Understanding The Ripple-$50M SEC Settlement: A Deep Dive Into The XRP Implications

Table of Contents

The Ripple Labs $50 million SEC settlement concluded a long-running legal battle over the classification of XRP, sending ripples (pun intended!) through the cryptocurrency world. This article delves into the details of the settlement, its implications for the future of XRP, and what it means for the broader cryptocurrency landscape. We'll examine the key takeaways and analyze the potential impact on XRP price and regulation, exploring the complexities of the Ripple-$50M SEC settlement and its lasting effects on XRP and the crypto market.

H2: Key Terms and Background of the Ripple SEC Lawsuit

H3: What was the SEC's Case Against Ripple?

The Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs, its CEO Brad Garlinghouse, and its co-founder Chris Larsen in December 2020. The SEC's central claim was that Ripple conducted an unregistered securities offering by selling XRP, arguing that XRP should be classified as a security under the Howey Test. Their allegations included:

- Unregistered Securities Offering: The SEC asserted that Ripple's sales of XRP constituted an unregistered securities offering, violating federal securities laws.

- Distribution of XRP: The SEC focused on the distribution of XRP to institutional investors and the general public, alleging these sales were unregistered securities transactions.

- Profit from XRP Sales: The SEC argued that Ripple and its executives profited significantly from the sale of XRP, benefiting from the investment of others.

The SEC's definition of XRP as a security hinged on the argument that purchasers of XRP reasonably anticipated profits based on Ripple's efforts and that the value of XRP was directly tied to Ripple's business activities.

H3: Ripple's Defense and Arguments:

Ripple vehemently denied the SEC's allegations, arguing that XRP is a cryptocurrency, a decentralized digital asset, and not a security. Their defense included:

- Decentralized Nature of XRP: Ripple emphasized that XRP operates on a decentralized ledger (the XRP Ledger) and is not centrally controlled by Ripple.

- Functional Equivalence to Other Cryptocurrencies: Ripple argued that XRP functions similarly to other established cryptocurrencies like Bitcoin and Ethereum, which are generally not considered securities.

- Programmatic Sales: Ripple pointed to the largely programmatic nature of XRP sales, arguing that this differed significantly from a traditional securities offering.

Ripple's legal strategy involved challenging the SEC's interpretation of the Howey Test and highlighting the differences between XRP and other assets the SEC has previously deemed securities.

H2: Details of the $50 Million Settlement

H3: What did the settlement entail?

The $50 million settlement involved Ripple paying the SEC without admitting or denying the allegations. The settlement did not include penalties against Garlinghouse or Larsen, a key point of contention for many XRP investors. The settlement terms included:

- $50 Million Payment: Ripple paid $50 million to settle the SEC's claims.

- No Admission of Guilt: Crucially, the settlement avoided Ripple admitting guilt on the central question of whether XRP is a security.

- Future Conduct: The settlement likely includes stipulations about Ripple's future conduct regarding the sale and distribution of XRP, although the specifics of these stipulations aren't fully public.

H3: Was it a Victory or Defeat for Ripple?

The settlement's interpretation varies widely. Ripple may view it as a victory by avoiding a potentially far more costly and protracted legal battle and avoiding an admission of guilt, which would have severely damaged the XRP ecosystem. The SEC might see it as a partial victory, achieving a financial settlement and setting a precedent for future regulatory actions against crypto firms. Many XRP investors consider it a mixed outcome, with the relief of avoiding a worse scenario contrasted by uncertainty about XRP’s future classification. The lack of a clear legal precedent remains a significant concern.

H2: Impact on XRP and the Cryptocurrency Market

H3: XRP Price Volatility Following the Settlement:

The Ripple-$50M SEC settlement immediately impacted XRP's price, initially causing a surge followed by subsequent volatility. Analyzing price charts reveals a complex pattern; however, in the long term, the effect has been a gradual climb back, suggesting positive investor sentiment concerning the lack of a guilty plea by Ripple.

- Immediate Impact: The settlement news triggered an initial price spike, reflecting the removal of uncertainty.

- Long-Term Effects: While initially positive, the long-term effect on XRP price remains to be seen and depends on further market factors and regulatory developments.

- Market Sentiment: Investor sentiment surrounding XRP has been a rollercoaster, with periods of both optimism and uncertainty.

(Include relevant charts and graphs here to illustrate price fluctuations.)

H3: Regulatory Implications for Other Cryptocurrencies:

The Ripple case has significant implications for other cryptocurrencies, especially those with similar business models or tokenomics. The settlement doesn't create a clear legal framework, leaving other crypto projects in a state of regulatory uncertainty.

- Regulatory Scrutiny: Other crypto projects now face increased regulatory scrutiny, prompting many to review their legal positions and operational strategies.

- Impact on Development and Adoption: The uncertainty surrounding regulation could hamper the development and mainstream adoption of new cryptocurrencies.

- Future Regulatory Frameworks: This case highlights the need for clearer and more consistent regulatory frameworks for the cryptocurrency industry globally.

H2: Looking Ahead: The Future of XRP and Crypto Regulation

H3: Potential Scenarios for XRP's Future:

Several potential scenarios exist for XRP’s future. These include:

- Continued Growth: Despite the settlement, XRP might continue to grow in adoption and utility, particularly if Ripple continues to innovate and build its ecosystem.

- Regulatory Clarity: The outcome could drive the push for clearer regulations, eventually boosting the confidence and credibility of XRP.

- Further Legal Challenges: The lack of a definitive decision might lead to future legal challenges, either from the SEC or other entities.

H3: The Ongoing Debate on Crypto Regulation:

The Ripple case underscores the ongoing global debate surrounding cryptocurrency regulation. The need for a balanced approach—one that promotes innovation while protecting investors—is paramount.

- Global Regulatory Harmonization: A more consistent global regulatory approach is necessary to prevent regulatory arbitrage and ensure a level playing field.

- Investor Protection: Strong investor protection mechanisms are crucial to prevent fraud and manipulation in the cryptocurrency market.

- Innovation: Regulations should avoid stifling innovation within the cryptocurrency industry.

Conclusion:

The Ripple-$50M SEC settlement is a significant development, yet it offers no definitive answers regarding the regulatory classification of all cryptocurrencies. Its effects on XRP’s price and the wider crypto market remain uncertain, creating both opportunities and challenges. Understanding the nuances of this case – the Ripple-$50M SEC settlement and its implications for XRP – is vital for anyone in the cryptocurrency market. Continue to monitor developments surrounding the Ripple-$50M SEC settlement and the evolving regulatory environment for cryptocurrencies like XRP to make informed decisions.

Featured Posts

-

Fortnite Item Shop Update Highly Demanded Skins Restock After 1000 Days

May 02, 2025

Fortnite Item Shop Update Highly Demanded Skins Restock After 1000 Days

May 02, 2025 -

Lotto 6aus49 Ergebnisse Vom 19 April 2025 Gewinnzahlen Und Zusatzzahl

May 02, 2025

Lotto 6aus49 Ergebnisse Vom 19 April 2025 Gewinnzahlen Und Zusatzzahl

May 02, 2025 -

Meer Dan Een Jaar Wachten Op Een Tbs Plek Een Schrijnend Tekort Aan Capaciteit

May 02, 2025

Meer Dan Een Jaar Wachten Op Een Tbs Plek Een Schrijnend Tekort Aan Capaciteit

May 02, 2025 -

Microsoft Activision Deal Ftc Files Appeal Against Court Ruling

May 02, 2025

Microsoft Activision Deal Ftc Files Appeal Against Court Ruling

May 02, 2025 -

Blay Styshn 6 Kl Ma Thtaj Merfth En Jhaz Alaleab Almntzr

May 02, 2025

Blay Styshn 6 Kl Ma Thtaj Merfth En Jhaz Alaleab Almntzr

May 02, 2025

Latest Posts

-

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025

Bangkok Post Growing Calls For Transgender Equality In Thailand

May 10, 2025 -

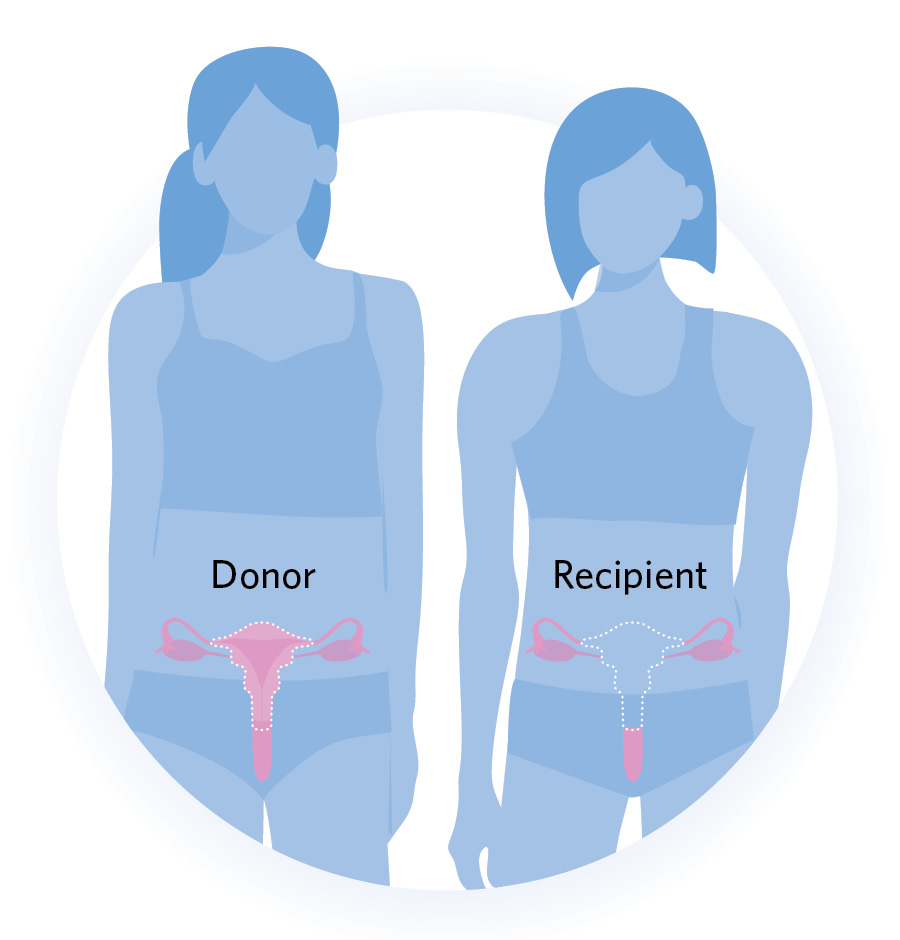

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025

A Community Voice Advocating For Uterus Transplants In Transgender Healthcare

May 10, 2025 -

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025

The Ethics And Feasibility Of Uterus Transplantation For Transgender Mothers

May 10, 2025 -

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025

Uterus Transplantation A New Frontier For Transgender Womens Reproductive Rights

May 10, 2025 -

Transgender Women And Childbearing Exploring The Possibility Of Uterus Transplantation

May 10, 2025

Transgender Women And Childbearing Exploring The Possibility Of Uterus Transplantation

May 10, 2025