Urgent HMRC Child Benefit Update: Important Messages To Act On

Table of Contents

Changes to Child Benefit Eligibility Criteria

Recent changes to the Child Benefit system mean it's vital to review your eligibility. Failing to do so could lead to an interruption in payments or even demands for repayment of overpaid benefits.

Income Threshold Adjustments

HMRC has adjusted the income threshold that determines eligibility for Child Benefit. These changes impact families whose income has increased or decreased significantly since their last assessment.

For example, if your combined household income exceeds the new threshold, you may no longer be eligible for the full Child Benefit amount, or may be eligible for a reduced rate.

- Key Changes: The income threshold for 2024 has increased to £60,000 (this is an example – check the official HMRC website for the most up-to-date figure).

- New Rule: Families exceeding the threshold may be required to complete a self-assessment tax return.

- Exception: Families receiving certain other benefits may still be eligible regardless of their income.

Changes to Residency Requirements

Updated residency rules clarify the requirements for claiming Child Benefit. It's important to understand these changes, particularly if you've recently spent time abroad or plan to do so.

If you're temporarily living abroad, you might still be eligible, but specific conditions apply, and providing proof of residency is crucial. Leaving this aspect unaddressed could result in delays or even discontinuation of your benefits.

- Key Changes: Continuous UK residency is still a key requirement; however, HMRC provides guidance on temporary absences allowed.

- Impact: Extended absences abroad may impact your eligibility; you may be required to inform HMRC of your current address and duration of stay overseas.

Updating Your Personal Information with HMRC

Maintaining accurate information with HMRC is paramount to avoid delays, overpayments, and other complications with your Child Benefit.

Importance of Accurate Information

Providing up-to-date and correct personal information is crucial. Inaccurate details can cause significant delays in payments and even lead to overpayments, which you will eventually be required to repay. This could also impact future tax credits and other benefits.

- Key Information to Update: Address, bank account details, contact phone number, number of children, and any changes in your employment status.

How to Update Your Details Online

Updating your details through the HMRC online portal is the quickest and easiest method.

- Log in to your HMRC online account.

- Navigate to your Child Benefit section.

- Click on "Update Your Details."

- Enter the required information and submit.

- Online Process Summary: Quick, secure, and allows for immediate confirmation of updates.

Alternative Update Methods (Phone, Post)

If you are unable to access the online portal, alternative methods exist:

-

Phone: Contact HMRC's Child Benefit helpline at [insert HMRC phone number].

-

Post: Use the contact address provided on HMRC's website, and remember to include your National Insurance number.

-

Alternative Contact Methods: Phone lines can be busy. Written correspondence might take longer to process.

Understanding Potential Overpayments and Repayment Procedures

Understanding how overpayments occur and how to deal with them is essential.

Identifying Overpayments

Overpayments can arise from various reasons, including changes in circumstances, incorrect information, or administrative errors. Regularly check your Child Benefit statements for any discrepancies.

- Signs of Potential Overpayment: Noticeably higher payments than usual, unexpected correspondence from HMRC, or inconsistencies in your annual tax summary.

HMRC Repayment Process

If HMRC identifies an overpayment, they will typically contact you directly outlining the amount owed and offering various repayment options. Ignoring these notifications can lead to further penalties.

- Repayment Options: Direct debit, bank transfer, or payment plan.

Seeking Further Help and Support from HMRC

If you have any questions or concerns regarding your Child Benefit or this HMRC Child Benefit Update, accessing the right resources is vital.

Contacting HMRC

HMRC offers various channels for support:

-

Phone: [insert HMRC phone number]

-

Email: [insert HMRC email address if applicable]

-

Website: [link to HMRC website contact page]

-

Contact Options Summary: Opening hours for phone lines may vary; the website provides comprehensive support materials.

Helpful Resources and Links

Act Now on Your Urgent HMRC Child Benefit Update

This HMRC Child Benefit Update highlights crucial changes affecting your eligibility and the importance of maintaining accurate information. Updating your details, checking your eligibility, and understanding potential overpayment procedures are vital steps to avoid delays or financial complications. Don't delay! Check your Child Benefit update today and ensure your HMRC Child Benefit information is accurate. Visit the HMRC website immediately to review your details and secure your benefits.

Featured Posts

-

Factors Affecting Giorgos Giakoumakis Transfer Value To The Mls

May 20, 2025

Factors Affecting Giorgos Giakoumakis Transfer Value To The Mls

May 20, 2025 -

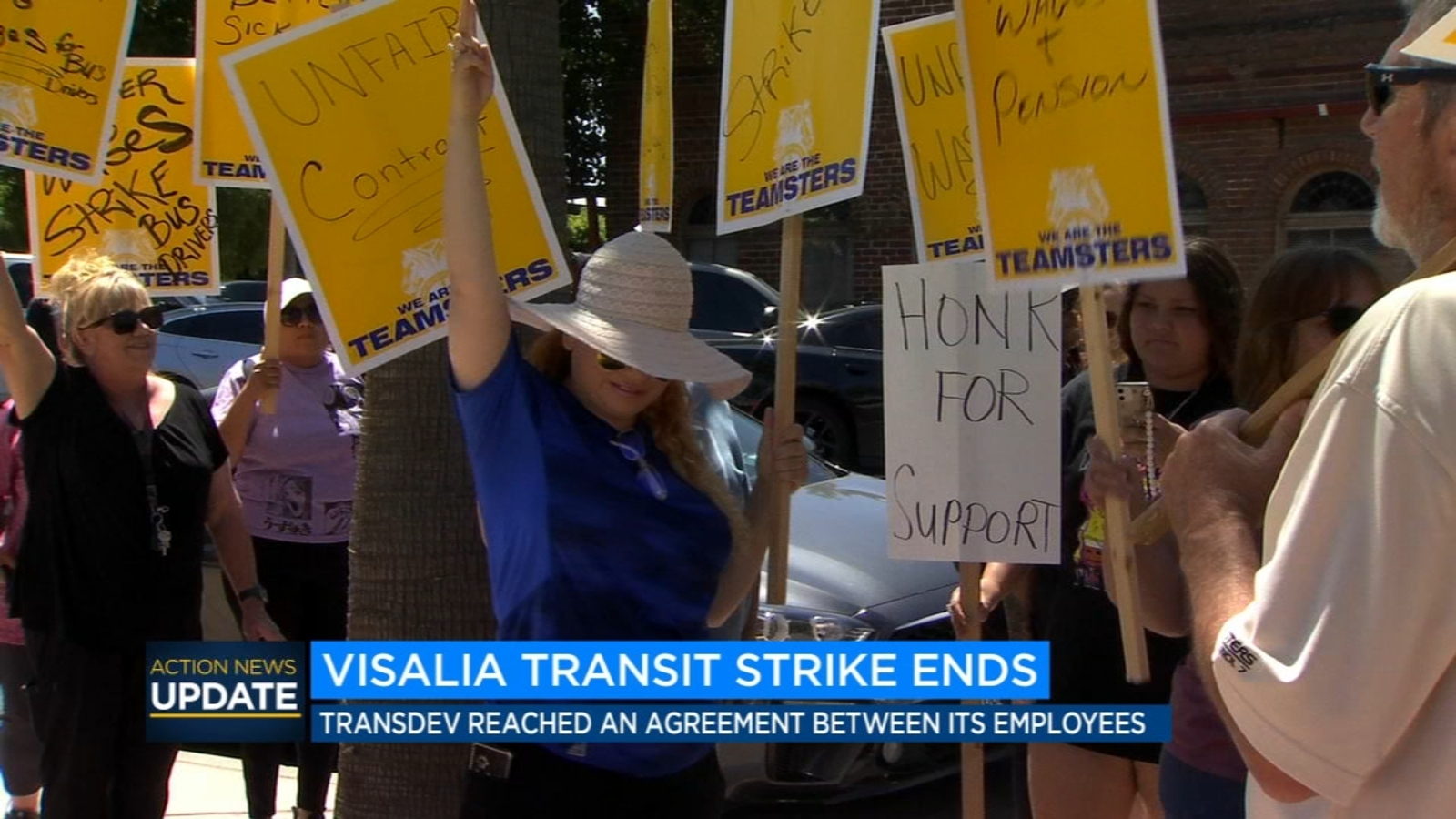

Potential Nj Transit Strike Resolved Tentative Agreement Reached With Engineers

May 20, 2025

Potential Nj Transit Strike Resolved Tentative Agreement Reached With Engineers

May 20, 2025 -

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025

Germany Nations League Squad Goretzka Included By Nagelsmann

May 20, 2025 -

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 20, 2025

Benjamin Kaellman Huuhkajien Uusi Taehti Maalivire Ja Kasvu Kentillae Ja Niiden Ulkopuolella

May 20, 2025 -

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025

Mass Layoffs Cast Shadow On Future Of Abc News Program

May 20, 2025