US Middle Class Income: A State-by-State Breakdown

Table of Contents

Factors Influencing Middle Class Income Across States

Several interconnected factors significantly influence the average middle class income across different US states. Understanding these factors is crucial to grasping the wide variations in financial well-being across the country.

-

Cost of Living: The cost of living, particularly housing costs, plays a dominant role. States with high housing costs, such as California and New York, often require higher salaries to maintain a comparable standard of living, impacting the disposable income available to the middle class. Transportation costs, grocery prices, and utility expenses also contribute to the overall cost of living and influence the net income available after essential expenses.

-

State and Local Taxes: Tax burdens vary substantially between states. High state and local income taxes, property taxes, and sales taxes can significantly reduce the net income of middle-class families, leaving less disposable income for savings, investments, or discretionary spending.

-

Job Market Strength: The strength of a state's job market directly impacts middle-class income. States with robust economies, high employment rates, and a diverse range of industries tend to offer higher average wages, boosting middle class incomes. Conversely, states with high unemployment or a concentration in low-wage industries often struggle with lower average incomes.

-

Dominant Industries and Average Salaries: The types of industries prevalent in a state significantly impact average salaries. States with a strong presence of high-paying industries like technology, finance, or healthcare generally have higher average middle class incomes compared to states dominated by lower-paying sectors like agriculture or manufacturing.

-

Education Levels: The correlation between education levels and earning potential is undeniable. States with higher rates of college education and skilled labor tend to boast higher average incomes due to the increased earning capacity of their workforce. Access to quality education and training opportunities is therefore a key driver of economic prosperity.

-

Healthcare Costs and Access: The cost of healthcare and access to affordable healthcare significantly impact disposable income. High healthcare costs, coupled with limited access to affordable insurance, can severely strain the budgets of middle-class families, diminishing their overall financial well-being.

State-by-State Income Data: High-Income States

Several states consistently rank high in terms of average middle-class income. These states often share common characteristics like strong economies, vibrant job markets, and a high concentration of skilled workers. While precise figures fluctuate yearly, based on data from the US Census Bureau and other reliable sources, the following states typically feature amongst the highest average middle-class incomes (note that these are illustrative and should be verified with the most current data):

- Maryland: Boasting a strong presence of government jobs and a diverse economy.

- Massachusetts: A hub for technology, education, and healthcare.

- Connecticut: Known for its strong financial sector and high concentration of skilled professionals.

- New Jersey: A key location for many large corporations and financial institutions.

- California: Despite high cost of living, key tech hubs drive high average incomes in specific areas. (Note that income inequality within California is significant).

- Washington: A growing tech sector and other high-paying industries.

It's vital to consult the latest data from the US Census Bureau and Bureau of Economic Analysis for the most up-to-date figures on average middle-class income for each state.

State-by-State Income Data: Low-Income States

Conversely, several states consistently report lower average middle-class incomes. Factors like a lower cost of living (which can sometimes offset lower wages), limited job opportunities in high-paying sectors, and lower educational attainment often contribute to this disparity. Again, using data from reliable sources such as the US Census Bureau, some states typically found at the lower end include (but are not limited to, and require verification with current data):

- Mississippi: Challenges with economic diversification and lower employment rates.

- West Virginia: Economic dependence on specific industries.

- Arkansas: Similar challenges to Mississippi and West Virginia.

- New Mexico: Issues with economic diversification and lower employment rates.

- Louisiana: Economic challenges impacting average incomes.

It's crucial to understand that lower average incomes don't always indicate a lower quality of life. In some states, a lower cost of living may offset lower wages. However, access to education, healthcare, and economic opportunities remains a critical concern in these states.

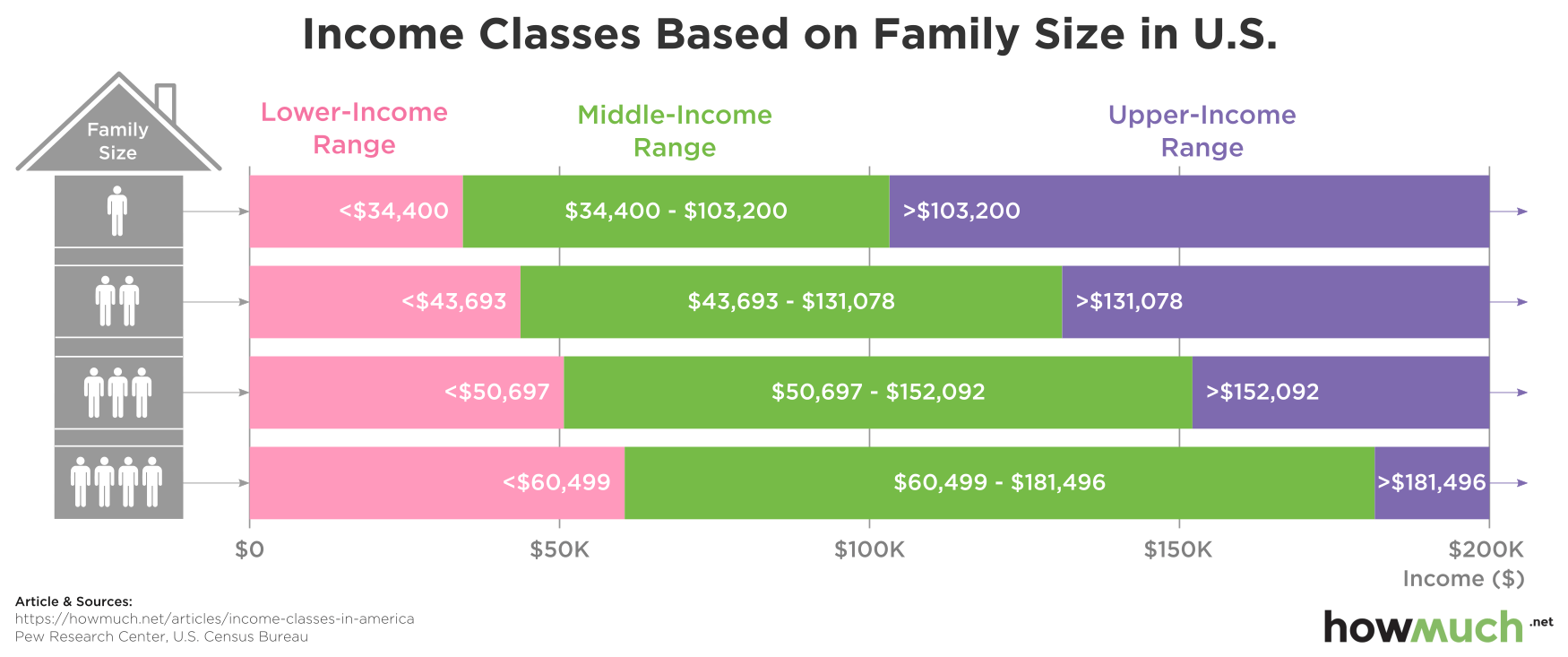

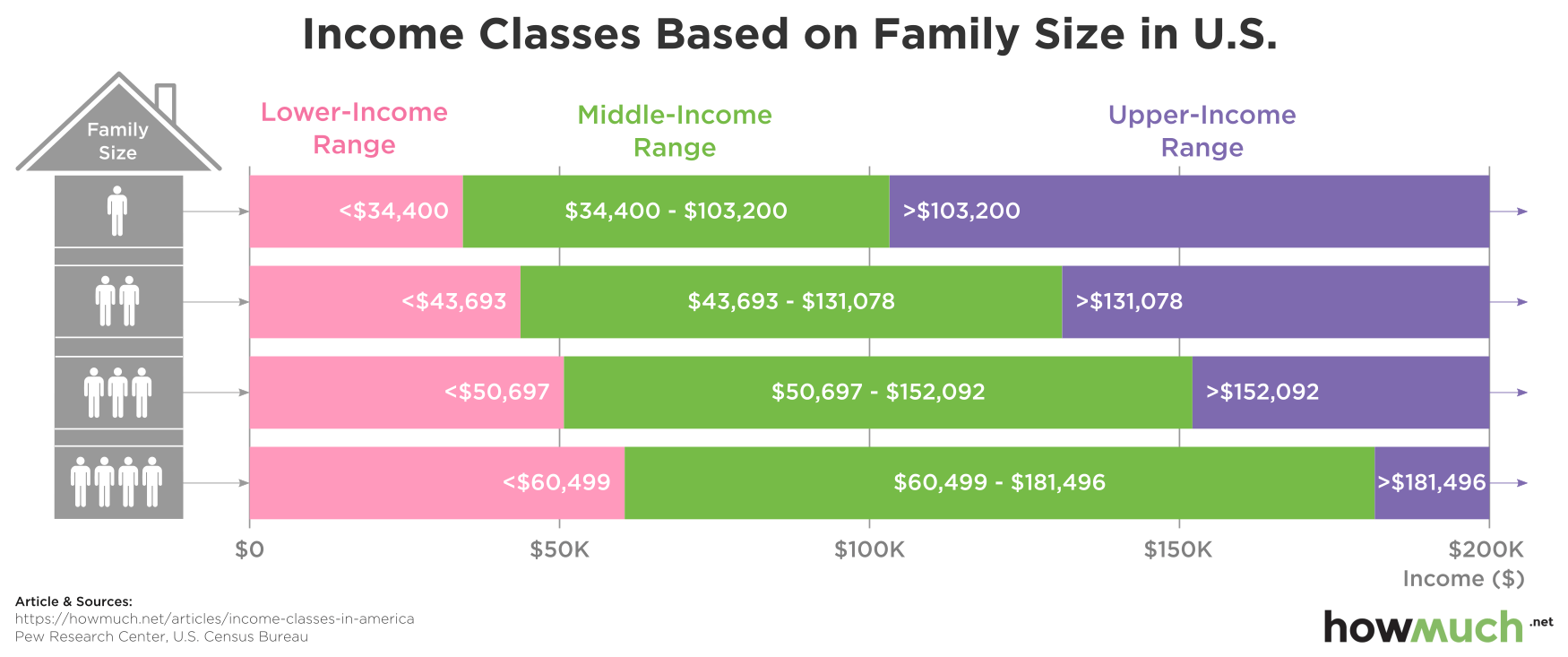

Visualizing the Data: Maps and Charts

To fully grasp the geographical variations in US middle class income, it's highly beneficial to visualize the data. Interactive maps and charts, color-coded to represent income brackets, provide an intuitive understanding of income distribution across the country. These visual aids can highlight income inequality and regional disparities, effectively communicating complex data in an accessible format. Numerous online resources provide such visualizations; searching for "middle class income map USA" or "US income inequality map" will yield relevant results.

Conclusion

This state-by-state breakdown of US middle class income reveals significant disparities across the nation. Factors like cost of living, job market strength, education levels, and healthcare access play crucial roles in shaping these variations. Understanding these influences is paramount for both individuals and policymakers. Understanding your state's average US middle class income is crucial for financial planning. Use this state-by-state breakdown to better understand your financial situation and explore opportunities for improvement, whether that involves career choices or considering relocation to a location more suited to your financial goals. Consult the latest data from official sources like the US Census Bureau to obtain the most current and precise information for your specific state.

Featured Posts

-

Feltri Riflessioni Sul Venerdi Santo

Apr 30, 2025

Feltri Riflessioni Sul Venerdi Santo

Apr 30, 2025 -

Xem Truc Tiep Vong Chung Ket Thaco Cup 2025 Lich Thi Dau Cap Nhat

Apr 30, 2025

Xem Truc Tiep Vong Chung Ket Thaco Cup 2025 Lich Thi Dau Cap Nhat

Apr 30, 2025 -

Los Angeles Wildfires And The Rise Of Disaster Related Betting Markets

Apr 30, 2025

Los Angeles Wildfires And The Rise Of Disaster Related Betting Markets

Apr 30, 2025 -

Is Age Just A Number Redefining Youth And Vitality

Apr 30, 2025

Is Age Just A Number Redefining Youth And Vitality

Apr 30, 2025 -

7 2025

Apr 30, 2025

7 2025

Apr 30, 2025