US Debt Limit: Potential August Expiration Raises Concerns

Table of Contents

What is the US Debt Ceiling and Why is it a Problem?

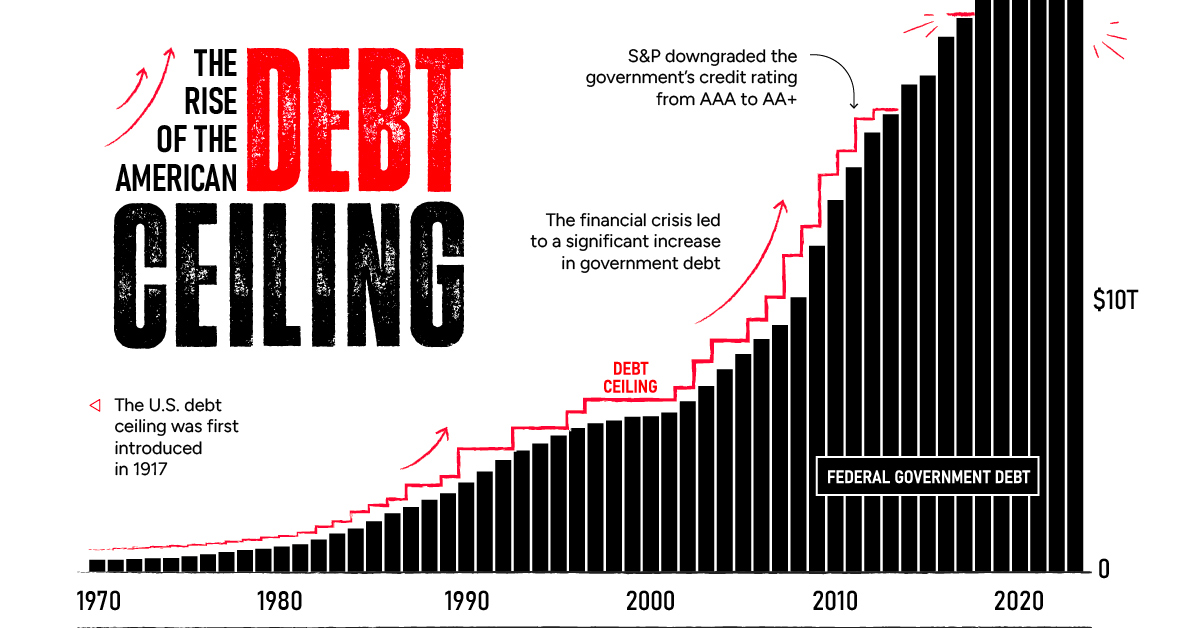

The US debt ceiling, also known as the US debt limit, is a legally imposed limit on the total amount of money that the US government can borrow to meet its existing obligations. This limit isn't about spending; it's about the government's ability to pay for what it has already legally committed to spending through previously enacted legislation. Congress sets this limit, and exceeding it has serious ramifications.

When the debt ceiling is reached, the government can no longer borrow money to cover its expenses. This impacts the ability to fulfill its financial obligations, triggering a cascade of negative consequences:

- Inability to pay government bills: This includes salaries for federal employees, Social Security benefits, Medicare payments, and crucial government services. A delay or halt in these payments could have devastating effects on millions of Americans.

- Potential default on US Treasury bonds: A default would severely damage the reputation of the US as a reliable borrower, impacting global confidence in the US dollar and potentially triggering a global financial crisis. The ripple effects would be widespread and profound.

- Negative impact on global financial markets: The uncertainty surrounding a potential default would create significant volatility in global stock markets, increasing interest rates and potentially triggering a recession.

- Credit rating downgrades: Major credit rating agencies could downgrade the US credit rating, making it more expensive for the government to borrow money in the future. This would increase the cost of government borrowing and potentially lead to higher taxes or cuts in government programs.

These potential consequences highlight the critical importance of addressing the debt ceiling issue promptly and effectively. Keywords: debt ceiling, US debt limit, government debt, treasury bonds, default risk.

The Potential Economic Consequences of Reaching the Debt Limit

Reaching the debt limit without a resolution could trigger a significant economic downturn. The consequences extend far beyond the immediate inability to pay bills:

- Increased interest rates: The uncertainty surrounding the debt ceiling would likely drive up interest rates, making borrowing more expensive for businesses and consumers, potentially slowing economic growth.

- Stock market volatility: A potential default or even the near-term threat of one could cause substantial volatility in the stock market, potentially leading to significant losses for investors.

- Reduced consumer confidence: The economic uncertainty would likely erode consumer confidence, leading to reduced spending and further dampening economic growth.

- Higher unemployment: A combination of reduced consumer spending, business uncertainty, and potential government spending cuts could lead to job losses and increased unemployment.

The ripple effects on global markets would be substantial. The US economy is the largest in the world, and a crisis here would undoubtedly have far-reaching global consequences. The potential for a global recession cannot be ignored. Different sectors of the economy, particularly those reliant on government spending, would be disproportionately affected. Keywords: economic consequences, recession risk, interest rates, stock market, inflation, consumer confidence.

Political Implications and Potential Solutions

The political stalemate surrounding the debt ceiling is a major obstacle to finding a timely solution. The partisan divide in Congress often hinders effective negotiations and compromises. The lack of consensus on long-term fiscal policy further complicates matters.

Potential solutions include:

- Short-term vs. long-term solutions: A short-term increase in the debt limit simply postpones the problem, while a long-term solution requires addressing the underlying issues driving the debt.

- Bipartisan negotiations and challenges: Reaching a bipartisan agreement is essential, but the deep political divisions make this challenging.

- The role of the Congress and the President: Both branches of government have a crucial role to play in resolving this issue, requiring collaboration and compromise.

Finding a solution requires a commitment to responsible fiscal policy and a willingness to negotiate across party lines. Keywords: political gridlock, bipartisan negotiations, debt ceiling compromise, fiscal policy.

Historical Precedents and Lessons Learned

The US has faced similar debt limit crises in the past. Examining these past instances offers valuable insights:

- Analysis of previous near-defaults and their impact: Previous near-defaults have caused market volatility, increased interest rates, and damaged investor confidence.

- Lessons learned from past negotiations: Past negotiations have shown the importance of timely action and bipartisan cooperation to prevent economic catastrophes.

- Comparison of current situation with previous crises: The current situation, while concerning, has some similarities and some key differences compared to previous crises. Analyzing these similarities and differences is critical.

Studying these precedents reinforces the urgent need for a proactive and responsible approach to the current debt limit crisis. Keywords: debt limit history, past crises, economic lessons, political precedent.

Conclusion

The potential expiration of the US debt limit in August presents a significant threat to the US and global economy. Understanding the ramifications of reaching this limit is crucial. The potential consequences, ranging from economic instability to political gridlock, necessitate immediate action. We must push for responsible fiscal policy and a swift resolution to avoid a catastrophic default. Stay informed about developments surrounding the US debt ceiling and urge your representatives to find a solution to this critical issue. Don't let the US debt limit crisis unfold without your informed participation. Stay updated on news related to the US debt limit and advocate for responsible solutions.

Featured Posts

-

Landmark Agreement Ottawa And Indigenous Capital Group Forge 10 Year Partnership

May 11, 2025

Landmark Agreement Ottawa And Indigenous Capital Group Forge 10 Year Partnership

May 11, 2025 -

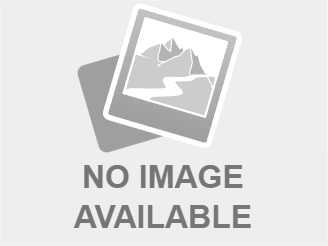

Polemica En La F1 Piloto Argentino Compara Argentina Y Uruguay

May 11, 2025

Polemica En La F1 Piloto Argentino Compara Argentina Y Uruguay

May 11, 2025 -

Argentina Vs Uruguay Las Controvertidas Declaraciones De Un Piloto Argentino De F1

May 11, 2025

Argentina Vs Uruguay Las Controvertidas Declaraciones De Un Piloto Argentino De F1

May 11, 2025 -

Pga Tours Zurich Classic Mc Ilroy And Lowry Commit To Return

May 11, 2025

Pga Tours Zurich Classic Mc Ilroy And Lowry Commit To Return

May 11, 2025 -

Indy Car St Petersburg Palous Win And De Francescos Comeback

May 11, 2025

Indy Car St Petersburg Palous Win And De Francescos Comeback

May 11, 2025