US$9 Billion Parkland Acquisition: June Shareholder Vote To Decide Fate

Table of Contents

The Details of the Proposed Parkland Acquisition

This section will unpack the specifics of the proposed US$9 billion Parkland acquisition, providing crucial context for understanding the upcoming shareholder vote. While the specific acquiring company isn't publicly named yet, we will use "Acquirer X" as a placeholder for brevity.

Acquiring Company and Their Rationale

Acquirer X, a major player in the healthcare industry known for its [mention Acquirer X's business model, e.g., innovative medical technology, robust hospital network, etc.], is reportedly driving the acquisition. Their stated rationale likely revolves around several key factors: expanding their market share, gaining access to Parkland's established patient base and experienced medical staff, and potentially leveraging synergies to streamline operations and reduce costs. The Acquirer X's existing market presence, particularly within [mention specific geographic regions or specialties], suggests a strategic move to consolidate its position and achieve wider geographic reach. The potential for improved operational efficiency through economies of scale is a powerful incentive.

Financial Aspects of the Deal

The US$9 billion price tag represents a substantial investment. The proposed payment structure, which will likely involve a combination of cash and stock, needs to be clarified. Analysts are currently assessing the premium offered compared to Parkland's current market valuation, examining whether it fairly reflects Parkland's long-term growth potential. Detailed financial projections, including expected return on investment (ROI) for Acquirer X, and the impact on Parkland's existing debt load, are eagerly awaited by investors.

- Breakdown of the acquisition cost: A precise allocation between cash and stock remains undisclosed.

- Key financial metrics for both companies: Detailed analysis of revenue, profitability, and debt ratios are vital for a comprehensive assessment.

- Expected return on investment for the acquiring company: Analysts are scrutinizing the projected ROI to gauge the financial soundness of the deal.

- Potential impact on Parkland's debt: How the acquisition will affect Parkland's existing financial obligations is a crucial consideration.

Arguments For and Against the Parkland Acquisition

The proposed Parkland acquisition isn't without its proponents and detractors. A careful evaluation of both sides is crucial before the June shareholder vote.

Pro-Acquisition Arguments

Supporters of the deal point to numerous potential benefits:

- Synergies and economies of scale: Combining operations could lead to significant cost reductions and operational efficiencies.

- Expanded market reach and patient base: The acquisition would grant Acquirer X access to Parkland's extensive patient network.

- Improved access to resources and technology: Both entities could benefit from the sharing of resources and cutting-edge technology.

- Enhanced financial performance: Proponents argue the acquisition will boost the profitability and overall financial health of the combined entity.

Anti-Acquisition Arguments

Conversely, concerns exist regarding:

- Potential for antitrust issues: Regulatory scrutiny is expected, with potential challenges related to market dominance.

- Integration risks and costs: Merging two large healthcare organizations is complex and could lead to significant integration challenges and unforeseen expenses.

- Impact on employee morale and retention: Job security and potential restructuring are concerns raised by employees and unions.

- Uncertainty regarding future performance: The long-term financial implications of the acquisition remain uncertain.

The June Shareholder Vote and Its Significance

The June shareholder vote is the pivotal moment determining the fate of the US$9 billion Parkland acquisition deal.

Voting Procedures and Timeline

Shareholders will be informed of the exact date and procedures for voting (in-person or by proxy). The required quorum for a valid vote will be stipulated, ensuring a fair and transparent process. Information regarding deadlines for submitting proxy votes will be crucial for shareholders to participate effectively in this decision.

Potential Outcomes and Their Implications

Several outcomes are possible:

- Approval: The acquisition proceeds, potentially reshaping the healthcare landscape.

- Rejection: The deal is terminated, leaving both companies to pursue alternative strategies.

- Postponement: Further negotiations or investigations might delay the final decision.

Each outcome carries significant implications for Parkland, Acquirer X, investors, and the broader healthcare industry. A detailed analysis of the market impact of each scenario is critical for informed decision-making.

- Key dates and deadlines related to the vote: Shareholders should be attentive to all relevant deadlines and communication from both organizations.

- Voting requirements and procedures: A clear understanding of the voting process is crucial for participation.

- Analysis of potential vote outcomes and their consequences: A thorough analysis of each potential outcome should guide shareholders.

- Predictions regarding shareholder voting behavior: Market analysts are closely monitoring investor sentiment to predict the outcome.

Conclusion

The US$9 billion Parkland acquisition stands as a significant event, with the June shareholder vote holding the key to its future. Understanding the financial aspects, the arguments for and against the deal, and the potential consequences of the vote is vital for investors and healthcare stakeholders. This landmark deal highlights the ongoing consolidation in the healthcare industry and the strategic decisions that shape its landscape.

Call to Action: Stay tuned for updates on the Parkland Acquisition and the June shareholder vote. Learn more about the implications of this landmark deal and how you can participate in shaping the future of Parkland. Follow the Parkland Acquisition closely by checking reliable news sources and investor relations websites for the latest information and updates on the shareholder vote. Search for "Parkland Acquisition Updates," "Parkland Shareholder Vote Results," and "Follow the Parkland Acquisition" to stay informed.

Featured Posts

-

Cavs Fill Rookie Car With Popcorn Donovan Mitchells Hilarious Game Prediction

May 07, 2025

Cavs Fill Rookie Car With Popcorn Donovan Mitchells Hilarious Game Prediction

May 07, 2025 -

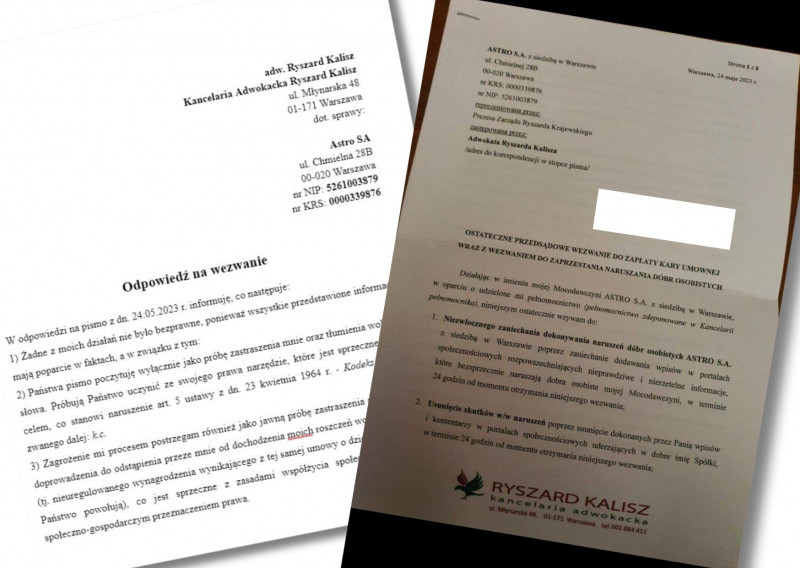

Panstwowa Spolka Zada 100 Tys Zl Od Dziennikarzy Onetu

May 07, 2025

Panstwowa Spolka Zada 100 Tys Zl Od Dziennikarzy Onetu

May 07, 2025 -

Macrons European Netflix A Vision Taking Shape

May 07, 2025

Macrons European Netflix A Vision Taking Shape

May 07, 2025 -

Golden State Warriors Steve Kerr On Stephen Currys Injury Recovery

May 07, 2025

Golden State Warriors Steve Kerr On Stephen Currys Injury Recovery

May 07, 2025 -

Wyniki Sondazu Prezydenckiego Onetu Analiza Dla Trzaskowskiego I Nawrockiego

May 07, 2025

Wyniki Sondazu Prezydenckiego Onetu Analiza Dla Trzaskowskiego I Nawrockiego

May 07, 2025