Where To Invest: Identifying The Country's Top Business Growth Areas

Table of Contents

Analyzing Macroeconomic Indicators for Investment Opportunities

Before diving into specific sectors and regions, it's crucial to analyze the overarching macroeconomic environment. Understanding macroeconomic factors is the foundation of successful investment analysis and predicting market trends. These indicators offer a broader perspective on the country's economic health and stability, directly impacting investment opportunities.

- GDP growth rate and projections: A consistently rising GDP signifies a healthy economy, creating a favorable climate for investment. Analyzing projected growth rates helps anticipate future returns.

- Inflation rate and stability: High and volatile inflation erodes purchasing power and increases investment risk. Stable, low inflation is generally preferred.

- Interest rates and monetary policy: Interest rate adjustments by the central bank influence borrowing costs and investment decisions. Low interest rates often stimulate economic activity.

- Government spending and fiscal policy: Government initiatives, such as infrastructure projects or tax incentives, can significantly impact specific sectors and regions.

- Foreign direct investment (FDI) inflows: High FDI inflows indicate confidence in the country's economic prospects, creating positive spillover effects.

Interpreting these economic indicators requires careful consideration of their interrelationships. For example, high GDP growth accompanied by high inflation might signal overheating, potentially leading to future interest rate hikes. Thorough investment analysis requires a comprehensive understanding of these dynamics.

Top Performing Sectors: Identifying High-Growth Industries

The country's economic landscape is diverse, with certain sectors exhibiting particularly strong growth potential. Smart investors carefully assess these high-growth industries to maximize returns.

- Technology (Software, Fintech, AI): The tech sector, fueled by innovation and digital transformation, presents significant tech investment opportunities. Software development, fintech solutions, and AI applications are driving considerable growth.

- Renewable Energy: Growing environmental awareness and government support are propelling the green energy investment sector. Opportunities exist in solar, wind, and other renewable energy technologies.

- Healthcare: An aging population and rising healthcare expenditures create substantial healthcare investment trends. Investment opportunities range from pharmaceuticals to medical technology and healthcare services.

- E-commerce and online retail: The rapid expansion of internet penetration and mobile commerce is fueling the ecommerce market growth. This sector offers opportunities in logistics, online marketplaces, and digital marketing.

- Tourism and hospitality: The country's attractive tourism destinations offer considerable tourism investment potential. Investment opportunities exist in hotels, resorts, and related services.

Each sector carries its own unique set of risks and rewards. Thorough market research and due diligence are crucial before committing capital.

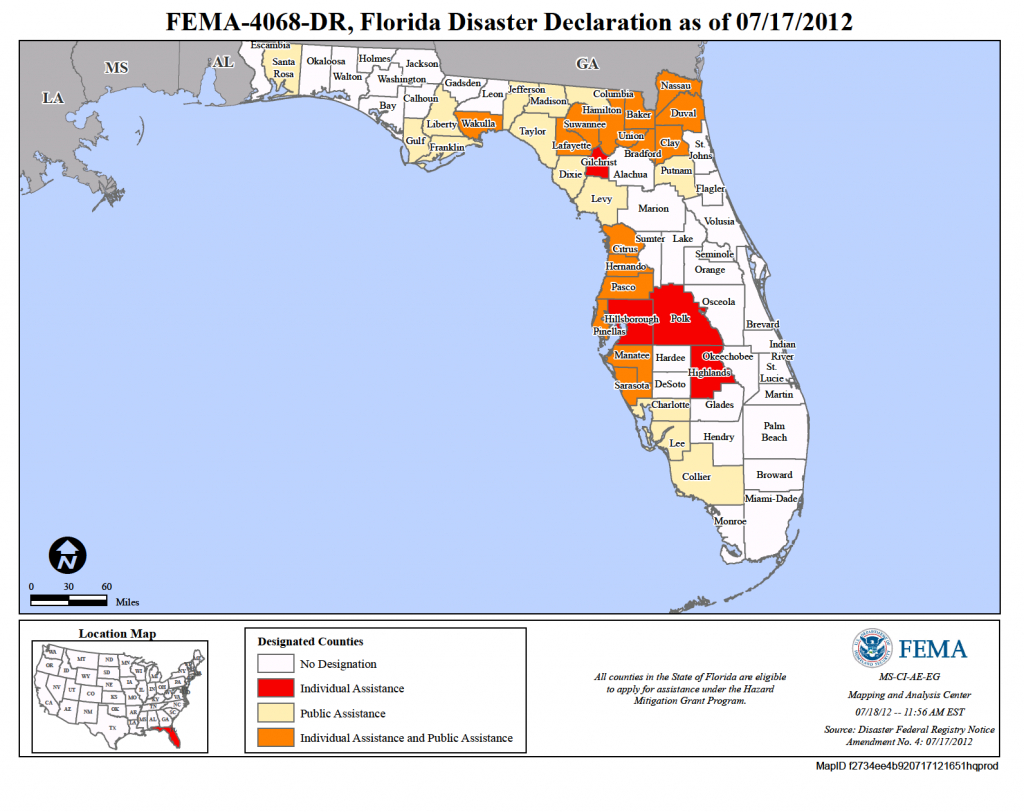

Geographical Distribution of Growth: Pinpointing Promising Regions

Economic growth isn't uniformly distributed across the country. Understanding regional investment opportunities and leveraging geographic diversification strategies are vital for success.

- Major metropolitan areas (e.g., economic hubs): Large cities typically offer concentrated economic activity, advanced infrastructure, and a skilled workforce.

- Emerging regional centers (e.g., up-and-coming cities): These areas often present high growth potential but may also involve higher risks due to less developed infrastructure.

- Specific provinces or states showing strong growth: Certain regions might experience rapid development due to specific government policies, resource discoveries, or industry clusters.

Investing in a specific region requires careful consideration of factors like infrastructure quality, labor costs, regulatory environments, and local competition.

Mitigating Risks: Due Diligence and Investment Strategies

While high-growth areas offer significant potential, it's crucial to acknowledge and mitigate associated risks. Effective investment risk management is paramount.

- Political and regulatory risks: Policy changes, political instability, and regulatory hurdles can negatively impact investments.

- Economic volatility: Economic downturns or unexpected shocks can significantly affect returns.

- Competition: Intense competition can reduce profitability and market share.

- Currency fluctuations: Changes in exchange rates can impact investment returns, particularly for foreign investors.

Strategies for mitigating these risks include diversification across sectors and regions, thorough due diligence process, comprehensive risk assessment, and robust financial planning.

Conclusion: Where to Invest: Your Guide to Smart Investment Decisions

Identifying where to invest: identifying the country's top business growth areas requires a multifaceted approach. By carefully analyzing macroeconomic indicators, identifying high-growth sectors and regions, and effectively managing investment risks, investors can significantly improve their chances of success. This article provides a framework for making informed decisions. We strongly encourage you to conduct further research using government reports, industry publications, and investment guides to refine your investment strategy. The potential for lucrative returns in the identified growth areas is considerable; seize the opportunity and build a prosperous investment portfolio.

Featured Posts

-

Orlando Healths Brevard County Hospital Closure Impact And Future Plans

May 19, 2025

Orlando Healths Brevard County Hospital Closure Impact And Future Plans

May 19, 2025 -

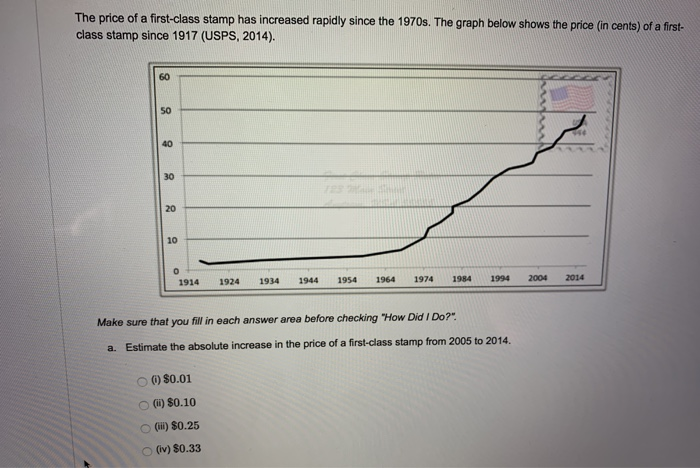

Impact Of The 1 70 First Class Stamp Price Increase

May 19, 2025

Impact Of The 1 70 First Class Stamp Price Increase

May 19, 2025 -

Az Rbaycanin Eurovision 2025 Soezcuesue S Fur Nin Rolunun H Miyy Ti

May 19, 2025

Az Rbaycanin Eurovision 2025 Soezcuesue S Fur Nin Rolunun H Miyy Ti

May 19, 2025 -

Haaland Announces New Mexico Gubernatorial Bid

May 19, 2025

Haaland Announces New Mexico Gubernatorial Bid

May 19, 2025 -

Tonawanda Employee Faces Drug Charges After Allegedly Supplying Coworker

May 19, 2025

Tonawanda Employee Faces Drug Charges After Allegedly Supplying Coworker

May 19, 2025