Unexpected Dip In PBOC's Daily Yuan Intervention

Table of Contents

Analyzing the Recent Decrease in PBOC Intervention

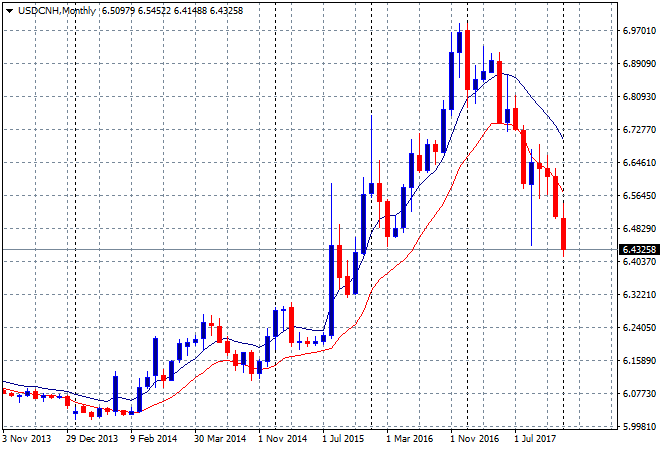

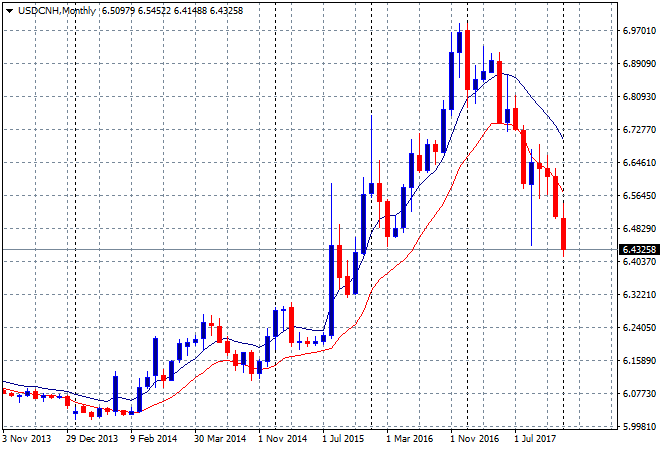

The PBOC typically intervenes in the foreign exchange market to manage the Yuan's value against other major currencies, primarily the US dollar. This intervention often involves buying or selling Yuan to influence its exchange rate, aiming for stability and preventing excessive volatility. However, recent data reveals an uncharacteristic decline in this activity. While precise figures may vary depending on the source and methodology, reports suggest a noticeable reduction in PBOC intervention starting [Insert Specific Dates, if available]. This change marks a significant departure from previous patterns, prompting speculation and analysis from economists and market observers worldwide.

-

Possible Reasons for Reduced Intervention:

- Increased Market Stability: The reduced intervention could indicate increased confidence in the market's ability to self-regulate the Yuan's value. A more stable and predictable market might require less direct PBOC involvement.

- Shift in Economic Policy: The PBOC might be subtly shifting its economic priorities, prioritizing other goals over strict Yuan management. This could reflect a broader change in China's economic strategy.

- Testing Market Depth: The decrease might be a strategic move to test the resilience and depth of the Yuan market, gauging its ability to withstand external pressures without heavy government intervention.

-

Impact on Yuan Volatility and Trading Volume: The reduction in PBOC intervention has led to increased volatility in the Yuan exchange rate. Trading volume has also experienced fluctuations, reflecting heightened market uncertainty.

-

Comparison to Previous Intervention Levels and Patterns: Comparing the current levels of PBOC intervention with historical data reveals a significant deviation from previous trends. This stark difference underscores the unusual nature of the recent events.

Potential Implications for the Chinese Economy

A less actively managed Yuan carries significant implications for the Chinese economy. The consequences are complex and multifaceted, potentially impacting various sectors.

-

Inflation: A weaker Yuan can lead to increased import costs, potentially fueling inflation. Conversely, a stronger Yuan could curb inflation but might negatively affect exports.

-

Exports and Imports: Fluctuations in the Yuan's value directly affect the price competitiveness of Chinese exports and imports. A weaker Yuan can boost exports but also increase import costs.

-

Foreign Investment: The level of PBOC intervention influences investor confidence. Reduced intervention might signal greater market risk, potentially affecting foreign direct investment flows into China.

-

Analysis of positive and negative impacts: While a more market-driven Yuan could foster greater efficiency and transparency, it also introduces greater uncertainty and risk. The net effect depends on various factors, including global economic conditions and domestic policies.

-

Consideration of short-term vs. long-term effects: The short-term effects of reduced intervention might include increased volatility, but the long-term effects could lead to a more resilient and market-oriented exchange rate system.

-

Expert opinions: Many economists are closely observing the situation, offering diverse perspectives on the implications. [Mention specific expert opinions and their sources].

Global Market Reactions to Reduced PBOC Intervention

The reduced PBOC intervention has sparked significant reactions in global markets, underscoring the Yuan's increasing global importance.

-

Global currency markets: The Yuan's movements have impacted other currencies, causing fluctuations and adjustments in various exchange rates.

-

International trade: The change in the Yuan's value has altered the dynamics of international trade, affecting pricing, competitiveness, and trade balances for various countries.

-

Investor confidence: The decreased intervention has introduced uncertainty, impacting investor confidence in the Chinese economy and potentially influencing investment decisions.

-

Specific examples of market reactions: [Provide specific examples of market fluctuations and their links to the reduced intervention].

-

Statements from international financial institutions: International organizations like the IMF have likely issued statements or analyses commenting on the situation. [Mention specific statements and their sources].

-

Potential ripple effects on other economies: The changes in the Chinese economy can have cascading effects on other globally connected economies.

The Role of External Factors

Several external factors might have contributed to the PBOC's decision to reduce its intervention.

-

Global economic uncertainty: Global economic headwinds and uncertainties might have prompted the PBOC to adopt a more flexible approach to the Yuan's management.

-

US-China relations: Geopolitical tensions and trade relations between the US and China could have played a role in the decision-making process.

-

Detailed explanation of each external factor and its influence: [Provide detailed explanations with supporting data].

Looking Ahead: Predicting Future PBOC Intervention Strategies

Predicting the PBOC's future actions is challenging, but several scenarios are possible.

-

Possible scenarios for increased or decreased intervention: The PBOC might increase intervention in response to excessive volatility or decrease it further to promote market-driven adjustments.

-

Factors that could influence future decisions: Domestic economic conditions, global economic developments, and geopolitical factors will all likely influence future PBOC decisions.

-

Expert predictions and forecasts: [Mention expert predictions and forecasts for future PBOC intervention strategies].

Conclusion

The unexpected dip in PBOC's daily Yuan intervention represents a significant development with far-reaching consequences for the Chinese economy and global markets. The reduced intervention has led to increased Yuan volatility and uncertainty, impacting international trade, investment flows, and investor confidence. While the long-term effects remain uncertain, careful monitoring of the situation is crucial. Understanding the nuances of PBOC's Yuan policy and its evolving dynamics is essential for navigating the complexities of the global economic landscape. Stay informed about future developments in PBOC's daily Yuan intervention and its broader economic consequences by subscribing to updates from reputable financial news sources and consulting expert analysis on Chinese currency intervention and Yuan exchange rate management.

Featured Posts

-

High Prices Paid For Kid Cudis Auctioned Possessions

May 16, 2025

High Prices Paid For Kid Cudis Auctioned Possessions

May 16, 2025 -

The Muncy Paradox Imagining A Conversation Between Two Max Muncys

May 16, 2025

The Muncy Paradox Imagining A Conversation Between Two Max Muncys

May 16, 2025 -

Tampa Bay Rays Achieve Series Sweep Against Padres

May 16, 2025

Tampa Bay Rays Achieve Series Sweep Against Padres

May 16, 2025 -

Winning Bets Nba And Nhl Round 2 Playoff Predictions

May 16, 2025

Winning Bets Nba And Nhl Round 2 Playoff Predictions

May 16, 2025 -

Padres Winning Streak Tatis Jr S Role And Team Dynamics

May 16, 2025

Padres Winning Streak Tatis Jr S Role And Team Dynamics

May 16, 2025