Urgent: HMRC Letters & £23,000 Income Threshold In The UK

Table of Contents

What is the £23,000 Income Threshold and Why Does it Matter?

The £23,000 income threshold represents the UK's personal allowance for the tax year 2023-2024. This means that individuals earning up to this amount are generally not liable to pay income tax. However, exceeding this threshold significantly impacts your tax liability.

Understanding Your Tax Liability

Understanding your tax liability is fundamental to navigating the UK tax system.

- Personal Allowance vs. Taxable Income: Your personal allowance (£12,570 for 2023-2024) is deducted from your total income before tax is calculated. Only the remaining amount (your taxable income) is subject to income tax. If your income is above £23,000, this means your personal allowance will be reduced, resulting in a higher tax bill.

- Income Above £23,000: Income exceeding £23,000 falls into higher tax bands, with progressively increasing tax rates. This means the more you earn above the threshold, the higher your percentage of tax will be.

- National Insurance Contributions: Exceeding the £23,000 threshold can also influence your National Insurance contributions. While the personal allowance doesn't directly affect National Insurance, your total earnings still determine your contribution level.

Who is Affected by the £23,000 Threshold?

While the £23,000 threshold primarily affects employees, it's crucial for various individuals to understand its implications:

- Employees: Anyone earning over £23,000 through employment will see their taxable income increase, resulting in a higher tax bill. This includes those with additional income from sources like rental properties or freelance work.

- Self-Employed Individuals: Self-employed individuals need to carefully track their income to ensure accurate tax return filing. Exceeding the £23,000 threshold will necessitate paying income tax on the portion above the allowance.

- Pensioners: Pension income can also push individuals over the £23,000 threshold, increasing their tax liability.

Deciphering HMRC Letters: Common Types & Actions to Take

HMRC correspondence can range from routine updates to urgent tax demands. Understanding the urgency of each letter is crucial.

Identifying Urgent HMRC Correspondence

Identifying urgent HMRC letters is paramount to avoid penalties. Look out for these key indicators:

- Tax Demand: This letter demands immediate payment of outstanding tax. Failure to comply promptly can lead to penalties and further action.

- Penalty Notice: This letter informs you of a penalty for late filing or unpaid tax. These penalties can be substantial.

- Investigation Letter: This letter indicates HMRC is investigating your tax affairs. It's essential to respond promptly and provide all necessary information.

Understanding Non-Urgent HMRC Communications

Not all HMRC letters require immediate action. These are usually:

- Confirmation of Tax Return Receipt: This confirms HMRC has received your self-assessment tax return.

- General Updates: These might contain information on changes to tax laws or reminders about upcoming deadlines. While not urgent, these should still be reviewed for your information.

Responding to HMRC Letters Promptly

Responding promptly to all HMRC correspondence is vital:

- Read Carefully: Thoroughly review the entire letter, noting deadlines and requested actions.

- Gather Necessary Documents: Collect all relevant documents, such as payslips, bank statements, and tax returns.

- Respond Within the Deadline: Failure to meet deadlines can result in penalties. Use the contact information provided in the letter to clarify any uncertainties. Visit the official HMRC website for helpful online resources and guidance: [insert HMRC website link here].

What to Do If You Owe Tax

Facing a tax bill you can't immediately pay can be stressful, but HMRC offers solutions:

Setting up a Payment Plan

If you can't afford to pay your tax bill immediately, contact HMRC to discuss setting up a payment plan:

- Contact HMRC: Contact HMRC through their online portal or by phone to discuss your situation.

- Payment Plan Options: They may offer various payment plans tailored to your financial circumstances.

- Implications of Non-Payment: Ignoring your tax liability can result in escalating penalties, debt collection actions, and potential legal consequences.

Seeking Professional Tax Advice

Navigating complex tax issues can be challenging. Consider professional guidance:

- Benefits of Professional Advice: A qualified tax advisor can provide tailored advice, ensure accurate tax return filing, and assist in resolving tax disputes.

- Finding a Qualified Tax Advisor: Search online directories for qualified tax advisors in your area.

- When Professional Advice is Necessary: If you're struggling to understand HMRC correspondence, owe a significant amount of tax, or face a tax investigation, seeking professional help is strongly recommended.

Conclusion

Understanding HMRC letters, particularly those related to the £23,000 income threshold, is crucial for UK taxpayers. Ignoring HMRC correspondence can lead to significant financial penalties and legal repercussions. Review your tax situation regularly, ensure you understand your tax liability concerning the £23,000 threshold, and respond promptly to any HMRC letters. Don't delay; understand your HMRC letters today! Learn more about HMRC letters and the £23,000 income threshold by visiting the official HMRC website [insert HMRC website link here]. Take control of your UK tax obligations – act now!

Featured Posts

-

Arsenals Pursuit Of Matheus Cunha A Transfer Update

May 20, 2025

Arsenals Pursuit Of Matheus Cunha A Transfer Update

May 20, 2025 -

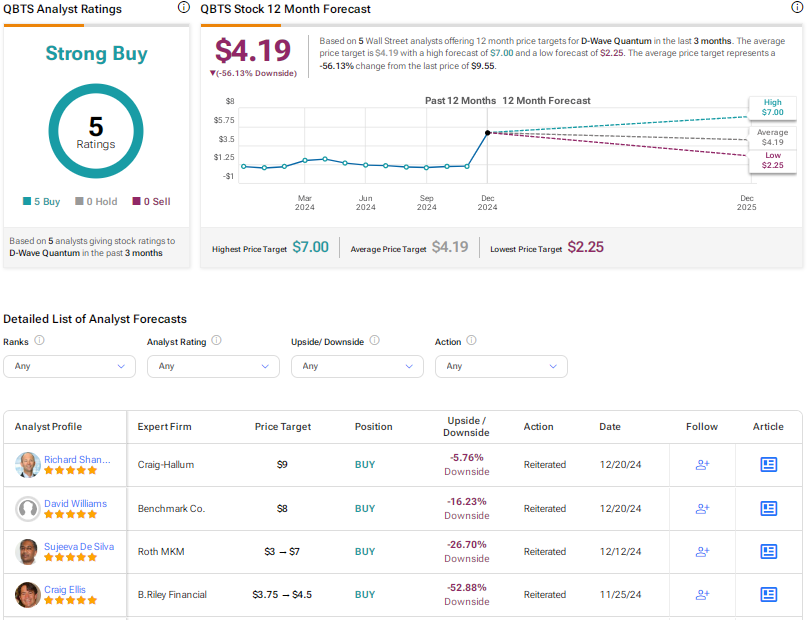

D Wave Quantum Qbts Stock Jump Analyzing Fridays Market Movement

May 20, 2025

D Wave Quantum Qbts Stock Jump Analyzing Fridays Market Movement

May 20, 2025 -

Cronin Appointed Head Coach Of Highfield Rfc

May 20, 2025

Cronin Appointed Head Coach Of Highfield Rfc

May 20, 2025 -

Novo Dijete Jennifer Lawrence Objava I Detalji

May 20, 2025

Novo Dijete Jennifer Lawrence Objava I Detalji

May 20, 2025 -

Jalkapallo Kamara Ja Pukki Sivussa Friisin Kokoonpano Yllaetys

May 20, 2025

Jalkapallo Kamara Ja Pukki Sivussa Friisin Kokoonpano Yllaetys

May 20, 2025