US Regulatory Developments Push Bitcoin To All-Time High

Table of Contents

Recent developments in US Bitcoin regulation have unexpectedly propelled the cryptocurrency to unprecedented highs, sparking debate and excitement within the financial world. This surge isn't simply a matter of market fluctuations; it's a direct consequence of evolving regulatory landscapes and their profound impact on investor sentiment and market participation. This article explores the key regulatory shifts and their influence on Bitcoin's remarkable price increase.

Increased Institutional Investment Fueled by Regulatory Clarity

The influx of institutional money into the Bitcoin market has been a significant driver of its recent price appreciation. Increased regulatory clarity has played a crucial role in fostering this institutional confidence.

Grayscale Bitcoin Trust's Success and Implications

- The Grayscale Bitcoin Trust (GBTC) has experienced substantial growth, reflecting the increasing appetite of institutional investors for Bitcoin exposure. Its performance serves as a barometer of institutional confidence in the cryptocurrency.

- The SEC's ongoing review of Bitcoin ETF applications, while not yet resulting in approvals for all applications, has nonetheless created a positive expectation among institutional investors. The potential for a Bitcoin ETF to further enhance liquidity and accessibility is a powerful incentive.

- The increased institutional adoption, fueled by the potential for regulatory approval and the success of vehicles like GBTC, has acted as a significant catalyst for Bitcoin's price increase. Large-scale investments from institutions are injecting significant capital into the market.

The Role of Bitcoin Futures and ETFs

- The availability of Bitcoin futures contracts on exchanges like CME and Cboe has provided institutional investors with a regulated avenue for hedging and speculating on Bitcoin's price. This added liquidity has contributed to price stability and reduced volatility.

- The ongoing discussion and potential approval of Bitcoin ETFs in the US represent a significant milestone. ETFs offer greater accessibility and lower barriers to entry for institutional investors, potentially unlocking a substantial influx of capital into the Bitcoin market.

- The regulatory landscape surrounding Bitcoin futures and ETFs continues to evolve, with proposals and potential approvals shaping the future of Bitcoin's price discovery and liquidity. These developments directly impact institutional investment strategies and, consequently, Bitcoin's price.

Easing of Regulatory Uncertainty and its Positive Impact

Regulatory clarity is crucial for attracting risk-averse investors. The reduction in Fear, Uncertainty, and Doubt (FUD) surrounding Bitcoin's future has been a game-changer.

Reduced Fear, Uncertainty, and Doubt (FUD)

- Clearer regulatory frameworks reduce the uncertainty surrounding Bitcoin's long-term prospects, making it more attractive to institutional and individual investors who prefer less volatile assets.

- The positive sentiment generated by regulatory progress contributes to increased demand and ultimately pushes the price higher.

- Decreased regulatory uncertainty is a key factor in reducing Bitcoin price volatility, attracting a broader range of investors.

Specific Regulatory Changes and Their Effects

While specific regulatory changes may vary and are subject to ongoing developments, any positive movement towards clearer guidelines tends to favorably impact investor confidence. For example, clarifications from FinCEN regarding cryptocurrency regulations, or statements from the OCC concerning banking relationships with cryptocurrency companies, can contribute to a more positive market sentiment. (Specific examples with dates and credible sources should be included here as information becomes available). These developments, when communicated clearly and consistently, reduce the ambiguity and foster greater confidence in the space.

Growing Adoption and Mainstream Acceptance

Increased adoption and mainstream acceptance further fuel the price appreciation of Bitcoin.

Increased Payments Processing and Merchant Adoption

- The growing number of merchants and businesses accepting Bitcoin as a payment method indicates increased mainstream acceptance.

- Regulatory clarity, by reducing risks associated with cryptocurrency transactions, encourages wider adoption among businesses.

- Improved payment processing infrastructure and user-friendly solutions are also contributing to the rise of Bitcoin payments.

Growing Public Awareness and Media Coverage

- Increased positive media coverage and public awareness are boosting demand for Bitcoin, driven by growing understanding and acceptance of its utility and potential.

- Significant events, such as institutional investments or regulatory announcements, tend to garner significant media attention, further fueling public interest.

- The overall sentiment surrounding Bitcoin in the media and public discourse is becoming increasingly positive, significantly impacting its adoption rate and, consequently, its price.

Conclusion

The recent surge in Bitcoin's price is a direct result of several key factors, all significantly influenced by evolving US regulatory developments. Increased institutional investment, fueled by regulatory clarity and the potential for Bitcoin ETFs, has played a major role. Simultaneously, the easing of regulatory uncertainty and the growth of mainstream adoption, driven by increased payment processing and positive media coverage, have further contributed to this upward trend. Understanding these interconnected factors is crucial for navigating the evolving landscape of cryptocurrency investments.

Call to Action: Stay informed about US regulatory developments impacting Bitcoin and other cryptocurrencies. Understanding the regulatory landscape is crucial for navigating the volatile but potentially rewarding world of Bitcoin investment. Learn more about how these latest developments could impact your Bitcoin strategy. [Link to relevant resources here]

Featured Posts

-

The Mc Laren Hamilton Rift An Honest Admission And Its Implications

May 23, 2025

The Mc Laren Hamilton Rift An Honest Admission And Its Implications

May 23, 2025 -

A Conversation With Jonathan Groff Exploring Asexuality

May 23, 2025

A Conversation With Jonathan Groff Exploring Asexuality

May 23, 2025 -

Your Guide To Netflixs May 2025 Movie And Tv Lineup

May 23, 2025

Your Guide To Netflixs May 2025 Movie And Tv Lineup

May 23, 2025 -

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025

Revealed Antonys Near Transfer To A Man Utd Rival

May 23, 2025 -

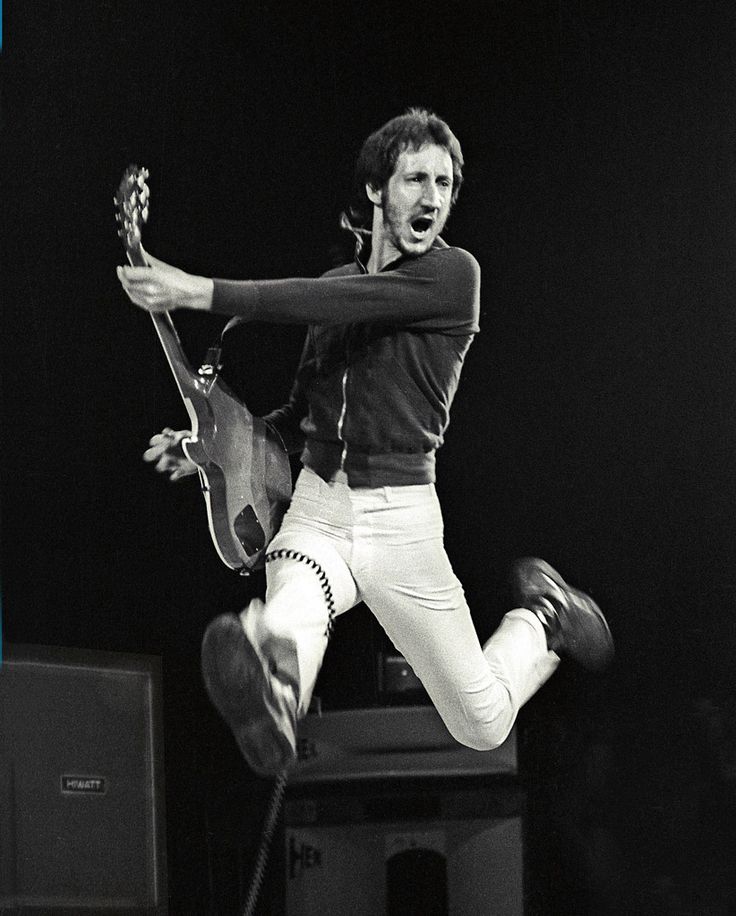

Pete Townshends Collaborative Process From Studio To Stage

May 23, 2025

Pete Townshends Collaborative Process From Studio To Stage

May 23, 2025

Latest Posts

-

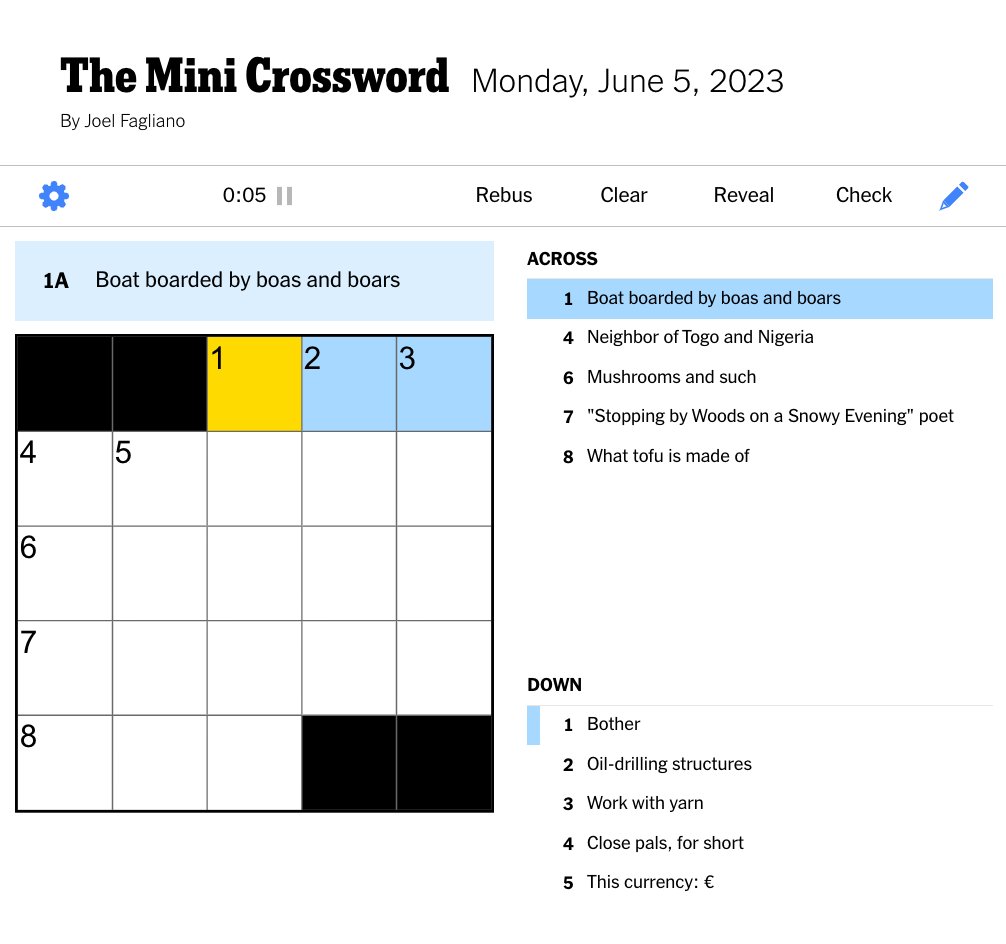

Solve The Nyt Mini Crossword March 6 2025 Answers And Clues

May 23, 2025

Solve The Nyt Mini Crossword March 6 2025 Answers And Clues

May 23, 2025 -

Nyt Mini Crossword March 13 2025 Solutions And Helpful Hints

May 23, 2025

Nyt Mini Crossword March 13 2025 Solutions And Helpful Hints

May 23, 2025 -

Finding The Answers Nyt Mini Crossword March 13 2025

May 23, 2025

Finding The Answers Nyt Mini Crossword March 13 2025

May 23, 2025 -

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 23, 2025

Nyt Mini Crossword Today Hints And Answers For March 6 2025

May 23, 2025 -

Nyt Mini Crossword Help Answers And Clues For March 13 2025

May 23, 2025

Nyt Mini Crossword Help Answers And Clues For March 13 2025

May 23, 2025