Understanding The Recent 20-Cent Increase In Gas Prices

Table of Contents

Global Crude Oil Prices and their Impact

The price of gasoline at the pump is intrinsically linked to global crude oil prices. Crude oil is the raw material from which gasoline is refined, meaning that fluctuations in the global oil market directly translate to changes in gas prices. Several factors influence these global prices, leading to the recent increase.

-

Increased global demand: The global economic recovery, particularly in regions like Asia, has led to a significant increase in the demand for crude oil. This heightened demand outstrips supply, driving prices upward. Stronger economic growth often translates to increased industrial activity and transportation needs, fueling the need for more oil.

-

Geopolitical instability: Geopolitical instability in regions like the Middle East, a major oil-producing area, frequently disrupts oil production and supply chains. Conflicts, sanctions, and political uncertainties create volatility in the oil market, leading to price spikes. The impact of these events on the global supply chain can be significant and immediate.

-

OPEC+ production decisions: The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) influence global oil supply through their production quotas. Decisions to reduce or increase production significantly impact the global oil price. These decisions are often based on a complex assessment of market dynamics and geopolitical factors.

-

Sanctions and their effects: International sanctions imposed on oil-exporting nations can restrict the global supply of crude oil. This scarcity directly contributes to higher prices. Sanctions can be a powerful tool, but they also have far-reaching economic consequences, including impacting gas prices.

-

Price fluctuations in major oil benchmarks: Keep an eye on key benchmarks like Brent Crude and West Texas Intermediate (WTI). These benchmarks reflect global oil prices and their movement directly impacts domestic gas prices. Tracking these indices offers valuable insights into future price trends.

Refinery Capacity and Operational Challenges

Refinery capacity plays a crucial role in determining the final price of gasoline. Even with abundant crude oil, limited refining capacity can constrain the supply of gasoline, leading to price increases.

-

Planned and unplanned refinery maintenance: Regular maintenance and unexpected shutdowns at refineries reduce their output, temporarily limiting the supply of gasoline and pushing prices higher. These shutdowns can be due to various factors, including equipment failures or necessary upgrades.

-

Demand exceeding refinery output: Periods of high demand, such as during peak driving seasons, can strain refinery capacity, leading to price increases as supply struggles to meet demand. This is particularly relevant during summer months and holiday periods.

-

Aging infrastructure: Many US refineries are aging, leading to reduced efficiency and increased maintenance needs. This can contribute to decreased output and higher gas prices. Investments in refinery modernization are crucial for ensuring sufficient capacity to meet demand.

-

Labor shortages: A shortage of skilled labor within the refining industry can impact operational efficiency, potentially leading to lower output and higher gas prices. Attracting and retaining skilled workers is vital for maintaining efficient refinery operations.

Seasonal Demand and its Effect on Prices

Seasonal changes significantly impact gasoline demand and, consequently, prices. Summer months, in particular, see a surge in demand due to increased travel and leisure activities.

-

Increased consumer travel: The summer driving season and holidays consistently drive up demand for gasoline. This increased consumption leads to higher prices as supply struggles to keep pace. Families taking road trips and increased tourism are major contributors to this seasonal increase.

-

Higher demand during holidays: Major holidays, such as Memorial Day, Independence Day, and Labor Day in the US, witness a sharp increase in gasoline demand, leading to higher prices. This predictable surge in demand impacts pricing across the country.

-

The role of weather patterns: Unexpected weather events, such as hurricanes or severe winter storms, can disrupt supply chains and lead to temporary gas price spikes. These events can damage infrastructure or restrict access to fuel, directly influencing availability and cost.

Government Regulations and Taxation

Government policies and taxes significantly influence the final price consumers pay at the pump.

-

Federal and state taxes on gasoline: Federal and state taxes on gasoline are substantial and vary across different jurisdictions. These taxes contribute significantly to the final price, differing based on location.

-

Environmental regulations: Environmental regulations aimed at reducing emissions from gasoline production and use can increase production costs, which in turn impact the retail price. These regulations aim to improve air quality and reduce carbon emissions, but can increase the cost of gasoline.

-

Carbon taxes: Some jurisdictions impose carbon taxes on gasoline, aiming to discourage the use of fossil fuels. These taxes directly add to the price of gasoline and aim to incentivize the use of cleaner energy sources.

The Role of Speculation in the Market

Market speculation also plays a role in gas price volatility. Traders' expectations about future oil prices can influence the current market price, contributing to price fluctuations independent of underlying supply and demand.

Conclusion

The recent 20-cent increase in gas prices is a result of a complex interplay of factors. Global crude oil prices, influenced by geopolitical events and OPEC+ decisions, play a significant role. Limited refinery capacity, seasonal demand fluctuations, and government regulations and taxes all contribute to the final price at the pump. Understanding these factors is crucial for consumers to make informed financial decisions. Stay informed about the fluctuating gas prices by regularly checking reliable news sources and energy market analyses. Understanding the factors influencing the price of gas empowers you to make better financial decisions and potentially mitigate the impact of future increases in gas prices. Keep an eye out for updates on future changes in gas prices and how to manage rising fuel costs.

Featured Posts

-

Kosova Ne Ligen B Investimet E Uefa S Dhe Perspektivat E Ardhshme

May 22, 2025

Kosova Ne Ligen B Investimet E Uefa S Dhe Perspektivat E Ardhshme

May 22, 2025 -

Konfiskatsiya Rosiyskikh Aktiviv Novini Ta Pozitsiya Lindsi Grama Ta Inshikh Senatoriv S Sh A

May 22, 2025

Konfiskatsiya Rosiyskikh Aktiviv Novini Ta Pozitsiya Lindsi Grama Ta Inshikh Senatoriv S Sh A

May 22, 2025 -

Saskatchewans Costco Campaign A Political Panel Analysis

May 22, 2025

Saskatchewans Costco Campaign A Political Panel Analysis

May 22, 2025 -

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025

Memes De La Final De La Liga De Naciones Panama Vs Mexico

May 22, 2025 -

Supera Al Arandano Este Superalimento Protege Contra Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025

Supera Al Arandano Este Superalimento Protege Contra Enfermedades Cronicas Y Promueve La Longevidad

May 22, 2025

Latest Posts

-

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025

The Border Mails James Wiltshire 10 Years Of Capturing Local Life

May 23, 2025 -

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025

James Wiltshires Photographic Legacy 10 Years With The Border Mail

May 23, 2025 -

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025

Ten Years At The Border Mail Reflecting On A Photographers Journey With James Wiltshire

May 23, 2025 -

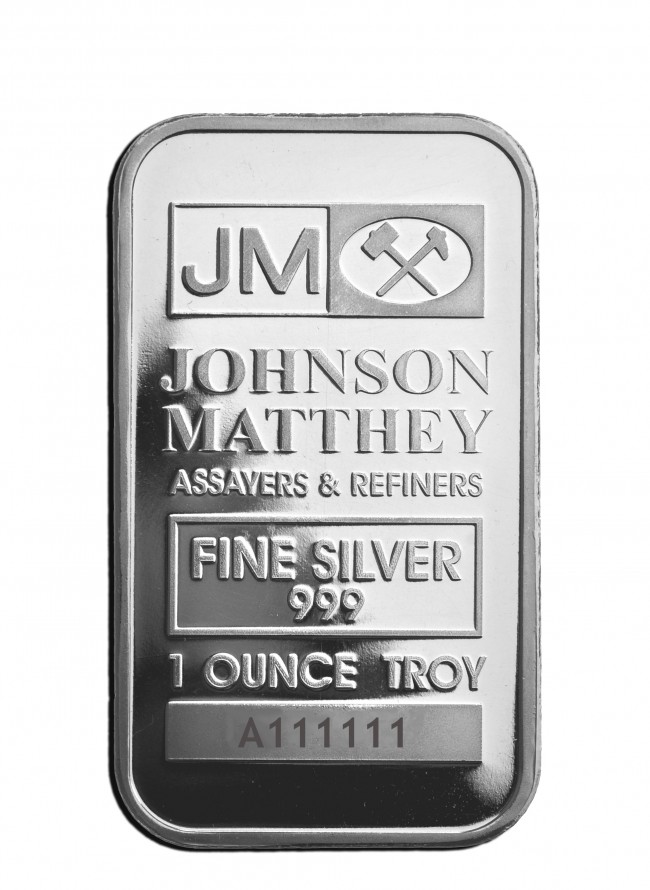

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025

Analysis Johnson Matthey Unit Sale And Subsequent Bt Profit Rise

May 23, 2025 -

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025

Financial Update Johnson Mattheys Honeywell Sale And Bt Profit

May 23, 2025