Unlocking Profitable Dividends: A Simple Strategy

Table of Contents

1. Introduction:

Dividend investing offers a compelling path to building wealth and generating passive income. Instead of solely relying on capital appreciation, dividend investing provides a regular stream of income from your investments. This article outlines a straightforward strategy to help you navigate the world of dividend stocks, ultimately unlocking profitable dividends for your financial future. We will explore the basics of dividend investing, teach you how to identify profitable stocks, and guide you in building a thriving dividend portfolio.

2. Main Points:

H2: Understanding Dividend Investing Basics

H3: What are Dividends?

Dividends are payments made by a company to its shareholders, typically from its profits. They represent a share of the company's earnings distributed to those who own its stock. This regular income stream can significantly benefit investors.

- Regular Income Stream: Dividends provide a consistent cash flow, acting as a reliable source of supplemental income.

- Potential for Capital Appreciation: While dividend income is a key benefit, the underlying stock can also appreciate in value, offering further returns.

- Tax Advantages (Depending on Location): In many jurisdictions, dividends may receive preferential tax treatment compared to capital gains. It is vital to understand your local tax laws.

- Reinvestment Options: Many companies offer dividend reinvestment plans (DRIPs), allowing you to automatically reinvest your dividends to purchase more shares, accelerating your wealth growth through compounding.

The dividend yield is the annual dividend per share divided by the share price, representing the percentage return based on the current price. The payout ratio, on the other hand, shows the percentage of earnings a company pays out as dividends.

H3: Types of Dividend-Paying Stocks

Different types of dividend stocks cater to various investment strategies and risk tolerances.

- Growth Stocks with Dividends: These companies prioritize growth but also distribute a portion of their earnings as dividends. Examples include Microsoft (MSFT) or Apple (AAPL).

- Value Stocks with High Dividends: These are often mature companies with lower growth potential but offer high dividend yields. Further research is crucial to assess the sustainability of these high yields.

- Blue-Chip Dividend Aristocrats: These are large, well-established companies with a long history of consistently increasing their dividends. Johnson & Johnson (JNJ) is a prime example. [Link to a resource on Dividend Aristocrats]

H3: Risk Assessment in Dividend Investing

While dividend investing offers significant benefits, it's essential to understand the inherent risks.

- Dividend Cuts: Companies can reduce or eliminate their dividends due to financial difficulties or changing business strategies.

- Company Performance Fluctuations: The value of the underlying stock can fluctuate, impacting both capital appreciation and dividend income.

Thorough due diligence is crucial. This includes:

- Careful analysis of the company's financial statements.

- Diversifying your portfolio across various sectors and companies.

- Understanding the company's business model and competitive landscape.

H2: Identifying Profitable Dividend Stocks

H3: Analyzing Financial Statements

Analyzing key financial metrics is crucial for evaluating the financial health and dividend sustainability of a company.

- Dividend Payout Ratio: A lower payout ratio (percentage of earnings paid as dividends) suggests greater dividend sustainability.

- Dividend Growth History: Consistent dividend growth demonstrates a company's commitment to returning value to shareholders.

- Debt-to-Equity Ratio: A lower ratio indicates lower financial risk.

- Return on Equity (ROE): A higher ROE suggests efficient use of shareholder equity.

[Link to a resource explaining financial statement analysis] This provides a step-by-step guide on interpreting these key metrics.

H3: Screening for High-Yield, Low-Risk Opportunities

Stock screeners are valuable tools for identifying potential dividend investments. Use them to filter based on:

- High dividend yield (but always consider sustainability!)

- Consistent dividend growth

- Strong financial health (based on the metrics discussed above)

[Link to a reliable online stock screener] Remember that high yield alone doesn't guarantee profitability; always look beyond yield.

H3: Diversification and Portfolio Management

Diversification is key to mitigating risk in dividend investing. Spread your investments across different sectors and companies to reduce the impact of any single company's underperformance.

- Consider a diversified portfolio including different types of dividend stocks (growth, value, blue-chip).

- Regularly rebalance your portfolio to maintain your desired asset allocation.

H2: Building a Profitable Dividend Portfolio

H3: Setting Your Investment Goals

Before investing, define your financial goals:

- Retirement

- Early retirement

- Supplemental income

Having clear goals will help you choose appropriate dividend stocks and manage your portfolio effectively.

H3: Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the stock price. This helps mitigate the risk of investing a lump sum at a market peak.

- Invest a set amount each month or quarter.

- This strategy helps average out your purchase price over time.

H3: Reinvesting Dividends

Reinvesting your dividends allows you to compound your returns, accelerating your wealth growth.

- Many companies offer DRIPs (Dividend Reinvestment Plans).

- Explore DRIPs to maximize the power of compounding.

3. Conclusion:

Unlocking profitable dividends requires a strategic approach. Understanding dividend investing basics, identifying profitable stocks through careful analysis, and building a diversified portfolio are all key steps. By utilizing stock screeners, analyzing financial statements, and employing strategies like dollar-cost averaging and dividend reinvestment, you can build a strong foundation for long-term financial success.

Start your journey towards building your profitable dividend portfolio today! Explore reliable resources, research dividend-paying stocks, and begin discovering profitable dividend strategies that align with your financial goals. [Link to a relevant resource, e.g., a financial planning tool or a comprehensive guide to dividend investing] Take control of your financial future and unlock higher dividend income.

Featured Posts

-

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025 -

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 10, 2025

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 10, 2025 -

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025

The Impact Of Figmas Ai On Adobe Word Press And Canva

May 10, 2025 -

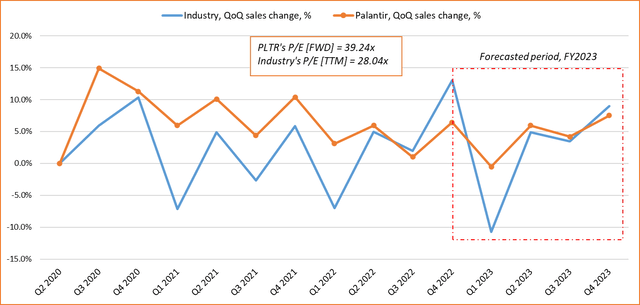

Should You Invest In Palantir Stock Before May 5th

May 10, 2025

Should You Invest In Palantir Stock Before May 5th

May 10, 2025 -

Bangkok Post Highlights Urgent Need For Transgender Equality Legislation

May 10, 2025

Bangkok Post Highlights Urgent Need For Transgender Equality Legislation

May 10, 2025