US IPO Filing: Klarna Announces 24% Revenue Surge

Table of Contents

Klarna's Impressive Revenue Growth and Market Position

24% Revenue Surge Detailed

Klarna's US IPO filing revealed substantial revenue growth. While precise figures may vary depending on the final filing, reports suggest a year-over-year increase of 24%, showcasing significant momentum. This growth isn't uniform across all regions; however, the filing likely details regional performance, highlighting key markets driving this expansion. Further analysis of the filing will reveal the specific contributions of different product offerings to this overall growth.

- Exact revenue numbers: (Insert exact numbers from the official filing once available. This section should be updated with the official data).

- Comparison to previous years: (Insert comparative data, demonstrating consistent or accelerating growth trends).

- Breakdown by geographic region: (Insert regional breakdown if available in the filing. Highlight key regions contributing most to growth).

- Specific products driving growth: (Mention specific products or services within Klarna's portfolio that contributed significantly to the revenue surge).

Klarna's Dominance in the BNPL Market

Klarna's 24% revenue growth solidifies its position as a leading player in the competitive BNPL market. The exact market share will depend on the final filing, but Klarna's brand recognition, user-friendly interface, and global reach are key competitive advantages. Strategic partnerships further strengthen its market position.

- Market share statistics: (Insert market share data once available from the filing. Cite reputable sources for this data).

- Key competitive differentiators: Klarna differentiates itself through a seamless user experience, a strong brand reputation, and a global presence, allowing it to cater to a wider consumer base compared to many competitors.

- Strategic partnerships: (Mention any significant partnerships that contribute to Klarna's market share and growth).

Key Factors Driving Klarna's Growth

Increasing Adoption of BNPL

The surge in Klarna's revenue is intrinsically linked to the broader growth of the BNPL market. Consumers are increasingly adopting BNPL services due to their convenience and flexibility. This trend is driven by several factors, making BNPL a popular payment method among various demographics.

- Statistics on BNPL market growth: (Insert relevant statistics showing the growth of the BNPL sector. Cite reputable industry reports).

- Consumer demographics using BNPL: (Discuss the demographic groups most likely to use BNPL services, highlighting key age ranges, income levels, and spending habits).

- Reasons for increasing popularity: The ease of use, flexible payment options, and often attractive promotional offers associated with BNPL contribute significantly to its growing popularity.

Klarna's Strategic Investments and Innovations

Klarna's growth isn't solely due to market trends; the company has strategically invested in innovation and expansion. These initiatives have played a significant role in driving revenue growth.

- New product launches: (List any recently launched products or services that have contributed to the revenue increase).

- Technology advancements: (Discuss any technological improvements that have enhanced the user experience or operational efficiency).

- Successful marketing campaigns: (Highlight successful marketing initiatives that contributed to increased customer acquisition and engagement).

- Expansion into new markets: (Mention any recent geographic expansions that have broadened Klarna's reach and revenue streams).

Implications of the IPO Filing for Investors

Valuation and Investment Potential

Klarna's IPO filing provides insights into its valuation, attracting significant investor attention. However, potential investors need to carefully assess both the potential returns and inherent risks.

- Projected valuation: (Insert projected valuation figures, if available from reputable sources. Note that this is subject to change).

- Key risks associated with the investment: Potential risks include increased competition within the BNPL sector, evolving regulatory landscapes, and the overall economic climate.

- Potential returns for investors: (Discuss potential returns based on projected growth and market conditions. This should be presented cautiously, emphasizing inherent investment risks).

Future Growth Prospects and Challenges

Klarna's future growth depends on its ability to navigate both opportunities and challenges within the dynamic fintech landscape.

- Growth projections: (Discuss future growth projections, referencing the company's own projections, if available, while acknowledging inherent uncertainties).

- Challenges posed by competitors: The BNPL sector is fiercely competitive; Klarna faces challenges from established players and new entrants.

- Potential regulatory hurdles: Regulatory scrutiny and potential changes in regulations pose a significant challenge to BNPL companies like Klarna.

- Klarna's strategy to overcome challenges: (Discuss Klarna's strategies to maintain its competitive edge and adapt to evolving regulatory environments).

Conclusion

Klarna's impressive 24% revenue surge, as revealed in its US IPO filing, demonstrates the company's strong position in the booming Buy Now Pay Later market. The filing highlights significant growth, strategic investments, and strong potential for future expansion. However, investors should carefully consider the associated risks before investing in the Klarna IPO.

Call to Action: Stay informed about the upcoming Klarna IPO and the evolving landscape of the Fintech industry. Learn more about Klarna's IPO and its potential impact on the BNPL market by following reputable financial news sources. Follow the developments surrounding the Klarna IPO for further insights into the future of this innovative financial technology company.

Featured Posts

-

Estonian Eurovision Acts Italian Parody A Semi Final Surprise

May 14, 2025

Estonian Eurovision Acts Italian Parody A Semi Final Surprise

May 14, 2025 -

Contesa Sanremo La Rai Diffida Il Comune Dettagli E Sviluppi

May 14, 2025

Contesa Sanremo La Rai Diffida Il Comune Dettagli E Sviluppi

May 14, 2025 -

Coco Gauff And Peyton Stearns Power Through To Rome Quarterfinals

May 14, 2025

Coco Gauff And Peyton Stearns Power Through To Rome Quarterfinals

May 14, 2025 -

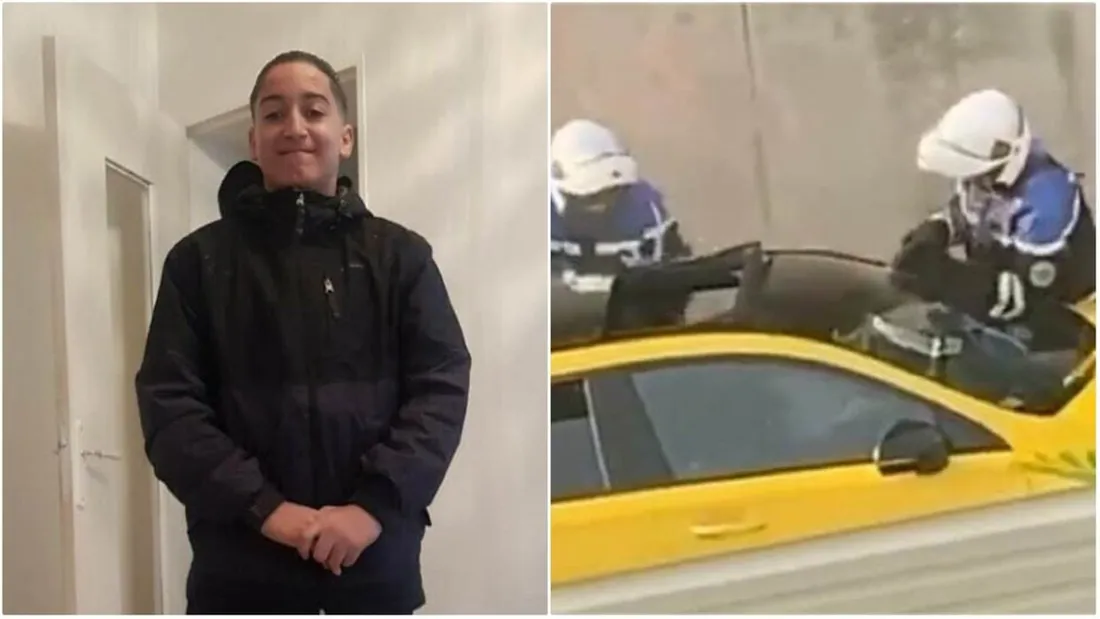

Nord Oqtf Fraude Sncf Et Exhibition Sexuelle Le Cas D Un Ivoirien

May 14, 2025

Nord Oqtf Fraude Sncf Et Exhibition Sexuelle Le Cas D Un Ivoirien

May 14, 2025 -

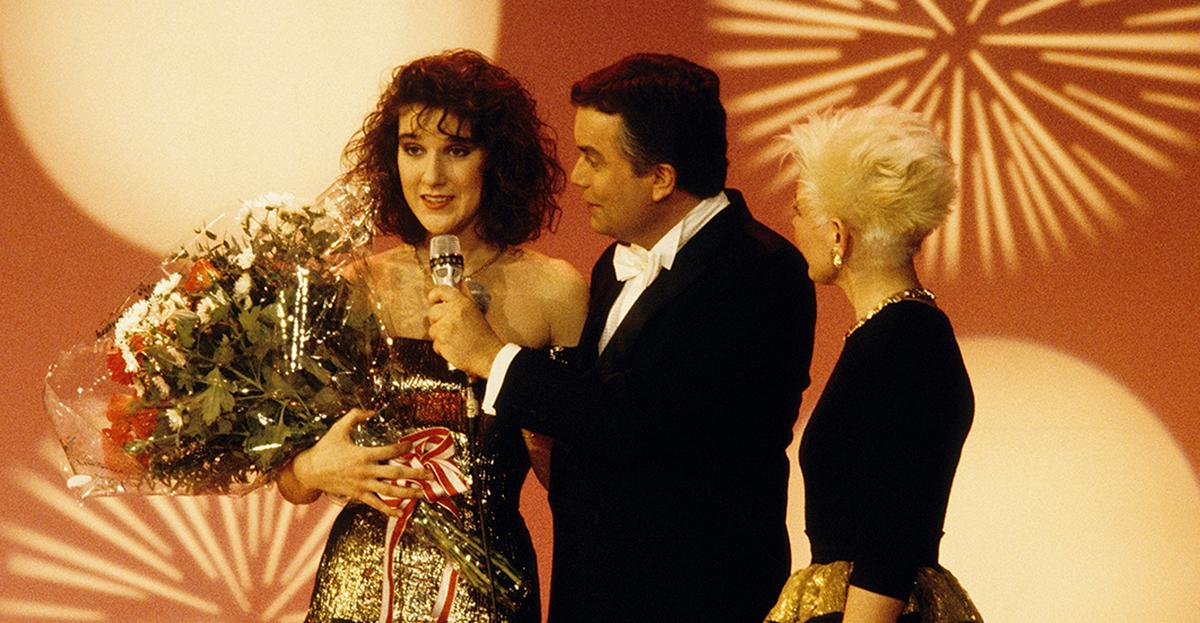

Nje Nderim Per Celine Dion Ne Eurovizionin E Zvicres 2025

May 14, 2025

Nje Nderim Per Celine Dion Ne Eurovizionin E Zvicres 2025

May 14, 2025