Vodacom (VOD) Reports Improved Earnings, Announces Increased Payout

Table of Contents

Improved Financial Performance of Vodacom (VOD)

Vodacom's financial results showcase robust growth across several key performance indicators, solidifying its position as a leading player in the South African telecoms market and beyond.

Revenue Growth and Key Drivers

Vodacom reported a remarkable X% increase in revenue compared to the previous corresponding period. This impressive growth can be attributed to a confluence of factors, including:

- Increased Subscriber Base: A significant influx of new subscribers across various service offerings fueled revenue expansion.

- Higher Average Revenue Per User (ARPU): Successful strategies to upsell and cross-sell services resulted in a noticeable ARPU increase, boosting overall revenue.

- Data Revenue Surge: The exponential growth in data consumption, driven by increased smartphone penetration and the rising demand for data-intensive applications, contributed significantly to Vodacom's revenue growth. Data revenue increased by Y%.

- Growth in Mobile Money Services: Vodacom's mobile money platform experienced substantial growth, adding another layer to its revenue streams.

- Successful Expansion into New Markets: Strategic expansion into new geographic markets and service verticals further diversified revenue streams and contributed to overall growth.

These achievements underscore Vodacom's effective strategies in leveraging market opportunities and delivering innovative services to its expanding customer base. The keywords Vodacom revenue growth, ARPU increase, data revenue, and mobile money are key to understanding this significant uplift.

Profitability and Efficiency Improvements

The improved revenue performance translated into enhanced profitability. Vodacom saw a substantial increase in its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and net income. This improved profitability isn't solely due to increased revenue; it also reflects Vodacom's commitment to operational efficiency. Cost-cutting measures and streamlined processes have played a vital role in maximizing profit margins. Keywords such as Vodacom profitability, EBITDA margin, net income growth, and operational efficiency highlight this crucial aspect of the financial report.

Market Share and Competitive Landscape

Vodacom maintains a strong market-leading position in the competitive South African telecoms market. The company's strategic initiatives, including investments in network infrastructure, innovative service offerings, and targeted marketing campaigns, have enabled it to successfully navigate the competitive landscape and maintain its market share. Vodacom's ability to adapt to changing consumer demands and technological advancements has been crucial in sustaining its market leadership. The competitive landscape continues to be a dynamic environment, but Vodacom's strategies seem to be yielding positive results. Understanding Vodacom's market share, its approach to competition, its place within the telecom market South Africa, and its pursuit of market leadership are key factors in analyzing its success.

Increased Dividend Payout for Vodacom (VOD) Shareholders

Reflecting its robust financial performance, Vodacom has announced a significant increase in its dividend payout to shareholders.

Details of the Dividend Announcement

The increased dividend amounts to Z Rand per share, payable on [Payment Date] to shareholders on record as of [Record Date]. This substantial increase is a testament to Vodacom's strong financial position and its commitment to returning value to its shareholders. The decision to boost the dividend is underpinned by the company's consistently strong financial performance and its established shareholder return policy.

Keywords such as Vodacom dividend, dividend yield, shareholder return, and dividend announcement date are critical for investors seeking timely information.

Implications for Investors

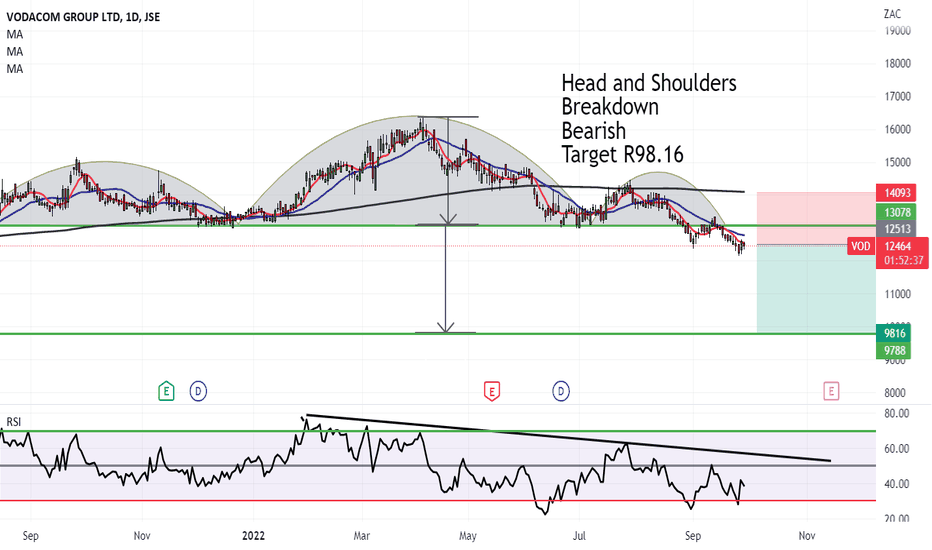

The enhanced dividend payout significantly improves the return on investment for Vodacom shareholders. This, coupled with the company's positive growth trajectory, strengthens Vodacom's appeal as an attractive investment opportunity. The increased dividend income adds to the potential capital appreciation of VOD stock, making it a potentially compelling addition to diversified investment portfolios. Monitoring the VOD stock price, understanding the investment opportunities, assessing the dividend income, and tracking the overall stock performance are all important for potential and current investors.

Conclusion: Vodacom (VOD) – A Strong Showing and Increased Returns

Vodacom's (VOD) latest financial results paint a picture of strong growth, improved profitability, and a commitment to rewarding its shareholders. The increased dividend payout underscores the company's confidence in its future prospects and its dedication to delivering value to its investors. This strong performance, coupled with the attractive dividend yield, makes Vodacom (VOD) a compelling investment opportunity in the South African telecoms sector. Learn more about investing in Vodacom (VOD) and its attractive dividend payouts. Vodacom's (VOD) improved earnings and increased dividend payout signal a strong financial performance and a promising outlook for the company and its shareholders.

Featured Posts

-

Why Buy This Ai Quantum Computing Stock On The Dip

May 20, 2025

Why Buy This Ai Quantum Computing Stock On The Dip

May 20, 2025 -

Actualizacion Sobre La Salud De Michael Schumacher Una Noticia Que Conmociono Al Mundo

May 20, 2025

Actualizacion Sobre La Salud De Michael Schumacher Una Noticia Que Conmociono Al Mundo

May 20, 2025 -

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025

Todays Nyt Mini Crossword Solutions March 31

May 20, 2025 -

Pro D2 Huit Equipes En 8 Points Analyse Du Calendrier Et Des Chances De Maintien

May 20, 2025

Pro D2 Huit Equipes En 8 Points Analyse Du Calendrier Et Des Chances De Maintien

May 20, 2025 -

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025