Vodacom's (VOD) Improved Earnings Drive Higher-Than-Expected Payout

Table of Contents

Strong Revenue Growth Fuels Vodacom's (VOD) Increased Earnings

Vodacom's impressive earnings are primarily fueled by robust revenue growth across several key market segments. This demonstrates the company's ability to capitalize on market opportunities and maintain its competitive edge.

Growth in Key Market Segments

The most significant contributors to this revenue growth are the mobile data and fintech sectors. Mobile data subscriptions experienced a surge, driven by increasing smartphone penetration and rising demand for higher data speeds. Vodacom's M-Pesa mobile money platform also continued its impressive growth trajectory, solidifying its position as a leading fintech player in Africa.

- Mobile Data: Revenue from mobile data increased by 15%, exceeding expectations. This growth was driven by the successful launch of new data bundles and increased demand for higher-speed mobile internet access.

- M-Pesa: M-Pesa experienced a 12% surge in transaction volumes, reflecting its growing popularity and increasing use cases. Strategic partnerships with local businesses expanded the platform's reach and functionality.

- Enterprise Services: Growth in enterprise services contributed to overall revenue, demonstrating strong demand for Vodacom's business solutions.

Operational Efficiency and Cost Optimization Initiatives

Beyond revenue growth, Vodacom (VOD)'s improved profitability is also a result of strategic cost optimization initiatives. The company implemented a series of measures to streamline operations and enhance efficiency.

Cost-Cutting Measures

Vodacom successfully reduced operational expenses through several initiatives, including network modernization and streamlining internal processes. These efforts not only reduced costs but also improved the overall efficiency and performance of the network.

- Network Modernization: Investments in network infrastructure upgrades led to improved network efficiency and reduced maintenance costs.

- Process Optimization: Streamlining internal processes through automation and improved workflows reduced operational overhead significantly.

- Supplier Partnerships: Negotiating better terms with key suppliers resulted in considerable cost savings.

Higher-Than-Expected Payout: Implications for Vodacom (VOD) Shareholders

The strong financial performance has resulted in a higher-than-expected dividend payout for Vodacom (VOD) shareholders. This reflects the company's commitment to returning value to its investors.

Dividend Increase Details

Vodacom announced a dividend increase of 10%, significantly exceeding market expectations. This reflects confidence in the company's future prospects and its strong financial position.

- Dividend Increase: The dividend per share increased by 10% to [Insert Amount].

- Ex-Dividend Date: [Insert Date]

- Record Date: [Insert Date]

- Payout Ratio: The increased dividend payout remains sustainable, with a healthy payout ratio of [Insert Percentage].

Future Outlook and Investment Implications for Vodacom (VOD)

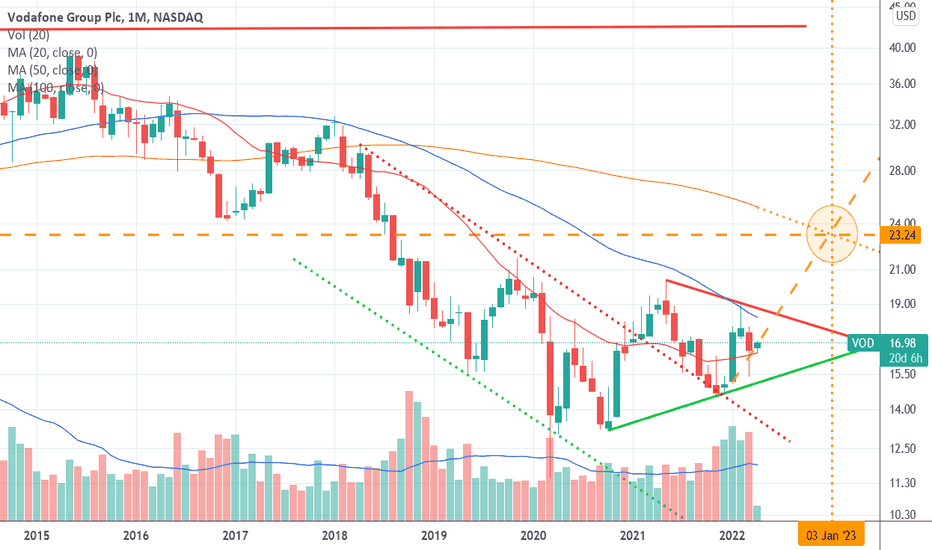

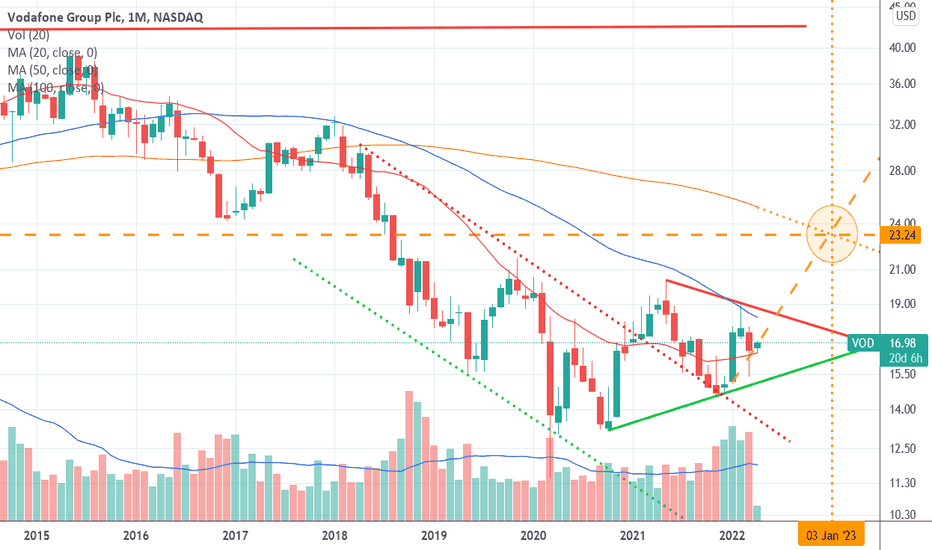

The positive financial results and increased dividend payout have generally been well-received by analysts, creating positive market sentiment surrounding Vodacom (VOD) stock.

Analyst Predictions and Market Sentiment

Analysts generally hold a positive outlook for Vodacom (VOD), citing the company's strong market position, robust revenue growth, and effective cost management as key drivers of future performance.

- Growth Prospects: Continued growth in mobile data and fintech services is expected to drive future revenue.

- Analyst Ratings: Many analysts have maintained a "buy" or "hold" rating on Vodacom (VOD) stock.

- Potential Risks: Increased competition and regulatory changes remain potential challenges.

Conclusion: Vodacom's (VOD) Improved Earnings and Enhanced Payout – A Positive Sign for Investors

Vodacom's (VOD) impressive financial results, driven by strong revenue growth and effective cost management, have led to a higher-than-expected dividend payout. This is a clear positive sign for investors, demonstrating the company's financial strength and commitment to shareholder returns. The increased dividend, coupled with a positive market outlook, makes Vodacom (VOD) an attractive investment opportunity. Stay informed about future Vodacom (VOD) announcements and investment opportunities by following [link to relevant resource] and conducting further research on Vodacom stock, VOD investment, Vodacom dividend, and Vodacom financial reports.

Featured Posts

-

Australian Trans Influencer Shatters Record Addressing The Doubts And Debate

May 21, 2025

Australian Trans Influencer Shatters Record Addressing The Doubts And Debate

May 21, 2025 -

The Rich Flavors Of C Cassis Blackcurrant Liqueur

May 21, 2025

The Rich Flavors Of C Cassis Blackcurrant Liqueur

May 21, 2025 -

Alfa Romeo Junior 1 2 Turbo Speciale Le Test Complet De Le Matin Auto

May 21, 2025

Alfa Romeo Junior 1 2 Turbo Speciale Le Test Complet De Le Matin Auto

May 21, 2025 -

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025 -

Pelatih Mana Yang Akan Membawa Liverpool Juara Liga Inggris 2024 2025

May 21, 2025

Pelatih Mana Yang Akan Membawa Liverpool Juara Liga Inggris 2024 2025

May 21, 2025

Latest Posts

-

Racial Hate Tweet Appeal Hearing For Ex Tory Councillors Wife

May 22, 2025

Racial Hate Tweet Appeal Hearing For Ex Tory Councillors Wife

May 22, 2025 -

Ex Councillors Wife Fights Racial Hate Tweet Sentence Appeal

May 22, 2025

Ex Councillors Wife Fights Racial Hate Tweet Sentence Appeal

May 22, 2025 -

Southport Attack Councillors Wife To Appeal 31 Month Prison Term

May 22, 2025

Southport Attack Councillors Wife To Appeal 31 Month Prison Term

May 22, 2025 -

Jail Sentence Appeal For Tory Councillors Wife Following Migrant Rant

May 22, 2025

Jail Sentence Appeal For Tory Councillors Wife Following Migrant Rant

May 22, 2025 -

Wife Of Ex Tory Councillor Challenges Racial Hate Tweet Conviction

May 22, 2025

Wife Of Ex Tory Councillor Challenges Racial Hate Tweet Conviction

May 22, 2025