Where To Invest: Mapping The Country's New Business Hot Spots

Table of Contents

The Tech Hubs: Thriving in the Digital Economy

The digital economy is booming, and savvy investors are flocking to the country's burgeoning tech hubs. These areas are attracting significant venture capital, fostering innovation, and producing successful startups at an incredible rate. Keywords like "Tech Hubs," "Digital Economy," and "Startup Investment" define this rapidly evolving landscape.

-

Analysis of specific tech hubs: While established centers like [mention a major tech city, e.g., Silicon Valley equivalent] continue to dominate, new tech hubs are rapidly emerging. Cities like [mention a rising tech city] are attracting significant attention due to lower operating costs and a growing pool of skilled talent. The rise of fintech centers in [mention a city known for fintech] is also noteworthy, indicating a significant shift towards financial technology innovation.

-

Government incentives and support for tech businesses: Many regions are actively courting tech companies with tax breaks, grants, and streamlined regulatory processes. These incentives can significantly reduce the financial burden on startups and established tech firms, making them even more attractive investment targets. Researching these incentives is crucial for maximizing ROI.

-

Examples of successful tech startups: The success of companies like [mention a successful tech startup] in [location] and [mention another successful startup] in [location] showcases the potential for substantial returns on investment in these burgeoning tech ecosystems. These case studies illustrate the dynamism and growth potential of the sector.

-

Future projections for growth in these tech hubs: Experts predict continued rapid growth in these tech hubs, driven by factors such as increased access to venture capital, a growing talent pool, and continued advancements in technology. This sustained growth presents attractive long-term investment opportunities.

Renewable Energy: Powering the Future's Investments

The renewable energy sector is experiencing unprecedented growth, driven by increasing environmental concerns and supportive government policies. Investing in renewable energy offers not only financial returns but also the satisfaction of contributing to a sustainable future. Keywords such as "Renewable Energy Investment," "Green Energy," and "Sustainable Business" highlight the sector's importance.

-

Government initiatives and subsidies for renewable energy projects: Numerous government initiatives, including tax credits, subsidies, and grants, are designed to incentivize investment in renewable energy projects. Understanding these incentives is critical for assessing the overall profitability of such ventures.

-

Analysis of regions with high solar or wind potential: Certain regions boast exceptional solar or wind resources, making them ideal locations for renewable energy projects. For example, [mention a region with high solar potential] is attracting significant investment in solar farms, while [mention a region with high wind potential] is becoming a hub for wind energy development.

-

Investment risks and opportunities in the renewable energy sector: While the sector presents significant opportunities, investors should be aware of potential risks, including fluctuating energy prices, technological advancements, and regulatory changes. Thorough due diligence is crucial.

-

Case studies of successful renewable energy projects: The success of projects like [mention a successful renewable energy project] highlights the potential for strong financial returns and positive environmental impact.

Agrotech: Farming the Future of Business

The intersection of agriculture and technology, known as agrotech, is revolutionizing the farming industry. This sector offers exciting investment opportunities in precision agriculture, sustainable farming practices, and innovative food technologies. Relevant keywords include "Agrotech Investment," "Precision Agriculture," and "Sustainable Farming."

-

Regions with strong agricultural economies and potential for agrotech investment: Areas with established agricultural bases and a supportive ecosystem for technological innovation present the most attractive investment opportunities. [Mention specific regions] are showing strong potential in this regard.

-

Technological advancements driving growth in this sector: Advances in areas such as robotics, data analytics, and biotechnology are transforming farming practices, leading to increased efficiency, sustainability, and yields.

-

Examples of successful agrotech startups and companies: Companies like [mention successful agrotech companies] demonstrate the potential for significant growth and profitability in this sector.

-

Future trends and investment potential in agrotech: The continued adoption of precision agriculture techniques, the growing demand for sustainable food production, and advancements in food technology indicate a bright future for agrotech investments.

Beyond the Big Cities: Discovering Untapped Potential in Smaller Markets

While major metropolitan areas often grab the headlines, smaller cities and rural areas present unique investment opportunities. These underserved markets often offer lower operating costs, a strong sense of community, and untapped potential for growth. Keywords like "Rural Business Investment," "Small Town Economy," and "Underserved Markets" are relevant here.

-

Analysis of specific smaller markets with strong growth potential: [Mention specific examples of smaller markets with promising growth potential, citing reasons for their potential]. These areas often possess unique advantages such as a skilled workforce or access to specific resources.

-

Challenges and opportunities of investing in smaller markets: Investors should be aware of potential challenges such as limited access to capital and infrastructure. However, the lower costs and strong community support can often outweigh these challenges.

-

Examples of successful businesses operating in smaller markets: [Mention examples of businesses thriving in smaller markets and highlight their success stories].

-

Government incentives and support for businesses in rural areas: Many governments offer incentives to encourage business development in rural areas. These incentives can significantly enhance the attractiveness of investments in these markets.

Conclusion

This article has mapped out several key areas representing the country's new business hot spots. From the dynamic tech hubs to the burgeoning renewable energy and agrotech sectors, and even the untapped potential of smaller markets, there are ample investment opportunities for those who are willing to explore beyond the traditional paths. By understanding the nuances of each sector and region, investors can make informed decisions and capitalize on the incredible growth potential these areas offer. Start exploring these promising business hot spots today and find your next profitable investment!

Featured Posts

-

The Price Of Progress Why Change Often Leads To Reprisal

May 25, 2025

The Price Of Progress Why Change Often Leads To Reprisal

May 25, 2025 -

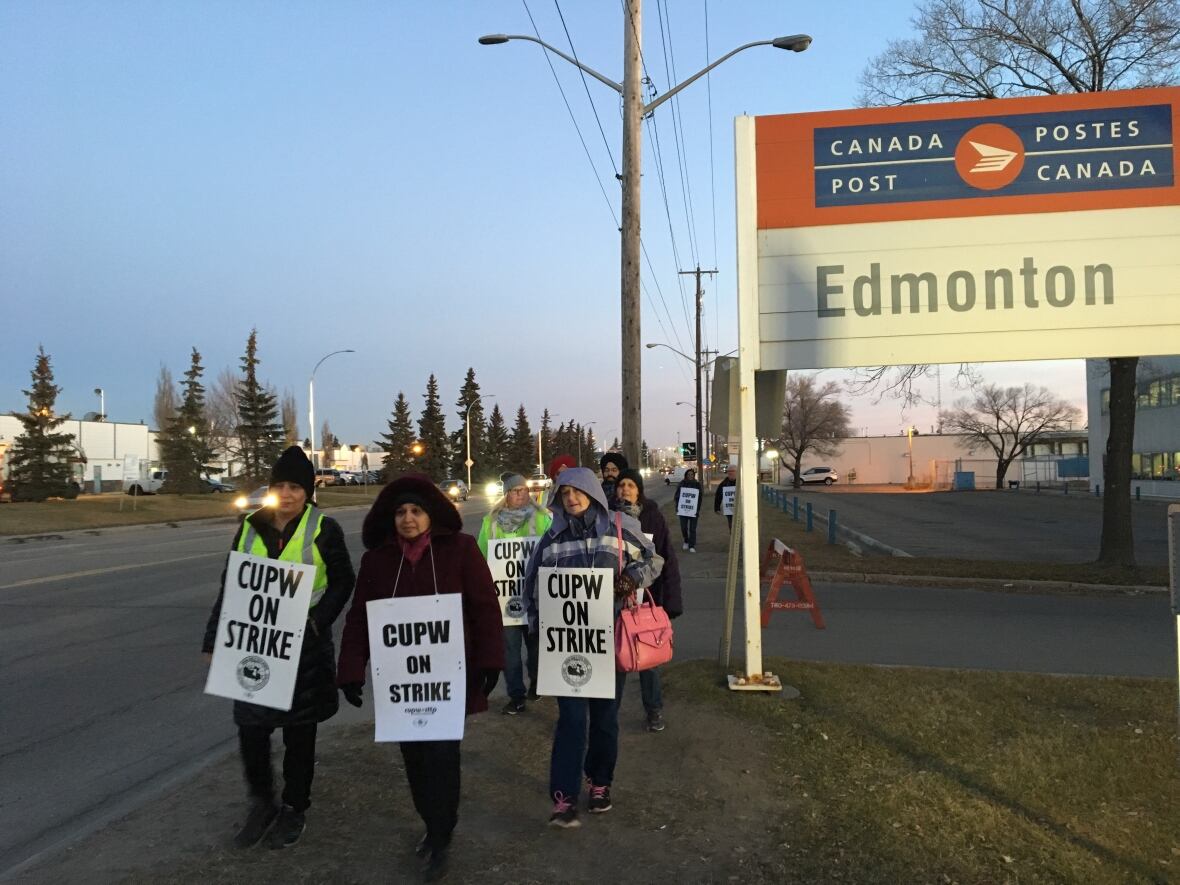

Will A Canada Post Strike Result In Lost Customers

May 25, 2025

Will A Canada Post Strike Result In Lost Customers

May 25, 2025 -

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Kecanggihan Porsche

May 25, 2025

Indonesia Classic Art Week 2025 Perpaduan Seni Dan Kecanggihan Porsche

May 25, 2025 -

Apple Stock Q2 Earnings A Deep Dive Into I Phone Sales And Beyond

May 25, 2025

Apple Stock Q2 Earnings A Deep Dive Into I Phone Sales And Beyond

May 25, 2025 -

Bbc Big Weekend Tickets 2025 Sefton Park Guide

May 25, 2025

Bbc Big Weekend Tickets 2025 Sefton Park Guide

May 25, 2025