Weihong Liu: Unveiling The Details Of His Hudson's Bay Leases Purchase

Table of Contents

The Scale and Scope of the Weihong Liu Hudson's Bay Lease Acquisition

The Weihong Liu Hudson's Bay lease acquisition represents a substantial investment in Canadian retail real estate. While precise details haven't been publicly disclosed in their entirety, reports suggest the purchase encompasses a considerable number of leases across multiple locations. This strategic move significantly expands Liu's already impressive property portfolio.

- Total number of leases purchased: The exact number remains unconfirmed, but industry sources suggest a figure in the hundreds, representing a significant portion of Hudson's Bay's leasehold portfolio.

- Key locations of acquired properties: Acquired properties are reportedly spread across major Canadian cities, including Toronto, Vancouver, Calgary, and Montreal, encompassing a diverse range of retail environments and demographics. The geographical diversification reduces risk and offers opportunities for varied development strategies.

- Estimated total investment cost: The estimated total value of the deal is substantial, placing it among the largest retail property acquisitions in recent Canadian history. Specific figures are yet to be confirmed by involved parties but media reports suggest a multi-billion dollar transaction.

- Types of retail properties involved: The acquired leases include a mix of properties, encompassing both large department store spaces and smaller retail units within Hudson's Bay complexes. This variety provides flexibility in future development and leasing strategies.

- Sources for the information: Information for this analysis comes from reputable sources including [cite relevant news articles, financial reports, or press releases here].

Weihong Liu's Business Background and Investment Strategy

Weihong Liu is a prominent figure in Canadian business, known for his shrewd investments across various sectors. His approach to real estate investments has been characterized by a focus on long-term value appreciation and strategic property acquisitions.

- Summary of Liu's business interests: Liu's business empire extends beyond real estate. He has significant holdings and investments in other areas, providing diverse revenue streams and enhancing his capacity for major real estate acquisitions.

- History of significant real estate investments: His past investments show a pattern of acquiring undervalued properties or strategically located assets with potential for redevelopment or significant rental income generation.

- Liu's investment philosophy and risk tolerance: Liu's investment style suggests a measured approach to risk with a long-term horizon. The Hudson's Bay acquisition aligns with this established strategy of identifying undervalued assets and realizing long-term growth.

- Analysis of this Hudson's Bay acquisition within his broader investment strategy: This acquisition marks a significant expansion into the Canadian retail real estate sector and represents a substantial addition to his portfolio, solidifying his position as a key player in the market.

Implications for the Future of Hudson's Bay and the Canadian Retail Landscape

The sale of these leases significantly impacts Hudson's Bay's business model and long-term strategy, potentially leading to a shift towards a more asset-light approach. The effects will also resonate throughout the Canadian retail sector.

- How the lease sale affects Hudson's Bay's financial position: The sale likely provides Hudson's Bay with much-needed capital, allowing them to refocus resources on their core operations and potentially invest in other areas of their business.

- Potential future uses of the acquired properties by Weihong Liu: Liu's plans for these properties could range from redevelopment into mixed-use spaces to leasing to new tenants, capitalizing on evolving retail trends and urban development.

- Implications for the Canadian retail market and competition: The acquisition might reshape the competitive landscape, particularly for lease availability in major cities. It could also influence rent prices and development plans in these areas.

- Analysis of potential long-term effects on property values in affected areas: Redevelopment potential in these prime retail locations could lead to increased property values, benefiting surrounding businesses and the wider community.

Potential Redevelopment and Future Plans for the Acquired Properties

Given Weihong Liu's investment history and current market trends, several redevelopment scenarios are plausible for the acquired Hudson's Bay properties.

- Possible redevelopment scenarios: Conversion to mixed-use spaces (combining residential, retail, and commercial components) is a strong possibility, aligning with current urban planning trends. Refurbishment and modernization of existing retail spaces are also likely.

- Potential new tenants: The spaces could attract a variety of new tenants, including other retail brands, restaurants, entertainment venues, or even co-working spaces, catering to the evolving needs of urban consumers.

- Opportunities for property value increases through refurbishment or redevelopment: Strategic redevelopment can significantly increase the value of these properties over the long term, contributing to a strong return on Liu's investment.

Conclusion

The Weihong Liu acquisition of Hudson's Bay leases represents a significant shift in the Canadian real estate market. This deal showcases Liu's strategic investment approach and highlights the evolving landscape of retail property ownership. The long-term implications for both Hudson's Bay and the Canadian retail sector remain to be seen, but the acquisition undoubtedly marks a pivotal moment. To stay updated on the ongoing developments surrounding the Weihong Liu and Hudson's Bay lease purchase and other key real estate transactions, continue to follow our updates. Learn more about similar significant Weihong Liu real estate acquisitions and their impact on the market.

Featured Posts

-

Ekstremni Goreschini Prez 2024 G Poveche Ot Polovinata Ot Sveta E Zasegnato

May 30, 2025

Ekstremni Goreschini Prez 2024 G Poveche Ot Polovinata Ot Sveta E Zasegnato

May 30, 2025 -

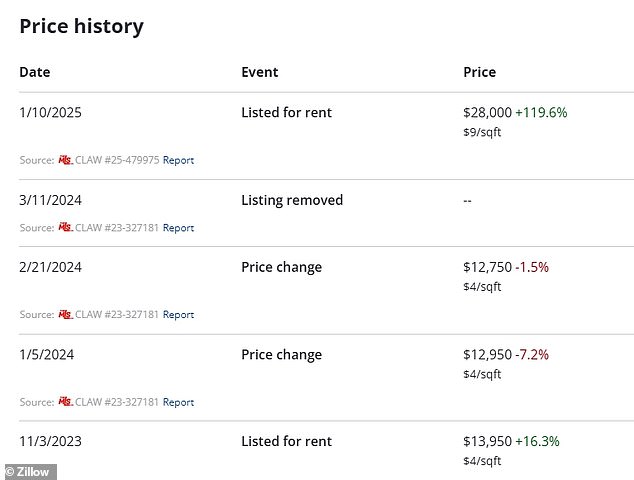

Increased Rent In La After Fires A Look At Price Gouging Claims

May 30, 2025

Increased Rent In La After Fires A Look At Price Gouging Claims

May 30, 2025 -

San Diego Inclement Weather Program Tonights Activation

May 30, 2025

San Diego Inclement Weather Program Tonights Activation

May 30, 2025 -

Noticias De Ticketmaster Incidente Del 8 De Abril Y Soluciones

May 30, 2025

Noticias De Ticketmaster Incidente Del 8 De Abril Y Soluciones

May 30, 2025 -

3 Olympia Theatre Olly Alexanders Electrifying Performance Photos

May 30, 2025

3 Olympia Theatre Olly Alexanders Electrifying Performance Photos

May 30, 2025