, 2025 -

Is An Arsenal Great The Next Manchester City Manager Report Suggests Guardiolas Successor

May 22, 2025

Is An Arsenal Great The Next Manchester City Manager Report Suggests Guardiolas Successor

May 22, 2025 -

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025

Ea Fc 24 Fut Birthday Comprehensive Tier List For The Best Players

May 22, 2025 -

Sound Perimeter And Community The Impact Of Shared Musical Experiences

May 22, 2025

Sound Perimeter And Community The Impact Of Shared Musical Experiences

May 22, 2025