US-China Trade Talks: Market Reaction Will Determine The Impact Of Agreements

Table of Contents

Immediate Market Response to Trade Agreement Announcements

The immediate reaction of stock markets, both in the US and China, will provide the first crucial clues about the perceived success of any trade deal. Market volatility, trading volume, and shifts in investor confidence will be key indicators. A positive announcement might initially trigger a surge in stock prices, reflecting optimism about increased trade and economic growth. Conversely, a perceived unfavorable agreement could lead to a sharp market downturn, revealing concerns about potential economic disruption.

-

Analysis of past trade agreement announcements and subsequent market fluctuations: Historical precedents, such as the initial reactions to previous trade deals between the US and China, offer valuable insights into how markets typically respond to such announcements. Studying these past reactions provides a baseline for predicting future market behavior. Analyzing the speed and magnitude of price changes following similar announcements is also critical.

-

The role of short-term speculation versus long-term investment strategies: The immediate market response often involves short-term speculation, driven by rapid reactions to news and anticipation of immediate gains or losses. Long-term investors, however, may adopt a wait-and-see approach, assessing the agreement's broader long-term implications before adjusting their portfolios.

-

Impact on specific sectors (technology, agriculture, manufacturing): Specific sectors will react differently. The technology sector, for example, might experience volatility based on the agreement's provisions regarding intellectual property rights. Agricultural exports could see immediate price changes, while manufacturing industries might adjust based on changes to tariffs and supply chains.

Long-Term Economic Implications & Market Adjustment

Beyond the initial market frenzy, the long-term economic consequences will significantly influence market performance. The agreements' impact on global supply chains, inflation, and consumer spending will shape economic growth projections and investor sentiment for years to come. Uncertainty regarding the agreement's effectiveness and enforcement could lead to extended periods of market adjustment.

-

Analysis of potential changes to global supply chains and their impact on businesses: Changes to tariffs and trade restrictions can force businesses to restructure their supply chains, potentially leading to higher costs, relocation of manufacturing, and disruptions to production.

-

Assessment of the potential for inflationary or deflationary pressures: The agreement could create inflationary pressures if it leads to higher import costs. Alternatively, increased efficiency and competition could potentially exert deflationary pressures.

-

Effects on US and Chinese GDP growth projections: Economists will closely monitor the agreement's impact on GDP growth projections for both the US and China. Positive impacts could lead to upward revisions, while negative impacts might necessitate downward adjustments.

The Role of Investor Sentiment in Shaping Market Reaction

Investor sentiment, a crucial driver of market reaction, is influenced by a range of factors, extending beyond the agreement’s specifics. Geopolitical tensions, domestic policy changes, and broader economic conditions all contribute to market sentiment indicators. Uncertainty, often amplified by media narratives, can significantly impact investor confidence and risk assessment.

-

Discussion of key sentiment indicators (e.g., VIX index): The VIX index, a measure of market volatility, often reflects investor anxiety and uncertainty. Monitoring such indicators provides insights into the market's overall mood.

-

Impact of news coverage and media narratives on investor psychology: Media portrayals of the agreement can strongly influence investor perceptions, shaping market behavior through the spread of optimism or pessimism.

-

The influence of uncertainty on investment decisions: Uncertainty regarding the agreement's long-term effects often leads to a more cautious approach by investors, potentially slowing down investments and impacting market activity.

Analyzing Specific Market Sectors Most Affected

The US-China trade agreement's impact will vary across different sectors. Some will emerge as winners, while others will face challenges. The technology sector, agriculture, and manufacturing are particularly sensitive to changes in trade relations.

-

Detailed examination of the tech industry's response to potential changes in intellectual property rights: The agreement's provisions concerning intellectual property rights will have a significant impact on technology companies, influencing investment decisions and innovation.

-

The impact on agricultural exports from both the US and China: Agricultural exports are heavily influenced by trade agreements, with potential for both gains and losses depending on tariff changes and market access.

-

Analysis of how manufacturing industries in both countries will adapt: Manufacturing industries will need to adapt to new trade rules and potential shifts in supply chains. This might involve restructuring, relocation, or the adoption of new technologies.

Conclusion

The ultimate success or failure of any US-China trade agreement will not solely depend on the terms negotiated, but critically on the subsequent market reaction. Investor sentiment, economic adjustments, and the performance of key sectors will be crucial in determining the long-term impact. Analyzing the nuances of market reaction to the US-China trade talks is essential for comprehending the agreement’s broader consequences.

Call to Action: Stay informed about the unfolding US-China trade talks and closely monitor market reactions to understand the real-world consequences of these crucial agreements. Continuous analysis of the market reaction to these US-China trade talks is vital for informed decision-making.

Featured Posts

-

Virginia Giuffre Skandalen En Komplett Oversikt Over Saken Mot Prins Andrew

May 12, 2025

Virginia Giuffre Skandalen En Komplett Oversikt Over Saken Mot Prins Andrew

May 12, 2025 -

Selena Gomezs Social Media Post Shows Unexpected Item Linked To Benny Blanco

May 12, 2025

Selena Gomezs Social Media Post Shows Unexpected Item Linked To Benny Blanco

May 12, 2025 -

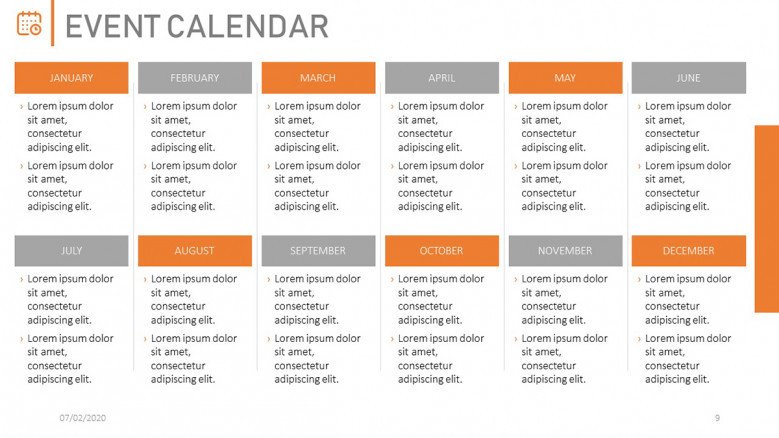

Your Guide To Senior Trips Activities And Events A Monthly Calendar

May 12, 2025

Your Guide To Senior Trips Activities And Events A Monthly Calendar

May 12, 2025 -

Foxs New Indy Car Documentary Launch Date Confirmed For May 18th

May 12, 2025

Foxs New Indy Car Documentary Launch Date Confirmed For May 18th

May 12, 2025 -

Ufc 315 New Fight Card After Jose Aldos Weight Cut Issues

May 12, 2025

Ufc 315 New Fight Card After Jose Aldos Weight Cut Issues

May 12, 2025

Latest Posts

-

Live Studio Reveal Kelly Ripa And Mark Consuelos Get Fan Reactions

May 13, 2025

Live Studio Reveal Kelly Ripa And Mark Consuelos Get Fan Reactions

May 13, 2025 -

Ncaa Tournament Oregon Ducks Upset Loss To Duke

May 13, 2025

Ncaa Tournament Oregon Ducks Upset Loss To Duke

May 13, 2025 -

No 10 Oregons Overtime Thriller Ncaa Tournament Triumph

May 13, 2025

No 10 Oregons Overtime Thriller Ncaa Tournament Triumph

May 13, 2025 -

Duke Defeats Oregon Ducks In Ncaa Womens Basketball Tournament

May 13, 2025

Duke Defeats Oregon Ducks In Ncaa Womens Basketball Tournament

May 13, 2025 -

New Kelly Ripa And Mark Consuelos Studio Unveiled How Fans Are Reacting

May 13, 2025

New Kelly Ripa And Mark Consuelos Studio Unveiled How Fans Are Reacting

May 13, 2025