Key Aspects of Chairman Gensler's Statement on Crypto Broker Regulation

Chairman Gensler's statements consistently emphasize the SEC's commitment to investor protection and preventing market manipulation within the crypto space. This focus on crypto regulatory clarity is driving significant changes to how the SEC views crypto assets and broker-dealer registration requirements. Key points include:

- Classification of Crypto Assets: The SEC continues to maintain that many crypto assets are securities, subjecting them to existing securities laws. This classification significantly impacts how platforms dealing in these assets must operate.

- Broker-Dealer Registration: The SEC is intensifying its efforts to ensure that all entities acting as crypto brokers register with the SEC and comply with existing broker-dealer regulations. This means stricter scrutiny of platforms facilitating the buying, selling, and trading of cryptocurrencies.

- Focus on Investor Protection: A core theme is the protection of investors from fraud and manipulation. The SEC is actively pursuing enforcement actions against platforms deemed non-compliant or engaging in fraudulent activities. This underlines the importance of

SEC crypto enforcement actions and their implications for market participants.

- Impact on Stablecoins and DeFi: The SEC's approach also extends to stablecoins and decentralized finance (DeFi) platforms, potentially leading to increased regulation and oversight in these rapidly evolving sectors. The lack of

crypto compliance requirements in these areas is a major concern.

- Specific Cryptocurrencies: While the SEC hasn't explicitly named specific cryptocurrencies in every statement, the regulatory actions taken suggest a broad approach, encompassing various digital assets depending on their underlying characteristics and how they are offered to investors.

Upcoming Changes to SEC Crypto Broker Rules: What to Expect

The impending changes to SEC crypto rule changes are substantial and will require significant adjustments from businesses operating within the crypto space. We can anticipate:

- Stricter Registration Requirements: The SEC is likely to implement more stringent registration requirements for crypto brokers, demanding more thorough disclosures and compliance checks. This will impact the ease of entry for new firms.

- Enhanced Reporting and Record-Keeping: Expect considerably stricter reporting and record-keeping requirements. This will involve meticulous tracking of transactions, client data, and internal operations to meet auditing standards. The

crypto regulatory updates will greatly impact operational procedures.

- Increased Compliance Costs: The added regulatory burden will inevitably increase compliance costs for crypto businesses. Companies will need to invest in robust compliance programs and hire specialized legal and compliance personnel. This will raise the barriers to entry and potentially reduce smaller firms’ competitiveness.

- Impact on Innovation: The stricter regulations could potentially stifle innovation within the crypto space, as the cost and complexity of compliance may deter the development of new products and services. The balance between

upcoming crypto regulations and innovation needs careful consideration.

- Increased Enforcement Actions: The SEC is likely to increase enforcement actions against non-compliant firms, leading to hefty fines and potential legal repercussions. The likelihood of

SEC crypto compliance guidance being insufficient for avoiding sanctions underscores the need for careful planning.

Navigating the Evolving Regulatory Landscape for Crypto Brokers

Navigating the complexities of crypto regulatory compliance requires proactive steps:

- Legal Counsel: Seeking experienced legal counsel is paramount to ensure compliance with the evolving regulatory landscape. This professional guidance is invaluable in understanding and adapting to the changing requirements.

- Robust Compliance Programs: Implementing robust compliance programs is essential. These should encompass thorough KYC/AML procedures, comprehensive transaction monitoring, and regular internal audits. This includes complying with

crypto legal advice and proactively seeking clarification.

- Adapting Business Models: Businesses may need to adapt their business models to align with regulatory requirements. This might involve altering product offerings, restructuring operations, or even ceasing certain activities.

- Available Resources and Support: Numerous resources and support systems are available to assist crypto businesses in navigating these changes. Leveraging industry associations and consulting firms can be beneficial. Access to

SEC crypto compliance guidance is vital.

- Client Communication: Keeping clients informed about regulatory updates and the company's commitment to compliance is crucial for maintaining trust and transparency.

The Impact on Investors: Increased Scrutiny and Protection

The increased regulatory scrutiny will significantly impact investors, offering both challenges and benefits:

- Increased Transparency and Protection: The new rules aim to increase transparency and investor protection in the crypto market, helping to reduce risks and fraud. This should result in a safer investing environment.

- Benefits of Greater Oversight: Greater regulatory oversight helps build confidence in the crypto market, attracting more mainstream investors and enhancing market stability. This can improve the

safe crypto investing experience.

- Challenges in a Complex Environment: Investors may face challenges navigating a complex and evolving regulatory environment, requiring increased diligence and awareness. Understanding the implications of

crypto investor rights is paramount.

- Identifying Legitimate Platforms: The regulatory changes will facilitate the identification of legitimate and compliant crypto platforms, making it easier for investors to differentiate between trustworthy exchanges and fraudulent operations. Improved

investor protection crypto measures are key.

Conclusion:

Chairman Gensler's statement signifies a major shift in the regulatory landscape for crypto brokers. Understanding the upcoming changes to SEC crypto broker rules is crucial for both businesses operating in the space and investors participating in the cryptocurrency market. The increased scrutiny and focus on investor protection will undoubtedly reshape the industry. The evolving nature of SEC crypto rules demands constant vigilance.

Call to Action: Stay informed about the evolving SEC crypto broker rules and take proactive steps to ensure compliance. Seek expert legal advice to navigate the complexities of this changing regulatory environment and protect your interests in the rapidly evolving world of digital assets. Understanding the implications of these changes is critical for responsible participation in the cryptocurrency market. Proactive compliance with SEC crypto broker rules will be critical for future success.

Tennisistki Kostyuk I Kasatkina Chto Proizoshlo Posle Smeny Grazhdanstva

Tennisistki Kostyuk I Kasatkina Chto Proizoshlo Posle Smeny Grazhdanstva

Watch Texas Rangers Vs Boston Red Sox Free Mlb Live Stream

Watch Texas Rangers Vs Boston Red Sox Free Mlb Live Stream

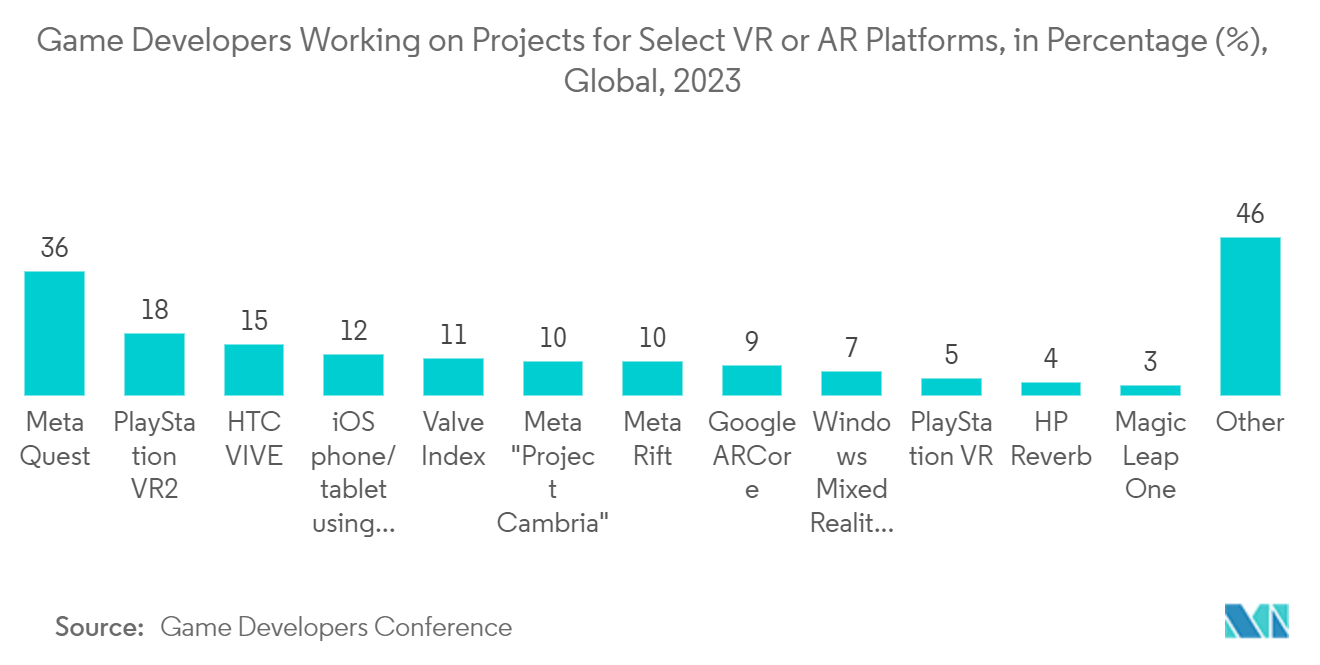

Xr Platforms The Ai Driven Battleground And Market Opportunity

Xr Platforms The Ai Driven Battleground And Market Opportunity

Elsbeth Season 2 Episode 15 A Disappointing Conclusion

Elsbeth Season 2 Episode 15 A Disappointing Conclusion

Walleye Cuts Credit Commodities Teams Prioritize Core Customer Groups

Walleye Cuts Credit Commodities Teams Prioritize Core Customer Groups