US Tech IPOs On Hold: Impact Of Tariffs And Market Volatility

Table of Contents

The Impact of Tariffs on US Tech IPOs

The imposition of tariffs, particularly on imported components crucial to the tech industry, has significantly hampered the viability of US Tech IPOs. This impact manifests in two key ways: increased costs and reduced profitability, and heightened uncertainty and investor hesitation.

Increased Costs and Reduced Profitability

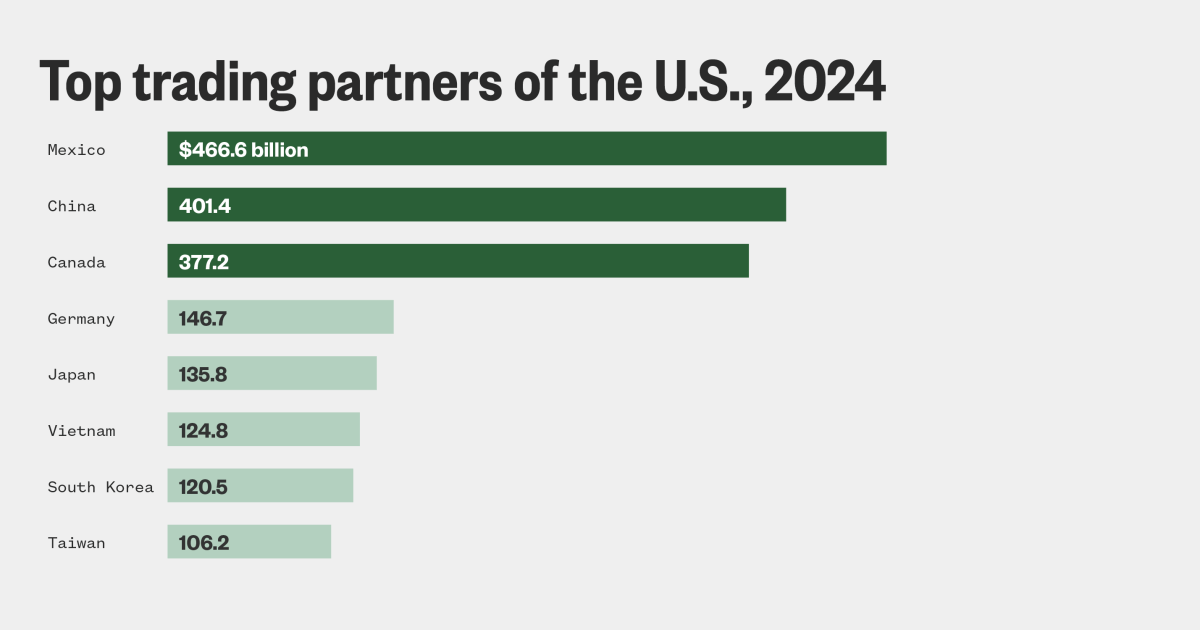

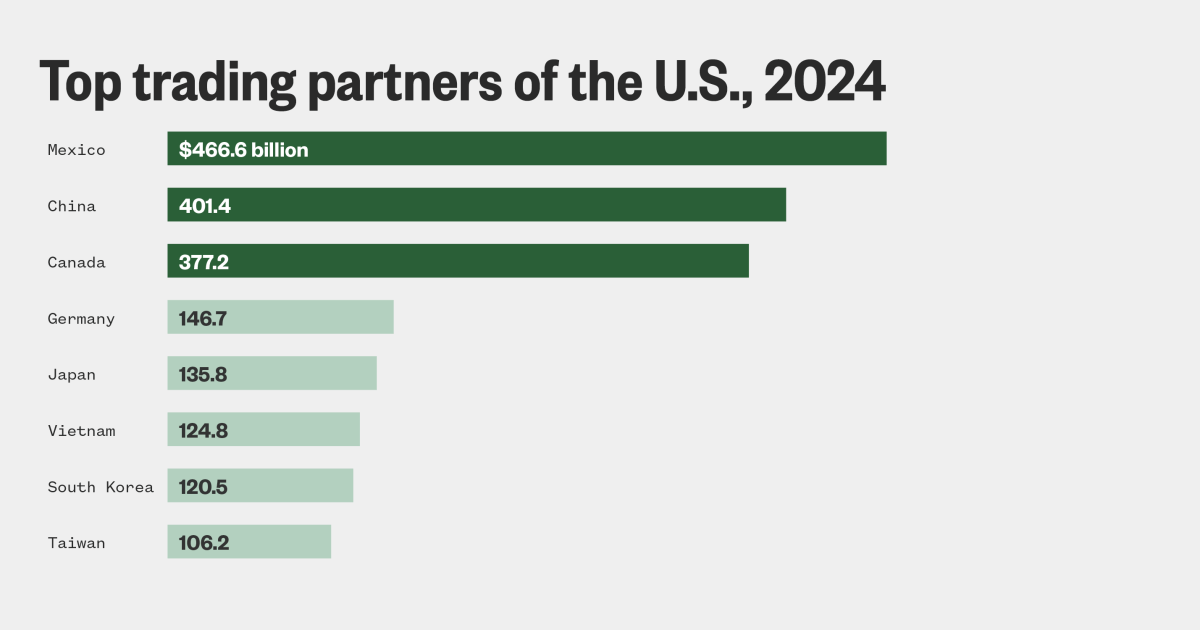

Tariffs directly translate into higher production costs for tech companies. The reliance on global supply chains means that many US tech firms rely on imported components, from semiconductors to rare earth minerals. These import duties, coupled with increased logistics and transportation expenses resulting from trade tensions, squeeze profit margins. This makes the prospect of an IPO, which requires demonstrating strong profitability and growth potential, considerably less attractive to investors.

- Higher import duties on crucial components like semiconductors: These are fundamental building blocks for many tech products, and increased tariffs inflate the cost of goods sold.

- Increased logistics and transportation expenses: Trade disputes often lead to delays and increased complexity in global supply chains, adding to the overall cost burden.

- Reduced competitiveness in the global market: Higher production costs reduce price competitiveness, potentially impacting market share and future revenue projections.

Uncertainty and Investor Hesitation

The unpredictability inherent in trade wars creates a climate of uncertainty, significantly impacting investor confidence. The potential for future tariff increases makes it difficult for tech companies to accurately forecast future revenue streams and profitability. This uncertainty deters investors who are hesitant to commit capital to companies facing significant, potentially insurmountable, tariff-related risks.

- Fear of future tariff increases impacting profitability projections: Investors demand clarity and stability; the unpredictability of tariffs makes long-term investment planning a significant challenge.

- Difficulty in accurately forecasting future revenue streams: The fluctuating landscape of trade policies makes it nearly impossible to create reliable financial models, a key element in IPO valuation.

- Reduced investor confidence in the long-term viability of some tech companies: Uncertainty regarding future costs and market access directly undermines investor confidence, discouraging IPOs.

Market Volatility and its Effect on US Tech IPOs

Beyond tariffs, the broader market volatility significantly impacts the decision of tech companies to pursue an IPO. Fluctuating stock prices and rising interest rates play a crucial role in this dynamic.

Fluctuating Stock Prices and Investor Sentiment

The current market volatility makes it incredibly challenging to determine an appropriate IPO price. Rapid price swings create uncertainty about valuations, and a negative market sentiment generally discourages companies from entering the public market. Investors, in a volatile market, tend to become more risk-averse, reducing demand for new IPOs.

- Increased risk aversion among investors leading to lower demand for IPOs: Investors seek safer havens during periods of uncertainty, reducing the pool of potential investors for tech IPOs.

- Difficulty in setting an appropriate IPO price given market fluctuations: Pricing an IPO accurately is already challenging; in a volatile market, this becomes an almost impossible task.

- Potential for significant losses for both companies and investors in a volatile market: A poorly timed IPO in a volatile market can lead to substantial losses for both the company and its early investors.

Interest Rate Hikes and Their Influence

The Federal Reserve's interest rate hikes further complicate the landscape for US Tech IPOs. Higher interest rates increase the cost of borrowing for companies, impacting their valuations and making alternative investments, such as fixed-income securities, more attractive to investors.

- Increased borrowing costs hinder company growth and expansion plans: Higher interest rates make it more expensive to secure loans for growth initiatives, slowing expansion and reducing attractiveness to potential investors.

- Reduced access to capital for tech startups: Higher interest rates make it harder for tech startups to access the capital necessary for growth and development, impacting their ability to even consider an IPO.

- Shift in investor preference towards fixed-income securities: When interest rates rise, investors often shift their investments toward fixed-income securities that offer higher returns, reducing their appetite for riskier ventures like tech IPOs.

Alternative Funding Routes for Tech Companies

Given the challenges associated with US Tech IPOs, many tech companies are exploring alternative funding routes. These include private equity funding, venture capital, and debt financing. Each option presents distinct advantages and disadvantages.

- Private equity offers significant capital but requires relinquishing control. Private equity firms provide substantial funding but often demand significant equity stakes and influence over company operations.

- Venture capital involves higher risk but offers potential for significant returns. Venture capitalists invest in early-stage companies with high growth potential, accepting higher risk in exchange for potentially substantial returns.

- Debt financing provides stability but can burden the company with high interest payments. Debt financing offers stability but increases the company's financial obligations and can limit flexibility in the future.

Conclusion

The slowdown in US Tech IPOs is a direct result of the interplay between escalating tariffs and market volatility. The resulting increased costs, uncertainty, and fluctuating market sentiment create a challenging environment for companies seeking a public listing. While alternative funding avenues exist, navigating this complex landscape demands careful consideration and strategic planning. Understanding the intricate relationship between these macroeconomic factors is crucial for making informed decisions regarding US Tech IPOs, both for companies considering going public and investors assessing their portfolio allocations. Stay informed about the latest developments impacting US Tech IPOs to make the best choices for your portfolio.

Featured Posts

-

Iwi Asset Growth A 8 2 Billion Report Reveals Steady Increase

May 14, 2025

Iwi Asset Growth A 8 2 Billion Report Reveals Steady Increase

May 14, 2025 -

Wynonna And Ashley Judd Open Up In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up In New Docuseries

May 14, 2025 -

Choosing The Right Loungefly Pokemon Bag Or Wallet For You

May 14, 2025

Choosing The Right Loungefly Pokemon Bag Or Wallet For You

May 14, 2025 -

Eurovision Song Contest 2025 Final And Semi Final Dates Announced

May 14, 2025

Eurovision Song Contest 2025 Final And Semi Final Dates Announced

May 14, 2025 -

Forest Awoniyi Successful Surgery After Post Collision

May 14, 2025

Forest Awoniyi Successful Surgery After Post Collision

May 14, 2025