Village Roadshow Sold: Alcon's Stalking Horse Bid Completes $417.5 Million Acquisition

Table of Contents

The Alcon Entertainment Acquisition – A Deep Dive

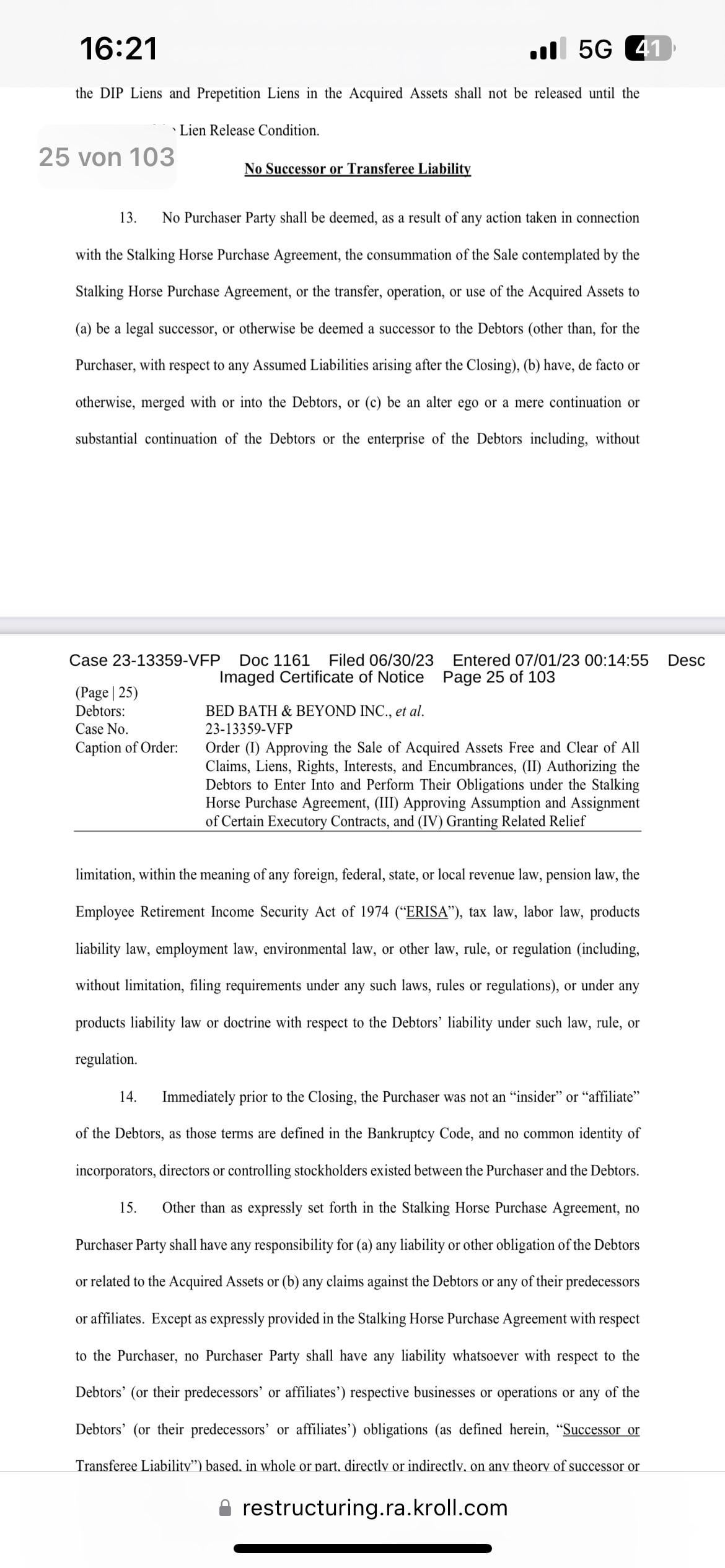

Understanding the Stalking Horse Bid

The Alcon Entertainment acquisition of Village Roadshow utilized a "stalking horse bid"—a strategic maneuver in mergers and acquisitions. A stalking horse bid involves a pre-arranged agreement with a buyer (Alcon) who sets a baseline bid price. This initial offer serves several crucial purposes:

- Define stalking horse bid: It establishes a minimum acceptable bid, setting a floor price for subsequent bidding. Any competing offers must exceed Alcon's initial bid.

- Explain its role in setting a floor price: This tactic reduces the risk for the seller (Village Roadshow), ensuring a minimum return on their assets.

- Discuss the advantages for the buyer (Alcon): For Alcon, it provides a strategic advantage, giving them an early entry into negotiations and potentially influencing the terms of the final deal. It also increases their chances of securing the acquisition.

- Mention potential drawbacks for Village Roadshow: While setting a floor price is advantageous, Village Roadshow might miss out on a potentially higher offer if the initial stalking horse bid is significantly lower than the asset's true market value.

Financial Details and Key Terms

The final acquisition price for Village Roadshow was $417.5 million. While precise details regarding the payment structure remain undisclosed, it's likely to involve a combination of cash and potentially some equity considerations.

- Specify the final acquisition price: $417.5 million represents a significant investment by Alcon Entertainment, highlighting their commitment to expanding their presence in the film and television industry.

- Mention any contingent payments or earn-outs: Contingent payments or earn-outs, tied to future performance metrics of Village Roadshow's assets, might also be part of the agreement.

- Discuss financing sources used by Alcon: Alcon likely secured financing through a combination of debt financing, equity investments, and potentially existing cash reserves. The exact financial arrangements will likely be detailed in subsequent regulatory filings.

Implications for Village Roadshow's Assets

The acquisition encompasses a wide range of Village Roadshow's assets, impacting its various business segments.

- List key assets involved in the sale: These include film studios, distribution networks, and a substantial library of intellectual property rights. The specific details of which assets were included in the sale are still emerging.

- Discuss the future of these assets under Alcon's ownership: Alcon will likely integrate these assets into their existing operations, leveraging synergies to enhance their production and distribution capabilities.

- Analyze potential changes in management and operations: Significant changes in management and operational strategies are expected as Alcon implements its vision for Village Roadshow's assets.

The Future of Alcon Entertainment and the Broader Media Landscape

Alcon's Strategic Goals

Alcon's acquisition of Village Roadshow represents a strategic move to expand its footprint in the global entertainment industry.

- Discuss Alcon's growth strategy and market positioning: Alcon likely aims to gain access to Village Roadshow's established distribution networks and content library, bolstering its existing portfolio.

- Analyze potential synergies between Alcon and Village Roadshow: Synergies are anticipated in production, distribution, and marketing, potentially leading to cost efficiencies and increased profitability.

- Explore future film and television production plans: We can anticipate a significant increase in Alcon's film and television production slate, utilizing Village Roadshow's infrastructure and talent pool.

Impact on the Australian Film Industry

The Village Roadshow sale has significant ramifications for the Australian film industry.

- Evaluate the implications for Australian filmmakers and talent: This acquisition could create both opportunities and challenges for Australian filmmakers and talent, depending on Alcon's future strategies.

- Analyze the effect on Australian film production and distribution: Alcon's approach will determine whether Australian film production and distribution remain a key focus or undergo significant changes.

- Discuss potential changes in the competitive landscape: The acquisition may reshape the competitive landscape within the Australian film industry.

Competitive Analysis within the Entertainment Sector

The acquisition positions Alcon as a more formidable player in the global entertainment sector.

- Identify key competitors to Alcon post-acquisition: Alcon now competes more directly with larger studios, including Warner Bros., Universal, and others.

- Analyze potential market consolidation or shifts: This acquisition might trigger further consolidation within the entertainment industry as other players seek to strengthen their positions.

- Discuss long-term implications for the industry: The long-term implications will depend heavily on Alcon’s integration strategy and its impact on both the Australian film industry and the wider global market.

Conclusion

The Alcon Entertainment acquisition of Village Roadshow for $417.5 million marks a significant milestone in the entertainment industry. This complex transaction, facilitated by a stalking horse bid, has significant implications for both companies and the broader media landscape. The future success hinges on Alcon's ability to integrate Village Roadshow's assets and navigate the competitive environment effectively. The impact on the Australian film industry remains to be seen, presenting both opportunities and challenges.

Stay updated on the latest developments in the entertainment industry and the impact of this major acquisition. Follow our blog for more in-depth analysis of the Village Roadshow sale and its consequences for the future of film. Learn more about the effects of this landmark Alcon Entertainment acquisition by subscribing to our newsletter.

Featured Posts

-

Alcons 417 5 Million Acquisition Of Village Roadshow Stalking Horse Bid Successful

Apr 24, 2025

Alcons 417 5 Million Acquisition Of Village Roadshow Stalking Horse Bid Successful

Apr 24, 2025 -

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Worth It

Apr 24, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 24, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 24, 2025 -

Interest In 65 Hudsons Bay Leases Soars

Apr 24, 2025

Interest In 65 Hudsons Bay Leases Soars

Apr 24, 2025 -

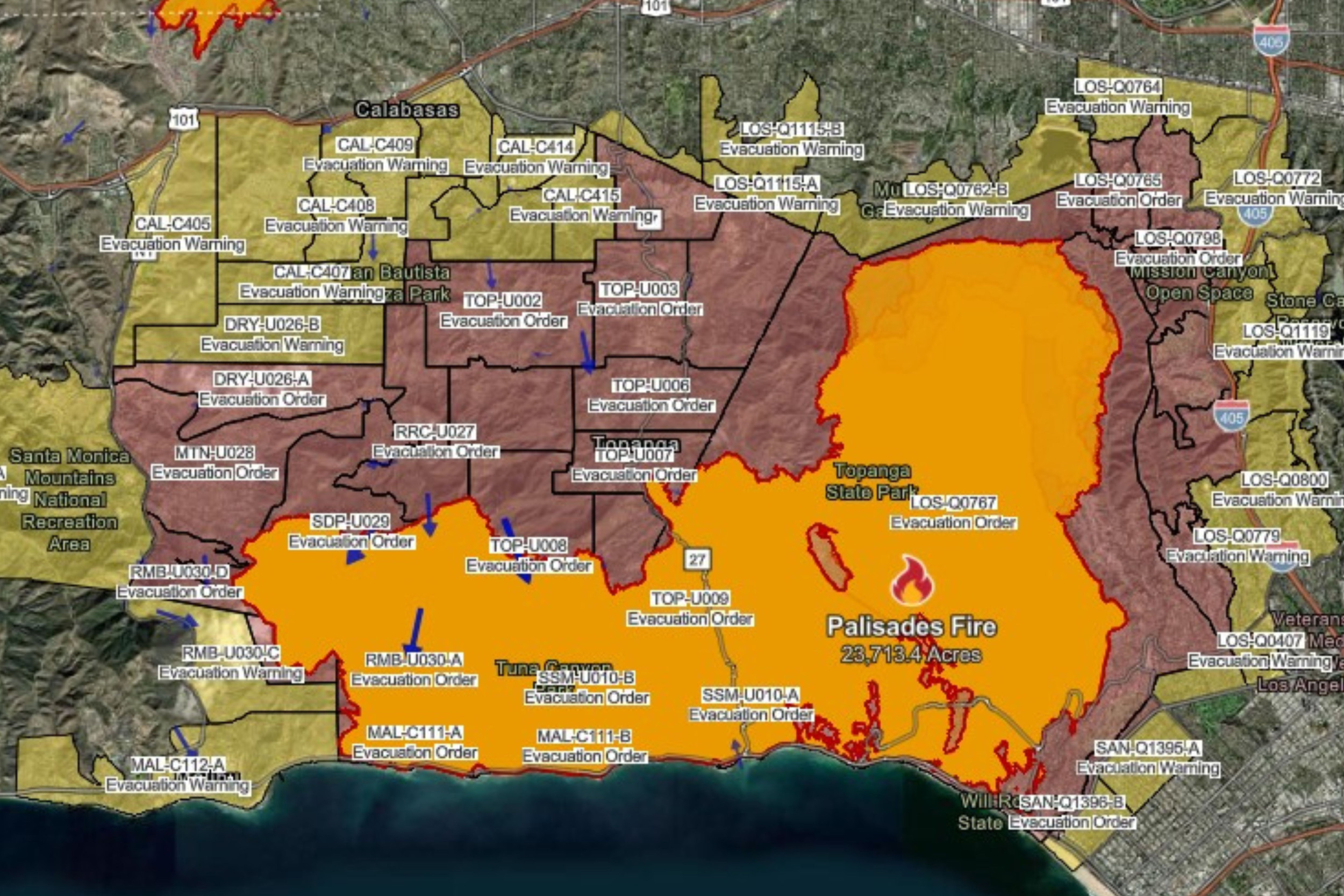

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 24, 2025

Los Angeles Palisades Fires A List Of Celebrities Who Lost Properties

Apr 24, 2025