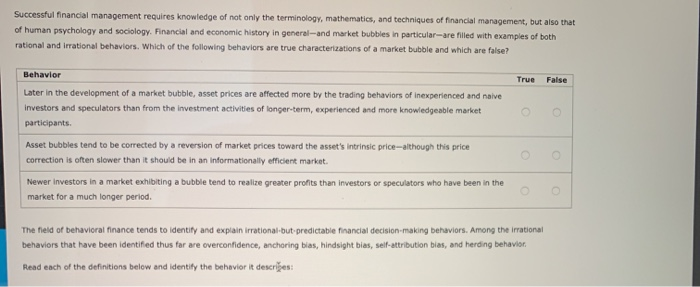

Wall Street's Strong Return: Implications For Bear Market Investors

Table of Contents

Understanding the Wall Street Rebound

Analyzing the Drivers of Growth

Wall Street's robust recovery is multifaceted, driven by a confluence of positive economic indicators and strategic shifts. Several key factors have contributed to this market resurgence:

- Improved Economic Data: Recent economic data, including [cite specific examples, e.g., lower-than-expected inflation figures, positive job growth reports], has boosted investor confidence and fueled market optimism. This positive economic sentiment is crucial for market recovery.

- Strong Corporate Earnings Reports: Many companies have reported better-than-expected earnings, demonstrating resilience and growth despite previous economic headwinds. These positive earnings reports signal a healthier corporate sector and bolster investor sentiment.

- Federal Reserve Policy Shifts: The Federal Reserve's adjustments to monetary policy, including [explain specific policy changes, e.g., interest rate hikes or pauses], have played a significant role in shaping market conditions and influencing investor behavior. These policy shifts impact market volatility and investment strategies.

- Technological Advancements: Continued advancements in technology, particularly in areas like artificial intelligence and renewable energy, have driven significant investment and growth in specific sectors, further contributing to the overall market recovery. This technological innovation is reshaping investment opportunities.

These factors have collectively contributed to a significant shift in investor sentiment, leading to increased investment activity and pushing market indices upward. The market recovery is not uniform, however, with specific sectors leading the charge.

Identifying Key Market Sectors Leading the Recovery

Certain market sectors have demonstrated disproportionate growth during this rebound. The technology sector, particularly companies focused on artificial intelligence and cloud computing, has seen significant gains. The energy sector has also experienced substantial growth, driven by [explain specific factors, e.g., increased energy demand, geopolitical instability]. Finally, the financial sector, reflecting improved economic conditions and increased financial activity, has also shown significant strength. Understanding sector performance is key to developing effective investment strategies. The strength of these sectors reflects broader stock market trends and presents unique investment opportunities.

Implications for Bear Market Investors

Assessing Portfolio Performance

For investors who endured the bear market, assessing portfolio performance in light of Wall Street's strong return is crucial. Investors should meticulously review their portfolios, calculating both gains and losses. This process enables a clear understanding of the impact of the bear market and subsequent recovery on their overall investment strategies. Analyzing portfolio performance is a vital part of effective portfolio management and risk assessment.

Rebalancing Strategies and Adjustments

The significant market shift necessitates portfolio rebalancing. Rebalancing involves adjusting your asset allocation to maintain your desired risk profile. This might involve selling some assets that have performed exceptionally well and reinvesting in those that have lagged. Examples of rebalancing strategies include shifting funds from equities to bonds or vice-versa, depending on your risk tolerance and investment goals. Portfolio rebalancing ensures effective asset allocation and implements diversification strategies.

Future Outlook and Investment Decisions

Predicting the future market is impossible, but analyzing current trends and potential scenarios is crucial for making informed investment decisions. Factors such as inflation, geopolitical events, and future Federal Reserve actions could influence market direction. Investors should carefully consider these factors while developing long-term investment plans and strategies. Effective investment planning necessitates careful consideration of market prediction and potential risks.

Risk Management in a Recovering Market

Recognizing Potential Risks

Even in a recovering market, risks persist. Market corrections are a possibility, and inflation could erode returns. Geopolitical instability also presents a significant risk. Investors need to be aware of these risks and develop strategies to mitigate them. Understanding investment risk and market volatility is paramount for effective risk management.

Diversification and Hedging Techniques

Diversification remains crucial in any market environment. A well-diversified portfolio across different asset classes reduces exposure to any single risk factor. Hedging techniques, such as using options or futures contracts, can further mitigate potential losses. Portfolio diversification and effective hedging strategies are essential for risk mitigation.

Conclusion: Navigating Wall Street's Strong Return

Wall Street's strong return presents both opportunities and challenges for investors. This rebound, driven by improved economic data, strong corporate earnings, and policy shifts, has significantly altered the market landscape. Key takeaways for bear market investors include the importance of carefully assessing portfolio performance, proactively rebalancing portfolios to maintain your risk profile, and developing a robust investment strategy that addresses potential future risks. Understanding Wall Street's strong return is crucial for navigating your investment portfolio effectively. Take control of your financial future by developing a robust investment strategy today. By staying informed and adapting your strategies, you can effectively navigate Wall Street's ever-changing landscape.

Featured Posts

-

Military Academies Under Pentagon Scrutiny Book Review And Potential Removal

May 11, 2025

Military Academies Under Pentagon Scrutiny Book Review And Potential Removal

May 11, 2025 -

Whoops Broken Promise User Anger Mounts Over Denied Free Upgrades

May 11, 2025

Whoops Broken Promise User Anger Mounts Over Denied Free Upgrades

May 11, 2025 -

Mtvs Movie And Tv Awards Absence Confirmed For 2025

May 11, 2025

Mtvs Movie And Tv Awards Absence Confirmed For 2025

May 11, 2025 -

Celtics Path To Division Title A Blowout Win

May 11, 2025

Celtics Path To Division Title A Blowout Win

May 11, 2025 -

10 Photos Of Benny Blanco Amid Selena Gomez Cheating Rumors

May 11, 2025

10 Photos Of Benny Blanco Amid Selena Gomez Cheating Rumors

May 11, 2025