Understanding The Volatility Of Riot Platforms (RIOT) And Coinbase (COIN) Stocks

Table of Contents

Factors Affecting the Volatility of RIOT Stock

Riot Platforms (RIOT) is a Bitcoin mining company, making its stock price highly sensitive to various market forces. The volatility of RIOT stock is significantly impacted by several key factors:

Bitcoin Price Fluctuations

The price of Bitcoin directly impacts Riot Platforms' revenue and profitability. Since RIOT's core business is Bitcoin mining, a rise in Bitcoin's price translates to increased revenue and higher profit margins, leading to a rise in RIOT's stock price. Conversely, a Bitcoin price drop significantly impacts RIOT's bottom line and stock value.

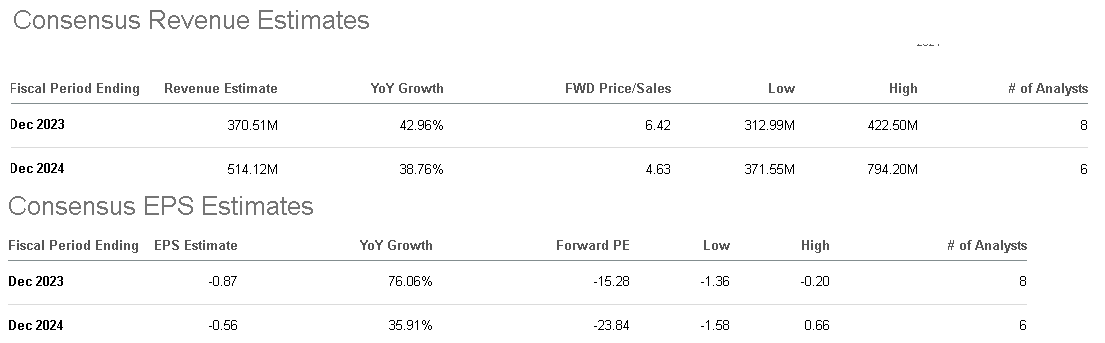

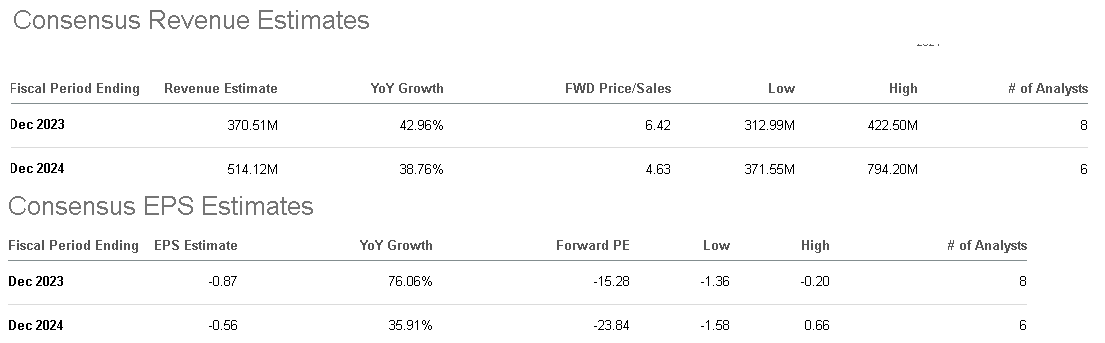

- Correlation: A strong positive correlation exists between Bitcoin's price and RIOT's share price. (Note: Include a chart or data points here showcasing this correlation if available).

- Bitcoin Halving Events: Bitcoin halving events, which reduce the rate of new Bitcoin creation, can influence RIOT's profitability in the long term. The reduced supply of new Bitcoin can potentially increase its price, but the impact on RIOT's short-term stock price can be complex and depends on various factors.

Regulatory Uncertainty

The cryptocurrency industry faces significant regulatory uncertainty globally. Changes in regulations concerning cryptocurrency mining, taxation, and environmental concerns directly impact RIOT's operations and stock performance.

- US Regulatory Landscape: Developments in US regulatory frameworks concerning cryptocurrency mining, including potential tax changes or environmental regulations, significantly influence investor sentiment towards RIOT.

- Geopolitical Risks: Governmental actions or policies in different countries regarding Bitcoin mining can also create volatility in RIOT's stock price. For example, changes in energy policies in regions where RIOT operates could affect its costs and profitability.

Operational Efficiency and Mining Costs

Riot Platforms' operational efficiency and mining costs play a crucial role in its profitability and consequently, its stock price.

- Energy Costs: The price of electricity is a major operating expense for Bitcoin mining companies. Fluctuations in energy prices directly impact RIOT's profitability and stock price.

- Mining Hardware: Technological advancements in mining hardware constantly affect the competitiveness of Bitcoin miners. RIOT's ability to upgrade its hardware and maintain operational efficiency impacts its market share and profitability.

- Expansion and Upgrades: Announcements regarding Riot's expansion plans, new mining facilities, or hardware upgrades can significantly influence investor sentiment and the RIOT stock price.

Factors Affecting the Volatility of COIN Stock

Coinbase (COIN), a major cryptocurrency exchange, is also subject to significant stock price volatility driven by various factors.

Cryptocurrency Market Trends

The overall cryptocurrency market’s performance heavily influences Coinbase's trading volume and revenue, directly affecting its stock price.

- Bull vs. Bear Markets: During bull markets (periods of rising cryptocurrency prices), Coinbase's trading volume and revenue surge, driving up its stock price. Conversely, bear markets lead to decreased trading activity and lower revenue, negatively impacting COIN's stock.

- Altcoin Performance: The performance of altcoins (cryptocurrencies other than Bitcoin) also influences COIN's trading volume and, consequently, its stock price.

- Major Cryptocurrency Events: News and events in the cryptocurrency market, such as new coin launches, regulatory announcements, or significant price movements, create volatility in COIN's stock price.

Trading Volume and Fees

Coinbase's revenue is directly tied to its trading volume and the fees it charges.

- Trading Volume: Higher trading volume directly translates to higher revenue for Coinbase. Factors influencing trading volume include market sentiment, cryptocurrency price movements, and overall investor participation.

- Competitive Landscape: Coinbase competes with other cryptocurrency exchanges. Competitive pricing and features influence its market share and profitability, impacting its stock price.

- User Growth and Adoption: Increased user adoption and growth on the Coinbase platform are vital for its long-term success and stock price performance.

Regulatory Scrutiny and Compliance Costs

The cryptocurrency exchange industry faces intense regulatory scrutiny globally. Compliance costs and regulatory challenges significantly impact Coinbase's profitability and stock price.

- Regulatory Actions and Investigations: Any regulatory actions, investigations, or lawsuits against Coinbase can significantly impact investor confidence and its stock price.

- Compliance Costs: The costs associated with complying with various regulations can reduce Coinbase's profitability.

- Reputational Risk: Negative news or events affecting Coinbase's reputation can severely impact its stock price.

Comparing the Volatility of RIOT and COIN

Both RIOT and COIN stocks exhibit significant volatility, but the nature and drivers of that volatility differ. RIOT's volatility is more directly tied to the price of Bitcoin, while COIN's volatility is influenced by a broader range of factors, including the overall cryptocurrency market, trading volume, and regulatory developments. (Note: Include a comparative analysis using historical data or volatility indices if available). Determining which stock is "more volatile" depends on the specific timeframe and market conditions.

Conclusion: Navigating the Volatility of Riot Platforms (RIOT) and Coinbase (COIN) Stocks

The volatility of Riot Platforms (RIOT) and Coinbase (COIN) stocks is driven by a complex interplay of factors, including cryptocurrency market trends, regulatory uncertainty, and company-specific performance. Understanding these factors is paramount for investors. RIOT's volatility is heavily influenced by Bitcoin's price, while COIN's volatility is linked to broader market trends and regulatory risks. Both stocks present significant opportunities but also carry substantial risk.

Key Takeaways:

- Bitcoin price directly impacts RIOT's stock price.

- Regulatory uncertainty affects both RIOT and COIN.

- Coinbase's success is linked to broader market trends and trading volume.

- Both stocks are highly volatile and require careful consideration.

Call to Action: While potentially rewarding, investing in RIOT and COIN requires a deep understanding of the volatility inherent in the cryptocurrency market. Conduct thorough due diligence, carefully assess your risk tolerance, and seek professional financial advice before investing in these volatile stocks. Remember to stay informed about the latest developments impacting the volatility of Riot Platforms (RIOT) and Coinbase (COIN) stocks.

Featured Posts

-

The Pros And Cons Of Using Smart Rings To Combat Infidelity

May 02, 2025

The Pros And Cons Of Using Smart Rings To Combat Infidelity

May 02, 2025 -

Amy Irvings Grief Remembering A Dallas And Carrie Legend

May 02, 2025

Amy Irvings Grief Remembering A Dallas And Carrie Legend

May 02, 2025 -

Mo Salah Contract Liverpools Plan And The Risks

May 02, 2025

Mo Salah Contract Liverpools Plan And The Risks

May 02, 2025 -

Bharty Ryasty Dhshtgrdy Eyd Pr Kshmyr Myn Nwjwan Shhyd

May 02, 2025

Bharty Ryasty Dhshtgrdy Eyd Pr Kshmyr Myn Nwjwan Shhyd

May 02, 2025 -

Should You Invest In Xrp Ripple While Its Under 3

May 02, 2025

Should You Invest In Xrp Ripple While Its Under 3

May 02, 2025

Latest Posts

-

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025

Deconstructing The Arguments Around Trumps Transgender Military Ban

May 10, 2025 -

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025

The Impact Of Trumps Transgender Military Ban An Opinion

May 10, 2025 -

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025

Trumps Transgender Military Policy A Comprehensive Analysis

May 10, 2025 -

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025

Dissecting Trumps Transgender Military Ban An Opinion Piece

May 10, 2025 -

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025

The Transgender Military Ban Unpacking Trumps Rhetoric

May 10, 2025