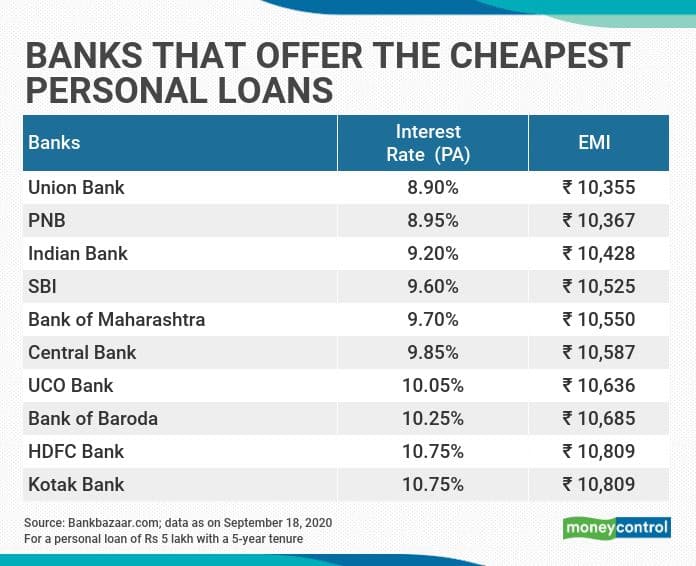

Understanding Today's Personal Loan Interest Rates: A Guide To Finding The Best Deal

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors empowers you to improve your chances of securing a lower rate.

-

Credit Score: Your credit score is a significant factor. Lenders use it to assess your creditworthiness and risk. A higher credit score (excellent: 750+, good: 700-749, fair: 650-699, poor: below 650) typically translates to lower interest rates. Conversely, a poor credit score can result in significantly higher rates or even loan rejection.

-

Loan Amount: Generally, larger loan amounts tend to come with slightly higher interest rates. Lenders perceive larger loans as higher risk.

-

Loan Term: The length of your loan (the term) directly impacts your interest rate. Shorter loan terms usually mean higher monthly payments but lower overall interest paid because you're paying off the principal faster. Longer terms result in lower monthly payments but higher total interest charges.

-

Debt-to-Income Ratio (DTI): Your DTI, the ratio of your monthly debt payments to your gross monthly income, is a crucial factor. A high DTI indicates a higher level of financial strain, leading lenders to offer higher interest rates or reject your application.

-

Type of Lender: Different lenders offer varying interest rates. Banks often offer competitive rates but might have stricter eligibility criteria. Credit unions may provide more favorable rates to their members, while online lenders can offer a wider range of options but sometimes charge higher fees.

-

Interest Rate Type: Personal loans come with either fixed or variable interest rates. Fixed rates remain constant throughout the loan term, offering predictability. Variable rates fluctuate based on market conditions, potentially leading to savings or increased costs depending on market trends.

| Factor | Impact on Interest Rate |

|---|---|

| Credit Score | Higher score = Lower rate; Lower score = Higher rate |

| Loan Amount | Larger amount = Potentially Higher rate |

| Loan Term | Shorter term = Higher monthly payments, Lower total interest; Longer term = Lower monthly payments, Higher total interest |

| Debt-to-Income Ratio | Higher DTI = Higher rate |

| Type of Lender | Varies by lender; Banks, Credit Unions, Online Lenders offer different rates |

| Interest Rate Type | Fixed rate = Predictable; Variable rate = Fluctuating |

How to Compare Personal Loan Interest Rates

Comparing personal loan interest rates effectively is crucial to finding the best deal. Don't just focus on the interest rate itself; consider the Annual Percentage Rate (APR).

-

APR vs. Interest Rate: The APR includes the interest rate plus any fees and charges associated with the loan. Comparing APRs gives a more accurate representation of the total cost of borrowing.

-

Comparing Offers: Shop around! Compare offers from multiple lenders – banks, credit unions, and online lenders – to find the most competitive APR.

-

Fees and Charges: Pay close attention to origination fees, late payment fees, and prepayment penalties. These can significantly impact the overall cost of your loan.

-

Online Comparison Tools: Use reputable online comparison websites to easily compare multiple loan offers side-by-side. These tools often filter results based on your needs and creditworthiness.

-

Key Steps for Comparison:

- Check the APR, not just the interest rate.

- Compare fees and charges meticulously.

- Read the fine print carefully – understand every term and condition.

- Use reputable comparison websites and avoid suspicious lenders.

Finding the Best Personal Loan Interest Rate for Your Needs

Your individual financial situation significantly impacts your eligibility for the best personal loan interest rates.

-

Pre-qualification vs. Application: Pre-qualification checks your eligibility without impacting your credit score. It gives you an idea of the rates you might qualify for. A formal application will result in a hard credit inquiry, which can slightly lower your score.

-

Improving Credit Score: Before applying, take steps to improve your credit score if it's less than ideal. Paying down debt, avoiding late payments, and keeping your credit utilization low can significantly impact your interest rate.

-

Shopping Around and Negotiating: Don't settle for the first offer. Shop around and compare multiple offers. Some lenders may be willing to negotiate interest rates based on your creditworthiness and the loan terms.

-

Key Steps to Secure a Favorable Rate:

- Check your credit score and obtain a copy of your credit report.

- Work to improve your creditworthiness before applying.

- Shop around and compare offers from different lenders.

- Negotiate with lenders to see if you can secure a better rate.

- Carefully consider your repayment ability to avoid financial strain.

Avoiding Personal Loan Interest Rate Traps

Be aware of predatory lending practices and high-interest loans that can trap you in a cycle of debt.

-

Predatory Lending: Beware of lenders offering excessively high interest rates or hidden fees. These are signs of predatory lending practices.

-

High-Interest Loans and Payday Loans: Avoid high-interest loans and payday loans unless absolutely necessary, as they can lead to a debt spiral.

-

Understanding Loan Terms: Carefully read and understand all loan terms and conditions before signing any agreement.

-

Hidden Fees and Charges: Scrutinize the loan agreement for hidden fees and charges that can inflate the total cost of borrowing.

-

Key Cautions:

- Beware of excessively high interest rates.

- Avoid lenders with a history of predatory practices.

- Read the loan agreement thoroughly before signing.

- Understand all fees and charges upfront.

- Borrow only the amount you truly need.

Conclusion

Securing the best personal loan interest rate involves understanding the key factors influencing rates, such as your credit score, loan amount, and lender type. By comparing APRs from multiple lenders, improving your creditworthiness, and carefully reviewing loan terms, you can significantly improve your chances of finding a favorable deal. Don't delay your financial goals! Start comparing personal loan interest rates today and secure the best possible deal. Use the resources available to find the perfect loan for you and take control of your finances.

Featured Posts

-

X Men 97s Brutal Wolverine Scene Still Unforgettable After A Year

May 28, 2025

X Men 97s Brutal Wolverine Scene Still Unforgettable After A Year

May 28, 2025 -

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025

Info Cuaca Terbaru Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 28, 2025 -

Controversy Over Dutch Deputy Pms Statement On Anti Semitism And Muslim Culture

May 28, 2025

Controversy Over Dutch Deputy Pms Statement On Anti Semitism And Muslim Culture

May 28, 2025 -

Ramalan Cuaca Kalimantan Timur Ikn Balikpapan Samarinda Dan Sekitarnya

May 28, 2025

Ramalan Cuaca Kalimantan Timur Ikn Balikpapan Samarinda Dan Sekitarnya

May 28, 2025 -

Informasi Jadwal Kapal Km Lambelu Nunukan Makassar Sampai Juni 2025

May 28, 2025

Informasi Jadwal Kapal Km Lambelu Nunukan Makassar Sampai Juni 2025

May 28, 2025

Latest Posts

-

Exclusion De Marine Le Pen En 2027 Les Declarations Inquietantes De Laurent Jacobelli

May 30, 2025

Exclusion De Marine Le Pen En 2027 Les Declarations Inquietantes De Laurent Jacobelli

May 30, 2025 -

Marine Le Pen Et La Presidentielle 2027 Jacobelli Denonce Une Tentative D Exclusion

May 30, 2025

Marine Le Pen Et La Presidentielle 2027 Jacobelli Denonce Une Tentative D Exclusion

May 30, 2025 -

Elections 2027 Laurent Jacobelli Affirme Que Marine Le Pen Pourrait Etre Empechee De Se Presenter

May 30, 2025

Elections 2027 Laurent Jacobelli Affirme Que Marine Le Pen Pourrait Etre Empechee De Se Presenter

May 30, 2025 -

Le 9 Mai 2025 Arcelor Mittal Et La Russie Selon Laurent Jacobelli

May 30, 2025

Le 9 Mai 2025 Arcelor Mittal Et La Russie Selon Laurent Jacobelli

May 30, 2025 -

Hanouna Le Pen 2027 Jacobelli S Inquiete D Une Exclusion De La Candidate

May 30, 2025

Hanouna Le Pen 2027 Jacobelli S Inquiete D Une Exclusion De La Candidate

May 30, 2025