US Tariffs And Brookfield's Manufacturing Investment Decisions

Table of Contents

Understanding Brookfield's Manufacturing Portfolio and its Global Reach

Brookfield, a global asset management company, possesses a substantial and diverse manufacturing portfolio. Its global footprint extends across numerous countries, showcasing a commitment to international diversification in its manufacturing investments. This extensive reach makes it particularly susceptible to, and adept at navigating, the complexities of global trade policies like US tariffs.

- Key Manufacturing Sectors: Brookfield's manufacturing investments span several key sectors, including renewable energy (solar panel manufacturing, wind turbine components), industrial manufacturing (steel processing, construction materials), and logistics (warehouse and distribution centers).

- Geographic Locations: Brookfield's manufacturing investments are geographically diversified, with significant holdings in North America, Europe, and Asia. This diversification helps mitigate some of the risks associated with regional trade conflicts.

- Scale of Investments: Brookfield's investments in manufacturing represent a significant portion of its overall portfolio, highlighting the importance of this sector to its overall investment strategy. The sheer scale of these investments underscores the significant impact US tariffs can have on their bottom line.

The Direct Impact of US Tariffs on Brookfield's Investment Strategy

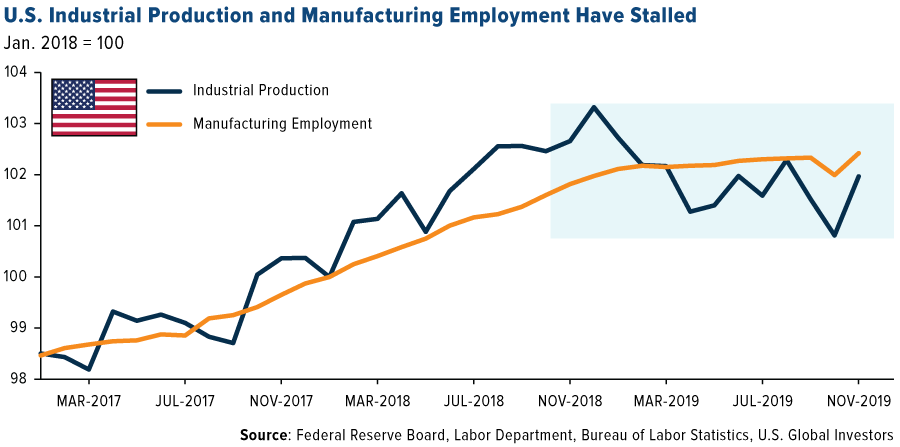

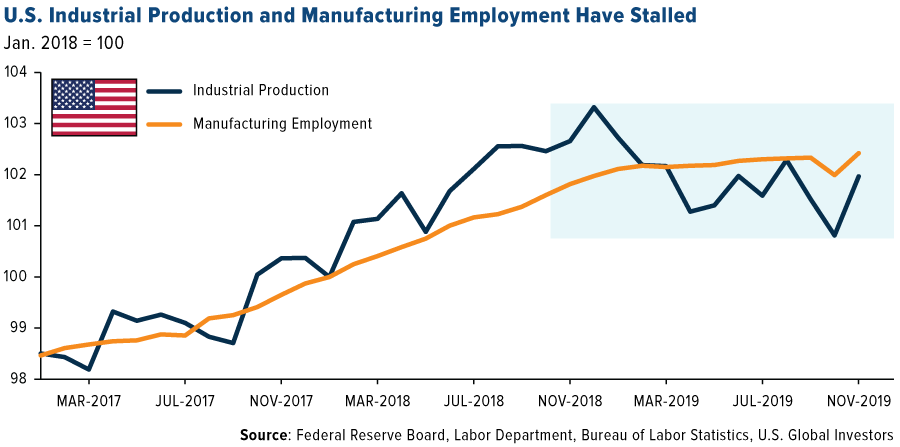

US tariffs, particularly those imposed on steel and aluminum, have a direct and quantifiable impact on Brookfield's manufacturing operations and profitability. These tariffs increase input costs for various manufacturing processes, forcing adjustments to their investment strategy.

- Increased Input Costs: The tariffs directly raise the cost of raw materials, impacting the overall production costs of goods manufactured in the US or using US-sourced materials.

- Pricing Strategies and Competitiveness: Increased input costs put pressure on Brookfield's pricing strategies, potentially reducing competitiveness against companies located in countries not subject to these tariffs.

- Shifting Production Locations: To mitigate the impact of tariffs, Brookfield might shift some of its production to locations outside the US, where input costs are lower and tariffs are avoided. This necessitates careful consideration of logistical challenges and potential trade-offs.

- Specific Examples: For instance, tariffs on steel could directly affect a Brookfield investment in a US-based construction materials company, while tariffs on aluminum might impact a renewable energy project utilizing aluminum components.

Indirect Effects of US Tariffs: Supply Chain Disruptions and Market Volatility

Beyond the direct impact, US tariffs create ripple effects across Brookfield's global supply chains and introduce significant market volatility. These indirect consequences are equally, if not more, challenging to manage.

- Increased Uncertainty: The fluctuating nature of tariff policies introduces uncertainty into long-term planning and investment decisions, making it difficult to predict future costs and market conditions.

- Consumer Demand: Higher prices due to tariffs can impact consumer demand, affecting the sales volume and profitability of Brookfield's manufacturing investments.

- Market Stability and Investment Confidence: The overall uncertainty created by trade disputes and tariffs can undermine market stability and investor confidence, leading to reduced investment in the manufacturing sector.

- Brookfield's Risk Mitigation: Brookfield likely employs sophisticated risk management strategies to account for supply chain disruptions, such as diversifying suppliers and securing alternative sourcing options.

Brookfield's Response to US Tariffs: Adaptation and Mitigation Strategies

Brookfield's response to US tariffs involves a multifaceted approach that combines adaptation and mitigation strategies to navigate the challenges and capitalize on opportunities.

- Diversification: Brookfield is likely diversifying its sourcing and manufacturing locations to reduce reliance on any single region affected by tariffs. This includes exploring opportunities in other countries with favorable trade policies.

- Technology Investment: Investing in automation and advanced technologies can help increase efficiency and reduce reliance on tariff-affected inputs, thereby lowering overall costs.

- Policy Engagement: Brookfield may engage in lobbying efforts or actively participate in policy discussions to influence trade policies or advocate for adjustments to existing tariffs.

- Strategic Partnerships: Forming strategic partnerships with other companies can help mitigate risks and share the burden of navigating tariff-related challenges.

The Long-Term Implications of US Tariffs on Brookfield's Manufacturing Decisions

US tariffs significantly impact Brookfield's manufacturing investment decisions at multiple levels. Direct cost increases, supply chain disruptions, market volatility, and the need for adaptive strategies all play a crucial role. Brookfield's response, involving diversification, technological advancements, and policy engagement, reflects a proactive approach to navigating this complex landscape. Understanding the intricate interplay between US tariffs and Brookfield’s manufacturing investment decisions requires continued analysis. Stay informed on how shifting trade policies will continue to influence global manufacturing landscapes and Brookfield's strategic approach to impact of US tariffs on Brookfield manufacturing. Further research into Brookfield's manufacturing investment strategy and US trade policy is crucial for understanding the long-term implications for both the company and the global manufacturing sector.

Featured Posts

-

On N Est Pas Stresse 8000 Km A Velo Pour Trois Jeunes Du Bocage Ornais

May 02, 2025

On N Est Pas Stresse 8000 Km A Velo Pour Trois Jeunes Du Bocage Ornais

May 02, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Others

May 02, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Others

May 02, 2025 -

Wrigley Field Incident Fan Hospitalized Following Fall

May 02, 2025

Wrigley Field Incident Fan Hospitalized Following Fall

May 02, 2025 -

Loyle Carner 3 Arena Gig Date Tickets And More

May 02, 2025

Loyle Carner 3 Arena Gig Date Tickets And More

May 02, 2025 -

Kendal Community Rallies Poppy Atkinson Fundraiser Exceeds Expectations

May 02, 2025

Kendal Community Rallies Poppy Atkinson Fundraiser Exceeds Expectations

May 02, 2025

Latest Posts

-

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025

Celebrity Stylist Elizabeth Stewart Designs Exclusive Capsule Collection For Lilysilk

May 10, 2025 -

Elizabeth Stewart X Lilysilk Spring 2024 Collaboration Unveiled

May 10, 2025

Elizabeth Stewart X Lilysilk Spring 2024 Collaboration Unveiled

May 10, 2025 -

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025

Elizabeth Stewart And Lilysilk Partner For A Stunning Spring Collection

May 10, 2025 -

Elizabeth Hurleys Bikini Fashion A Maldives Vacation Diary

May 10, 2025

Elizabeth Hurleys Bikini Fashion A Maldives Vacation Diary

May 10, 2025 -

Maldives Vacation Elizabeth Hurleys Bikini Looks

May 10, 2025

Maldives Vacation Elizabeth Hurleys Bikini Looks

May 10, 2025