Upcoming MNTN IPO: What To Expect From Ryan Reynolds' Company

Table of Contents

MNTN's Unique Marketing Approach & Business Model

MNTN differentiates itself from traditional advertising agencies by focusing on creator-driven marketing. Instead of relying on mass-market, impersonal campaigns, MNTN leverages the power of authentic creator collaborations and short-form video ads to connect brands with their target audiences in a meaningful way. This approach is particularly effective in today's digital landscape, where consumers are increasingly discerning and resistant to intrusive advertising.

This innovative strategy is facilitated by MNTN's proprietary technology platform, which streamlines campaign management and provides valuable data-driven insights. The platform allows for efficient campaign creation, optimization, and tracking, ultimately enabling MNTN to deliver measurable ROI for its clients.

- Focus on short-form video ads: MNTN capitalizes on the popularity of platforms like TikTok, Instagram Reels, and YouTube Shorts to create engaging, shareable content.

- Emphasis on influencer marketing and creator collaborations: The company partners with a diverse range of creators to reach specific niche audiences.

- Data-driven approach to campaign optimization: MNTN utilizes advanced analytics to constantly refine and improve its marketing campaigns.

- Emphasis on measurable ROI for clients: The company’s focus on tangible results makes it an attractive option for brands seeking a high return on their marketing investments.

MNTN's Financial Performance & Growth Projections

While specific financial details may be limited until closer to the IPO, MNTN's rapid growth and success in securing high-profile clients suggest a strong financial foundation. The company's revenue growth has been impressive, fueled by its unique marketing approach and the increasing demand for creator-driven marketing solutions. Key financial metrics like revenue, EBITDA, and customer acquisition cost will be closely scrutinized by potential investors.

- Year-over-year revenue growth: Expect to see significant year-over-year increases in revenue as MNTN continues to expand its client base and service offerings.

- Key client acquisitions and partnerships: MNTN's portfolio of clients is a testament to the effectiveness of its marketing strategies. The addition of new, high-profile clients will be crucial in driving future revenue growth.

- Projected market share in the creator marketing space: MNTN is poised to capture a significant portion of the growing creator marketing market. The company's innovative approach and technology platform give it a competitive edge.

- Potential for future revenue streams and expansion: MNTN can potentially expand its offerings beyond creator marketing, such as into other digital marketing services, creating new revenue streams and growth opportunities.

Risks and Challenges Associated with the MNTN IPO

As with any IPO, potential investors should be aware of the inherent risks involved. The MNTN IPO is not without its challenges. The competitive landscape in the digital marketing industry is intense, with established agencies and platforms vying for market share. MNTN’s success is also closely tied to the continued effectiveness of creator collaborations and the broader digital advertising landscape.

- Competition from established marketing agencies and platforms: MNTN will face competition from large, established players in the advertising industry.

- Dependence on the success of creator collaborations: The company's success is contingent upon maintaining strong relationships with influential creators. Changes in influencer marketing trends could impact the company's performance.

- Potential for changes in the digital advertising landscape: Algorithm changes on social media platforms or shifts in consumer behavior could affect the effectiveness of MNTN’s marketing strategies.

- Risk factors related to the overall economic climate: A downturn in the economy could negatively impact spending on marketing and advertising, affecting MNTN’s revenue.

Valuation and Investment Considerations for the MNTN IPO

The anticipated valuation of MNTN will depend on a number of factors, including its revenue growth, profitability, and market position. Comparing MNTN to similar publicly traded companies in the advertising and marketing technology sectors will provide valuable insights. Investors should carefully analyze potential upside and downside scenarios before making an investment decision.

- Expected IPO price range: The IPO price range will be determined by various factors, including market conditions and the company’s financial performance.

- Comparison to similar publicly traded companies: Analyzing the valuations of comparable companies can provide a benchmark for MNTN's expected valuation.

- Analysis of potential upside and downside scenarios: A thorough risk assessment is essential before making any investment decision.

- Considerations for long-term vs. short-term investment strategies: Investors should determine their investment horizon and risk tolerance before investing in the MNTN IPO.

Conclusion

The MNTN IPO presents a unique investment opportunity in the rapidly evolving creator marketing space. Ryan Reynolds' innovative approach, combined with MNTN's proprietary technology and data-driven strategies, positions the company for significant growth. However, potential investors must carefully consider the risks associated with this investment, including competition, market volatility, and dependence on key personnel. Remember to conduct thorough due diligence before investing. The MNTN IPO is an exciting development in the world of digital marketing, and by understanding its intricacies, you can make an informed investment decision. Learn more about the MNTN IPO and Ryan Reynolds' innovative approach to marketing – don’t miss out on this potentially lucrative investment opportunity.

Featured Posts

-

Experience The Grand Slam Jamaica Observers Reports

May 12, 2025

Experience The Grand Slam Jamaica Observers Reports

May 12, 2025 -

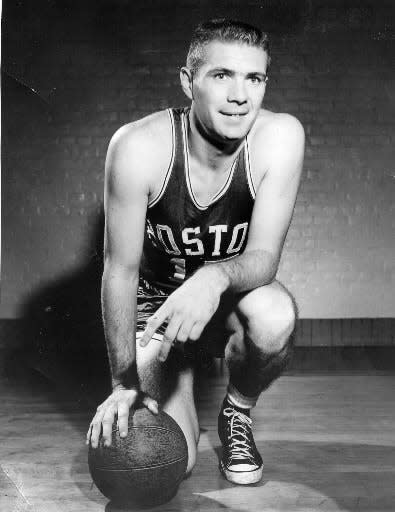

Boston Celtics Player Forgoes Nba Award Campaign

May 12, 2025

Boston Celtics Player Forgoes Nba Award Campaign

May 12, 2025 -

Santorini Earthquake Outlook Scientists Analyze Reduced Seismic Activity

May 12, 2025

Santorini Earthquake Outlook Scientists Analyze Reduced Seismic Activity

May 12, 2025 -

Mask Singer 2025 L Autruche Revelee Surprise De Chantal Ladesou Et Laurent Ruquier

May 12, 2025

Mask Singer 2025 L Autruche Revelee Surprise De Chantal Ladesou Et Laurent Ruquier

May 12, 2025 -

How To Meet Shane Lowry A Fans Guide

May 12, 2025

How To Meet Shane Lowry A Fans Guide

May 12, 2025

Latest Posts

-

Conclave 2023 Analyzing Potential Candidates To Replace Pope Francis

May 12, 2025

Conclave 2023 Analyzing Potential Candidates To Replace Pope Francis

May 12, 2025 -

Possible Candidates To Succeed Pope Francis

May 12, 2025

Possible Candidates To Succeed Pope Francis

May 12, 2025 -

Boxings Next Big Fight Cissokho Kavaliauskas Wbc Eliminator

May 12, 2025

Boxings Next Big Fight Cissokho Kavaliauskas Wbc Eliminator

May 12, 2025 -

Intriguing Wbc Final Eliminator Cissokho Takes On Kavaliauskas

May 12, 2025

Intriguing Wbc Final Eliminator Cissokho Takes On Kavaliauskas

May 12, 2025 -

Wbc Final Eliminator Cissokho Faces Kavaliauskas In High Stakes Bout

May 12, 2025

Wbc Final Eliminator Cissokho Faces Kavaliauskas In High Stakes Bout

May 12, 2025