Unprecedented Growth: Saudi Arabia's ABS Market After Key Regulatory Reform

Table of Contents

The Regulatory Landscape Before and After the Reform

Prior to the regulatory overhaul, Saudi Arabia's ABS market faced several limitations hindering its development. Complex approval processes, unclear guidelines, and a lack of transparency discouraged participation from both issuers and investors. The securitization process was cumbersome, leading to higher costs and longer timelines. This stifled innovation and limited the market's potential.

The key reforms implemented have dramatically altered this landscape. The changes focused on streamlining processes, enhancing transparency, and clarifying the legal frameworks surrounding securitization. These improvements have instilled greater confidence among investors, paving the way for significant growth in Saudi Arabia's ABS market.

Here are some specific changes and their impact:

- Streamlined approval processes for ABS issuances: Reduced processing times from months to weeks, encouraging more frequent issuances.

- Increased investor confidence due to enhanced transparency requirements: More detailed disclosures and standardized reporting have built trust in the market.

- Clarification on legal frameworks surrounding securitization: Reduced legal ambiguity and risk for issuers and investors, leading to greater participation.

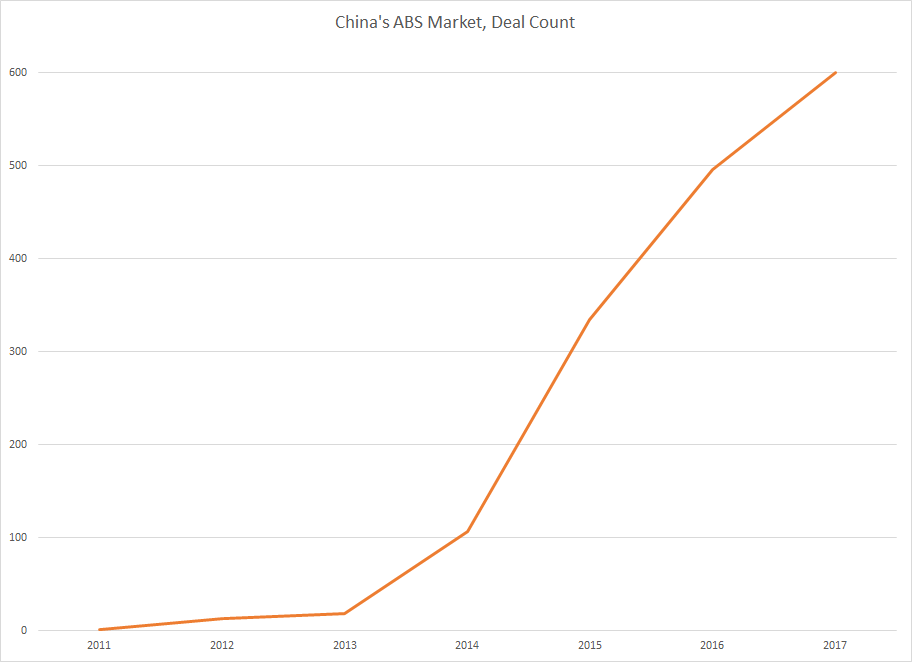

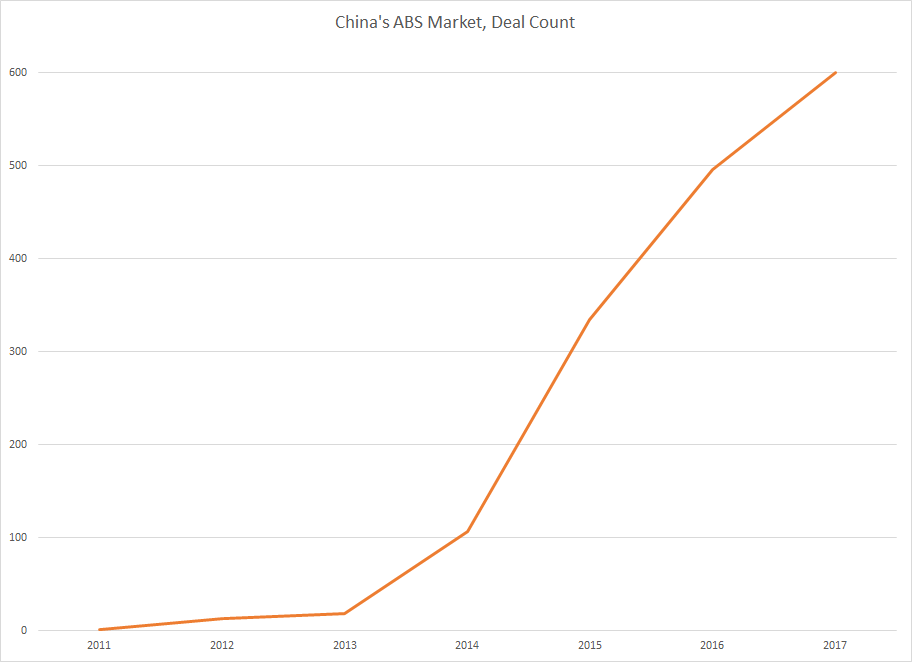

Data illustrating the positive impact of these reforms, while not readily available publicly in a consolidated form, would show a significant increase in the number of ABS issuances and the overall market volume post-reform. The increased efficiency and clarity have been instrumental in unlocking the potential of Saudi Arabia's ABS market.

Increased Participation and Market Depth

The regulatory reforms have spurred a noticeable rise in participation from both issuers and investors in Saudi Arabia's ABS market. A wider range of assets are now being securitized, including auto loans, mortgages, and credit card receivables. This diversification strengthens the market's resilience and attracts a more diverse investor base.

The growth in market volume and trading activity is remarkable. [Insert chart or graph illustrating growth in market volume]. The influx of both domestic and international investors reflects the growing confidence in the market's stability and potential for returns. This increase in liquidity further strengthens Saudi Arabia's ABS market.

Key examples of this increased participation include:

- Significant increase in the number of ABS issuances in the last [number] years: [Insert specific numbers if available].

- Growth in the total value of ABS outstanding: [Insert specific numbers if available].

- Attraction of international investors seeking opportunities in the Saudi market: [Mention specific examples of international investors if possible].

The Role of Technology and Fintech in ABS Market Growth

Technological advancements are playing a crucial role in boosting the efficiency and transparency of Saudi Arabia's ABS market. The adoption of blockchain technology, for instance, enhances security and transparency in transaction processing, reducing the risk of fraud and improving trust. Artificial intelligence (AI) is also being applied to improve credit risk assessment, leading to more accurate pricing and better risk management.

Fintech companies are facilitating transactions and providing innovative solutions, further streamlining the process. Government initiatives promoting the digitalization of financial services have also contributed to the growth.

Here are specific examples of technological impact:

- Use of blockchain for enhanced security and transparency in transaction processing: Reducing costs and improving efficiency.

- Application of AI for improved credit risk assessment: Leading to better pricing and risk management.

- Government initiatives promoting digitalization of financial services: Creating a supportive ecosystem for fintech innovation.

Challenges and Future Outlook for Saudi Arabia's ABS Market

Despite the significant progress, challenges remain. Standardization across different asset classes is crucial for further growth, along with improved investor education to increase participation. The global economic climate also presents a degree of uncertainty.

However, the future outlook remains positive. The potential for growth in Saudi Arabia's ABS market is considerable. Expansion into new asset classes for securitization, further refinement of the regulatory framework, and increased investor awareness and education will all contribute to the market's continued development.

Potential future developments include:

- Expansion into new asset classes for securitization: Such as infrastructure projects or renewable energy assets.

- Further development of the regulatory framework: Addressing any remaining ambiguities and fostering greater innovation.

- Increased investor awareness and education: Promoting understanding of ABS and attracting a wider range of investors.

Conclusion: Harnessing the Potential of Saudi Arabia's ABS Market

The unprecedented growth of Saudi Arabia's ABS market is a testament to the success of the recent regulatory reforms. The increased participation, technological advancements, and improved transparency have combined to unlock the market's enormous potential. This growth is vital for the overall economic development of Saudi Arabia, providing a crucial channel for capital formation and investment.

To fully harness the potential of Saudi Arabia's ABS market, continued investment in technology, further refinement of the regulatory framework, and targeted investor education are essential. The opportunities are significant, making investing in the Saudi Arabian ABS sector an attractive prospect for both domestic and international players. Explore the opportunities presented by the dynamic Saudi ABS market growth and become a part of this exciting transformation.

Featured Posts

-

Fortnite Item Shop Update Highly Demanded Skins Restock After 1000 Days

May 02, 2025

Fortnite Item Shop Update Highly Demanded Skins Restock After 1000 Days

May 02, 2025 -

Energiecrisis Duurzaam Schoolgebouw Kampen Zonder Stroom Kort Geding Gestart

May 02, 2025

Energiecrisis Duurzaam Schoolgebouw Kampen Zonder Stroom Kort Geding Gestart

May 02, 2025 -

Tuerkiye Nin Avrupa Ile Is Birligi Politikalari

May 02, 2025

Tuerkiye Nin Avrupa Ile Is Birligi Politikalari

May 02, 2025 -

Gueclue Bir Avrupa Is Birligi Icin Yol Haritasi

May 02, 2025

Gueclue Bir Avrupa Is Birligi Icin Yol Haritasi

May 02, 2025 -

Priscilla Pointer Dead At 100 Dallas Star And Steven Spielbergs Mother In Law Passes Away

May 02, 2025

Priscilla Pointer Dead At 100 Dallas Star And Steven Spielbergs Mother In Law Passes Away

May 02, 2025

Latest Posts

-

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 10, 2025 -

Your Complete Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025

Your Complete Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025 -

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025

Your Guide To Live Music And Events In Lake Charles This Easter

May 10, 2025 -

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025 -

The Luis Enrique Effect A Winning Strategy For Paris Saint Germain

May 10, 2025

The Luis Enrique Effect A Winning Strategy For Paris Saint Germain

May 10, 2025