Where To Invest: Mapping The Country's Best Business Opportunities

Table of Contents

Thriving Sectors: Identifying High-Growth Industries

Several sectors are experiencing explosive growth, presenting lucrative investment opportunities. Smart investors are focusing on these areas for significant returns.

The Technology Boom: Investment in Tech Startups and Innovation

The country's tech sector is booming, fueled by a young, tech-savvy population and government initiatives promoting innovation. This creates a fertile ground for "tech investment" and "startup funding."

- Examples of Success: [Insert examples of successful tech startups in the country]. These success stories demonstrate the potential for significant returns on "AI investment" and growth in the "fintech opportunities" and cybersecurity sectors.

- Government Incentives: The government offers various tax breaks and grants to encourage "tech investment," making it an even more attractive proposition. These incentives range from seed funding for startups to tax reductions for established tech companies.

- Future Growth Potential: The future looks bright for AI, fintech, and cybersecurity, presenting significant potential for long-term growth and high returns on investment.

Renewable Energy and Sustainable Investments: A Green Future

Growing environmental awareness and government policies promoting sustainability are driving a surge in "renewable energy investment." This translates to substantial opportunities in the "green technology investment" space.

- Government Support: The government is actively investing in renewable energy infrastructure and offering attractive incentives for private investment in "sustainable business" ventures.

- Growing Demand: The rising demand for clean energy solutions creates a strong market for solar, wind, and other renewable energy sources, promising high returns for early investors.

- Investment Opportunities: Investment opportunities abound in the development and deployment of renewable energy technologies, from solar farms and wind turbines to smart grids and energy storage solutions.

Real Estate and Infrastructure Development: Building for the Future

The country's burgeoning population and economic expansion are driving significant growth in the "real estate investment" and infrastructure sectors.

- Commercial and Residential Real Estate: Opportunities span both commercial and residential property investment, catering to a growing demand for housing and office spaces in major cities and expanding urban areas.

- Infrastructure Projects: Massive investments in infrastructure projects – including roads, bridges, railways, and utilities – create numerous lucrative opportunities for investors. These "infrastructure projects" are vital for supporting economic growth and attracting further investment.

- Influencing Factors: Factors like location, proximity to amenities, and government regulations significantly influence "real estate investment" returns. Thorough due diligence is crucial.

Geographic Hotspots: Regional Investment Opportunities

Investment opportunities aren't uniformly distributed; certain regions offer more attractive prospects than others.

Major Cities: Hubs of Economic Activity

Major cities like [City Name 1] and [City Name 2] are thriving economic hubs, offering diverse investment opportunities.

- Attractiveness Factors: These cities boast a highly skilled workforce, well-developed infrastructure, and easy access to major markets, making them attractive locations for investment.

- Investment Opportunities: "City investment" in these areas spans various sectors, including technology, real estate, and finance. Specific opportunities vary depending on the city's unique strengths. For instance, "[City Name 1] investment" might focus on tech startups, while "[City Name 2] business opportunities" could be centered around tourism.

Emerging Regions: Untapped Potential

While major cities offer established markets, emerging regions present exciting opportunities with high growth potential, though often with higher risks. "Regional investment" in these areas is key for long-term growth.

- High-Growth Potential: Regions like [Region Name] are experiencing rapid growth, driven by factors like the discovery of natural resources or the emergence of new industries.

- Risks and Rewards: Investing in "emerging markets" can yield substantial returns, but it also entails higher risks, including political instability or infrastructure limitations. Careful "risk management" is vital.

Due Diligence and Risk Management: Navigating the Investment Landscape

Before committing to any investment, thorough due diligence and risk management are crucial.

Understanding Market Research and Analysis

Effective "market research" and analysis are foundational to successful investment.

- Thorough Research: Conduct comprehensive research to understand industry trends, identify competitors, and assess market size and potential. Effective "competitive analysis" is vital.

- Data-Driven Decisions: Base investment decisions on solid data and analysis, not just speculation.

Legal and Regulatory Considerations

Navigating the legal and regulatory landscape is essential.

- Compliance: Ensure full compliance with local laws and regulations, securing all necessary permits and licenses.

- Tax Implications: Understand the tax implications of your investment to optimize returns and minimize liabilities.

Managing Investment Risks

Every investment carries inherent risks.

- Risk Identification: Identify potential risks, including market risk, political risk, and financial risk.

- Mitigation Strategies: Develop and implement strategies to mitigate these risks, such as diversification and hedging. Effective "risk management" is a cornerstone of successful investing.

Conclusion: Unlocking Investment Success: Your Guide to the Best Opportunities

This article has highlighted key sectors like technology, renewable energy, and real estate, alongside promising geographic hotspots for investment within the country. Remember, successful investment hinges on thorough "market research," adherence to "legal compliance," and robust "risk management." Start exploring the best investment opportunities in the country today! Find your perfect fit among these thriving sectors and geographic hotspots. Begin your journey to financial success with informed decisions based on our guide on where to invest.

Featured Posts

-

The Impact Of Tariffs On The Buy Canadian Beauty Movement

May 20, 2025

The Impact Of Tariffs On The Buy Canadian Beauty Movement

May 20, 2025 -

Wireless Headphones Better Sound Better Features

May 20, 2025

Wireless Headphones Better Sound Better Features

May 20, 2025 -

Analysis Why Tony Hinchcliffes Wwe Appearance Didnt Work

May 20, 2025

Analysis Why Tony Hinchcliffes Wwe Appearance Didnt Work

May 20, 2025 -

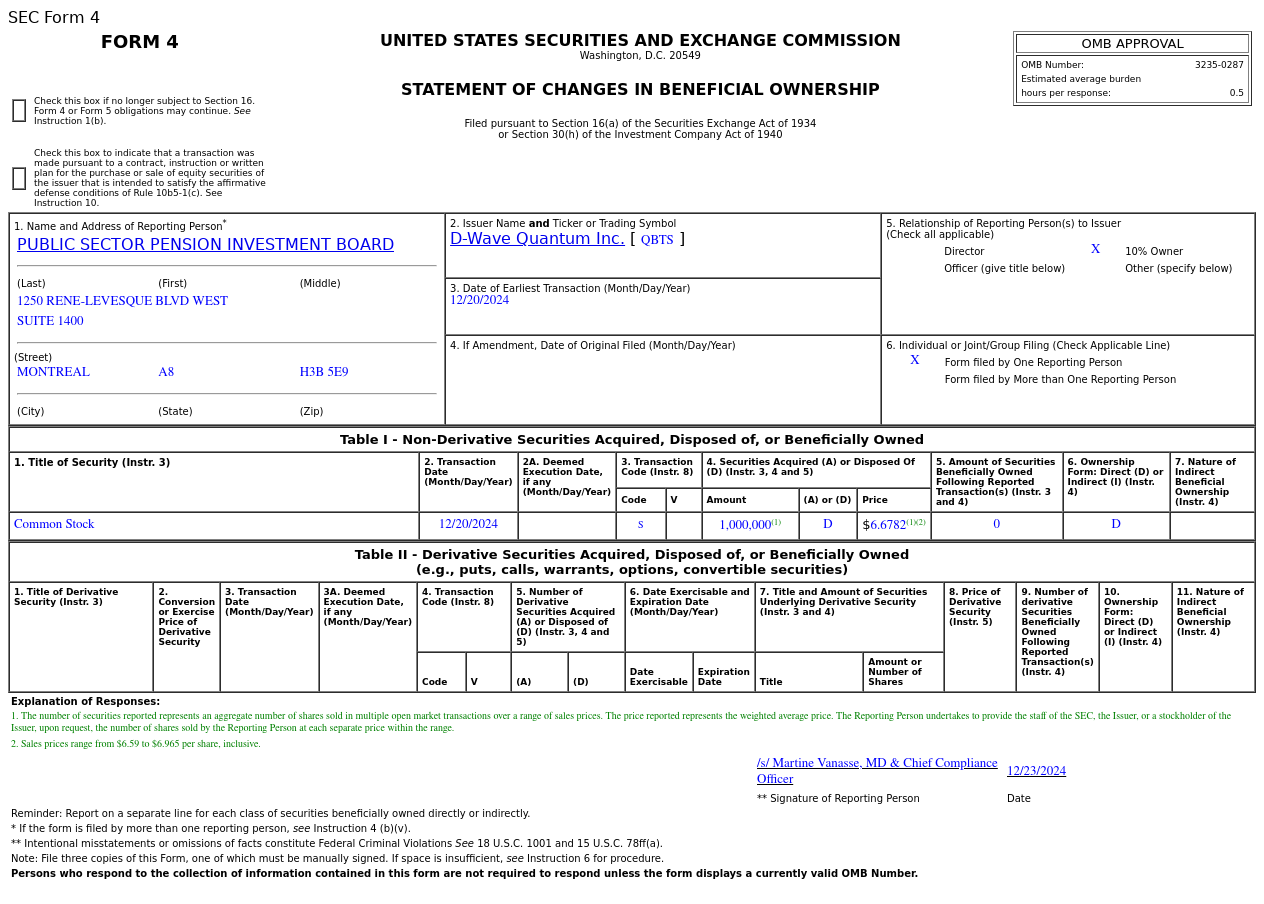

Recent Gains In D Wave Quantum Qbts Stock Exploring The Contributing Factors

May 20, 2025

Recent Gains In D Wave Quantum Qbts Stock Exploring The Contributing Factors

May 20, 2025 -

Paulina Gretzkys Sophisticated Leopard Dress Photos

May 20, 2025

Paulina Gretzkys Sophisticated Leopard Dress Photos

May 20, 2025