Where To Invest: A Data-Driven Map Of The Country's Top Business Hot Spots

Table of Contents

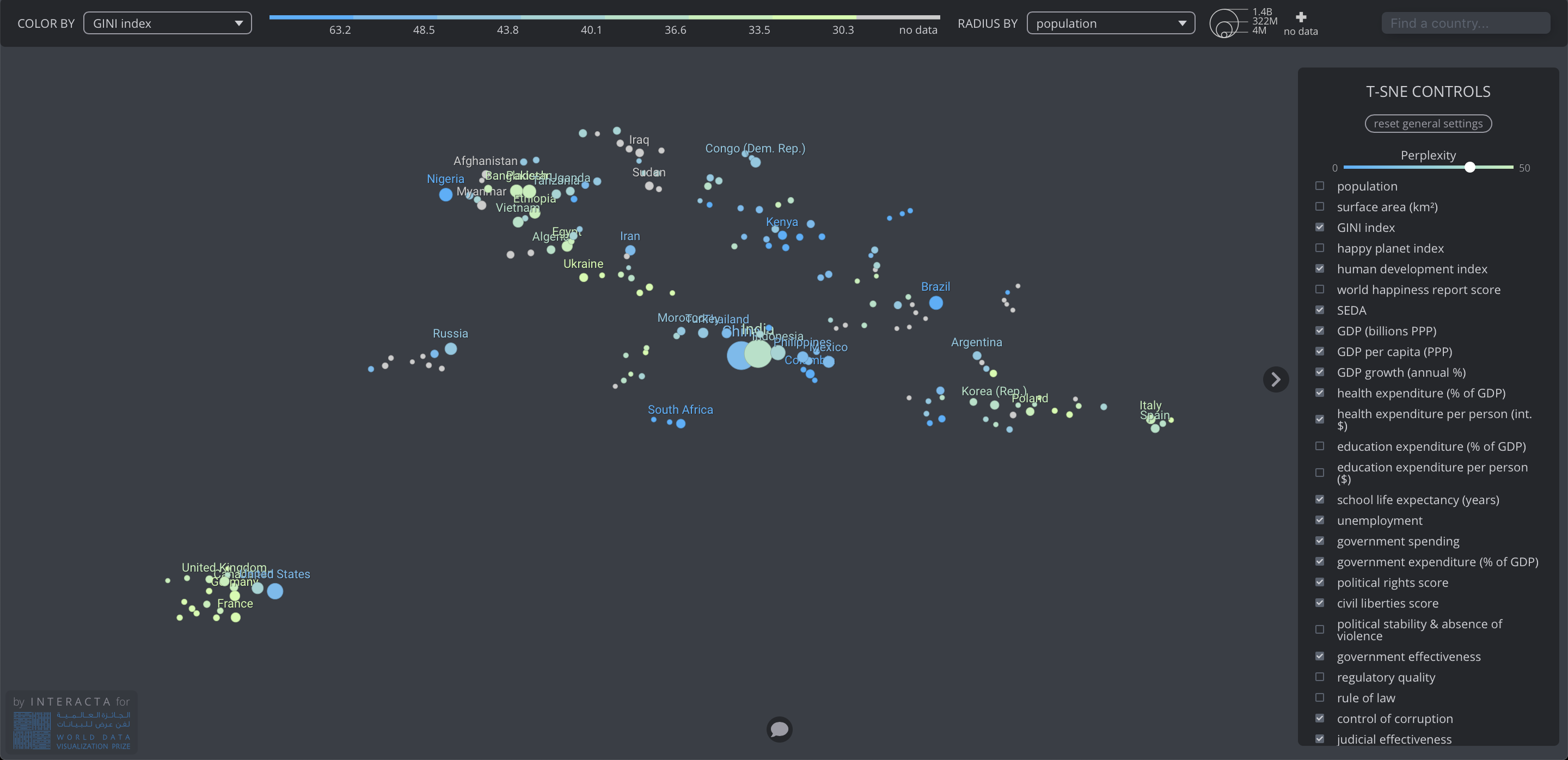

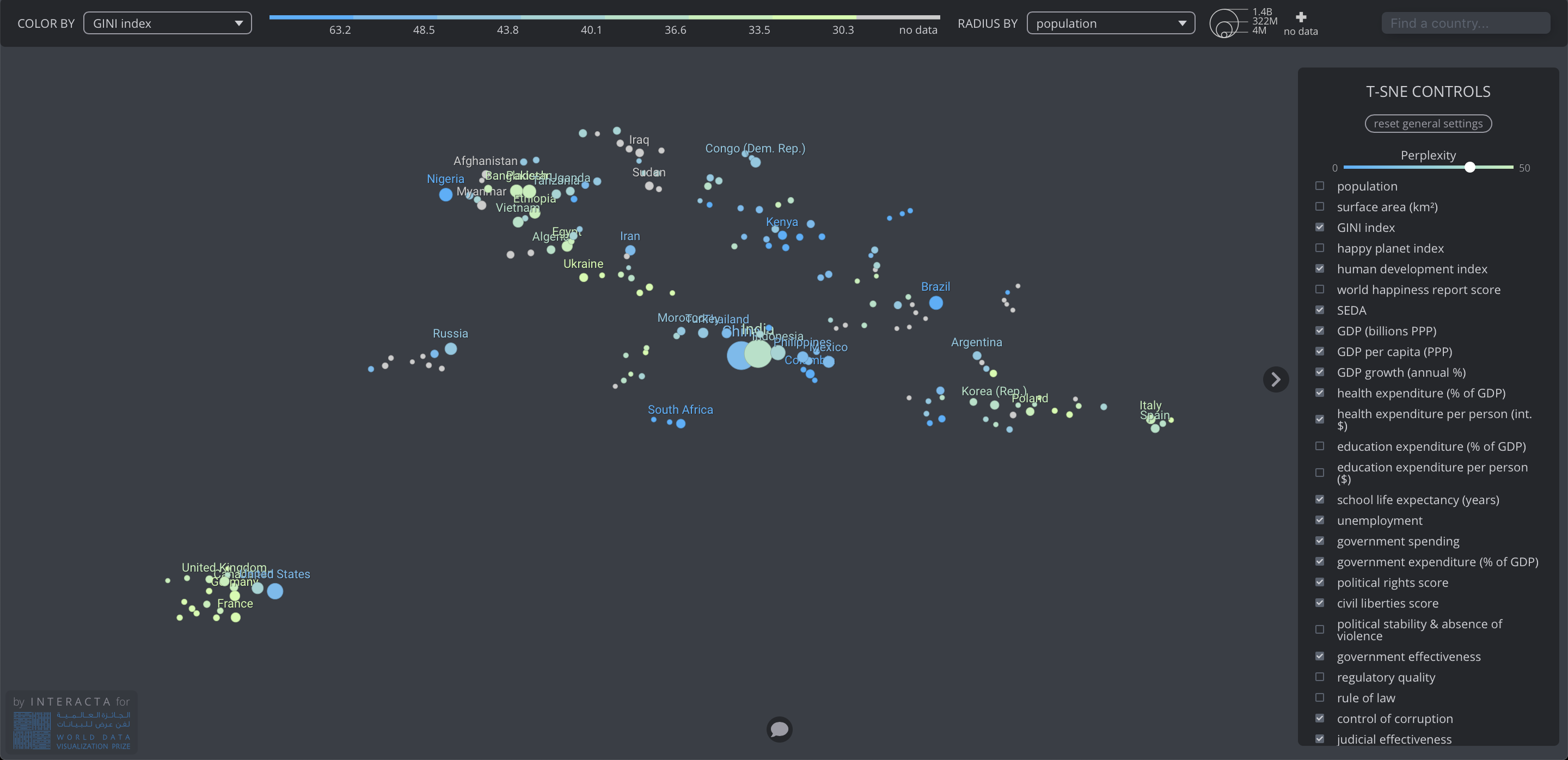

Analyzing Key Economic Indicators for Investment Decisions

Making smart investment decisions requires a thorough understanding of key economic indicators. These indicators provide valuable insights into the health and future prospects of different regions, helping you identify the best places to invest your money. Analyzing these metrics is crucial for mitigating risk and maximizing return on investment (ROI).

-

GDP Growth Rates: Examining GDP growth rates across different regions allows you to identify areas experiencing consistent, above-average growth. Regions with sustained high GDP growth generally offer more promising investment opportunities. Look for regions showing consistent growth over several years, signifying a stable and expanding economy.

-

Unemployment Rates: Low unemployment rates indicate a strong labor market, reducing the risk associated with finding and retaining skilled employees. A robust labor pool is essential for many businesses, making areas with low unemployment attractive investment locations.

-

Population Growth: Understanding population growth trends helps predict future demand and market potential. Areas with significant population growth often experience increased consumer spending and a greater need for goods and services. This translates into more potential customers and higher investment returns.

-

Consumer Spending: Assessing consumer spending patterns provides insights into the strength of local economies. High consumer spending suggests a thriving market with significant purchasing power, indicating a fertile ground for business investments.

-

Infrastructure Development: Robust infrastructure, including roads, transportation networks, and utilities, is essential for business operations. Significant infrastructure development projects signal future growth and can attract further investment. Look for areas investing in modernizing their infrastructure.

-

Tax Incentives and Government Support: Researching tax incentives and government support programs is crucial. Many regions offer tax breaks and other incentives to attract businesses, potentially significantly lowering investment costs and boosting profitability. These programs can make a significant difference in your overall ROI.

Geographic Breakdown of Top Business Hot Spots by Sector

The ideal location for your investment depends heavily on your industry sector. Different regions excel in various fields, making it crucial to identify the best fit for your business. Let's examine some top business hot spots by sector:

-

Tech Hubs: Areas like [Specific Tech Hub Location 1] and [Specific Tech Hub Location 2] are thriving tech hubs, boasting a skilled workforce, access to venture capital, and vibrant innovation clusters. These locations offer unparalleled opportunities for tech startups and established tech companies alike. Their strong concentration of talent and resources makes them ideal for tech-focused investments.

-

Manufacturing Centers: Regions with robust manufacturing industries, such as [Specific Manufacturing Center Location 1] and [Specific Manufacturing Center Location 2], benefit from access to raw materials, efficient transportation infrastructure, and a skilled workforce. These factors contribute to lower production costs and enhanced competitiveness.

-

Agricultural Regions: Prime agricultural regions, such as [Specific Agricultural Region 1] and [Specific Agricultural Region 2], offer fertile land, access to water resources, and favorable climates, creating opportunities in farming, food processing, and agribusiness. Consider the climate, soil conditions, and market access when assessing these areas.

-

Tourism Destinations: Popular tourism destinations like [Specific Tourism Destination 1] and [Specific Tourism Destination 2] attract high visitor numbers, supporting thriving hospitality and tourism-related businesses. Infrastructure, such as hotels and transportation networks, is also a key factor in the success of these areas.

-

Real Estate Markets: Analyzing real estate markets in different regions requires evaluating property values, rental yields, and future growth potential. Areas like [Specific Real Estate Market Location 1] and [Specific Real Estate Market Location 2] are experiencing strong growth and potentially offer high returns on real estate investments.

Case Studies: Success Stories from Top Investment Locations

Real-world examples illustrate the potential for success in specific locations.

-

Case Study 1: [Company A] in [Location A] leveraged the region's skilled workforce and access to venture capital to achieve a [quantifiable ROI] in just [timeframe]. Their success showcases the advantages of investing in a thriving tech hub.

-

Case Study 2: [Company B] in [Location B] benefitted from the region's strong manufacturing infrastructure and access to raw materials, resulting in [quantifiable ROI] and demonstrating the potential of investments in established manufacturing centers.

-

Case Study 3: [Company C] in [Location C] capitalized on the growing tourism sector, achieving a [quantifiable ROI] through strategic location and excellent infrastructure. This highlights the potential of investing in booming tourism destinations.

Mitigating Risks and Choosing the Right Investment Strategy

Even the most promising investment locations carry inherent risks. Thorough due diligence and a well-defined investment strategy are crucial for mitigating these risks.

-

Due Diligence: Before committing to any investment, conduct thorough due diligence. This includes detailed market research, analyzing financial statements, and evaluating management teams.

-

Risk Mitigation Strategies: Diversification, spreading investments across multiple sectors and locations, reduces risk. Financial planning, including contingency plans, is essential for managing potential losses.

-

Market Research: Conduct comprehensive market research to understand the competitive landscape, identify potential opportunities, and assess potential risks.

-

Risk Assessment: Evaluate potential risks, such as economic downturns, political instability, and natural disasters, and develop strategies to mitigate their impact.

Conclusion

Determining where to invest requires a thorough understanding of the economic landscape. This data-driven analysis has highlighted key indicators and geographic areas with significant potential. By analyzing economic indicators, understanding industry sectors, and mitigating risk, investors can make informed decisions to maximize returns and contribute to the growth of the country's economy. Start your journey to finding the best investment opportunities today – explore the data and discover your ideal business hot spot! Use this guide to confidently identify where to invest your capital for optimal growth. Finding the best places to invest is a crucial step towards achieving financial success.

Featured Posts

-

Tate Mc Raes Musical Choice Examining The Political Fallout From The Wallen Collaboration

May 29, 2025

Tate Mc Raes Musical Choice Examining The Political Fallout From The Wallen Collaboration

May 29, 2025 -

Oregon Ags Legal Win Against Live Nation Portland Venue Plans In Jeopardy

May 29, 2025

Oregon Ags Legal Win Against Live Nation Portland Venue Plans In Jeopardy

May 29, 2025 -

Mkhatr Alensryt Almqnet Ela Alryadt Alsewdyt Wkyfyt Alhd Mnha

May 29, 2025

Mkhatr Alensryt Almqnet Ela Alryadt Alsewdyt Wkyfyt Alhd Mnha

May 29, 2025 -

Woman And 8 Year Old Hurt In South Seattle Drive By

May 29, 2025

Woman And 8 Year Old Hurt In South Seattle Drive By

May 29, 2025 -

Netflix Stranger Things Season 5 When Will The Teaser Trailer Arrive

May 29, 2025

Netflix Stranger Things Season 5 When Will The Teaser Trailer Arrive

May 29, 2025

Latest Posts

-

How To Achieve The Good Life A Step By Step Approach

May 31, 2025

How To Achieve The Good Life A Step By Step Approach

May 31, 2025 -

The Good Life Defining And Achieving Your Personal Best

May 31, 2025

The Good Life Defining And Achieving Your Personal Best

May 31, 2025 -

The Good Life Prioritizing Wellbeing And Meaning

May 31, 2025

The Good Life Prioritizing Wellbeing And Meaning

May 31, 2025 -

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025

Live The Good Life Practical Tips For A Fulfilling Existence

May 31, 2025 -

Creating A Good Life A Personalized Approach

May 31, 2025

Creating A Good Life A Personalized Approach

May 31, 2025