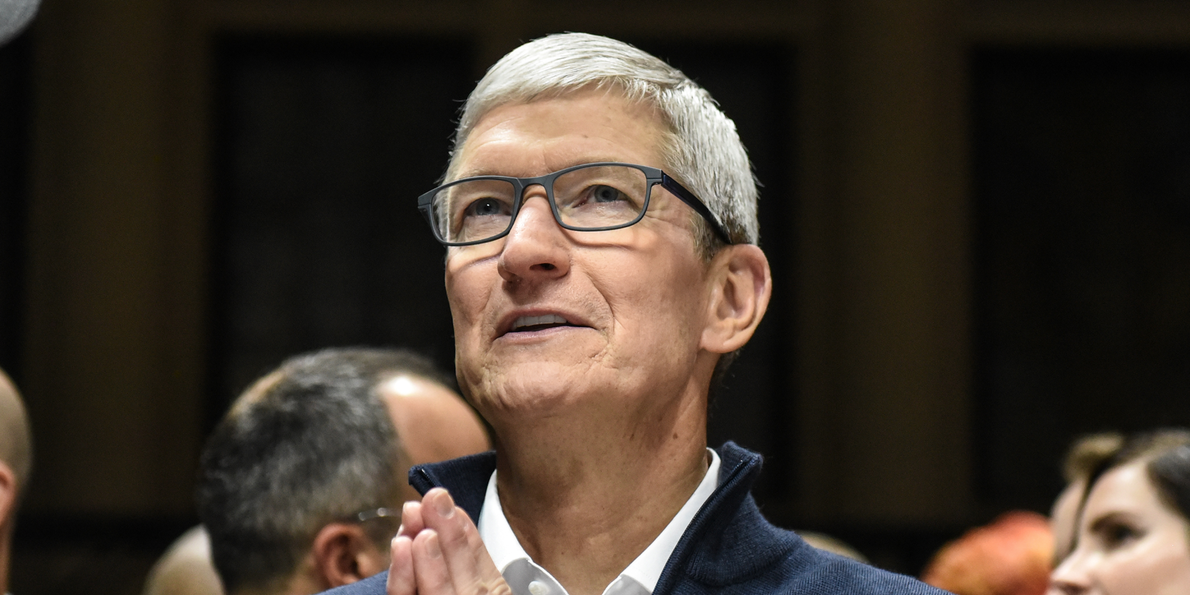

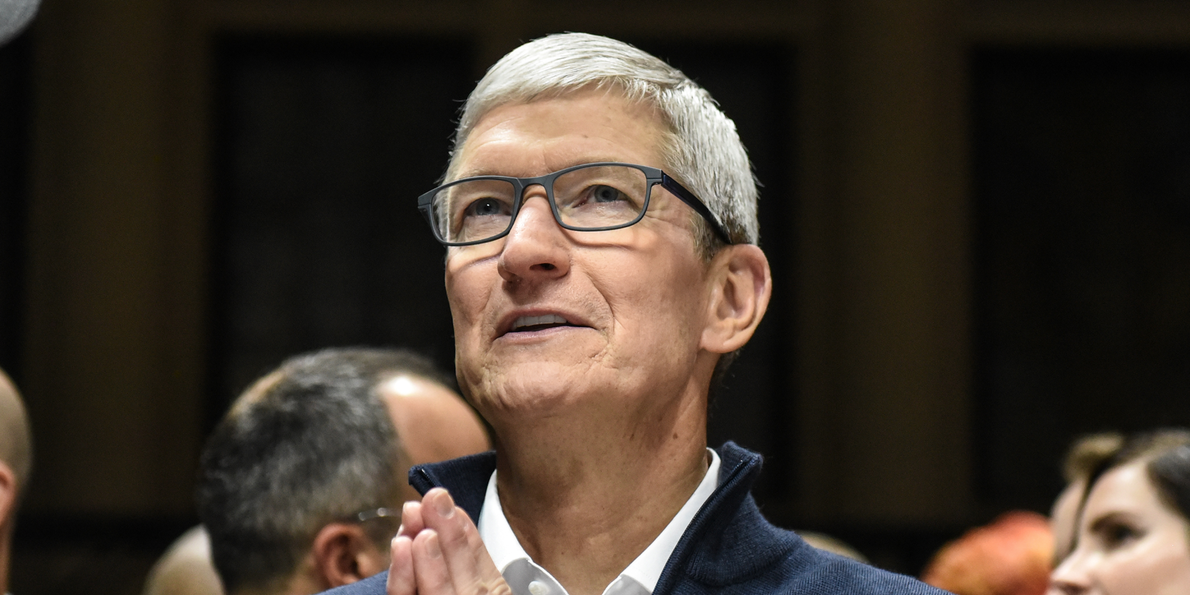

Wedbush's Apple Outlook: Bullish Despite Price Target Reduction

Table of Contents

Wedbush's Rationale Behind the Reduced Price Target

Wedbush's decision to lower its price target isn't a reflection of diminished faith in Apple's long-term potential. Instead, it's a nuanced assessment of several factors impacting the company's near-term performance.

Impact of Macroeconomic Factors

Global economic headwinds are undeniably impacting various sectors, and Apple is not immune. The current macroeconomic environment presents significant challenges.

- Inflation and Interest Rate Hikes: Rising inflation and subsequent interest rate hikes are dampening consumer spending, potentially affecting discretionary purchases like iPhones and other Apple products. This reduced consumer confidence directly impacts sales projections.

- Global Recessionary Fears: Concerns about a potential global recession are also contributing to a more cautious outlook. Uncertainty surrounding future economic growth naturally leads to more conservative financial forecasts.

- Weakening Consumer Demand: A combination of inflation, interest rate increases and recessionary fears are leading to a weakening consumer demand for electronics in general, impacting Apple's projected sales growth.

Supply Chain Challenges and Their Mitigation

Persistent supply chain disruptions continue to pose a hurdle for Apple's production and delivery timelines. However, Wedbush acknowledges Apple's proactive efforts to mitigate these issues.

- Component Shortages: The ongoing semiconductor shortage and difficulties in sourcing other crucial components are still impacting production capacity.

- Geopolitical Instability: Global political instability and trade tensions further complicate the already complex supply chain landscape.

- Apple's Mitigation Strategies: Apple has invested heavily in diversifying its supply chain and developing strategic partnerships to navigate these challenges. Wedbush believes these strategies are proving effective, albeit gradually.

Competition and Market Saturation

The smartphone market is increasingly competitive, with strong players vying for market share. Wedbush acknowledges the competitive pressure Apple faces.

- Android Competitors: Android-based smartphones from companies like Samsung and Google continue to pose a significant challenge to Apple's dominance.

- Market Saturation in Developed Markets: In mature markets, the rate of smartphone upgrades is slowing, leading to potential market saturation.

- Apple's Innovation and Brand Loyalty: Despite the competitive landscape, Wedbush highlights Apple's ability to maintain a strong brand image and to innovate with new products and services. This is vital for sustaining growth.

Maintaining a Bullish Stance on Apple Stock

Despite the price target reduction, Wedbush remains bullish on Apple's long-term prospects, highlighting several key factors.

Long-Term Growth Potential

Wedbush's optimism stems from Apple's robust long-term growth drivers.

- Services Revenue Growth: Apple's services segment, encompassing the App Store, iCloud, Apple Music, and other subscription services, is experiencing significant growth and is expected to continue doing so.

- New Product Launches: Innovation continues to be a core strength, with anticipated launches of new products and services expected to drive future revenue.

- International Expansion: Further expansion into emerging markets presents significant opportunities for growth.

Strengths of Apple's Ecosystem

Apple's integrated ecosystem is a major source of its strength and resilience.

- App Store Revenue: The App Store generates substantial revenue and reinforces the value of the Apple ecosystem.

- Hardware-Software Integration: The seamless integration of hardware and software enhances user experience and fosters brand loyalty.

- Brand Loyalty and High Switching Costs: Apple users often demonstrate strong brand loyalty, creating high switching costs that benefit Apple in the long run.

Valuation and Investment Recommendations

Wedbush's revised price target reflects a careful reassessment of current market conditions and near-term challenges.

- Discounted Cash Flow Model: Wedbush likely employs a discounted cash flow model (DCF) to value Apple, considering factors like future revenue growth, profitability, and the risk-free rate of return.

- Revised Price Target Justification: The reduction in the price target is primarily attributed to macroeconomic headwinds and near-term uncertainties.

- Investment Recommendation: Despite the price target reduction, Wedbush likely maintains a "buy" or "outperform" rating, reflecting long-term confidence in Apple's growth trajectory.

Conclusion

The Wedbush Apple Outlook, while incorporating a reduced price target, remains fundamentally bullish. The firm recognizes near-term headwinds from macroeconomic factors and supply chain complexities. However, Apple's strong brand, robust ecosystem, and long-term growth potential remain compelling reasons for a positive outlook. Understanding the nuanced details of this Wedbush Apple Outlook allows for a more informed investment decision. Stay updated on the latest developments in the Wedbush Apple Outlook by [link to relevant resource/report]. Further research into the Wedbush Apple outlook and independent analysis are crucial for making informed investment choices.

Featured Posts

-

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025

Analysis Brbs Banco Master Purchase And Its Implications For Brazilian Banking

May 25, 2025 -

The Doomed Destiny Of Eldorado A Bbc Soaps Pre Production Collapse

May 25, 2025

The Doomed Destiny Of Eldorado A Bbc Soaps Pre Production Collapse

May 25, 2025 -

They Came From Afar Found Love In Dc Then Tragedy Struck

May 25, 2025

They Came From Afar Found Love In Dc Then Tragedy Struck

May 25, 2025 -

Bundesliga Saison Der Hsv Und Der Kampf Um Den Aufstieg

May 25, 2025

Bundesliga Saison Der Hsv Und Der Kampf Um Den Aufstieg

May 25, 2025 -

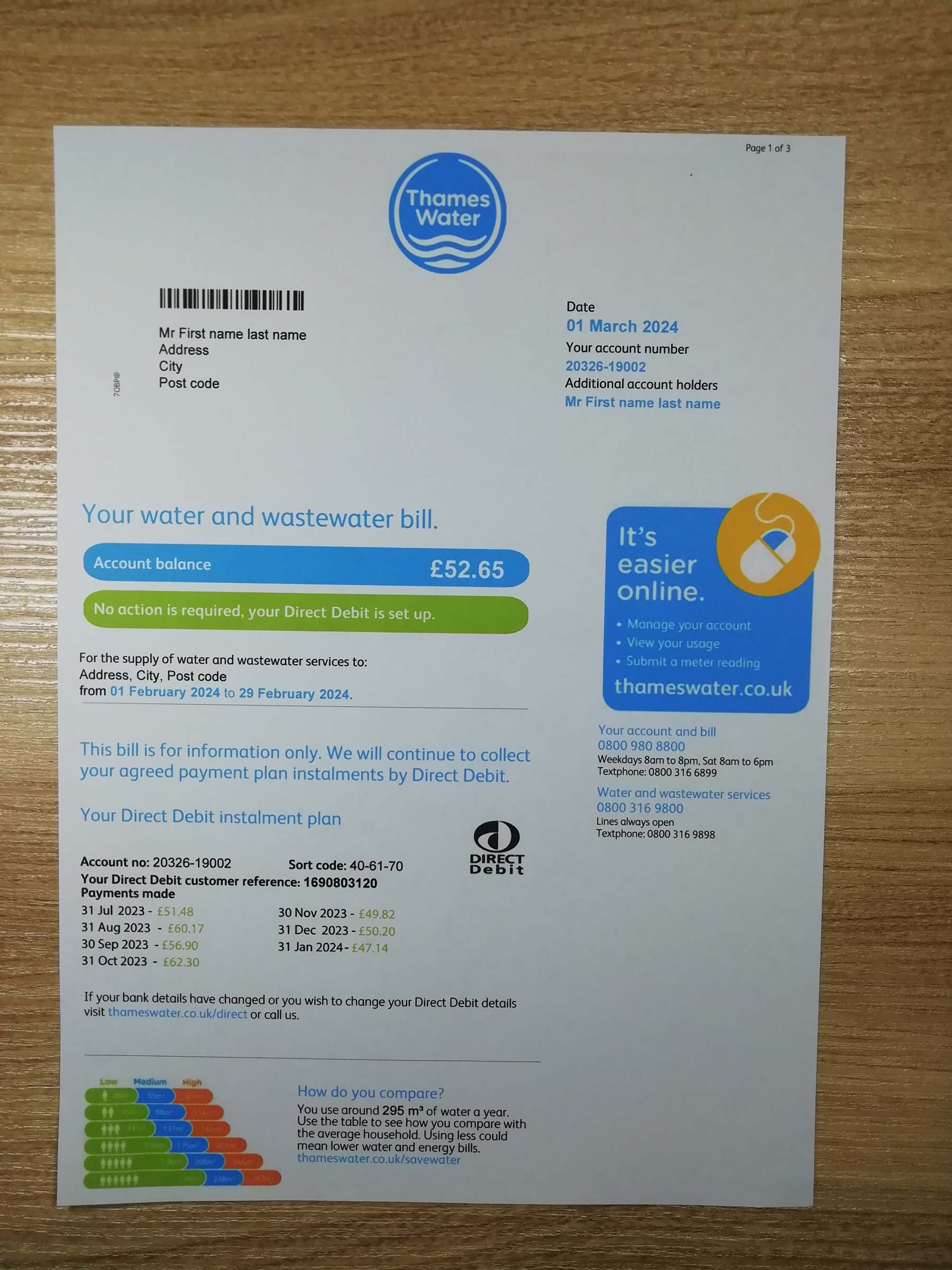

Thames Water Executive Pay And Performance Reviewed

May 25, 2025

Thames Water Executive Pay And Performance Reviewed

May 25, 2025