US Credit Rating Downgrade: Live Updates On Dow Futures And Dollar

Table of Contents

Immediate Impact on Dow Futures

Initial Market Reactions

The announcement of the US credit rating downgrade triggered an immediate and sharp decline in Dow futures. Pre-market trading saw a significant drop, reflecting widespread investor concern. While precise percentage drops vary depending on the specific futures contract and timing, reports indicate substantial declines, coupled with a significant surge in trading volume. This heightened activity underscores the market's volatile response to the news.

(Insert chart or graph here visualizing the Dow Jones Industrial Average's movement immediately following the downgrade announcement. Source should be cited.)

- Sharp decline in pre-market trading: Futures contracts experienced a dramatic sell-off.

- Increased volatility in futures contracts: Trading volume spiked as investors reacted to the unexpected news.

- Investor sentiment turning negative: The downgrade fueled a wave of pessimism, leading to widespread risk aversion.

Factors Influencing Dow Futures

The decline in Dow futures isn't solely attributable to the credit rating downgrade. Other economic factors are at play, amplifying the negative market reaction.

- Inflation concerns: Persistent inflation and the Federal Reserve's efforts to control it continue to weigh on market sentiment.

- Interest rate hikes: Further interest rate increases by the Federal Reserve could further dampen economic growth and corporate profits.

- Geopolitical instability: Ongoing geopolitical uncertainties contribute to overall market volatility and investor apprehension.

Effect on the US Dollar

Dollar's Response to the Downgrade

The impact of the credit rating downgrade on the US dollar's value against other major currencies is complex and dynamic. Initially, a "flight to safety" might strengthen the dollar as investors seek refuge in the perceived stability of US assets. However, the long-term effect could be a weakening of the dollar due to concerns about the US economy's fiscal health.

(Insert chart or graph here visualizing the US Dollar Index (DXY) movement following the downgrade announcement. Source should be cited.)

- Strengthening or weakening of the dollar: The immediate direction is dependent on the prevailing market sentiment (e.g., flight to safety vs. risk aversion).

- Flight to safety or risk-off sentiment: Investors may shift their investments towards US assets, temporarily strengthening the dollar.

- Impact on international trade: A weaker dollar could make US exports more competitive but also increase the cost of imports.

Long-term Implications for the Dollar

The long-term effects of the credit rating downgrade on the US dollar are uncertain. Several factors will play a crucial role in shaping its future trajectory.

- Potential for further decline or recovery: The dollar's value will likely depend on the US government's response and broader economic conditions.

- Influence of monetary policy: The Federal Reserve's monetary policy decisions will significantly impact the dollar's strength.

- Global economic conditions: Global economic growth and stability will also influence the dollar's performance against other currencies.

Analysis of the Credit Rating Downgrade

Reasons Behind the Downgrade

The rating agency cited several key reasons for the downgrade, all pointing towards concerns about the US government's fiscal management and its potential long-term consequences.

- Increasing national debt: The persistently high and rising national debt raises concerns about the US government's ability to meet its financial obligations.

- Political gridlock: Political divisions and inaction on fiscal issues have hampered efforts to address the nation's debt.

- Fiscal mismanagement: Concerns about the lack of a comprehensive plan to address the nation's long-term fiscal challenges contributed to the downgrade.

Potential Consequences of the Downgrade

The downgrade carries significant implications for the US economy, extending beyond the immediate impact on Dow futures and the dollar.

- Higher borrowing costs for the government: The downgrade will likely lead to higher interest rates on US government debt, increasing borrowing costs.

- Reduced investor confidence: The downgrade could erode investor confidence in the US economy, potentially leading to capital flight.

- Potential for economic slowdown: Higher borrowing costs and reduced investor confidence could contribute to an economic slowdown.

Conclusion

The US credit rating downgrade has had a significant and immediate impact on Dow futures and the US dollar. The initial market reaction reveals considerable volatility, with further consequences expected in the coming days and weeks. The reasons behind the downgrade highlight serious concerns about the US fiscal situation and its potential long-term effects. Understanding these factors is crucial for navigating the current economic uncertainty.

Call to Action: Stay informed about the evolving situation with ongoing live updates on the US Credit Rating Downgrade and its continuing impact on Dow futures and the dollar. Monitor reputable financial news sources for the latest developments and make informed investment decisions based on the unfolding economic landscape. Understanding the implications of a US credit rating downgrade is vital for effective financial planning.

Featured Posts

-

Man Utd Transfer Target Premier League Forwards Future Uncertain Amid Newcastle Interest

May 20, 2025

Man Utd Transfer Target Premier League Forwards Future Uncertain Amid Newcastle Interest

May 20, 2025 -

Wwe Hinchcliffes Segment Falls Short Of Expectations

May 20, 2025

Wwe Hinchcliffes Segment Falls Short Of Expectations

May 20, 2025 -

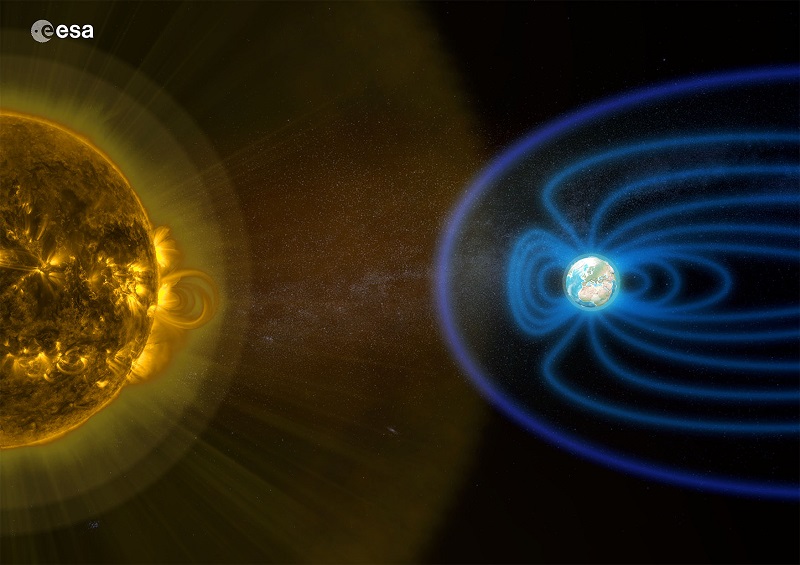

Damaging Winds How Fast Moving Storms Impact Watches And Warnings

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Watches And Warnings

May 20, 2025 -

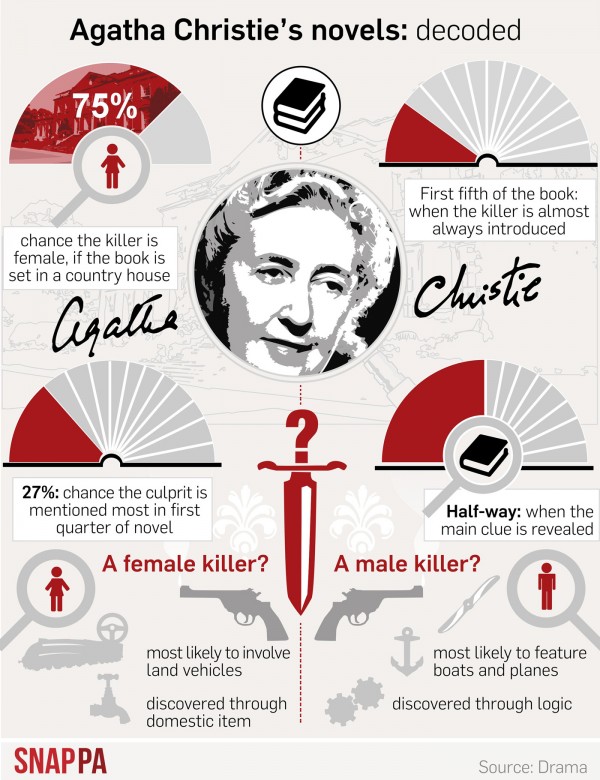

Family Conflict Over Agatha Christies Legacy Revealed In Private Letters

May 20, 2025

Family Conflict Over Agatha Christies Legacy Revealed In Private Letters

May 20, 2025 -

Man Utds 62 5 Million Pursuit Arsenal And Chelseas Transfer Target

May 20, 2025

Man Utds 62 5 Million Pursuit Arsenal And Chelseas Transfer Target

May 20, 2025