Walleye's Credit And Commodity Strategy: A Focus On Core Client Groups

Table of Contents

Understanding Our Core Client Groups

Client segmentation is fundamental to our success. We understand that a one-size-fits-all approach to credit and commodity strategies is ineffective. Therefore, we segment our clients based on industry, size, and risk profile, allowing us to develop highly specific and effective solutions. This client-centric approach allows us to provide tailored financial services that truly address the unique needs of each client group. Understanding the nuances of each sector allows for targeted financial solutions.

- Agricultural producers: We provide financing for planting, harvesting, and equipment purchases, along with risk management tools to mitigate commodity price fluctuations.

- Energy companies: Our services include financing for exploration, production, and distribution, alongside hedging strategies to manage volatile energy prices.

- Manufacturing businesses: We offer working capital loans and term loans to support operations, expansion, and supply chain management.

- Small and medium-sized enterprises (SMEs): We provide accessible credit lines and tailored financial guidance to help these businesses grow and thrive.

- Large corporations: We develop sophisticated, large-scale financial solutions encompassing complex credit facilities and commodity risk management strategies.

Understanding the unique financial challenges and opportunities faced by each group is paramount. We dedicate specialized teams with industry-specific expertise to serve these clients effectively, ensuring a deep understanding of their individual needs.

Tailored Credit Solutions

We offer a diverse range of credit products designed to meet the specific financial needs of each client group. Our rigorous credit risk assessment process ensures responsible lending practices while providing efficient and accessible financing options. This commitment to responsible lending is integral to our long-term relationships with clients.

- Working capital loans: Support day-to-day operations and cash flow management.

- Term loans: Provide financing for long-term investments and expansion projects.

- Lines of credit: Offer flexible access to funds as needed.

- Equipment financing: Facilitate the acquisition of essential machinery and equipment.

- Supply chain financing: Optimize cash flow throughout the supply chain.

Our sophisticated credit scoring models, combined with personalized client interactions, allow us to provide the appropriate financing options quickly and efficiently. We strive to make the credit application and approval process as seamless as possible.

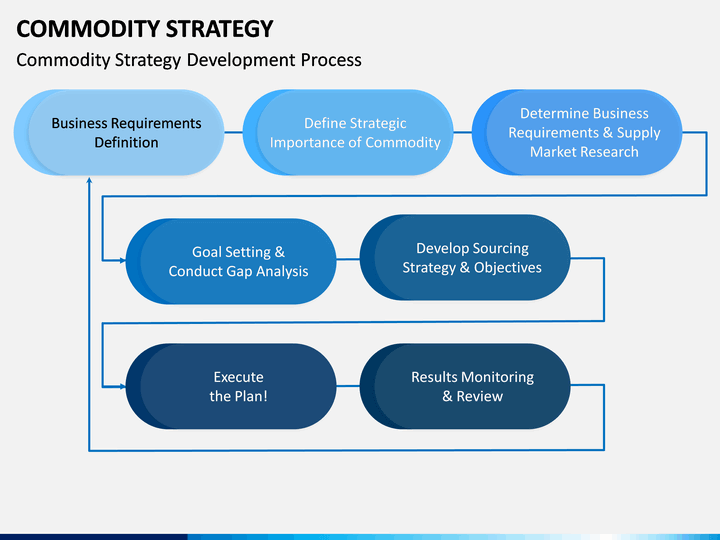

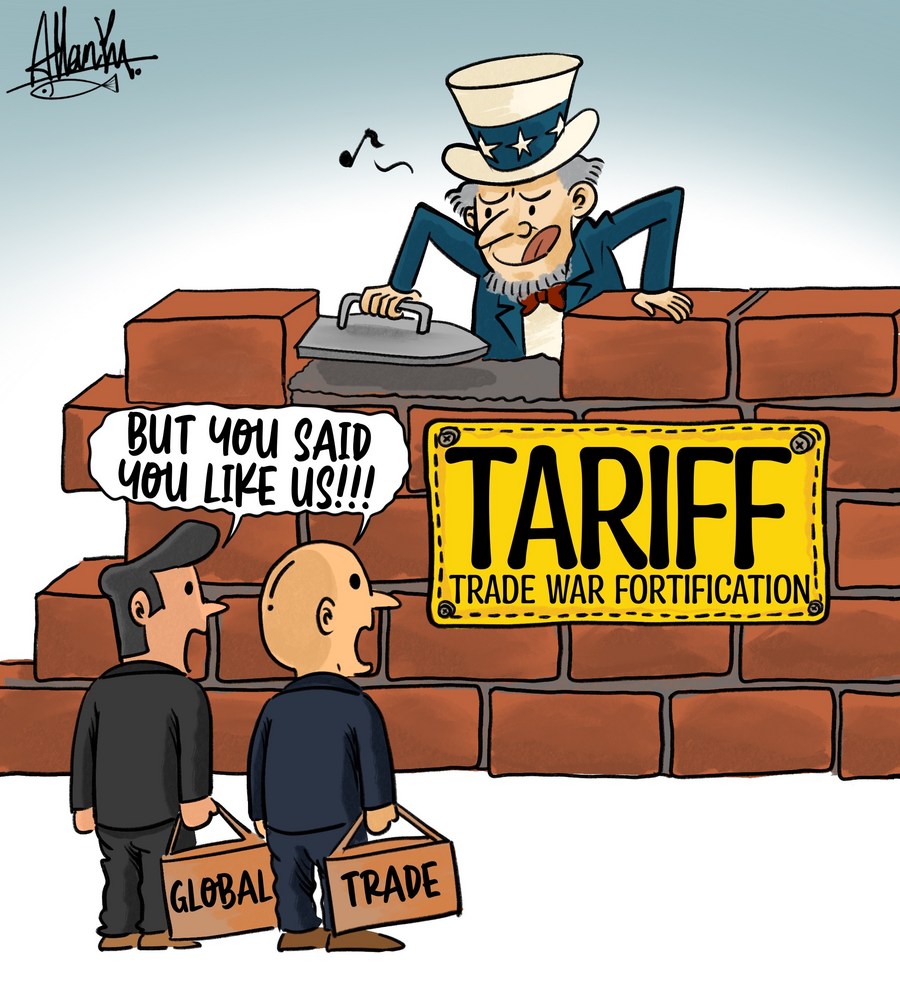

Strategic Commodity Management

For clients heavily involved in commodity markets, we offer comprehensive risk management strategies designed to protect profitability and optimize supply chain efficiency. This involves understanding commodity price risk and utilizing effective hedging techniques. Our approach to commodity management is proactive and tailored to the specific commodities and market conditions our clients face.

- Price risk management tools: We utilize sophisticated tools and models to forecast and manage price volatility.

- Hedging strategies (futures, options, swaps): We employ a variety of hedging strategies to mitigate price risk and protect against losses.

- Commodity price forecasting: Our experts provide insightful analysis to help clients make informed decisions.

- Supply chain analysis: We help clients optimize their supply chain to improve efficiency and reduce costs.

Our experienced commodity specialists work closely with clients to develop tailored hedging strategies that protect their profitability in fluctuating markets. We believe in transparency and clear communication throughout the process.

Technology and Innovation in Credit and Commodity Management

Walleye leverages cutting-edge technology to enhance both credit and commodity management processes, leading to improved efficiency and a better client experience. Our commitment to technological innovation allows us to offer more streamlined and effective solutions.

- Advanced data analytics for risk assessment: We use data-driven insights to make informed lending decisions and manage risk more effectively.

- Algorithmic trading platforms for optimized execution: We leverage technology to execute trades efficiently and at optimal prices.

- Secure online client portal for convenient access to information and services: Our online platform provides clients with 24/7 access to their accounts and financial information.

Conclusion

Walleye's commitment to a robust credit and commodity strategy, finely tuned to the unique needs of our core client groups, sets us apart. By combining industry expertise, advanced technology, and a client-centric approach, we deliver superior financial services and build lasting partnerships. To learn more about how Walleye's credit and commodity strategy can benefit your business, contact us today to discuss your specific needs and discover how we can help you achieve your financial goals. Let Walleye be your trusted partner in navigating the complexities of credit and commodity markets.

Featured Posts

-

Tennisistki Kostyuk I Kasatkina Chto Proizoshlo Posle Smeny Grazhdanstva

May 13, 2025

Tennisistki Kostyuk I Kasatkina Chto Proizoshlo Posle Smeny Grazhdanstva

May 13, 2025 -

Meet The Men Who Inspired F Scott Fitzgeralds The Great Gatsby

May 13, 2025

Meet The Men Who Inspired F Scott Fitzgeralds The Great Gatsby

May 13, 2025 -

Blow Your Mind Unforgettable Adventures And Thrilling Activities

May 13, 2025

Blow Your Mind Unforgettable Adventures And Thrilling Activities

May 13, 2025 -

The Tech Industry And Tariffs Abi Researchs Analysis Of The Trump Administrations Trade Policies

May 13, 2025

The Tech Industry And Tariffs Abi Researchs Analysis Of The Trump Administrations Trade Policies

May 13, 2025 -

How To Make Spring Break Better For Kids Fun Activities And Tips

May 13, 2025

How To Make Spring Break Better For Kids Fun Activities And Tips

May 13, 2025